Charitable Contribution Calculator

Charitable Contribution Calculator - This publication is designed to help donors and appraisers determine the value of property (other than cash) that is given to qualified organizations. Web your deduction for charitable contributions generally can't be more than 60% of your agi, but in some cases 20%, 30%, or 50% limits may apply. Simply select your 2024 filing. The profits will receive a charitable contribution deduction of $33,248 this year. Use our interactive tool to see how giving can help you save on.

You can deduct up to 60% of your. Web your deduction for charitable contributions generally can't be more than 60% of your agi, but in some cases 20%, 30%, or 50% limits may apply. Cash contributions in 2023 and 2024 can make up 60% of your agi. Web monthly lifetime payments are to begin immediately. Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. Web if you use the standard deduction the calculator will include a charitable contribution deduction (of up to $300, $600 for married filing jointly). Web special $300 tax deduction.

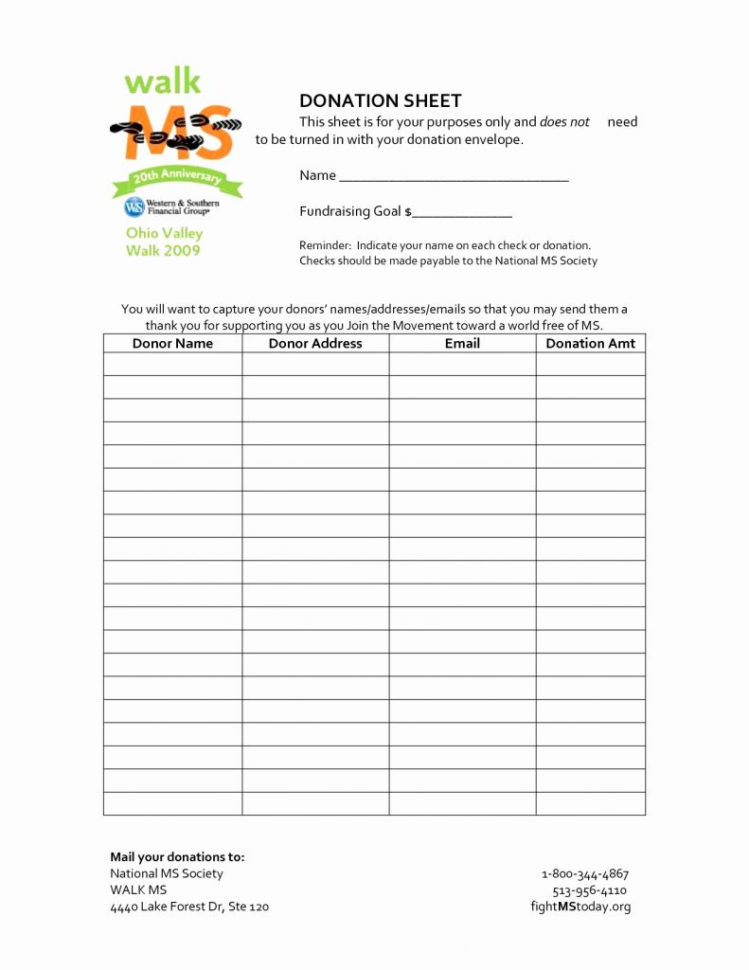

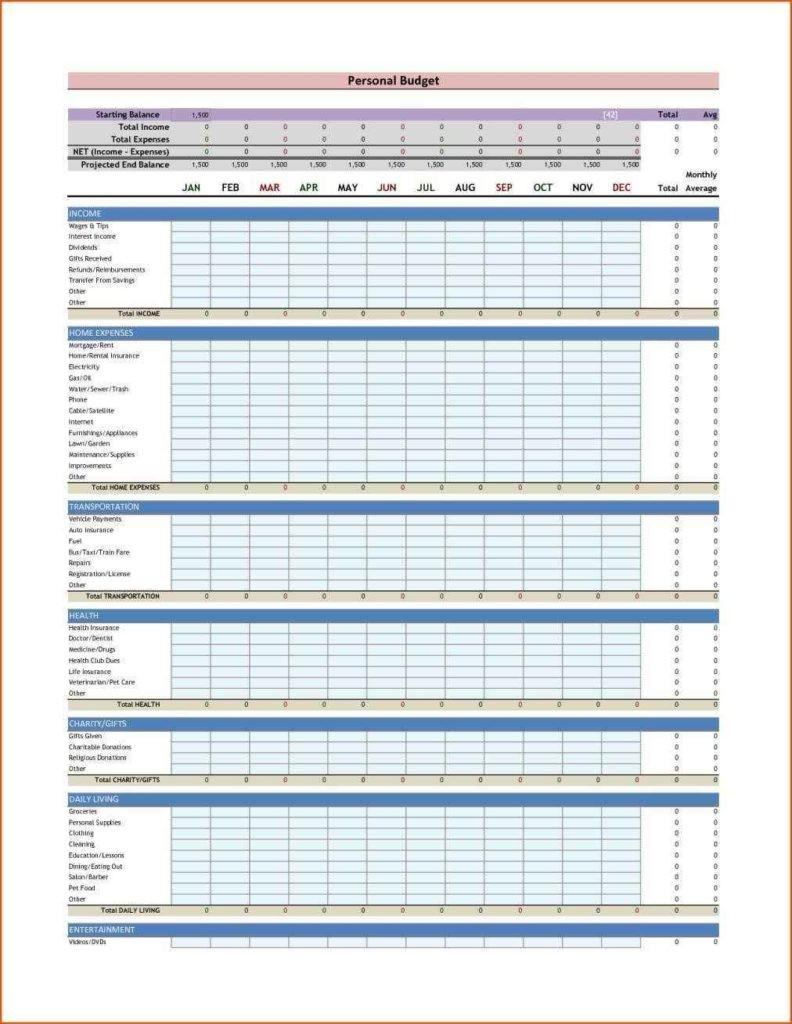

Excel Charitable Donation Spreadsheet —

Web discover the impact a charitable donation can have on your taxes. This publication is designed to help donors and appraisers determine the value of property (other than cash) that is given to qualified organizations. Web our bunching and tax savings calculator can help you determine if bunching contributions might provide you with more tax.

Excel Charitable Donation Spreadsheet throughout Charitable Donation

Web simply enter the amount you'd like to give and your federal tax bracket.*. The profits will receive a charitable contribution deduction of $33,248 this year. The internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this. This calculator determines.

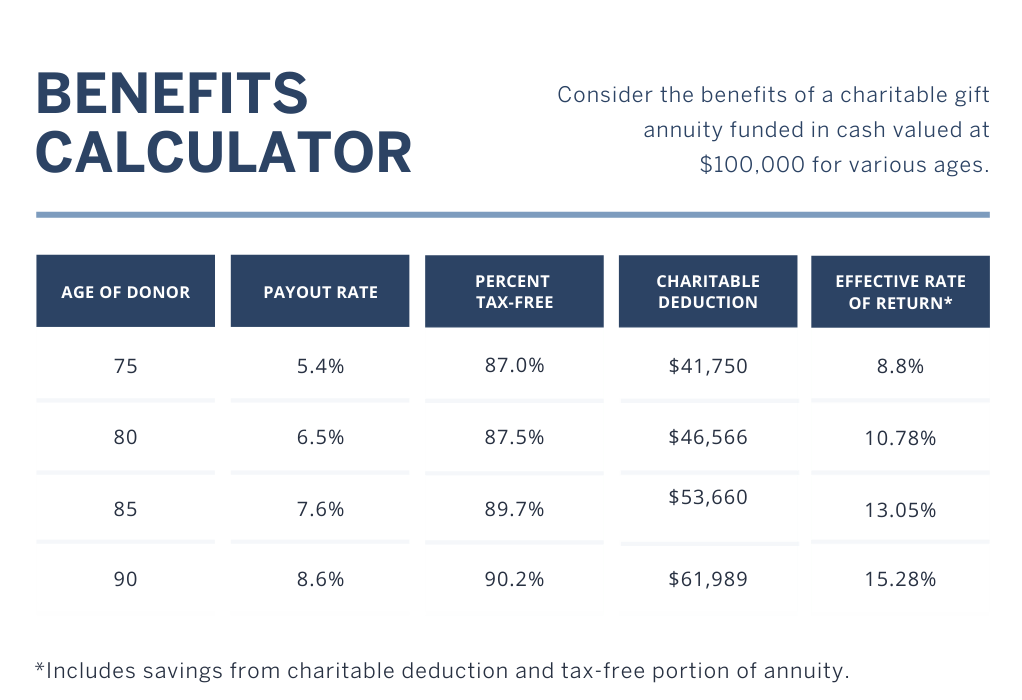

Diversify Your Portfolio with a Charitable Gift Annuity Southwestern

Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). The internal revenue service has a special new provision that will allow more people to easily deduct up to $300.

Excel Charitable Donation Spreadsheet —

If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). These are listed online at the irs exempt organizations. Web our bunching and tax savings calculator can help you determine if bunching contributions might provide you with more tax deductions. Use our interactive tool to see.

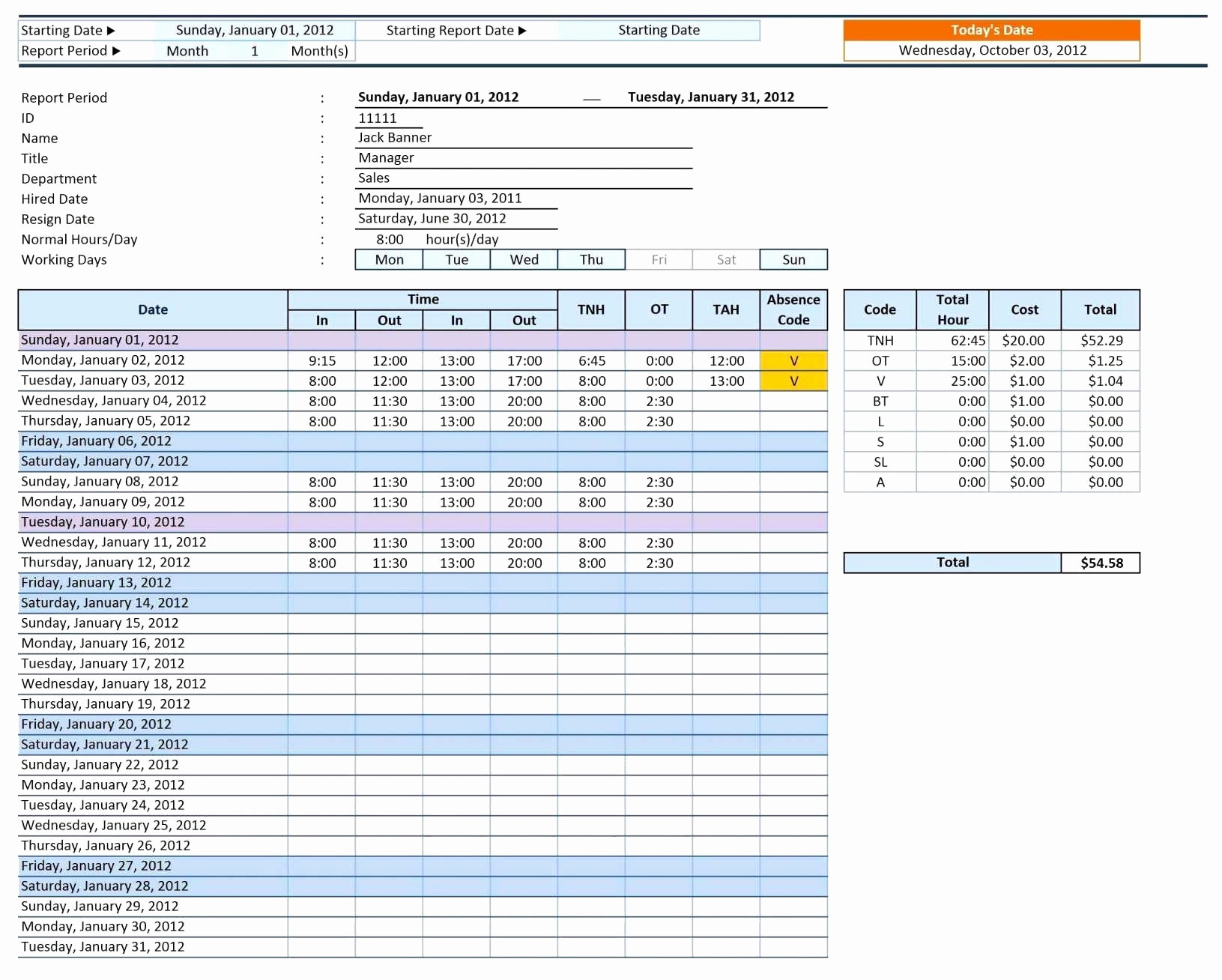

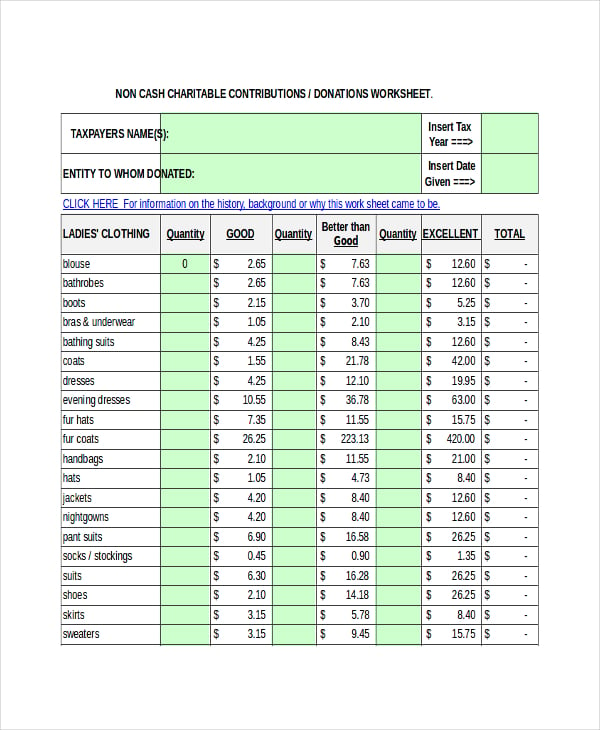

Non Cash Charitable Contributions Donations Worksheet

• to qualify as a tax deduction, your charitable contribution needs to be given to a 503 (c) organization. Each year they’ll receive a total. Web simply enter the amount you'd like to give and your federal tax bracket.*. Web if you use the standard deduction the calculator will include a charitable contribution deduction (of.

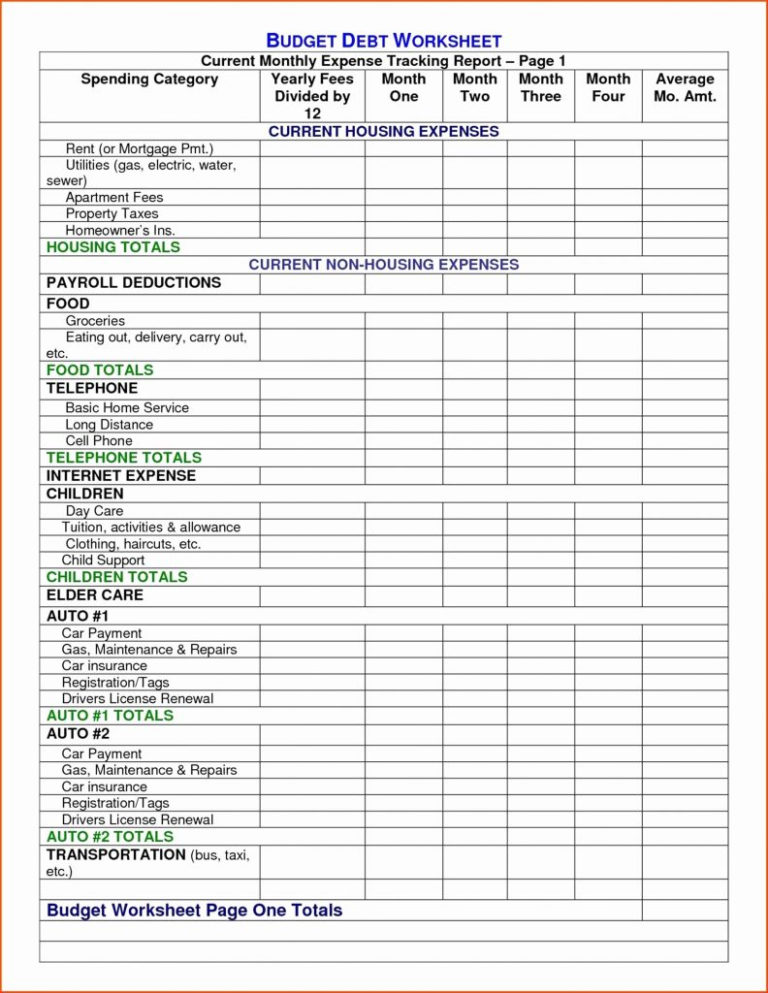

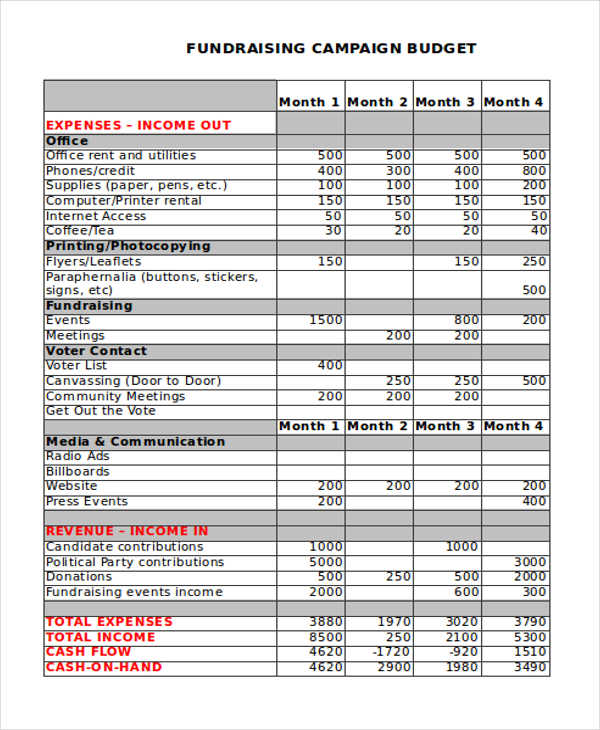

12+ Fundraising Budget Templates Free Sample, Example Format Download

Table 1 gives examples of. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). Web special $300 tax deduction. Cash contributions in 2023 and 2024 can make up 60% of your agi. The profits will receive a charitable contribution deduction of $33,248 this year. Web.

Charitable Giving Tax Savings Calculator Fidelity Charitable

If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). Each year they’ll receive a total. You can look up clothing, household goods furniture and appliances. Web discover the impact a charitable donation can have on your taxes. Web special $300 tax deduction. Web here’s an.

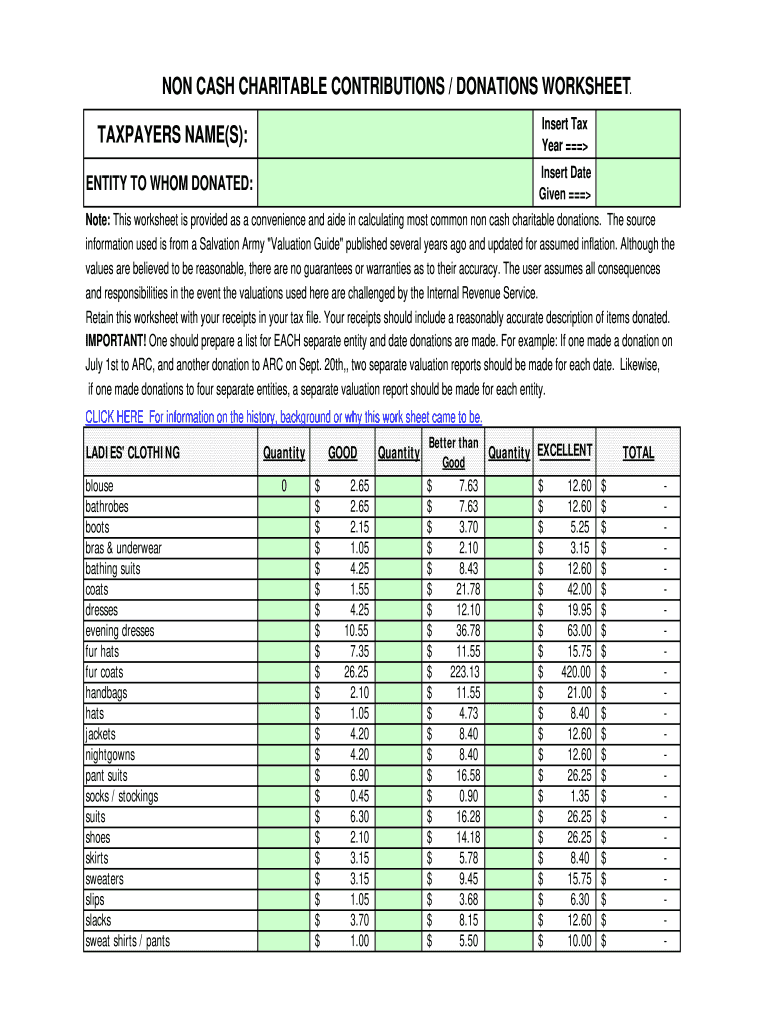

Donation value guide 2022 spreadsheet Fill out & sign online DocHub

You may be surprised to learn. Web if you use the standard deduction the calculator will include a charitable contribution deduction (of up to $300, $600 for married filing jointly). Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which will cost you.

Download Non Cash Charitable Contribution Worksheet for Free FormTemplate

This calculator determines how much you could save based on your donation and place of residence. You can deduct up to 60% of your. Web if you use the standard deduction the calculator will include a charitable contribution deduction (of up to $300, $600 for married filing jointly). Web simply enter the amount you'd like.

Excel Charitable Donation Spreadsheet —

The net cost of a charitable gift, especially for high incomes, may surprise you. You can deduct up to 60% of your. Cash contributions in 2023 and 2024 can make up 60% of your agi. You may be surprised to learn. If your agi is $60,000, the maximum amount you can deduct for charitable contributions.

Charitable Contribution Calculator Web simply enter the amount you'd like to give and your federal tax bracket.*. This calculator indicates the charitable income tax deduction available to donors making a current contribution to a currently offered u.s. Web your deduction for charitable contributions generally can't be more than 60% of your agi, but in some cases 20%, 30%, or 50% limits may apply. You may be surprised to learn. Web discover the impact a charitable donation can have on your taxes.

You Can Deduct Up To 60% Of Your.

Web simply enter the amount you'd like to give and your federal tax bracket.*. Web if you use the standard deduction the calculator will include a charitable contribution deduction (of up to $300, $600 for married filing jointly). This publication is designed to help donors and appraisers determine the value of property (other than cash) that is given to qualified organizations. Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving.

These Are Listed Online At The Irs Exempt Organizations.

Web your deduction for charitable contributions generally can't be more than 60% of your agi, but in some cases 20%, 30%, or 50% limits may apply. Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which will cost you at least $7,500. You may be surprised to learn. Web special $300 tax deduction.

Web Charitable Giving Tax Deduction Limits Are Set By The Irs As A Percentage Of Your Income.

Web monthly lifetime payments are to begin immediately. Web discover the impact a charitable donation can have on your taxes. The internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this. Web our bunching and tax savings calculator can help you determine if bunching contributions might provide you with more tax deductions.

Table 1 Gives Examples Of.

These tools will help you better understand how to use charitable giving as part of your investment portfolio. The profits will receive a charitable contribution deduction of $33,248 this year. Web charitable contribution calculators & tools. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60).