Care Credit Payment Calculator

Care Credit Payment Calculator - Web the standard deduction for 2023 is: Web log in to your carecredit credit card account. Web here’s what it means for you. Enter the amount you want to finance and learn more about the. $13,850 for single or married filing separately.

Web how to use the credit card minimum payment calculator. Multiply that $10,500 by 15%, and the parent's maximum. Story by katie teague • 1w. The house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit. Web the standard deduction for 2023 is: Select a payment schedule based on: For instance, if you are filing for a single return and your annual.

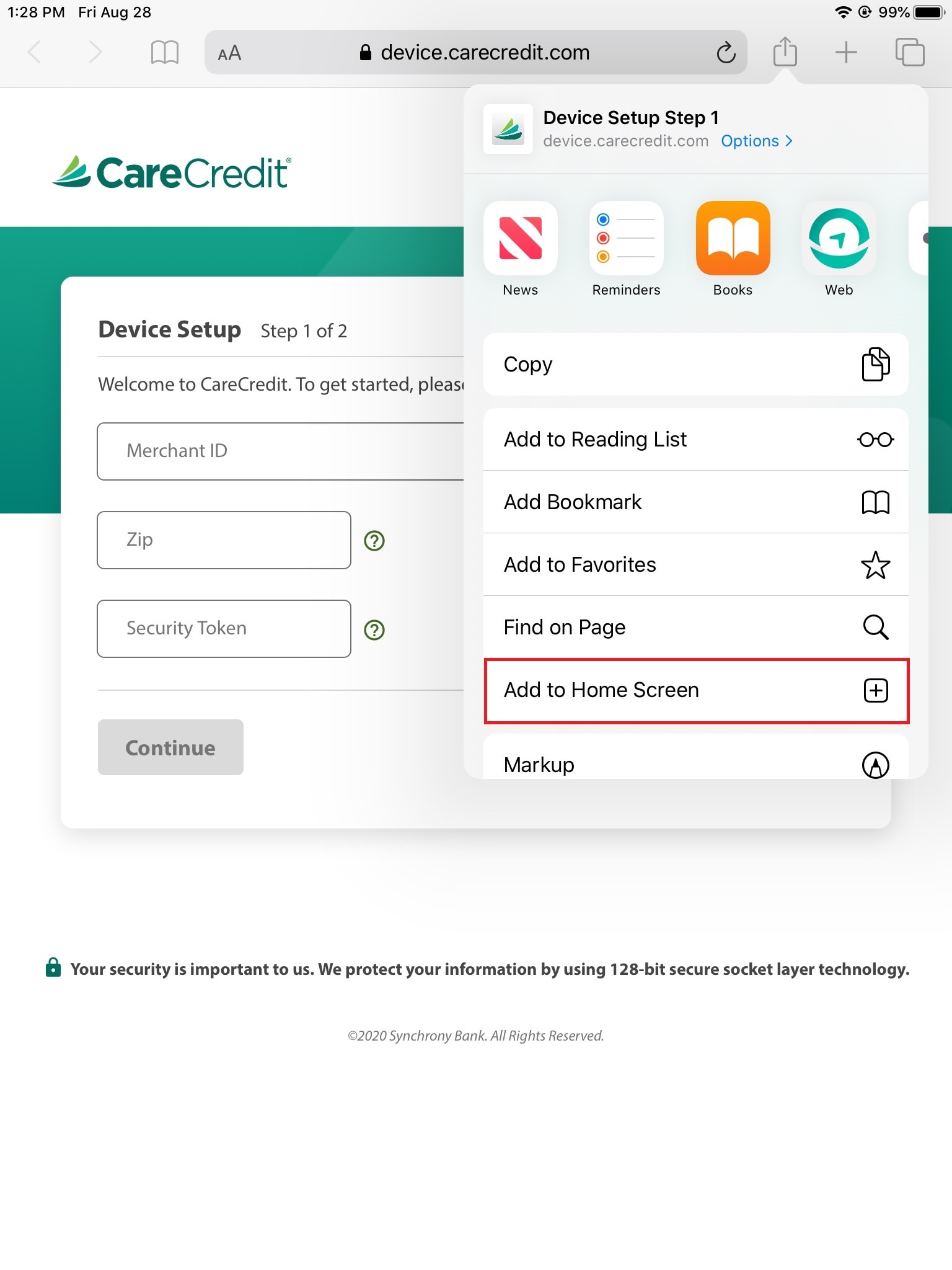

CareCredit Provider Center

14 states are sending out child tax credit payments in 2024. Learn more about the benefits, features, and. Web calculate your monthly payment for financing healthcare procedures with carecredit, a healthcare credit card. Web our calculator can help you estimate when you’ll pay off your credit card debt or other debt — such as auto.

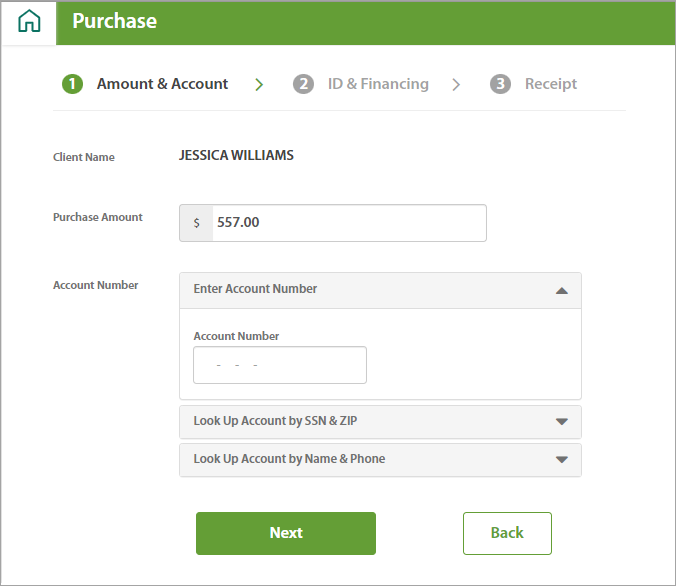

Patient Financing Payment Solutions for Providers CareCredit Provider

Web how to use the credit card minimum payment calculator. For instance, if you are filing for a single return and your annual. If you choose to call, you can use our automated system 24/7 or you can apply with a live agent between 9:00am. $27,700 for married couples filing jointly or qualifying surviving spouse..

How much credit will CareCredit give you? Leia aqui How many months

Web the credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for. $27,700 for married couples filing jointly or qualifying surviving spouse. Web the small business health care tax credit estimator can help you determine.

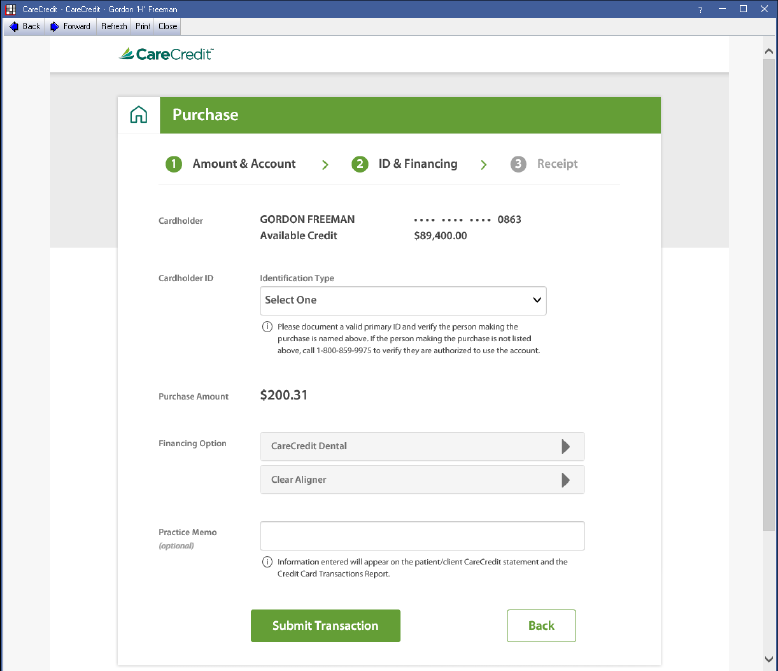

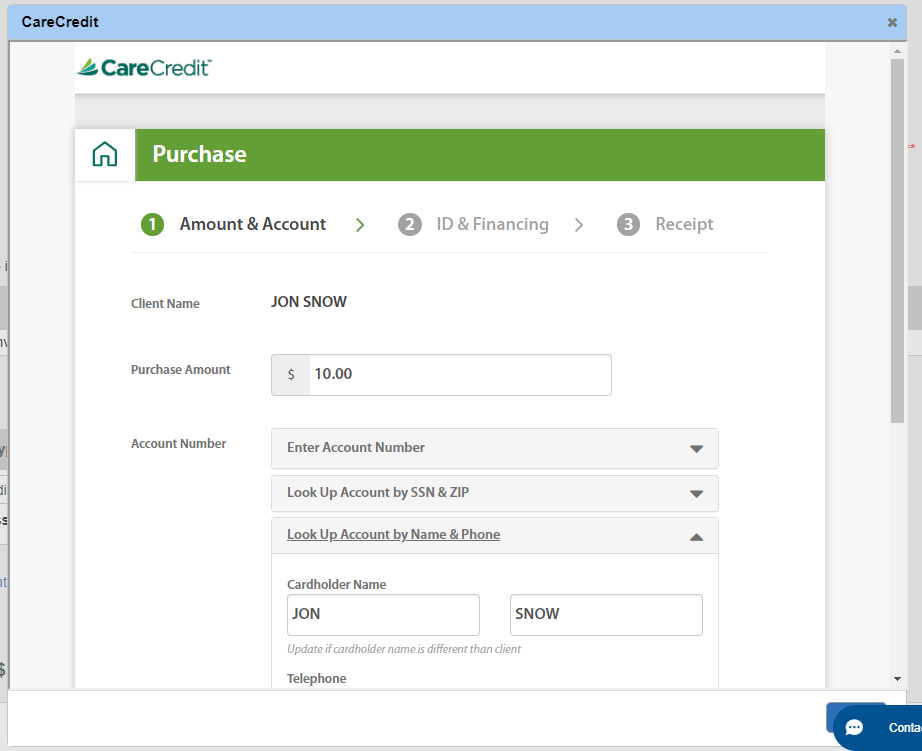

Open Dental Software CareCredit Payment

$13,850 for single or married filing separately. The child and dependent care tax credit is worth anywhere from 20% to 35% of qualifying care expenses. The irs just in the first week of filing this tax season sent 2.6 million refunds. Web calculating how much the credit is worth to you. More specifically, the carecredit.

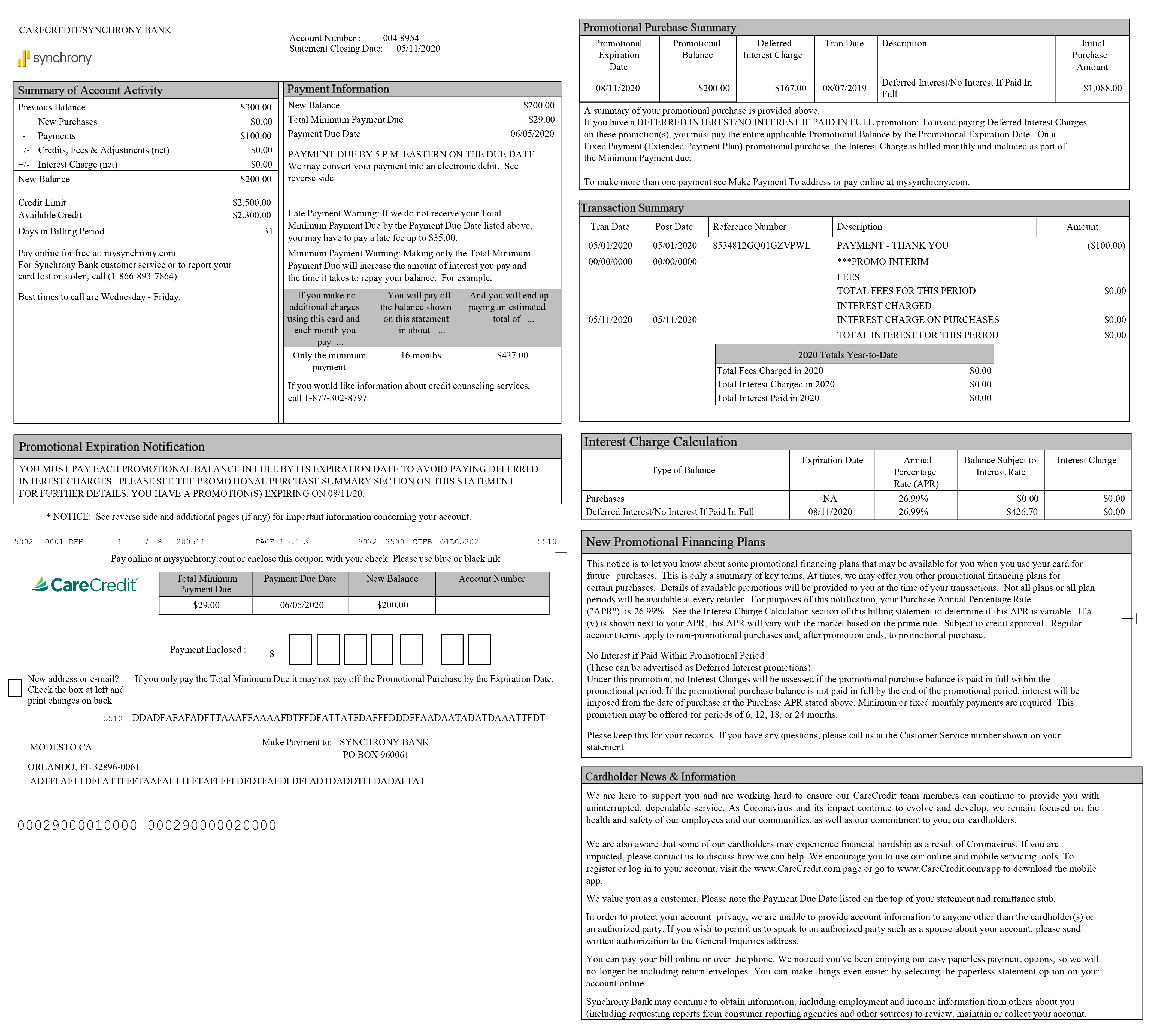

Existing CareCredit Cardholders CareCredit

Web calculating how much the credit is worth to you. $27,700 for married couples filing jointly or qualifying surviving spouse. Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. 14 states are sending out child tax credit payments in 2024. Web log in to your carecredit.

How do I set up and use the CareCredit payment integration? Covetrus

Story by katie teague • 1w. Web the child and dependent care tax credit is for caregivers with expenses related to caring for a dependent while they work or look for work. Web how to use the credit card minimum payment calculator. For instance, if you are filing for a single return and your annual..

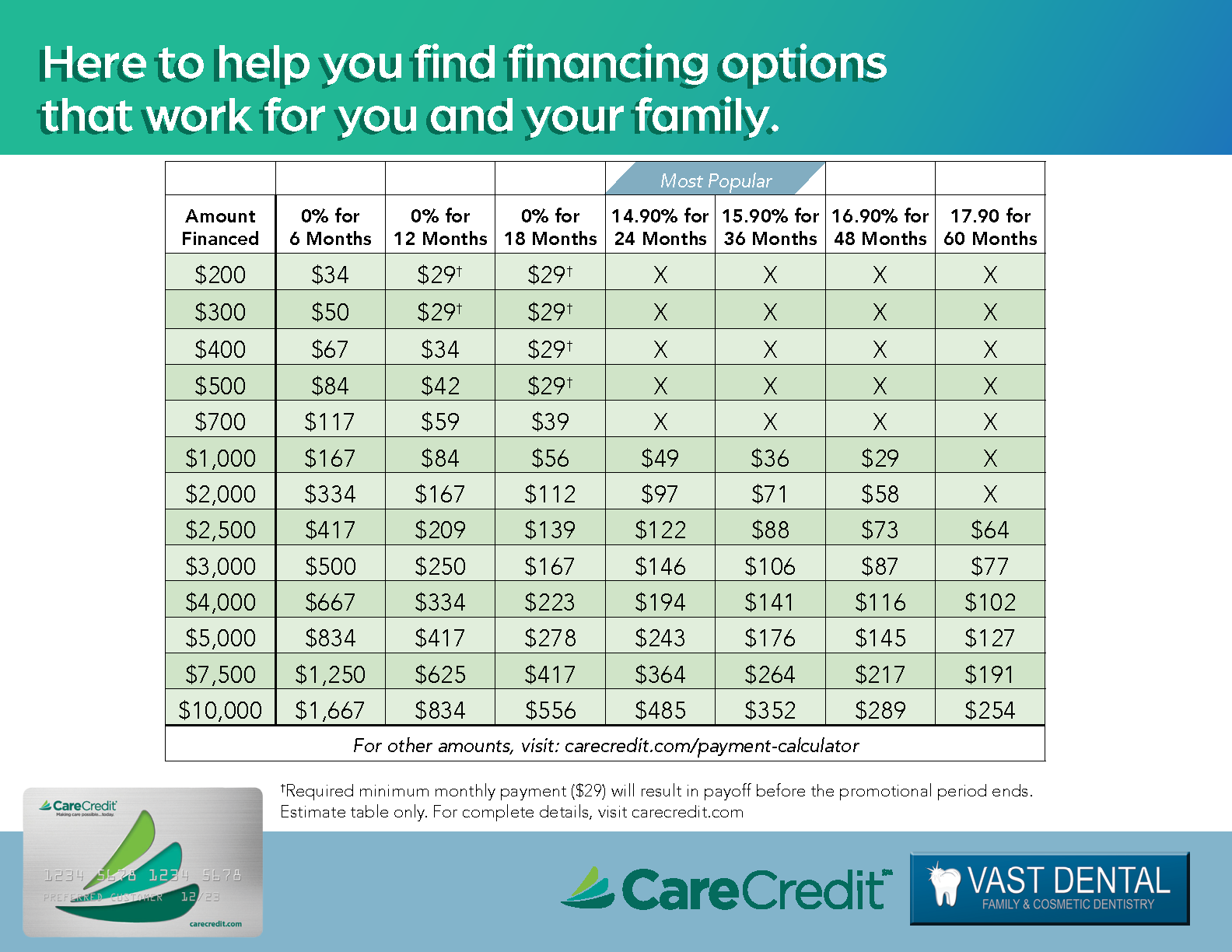

care credit, CareCredit, dental Payment Plan, 0 Down

Web the credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for. More specifically, the carecredit credit card minimum payment is. Web the standard deduction for 2023 is: Web the child and dependent care credit.

How to make your CareCredit card payment online

If you choose to call, you can use our automated system 24/7 or you can apply with a live agent between 9:00am. Select a payment schedule based on: Web the standard deduction for 2023 is: 14 states are sending out child tax credit payments in 2024. Story by katie teague • 1w. Learn more about.

Easily Pay Your Provider With the CareCredit Mobile App YouTube

If you choose to call, you can use our automated system 24/7 or you can apply with a live agent between 9:00am. Web in 2021, the credit is unavailable for any taxpayer with adjusted gross income over $438,000. Web here’s what it means for you. Web calculating how much the credit is worth to you..

How do I set up and use the CareCredit payment integration

Web our calculator can help you estimate when you’ll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how much you’ll need to. 14 states are sending out child tax credit payments in 2024. Web the small business health care tax credit estimator.

Care Credit Payment Calculator Web the small business health care tax credit estimator can help you determine if you might be eligible for the small business health care tax credit and. Web the child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons). Web log in to your carecredit credit card account. Web in 2021, the credit is unavailable for any taxpayer with adjusted gross income over $438,000. That much shorter than the.

Web The Increased Child Tax Credit Is Reduced By $50 For Every $1,000 Income Above The Thresholds.

Web the carecredit credit card can help you pay for health and wellness costs over time with special financing options that help fit your needs.* carecredit helps you. $13,850 for single or married filing separately. The house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit. Learn more about the benefits, features, and.

You Can Use The Calculator To Determine How Long It Will Take You To Pay Off Your Credit Card Balance.

Enter the amount you want to finance and learn more about the. If you choose to call, you can use our automated system 24/7 or you can apply with a live agent between 9:00am. Web calculate your monthly payment for financing healthcare procedures with carecredit, a healthcare credit card. Web the child and dependent care tax credit is for caregivers with expenses related to caring for a dependent while they work or look for work.

More Specifically, The Carecredit Credit Card Minimum Payment Is.

That much shorter than the. For instance, if you are filing for a single return and your annual. Select a payment schedule based on: Story by katie teague • 1w.

The Irs Just In The First Week Of Filing This Tax Season Sent 2.6 Million Refunds.

Web the child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons). Web the small business health care tax credit estimator can help you determine if you might be eligible for the small business health care tax credit and. Web calculating how much the credit is worth to you. 14 states are sending out child tax credit payments in 2024.