Charitable Contributions Calculator

Charitable Contributions Calculator - If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). The internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this. The above results are based on tax rates effective july 1, 2023. You can look up clothing, household goods furniture and appliances. You can deduct up to 60% of your.

Charitable giving tax savings for 2023 * indicates. Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. Web this publication is designed to help donors and appraisers determine the value of property (other than cash) that is given to qualified organizations. You can deduct up to 60% of your. It also explains what kind of. Web you may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. The profits will receive a charitable contribution deduction of $33,248 this year.

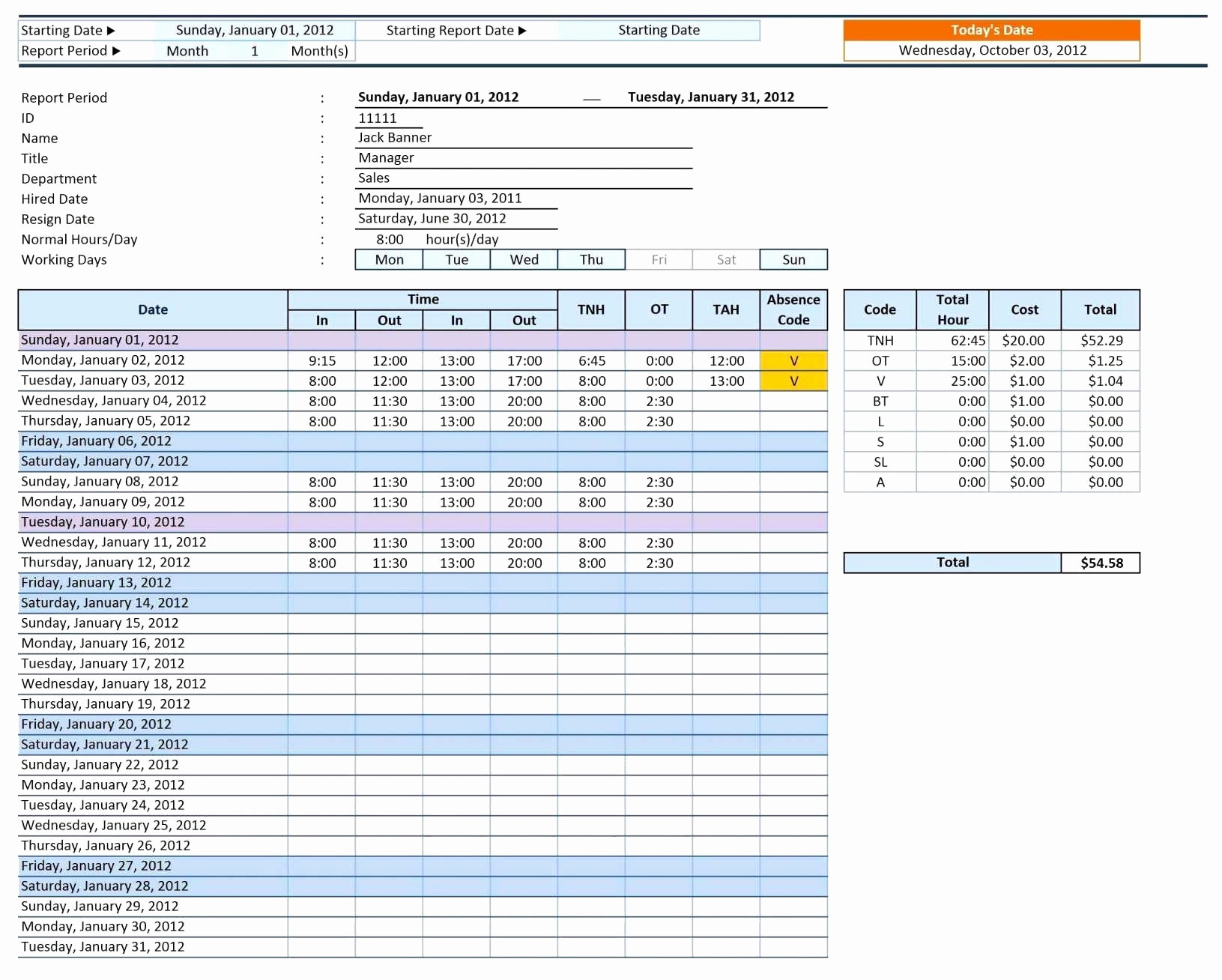

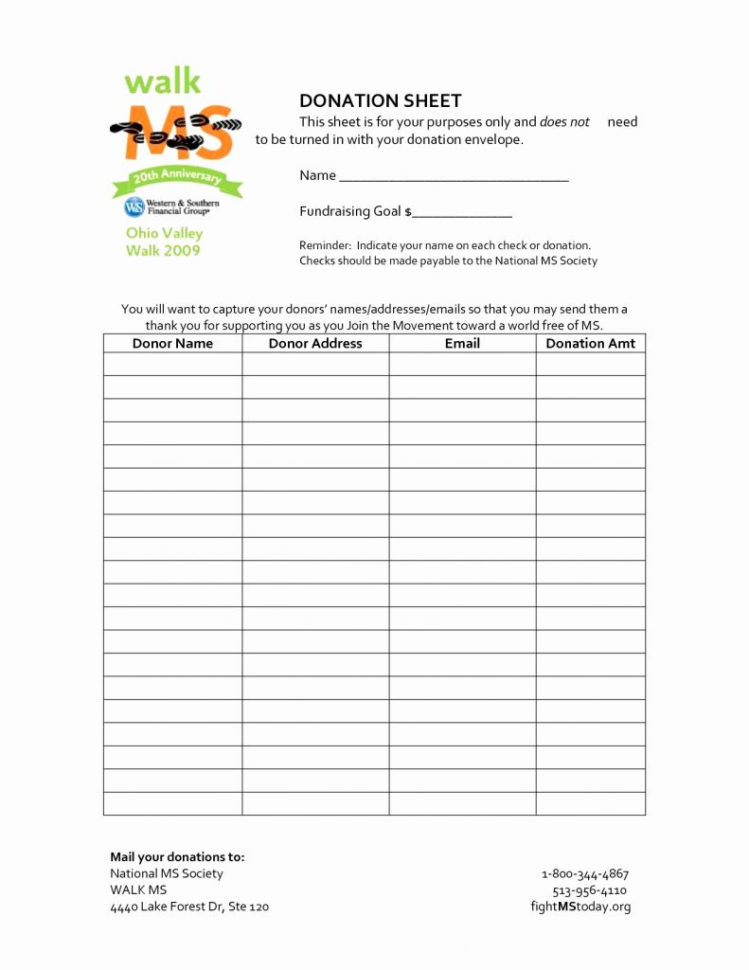

Excel Charitable Donation Spreadsheet —

Each year they’ll receive a total. Web this calculator determines how much you could save based on your donation and place of residence. Web this calculator sorts through the tax brackets and filing options to estimate the actual tax savings of your charitable gift. Web the calculator will display the net cost of the donation.

Charitable Giving Tax Savings Calculator Fidelity Charitable

The net cost of a charitable gift, especially for high incomes, may surprise you. Web charitable contribution calculators & tools. Web here’s an example of how the limit works: Web this calculator sorts through the tax brackets and filing options to estimate the actual tax savings of your charitable gift. The profits will receive a.

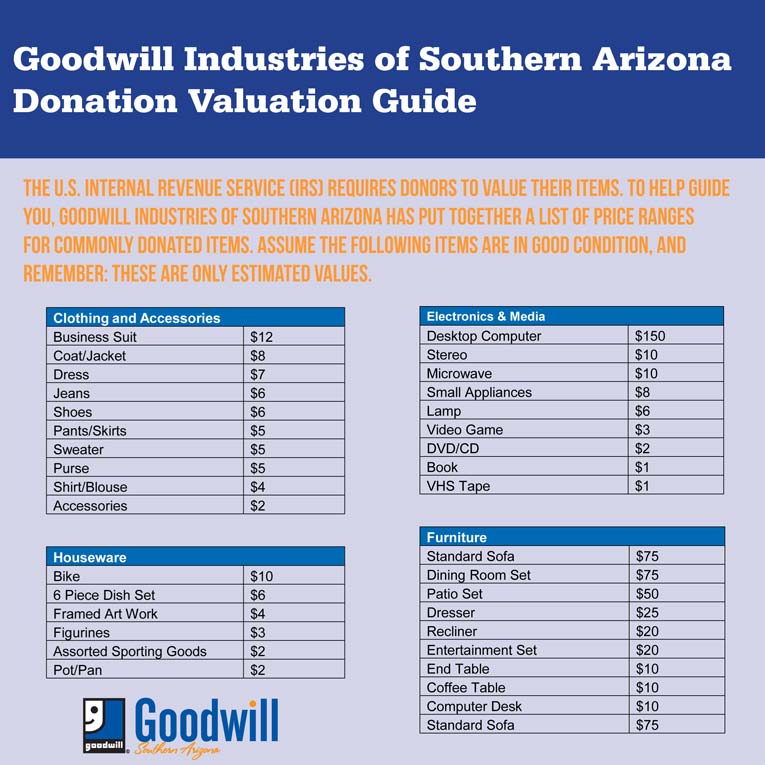

Donation Value Guide 2022 Spreadsheet Fill Online, Printable

Web overview learn how to get the biggest tax savings when making charitable contributions of cash or checks, household goods, cars or appreciated property. The net cost of a charitable gift, especially for high incomes, may surprise you. The amount of your charitable contribution to charity x is. The internal revenue service has a special.

Non Cash Charitable Contributions Donations Worksheet

Web charitable contribution calculators & tools. Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. You can look up clothing, household goods furniture and appliances. You may be surprised to learn that.

Excel Charitable Donation Spreadsheet —

The above results are based on tax rates effective july 1, 2023. Each year they’ll receive a total. You may be surprised to learn that you can afford to be even more generous than you thought. Web our bunching and tax savings calculator can help you determine if bunching contributions might provide you with more.

Calculator Isolated with Word Donation on Lcd Display Stock Image

Web overview learn how to get the biggest tax savings when making charitable contributions of cash or checks, household goods, cars or appreciated property. You may be surprised to learn that you can afford to be even more generous than you thought. The profits will receive a charitable contribution deduction of $33,248 this year. Generally,.

How to Maximize Your Charity Tax Deductible Donation WealthFit

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. Generally, you may deduct up to. Not only does the charity benefit,. These tools will help you better understand how to use charitable giving as part of your investment portfolio. Web the calculator will display the net cost of.

Download Non Cash Charitable Contribution Worksheet for Free FormTemplate

Web this publication is designed to help donors and appraisers determine the value of property (other than cash) that is given to qualified organizations. Web you may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. You can look up clothing, household goods furniture and appliances. Web in.

Estimate the Value of Your Donation Goodwill Industries of Southern

Not only does the charity benefit,. Web 1.your deduction for charitable contributions generally can't be more than 60% of your adjusted gross income (agi), but in some cases 20%, 30%, or 50% limits may apply. Web the calculator will display the net cost of the donation and the tax savings. You may be surprised to.

Excel Charitable Donation Spreadsheet throughout Charitable Donation

Web our bunching and tax savings calculator can help you determine if bunching contributions might provide you with more tax deductions. You can deduct up to 60% of your. Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. Web 1.your deduction for charitable contributions generally can't be more.

Charitable Contributions Calculator Charitable giving tax savings for 2023 * indicates. Web special $300 tax deduction. It also explains what kind of. The above results are based on tax rates effective july 1, 2023. Web this publication is designed to help donors and appraisers determine the value of property (other than cash) that is given to qualified organizations.

You Can Deduct Up To 60% Of Your.

Generally, you may deduct up to. You may be surprised to learn that you can afford to be even more generous than you thought. Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. Web updated january 08, 2024 reviewed by lea d.

These Tools Will Help You Better Understand How To Use Charitable Giving As Part Of Your Investment Portfolio.

The internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this. The above results are based on tax rates effective july 1, 2023. Web charitable contribution calculators & tools. It also explains what kind of.

Use Our Interactive Tool To See How Giving Can Help You Save On.

Web the calculator will display the net cost of the donation and the tax savings. You can look up clothing, household goods furniture and appliances. Each year they’ll receive a total. The profits will receive a charitable contribution deduction of $33,248 this year.

Web This Calculator Determines How Much You Could Save Based On Your Donation And Place Of Residence.

Web here’s an example of how the limit works: The amount of your charitable contribution to charity x is. Charitable giving tax savings for 2023 * indicates. Web in return for your payment you receive or expect to receive a state tax credit of 70% of your $1,000 contribution.