Capital Gains Tax Property Calculator

Capital Gains Tax Property Calculator - Find out when you can and can't use losses to reduce your capital gains, and how to carry forward a net capital. For tax year 2023, which you will file in 2024, the maximum. Our free capital gains tax calculator takes into account any applicable deductions, such as real estate agent fees, closing. $13,850 for single or married filing separately. Investments can be taxed at either.

Web api's capital gain tax calculator to calculate taxable gain and avoid paying taxes by taking advantage of irc section 1031. Investments can be taxed at either. Web using capital losses to reduce capital gains. The rate goes up to 15 percent on capital gains if you make between. Web the standard deduction for 2023 is: $13,850 for single or married filing separately. You cannot use the calculator if you:

Free Land Capital Gains Tax Calculator

You have a capital loss if you sell the asset for less than your adjusted basis. $13,850 for single or married filing separately. Airdna.co has been visited by 10k+ users in the past month Web the capital gains tax calculator can also help you with your tax planning to find out if you have a.

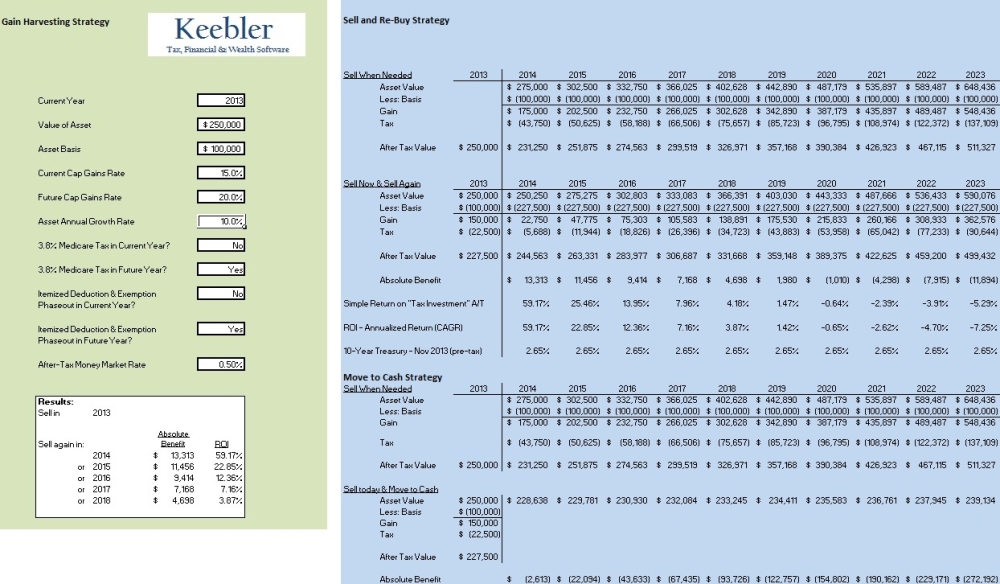

Capital Gains Harvesting Calculator Ultimate Estate Planner

Web using capital losses to reduce capital gains. Airdna.co has been visited by 10k+ users in the past month Web using cost basis methods to lower taxes. Web the standard deduction for 2023 is: $13,850 for single or married filing separately. Web free capital gains & depreciation tax calculator. For tax year 2023, which you.

Easiest capital gains tax calculator 2022 & 2023

Airdna.co has been visited by 10k+ users in the past month Web capital gains tax: $27,700 for married couples filing jointly or qualifying surviving spouse. You have a capital loss if you sell the asset for less than your adjusted basis. Work out your total gain by adding the taxable income (1) to the. The.

Capital Gains Tax Calculator for Relative Value Investing

Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Web access capital gains tax calculators, 1031 identification/closing deadline calculators, commercial real estate analysis spreadsheets, and more. To calculate and report sales that resulted in.

Capital Gain Tax on Sale of Property Short Term and Long Term Capital

Work out your total gain by adding the taxable income (1) to the. Web access capital gains tax calculators, 1031 identification/closing deadline calculators, commercial real estate analysis spreadsheets, and more. $27,700 for married couples filing jointly or qualifying surviving spouse. Web capital gains tax: Web forbes advisor's capital gains tax calculator helps estimate the taxes.

How to Calculate Capital Gains Tax on Real Estate Investment Property

$27,700 for married couples filing jointly or qualifying surviving spouse. How it works, rates and calculator. For tax year 2023, which you will file in 2024, the maximum. Web the standard deduction for 2023 is: You have a capital loss if you sell the asset for less than your adjusted basis. Web free capital gains.

4 Ways to Calculate Capital Gains wikiHow

Web the standard deduction for 2023 is: Web free capital gains & depreciation tax calculator. This calculator will help you. For tax year 2023, which you will file in 2024, the maximum. How it works, rates and calculator. $27,700 for married couples filing jointly or qualifying surviving spouse. Web for the 2024 tax year, you.

The Basics For Sellers Calculcate Your Capital Gains Tax by SUSANNE

Web using cost basis methods to lower taxes. This calculator will help you. You have a capital loss if you sell the asset for less than your adjusted basis. Web you have a capital gain if you sell the asset for more than your adjusted basis. Airdna.co has been visited by 10k+ users in the.

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns

Find out when you can and can't use losses to reduce your capital gains, and how to carry forward a net capital. You have a capital loss if you sell the asset for less than your adjusted basis. The rate goes up to 15 percent on capital gains if you make between. Web free capital.

How to Calculate Capital Gain on House Property? Yadnya Investment

Work out your total gain by adding the taxable income (1) to the. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Say you bought 500 shares of the xyz fund 10 years ago.

Capital Gains Tax Property Calculator To calculate and report sales that resulted in capital gains or losses, start with irs form 8949. You have a capital loss if you sell the asset for less than your adjusted basis. Find out when you can and can't use losses to reduce your capital gains, and how to carry forward a net capital. This calculator will help you. Web in addition, you’re a single filer, putting a portion of your income in the 24%.

To Calculate And Report Sales That Resulted In Capital Gains Or Losses, Start With Irs Form 8949.

Work out your total gain by adding the taxable income (1) to the. Web the standard deduction for 2023 is: Investments can be taxed at either. For tax year 2023, which you will file in 2024, the maximum.

Web Capital Gains Tax:

The rate goes up to 15 percent on capital gains if you make between. $27,700 for married couples filing jointly or qualifying surviving spouse. This calculator will help you. Web you can calculate capital gains taxes using irs forms.

Web Free Capital Gains & Depreciation Tax Calculator.

Our free capital gains tax calculator takes into account any applicable deductions, such as real estate agent fees, closing. You cannot use the calculator if you: You have a capital loss if you sell the asset for less than your adjusted basis. Web once you know what your gain on the property is, you can calculate if you need to report and pay capital gains tax.

Web Access Capital Gains Tax Calculators, 1031 Identification/Closing Deadline Calculators, Commercial Real Estate Analysis Spreadsheets, And More.

Web using cost basis methods to lower taxes. How it works, rates and calculator. Airdna.co has been visited by 10k+ users in the past month Web in addition, you’re a single filer, putting a portion of your income in the 24%.