Car Allowance Calculator

Car Allowance Calculator - Web as mentioned above, the cost of fuel, maintenance, taxes, and reimbursements all influence how much the car allowance will be. yes, a car allowance is generally considered taxable income at both the state and federal levels in the us. You must not have claimed actual expenses after 1997 for a car you lease. Web the average car allowance of 2022 i s $576, and has hovered around that rate for several years. Or you can use hmrc’s company car and car fuel benefit calculator.

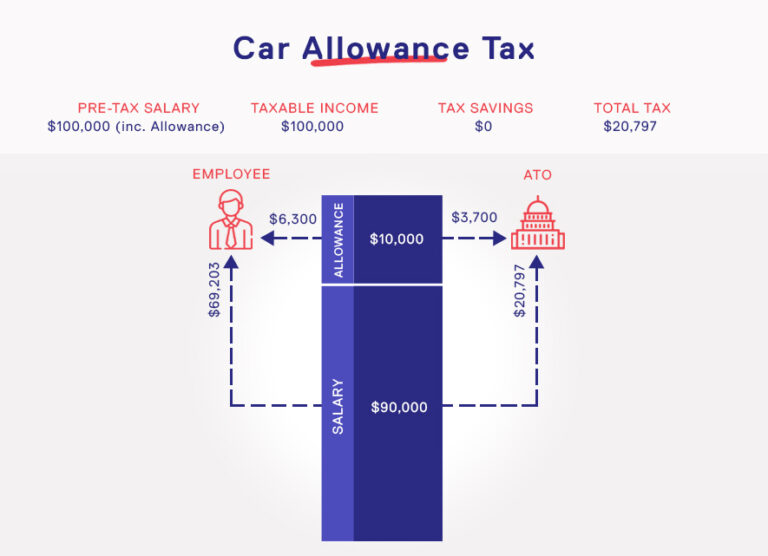

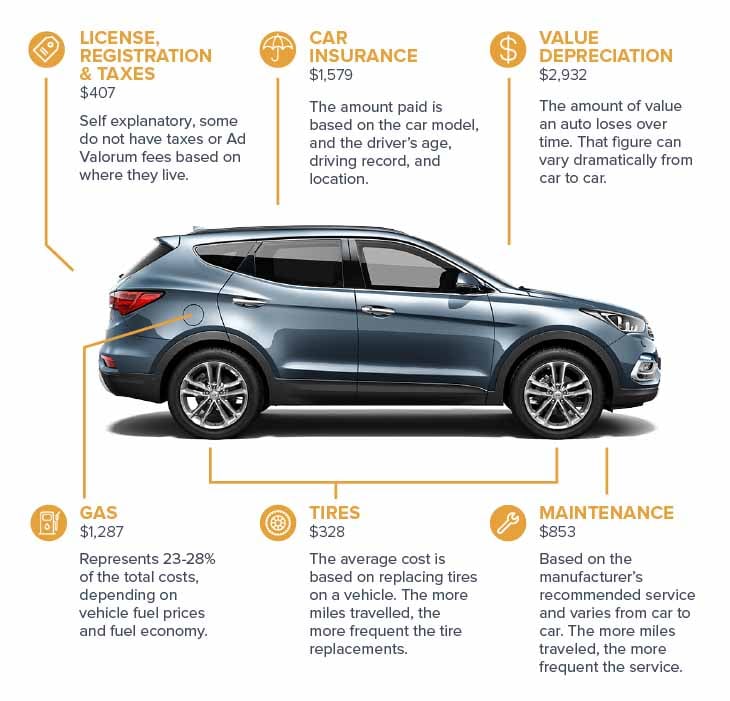

That price is tax waste. Web a company car allowance reimburses employees that use their personal vehicle for work. Some expected fixed costs to consider include the following: Or you can use hmrc’s company car and car fuel benefit calculator. 28 august 2016 at 10:31am. Company cars and car allowances are two of the most popular vehicle programs—but which is best for your company? Web for 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile.

Car Allowance in Australia » The Complete Guide Easifleet

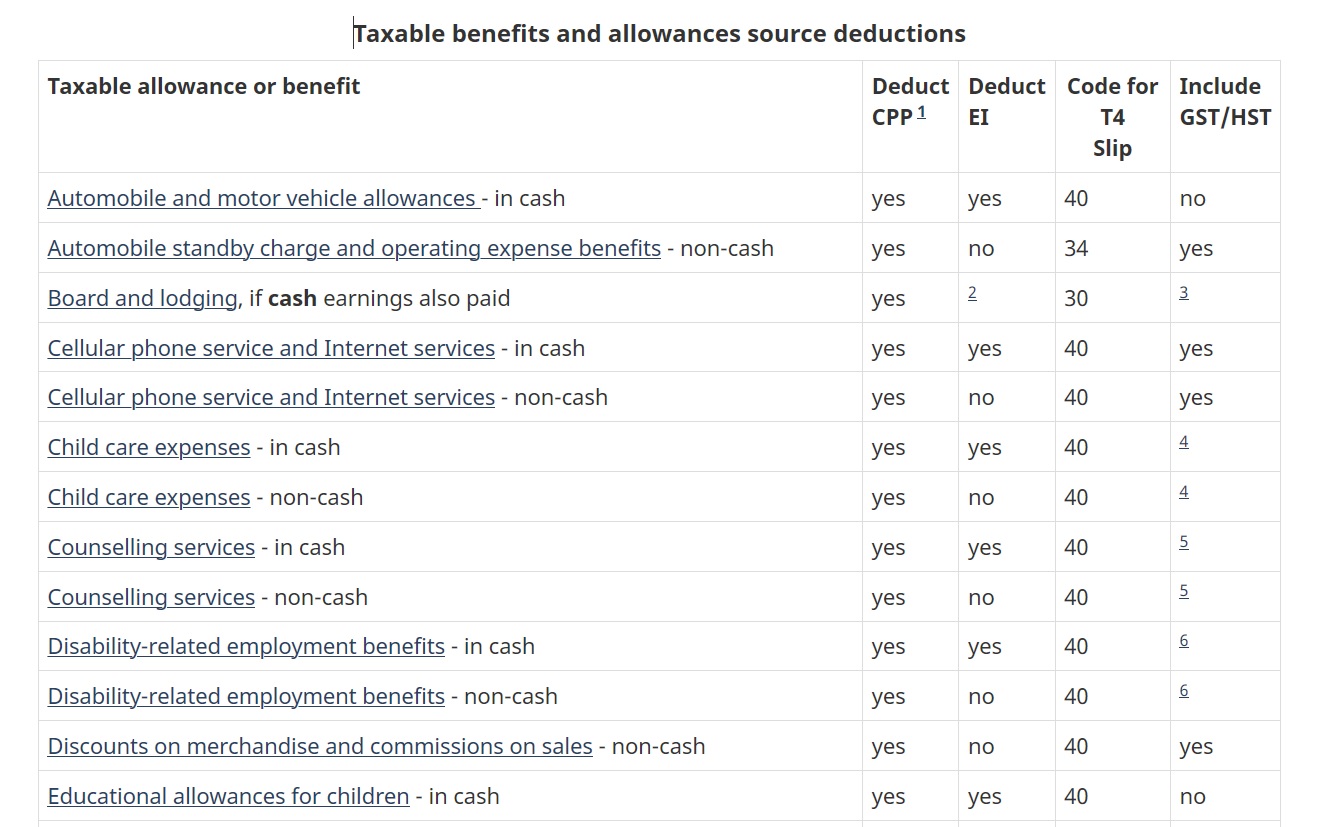

You must not have claimed actual expenses after 1997 for a car you lease. Calculate company savings, employee benefits, and total tax waste. Or you can use hmrc’s company car and car fuel benefit calculator. Web car allowance is a stipend paid to an employee for vehicle use. Web on a favr allowance, these costs.

Fair Car Allowance Calculator Calculator Academy

Web the automobile benefits online calculator allows you to calculate the estimated automobile benefit for employees (including shareholders) based on the. You must not have claimed actual expenses after 1997 for a car you lease. Take a few minutes to run down what you spend every month. Web on a favr allowance, these costs should.

Car Allowance Tax Calculator CassiekruwFinley

Web as mentioned above, the cost of fuel, maintenance, taxes, and reimbursements all influence how much the car allowance will be. so, how much tax you’ll pay on car allowance largely. Web for 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile..

2024 Everything You Need To Know About Car Allowances

Web the average car allowance of 2022 i s $576, and has hovered around that rate for several years. Take a few minutes to run down what you spend every month. Web the downsides of a car allowance. Web as mentioned above, the cost of fuel, maintenance, taxes, and reimbursements all influence how much the.

FAVR Flat Car Allowance Reimbursement Assessment

Web the average car allowance of 2022 i s $576, and has hovered around that rate for several years. Web you can calculate taxable value using commercial payroll software. Add the car allowance to the basic salary and reduce the pension % so that the actual amount in £. You must not have claimed actual.

Car Allowance Tax Rebate Calculator 2023

Costs include wear and tear, fuel, and other expenses that they incur. Web the automobile benefits online calculator allows you to calculate the estimated automobile benefit for employees (including shareholders) based on the. so, how much tax you’ll pay on car allowance largely. yes, a car allowance is generally considered taxable income at.

Car allowance tax calculator KeiranDaelen

Company cars and car allowances are two of the most popular vehicle programs—but which is best for your company? It depends on factors such as business. Add the car allowance to the basic salary and reduce the pension % so that the actual amount in £. Find out how much you can save today! Calculate.

Company Car Vs Car Allowance Calculator Excel CALCULATORUK HJW

Or you can use hmrc’s company car and car fuel benefit calculator. Find out how much you can save today! Learn what to consider before offering. Web a company car allowance reimburses employees that use their personal vehicle for work. Calculate company savings, employee benefits, and total tax waste. Web 17 rows standard mileage rates.

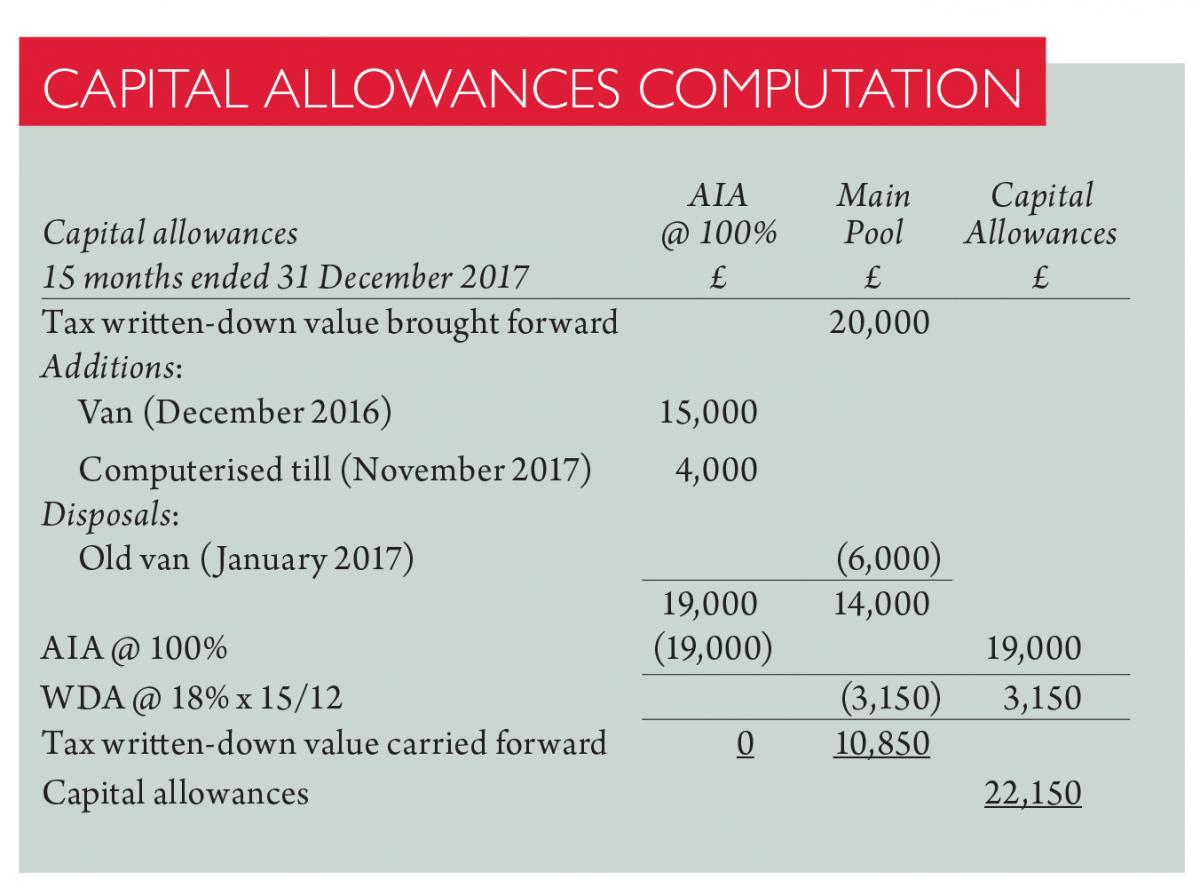

How To Calculate Capital Allowance For Motor Vehicle In Malaysia

Web calculate your automotive budget. Web for 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Web the automobile benefits online calculator allows you to calculate the estimated automobile benefit for employees (including shareholders) based on the. yes, a car allowance is.

Car Allowance in Australia » The Complete Guide Easifleet

Take a few minutes to run down what you spend every month. Car allowances are simple to implement, but that simplicity has a price. Web the downsides of a car allowance. so, how much tax you’ll pay on car allowance largely. Some expected fixed costs to consider include the following: Web on a favr.

Car Allowance Calculator Some expected fixed costs to consider include the following: Web compare your car allowance to a favr plan. so, how much tax you’ll pay on car allowance largely. Car expenses and use of the standard mileage rate are. You must not have claimed actual expenses after 1997 for a car you lease.

Some Expected Fixed Costs To Consider Include The Following:

Add the car allowance to the basic salary and reduce the pension % so that the actual amount in £. Or you can use hmrc’s company car and car fuel benefit calculator. Web on a favr allowance, these costs should be identified regionally, using local expense data. Web the automobile benefits online calculator allows you to calculate the estimated automobile benefit for employees (including shareholders) based on the.

Web Calculate Your Automotive Budget.

Calculate company savings, employee benefits, and total tax waste. It depends on factors such as business. Car allowances are simple to implement, but that simplicity has a price. Car expenses and use of the standard mileage rate are.

Web For 2023, The Standard Mileage Rate For The Cost Of Operating Your Car For Business Use Is 65.5 Cents ($0.655) Per Mile.

so, how much tax you’ll pay on car allowance largely. Web you must not have claimed the special depreciation allowance on the car, and; Take a few minutes to run down what you spend every month. Web 17 rows standard mileage rates if you use your car for business, charity, medical or moving purposes, you may be able to take a deduction based on the mileage used for.

That Price Is Tax Waste.

Find out how much you can save today! Web as mentioned above, the cost of fuel, maintenance, taxes, and reimbursements all influence how much the car allowance will be. Web compare your car allowance to a favr plan. Costs include wear and tear, fuel, and other expenses that they incur.