Charitable Donation Calculator

Charitable Donation Calculator - Web charitable giving tax deduction limits are set by the irs as a percentage of your income. Enter the donation amount in the box below and press the calculate button. Web fair market value calculator use the slider to estimate the fair market value of an item. It includes low and high estimates. Web charitable contribution calculators & tools.

Enter the number of items you donate and get a table of values. Web you subtract that to determine a deduction of $40. Web charitable tax deduction calculator. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). You may be surprised to learn that you can afford to be even more generous than you thought. Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which will cost you at least $7,500. Web enter the number of years you will make these subsequent contributions to your account.

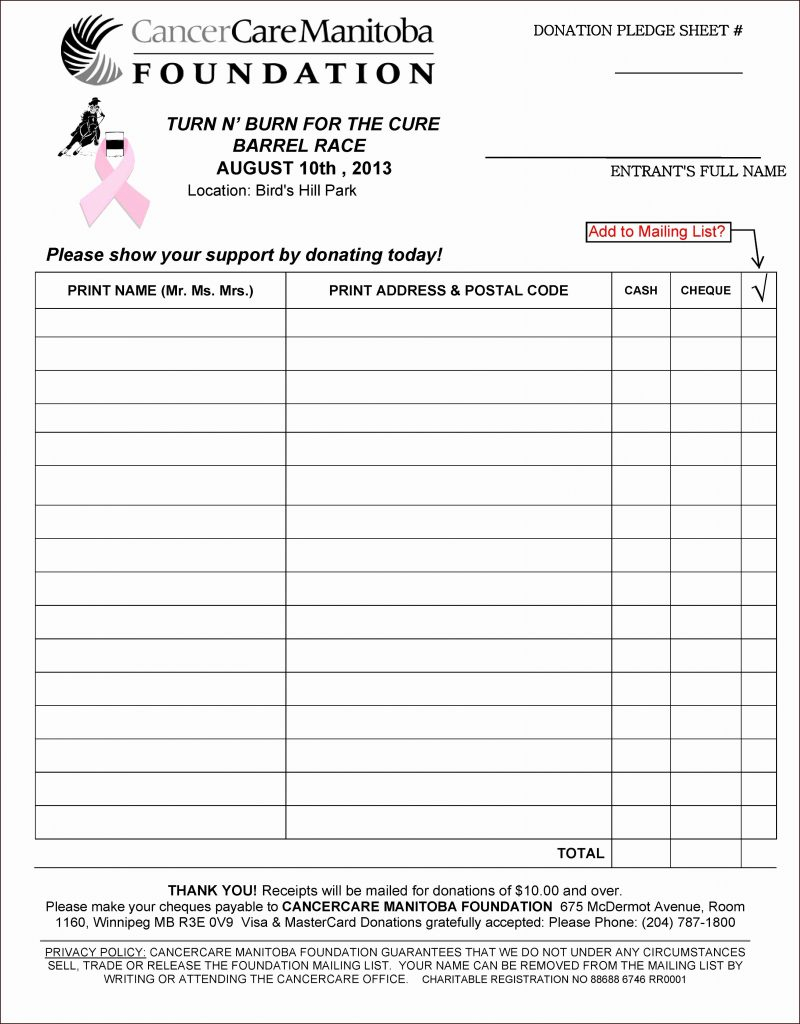

Charitable Donations Tax Credits Calculator CanadaHelps

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. Web charitable tax deduction calculator. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). Use our interactive tool to see how giving can help you save on. If you.

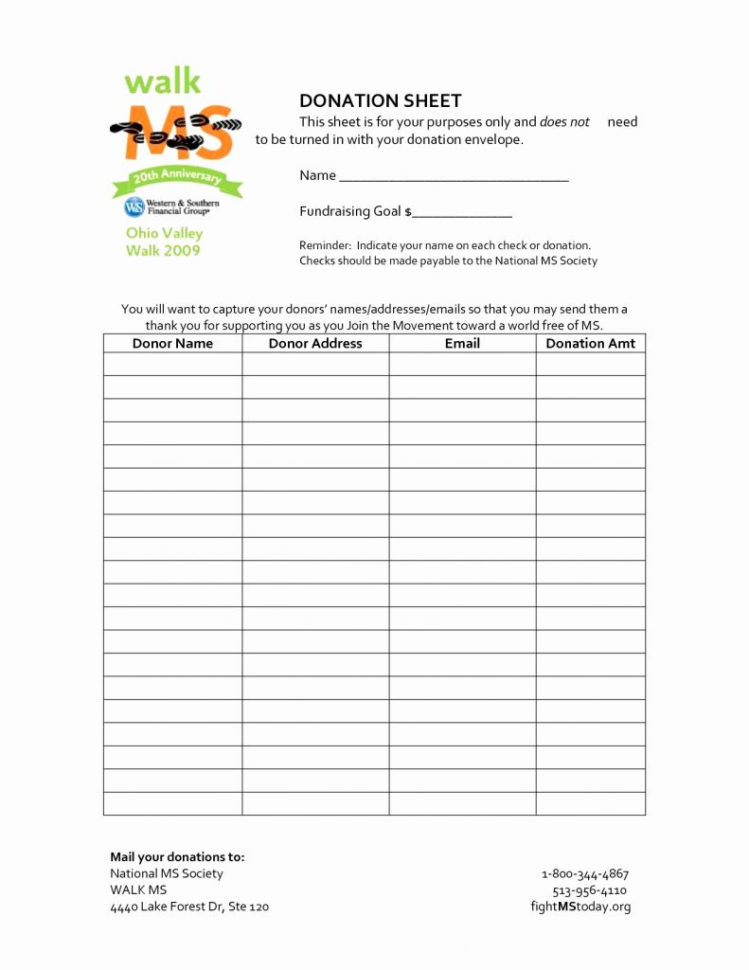

Charitable Donations Tax Deduction Calculator

Any donation you made on or by december 31, 2008 will qualify as a deduction for 2008. Web this calculator determines how much you could save based on your donation and place of residence. Any donations made in 2009 (even at 12:01 a.m. Enter the donation amount in the box below and press the calculate.

Excel Charitable Donation Spreadsheet Spreadsheet Downloa excel

Enter the donation amount in the box below and press the calculate button. It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund. Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which.

Charitable Remainder Trust Calculator CRUT Calculator

These tools will help you better understand how to use charitable giving as part of your investment portfolio. Enter the number of items you donate and get a table of values. Web charitable giving tax deduction limits are set by the irs as a percentage of your income. It's true that if all you gave.

Donation Value Guide 2018 Spreadsheet Pertaining To Charitable Donation

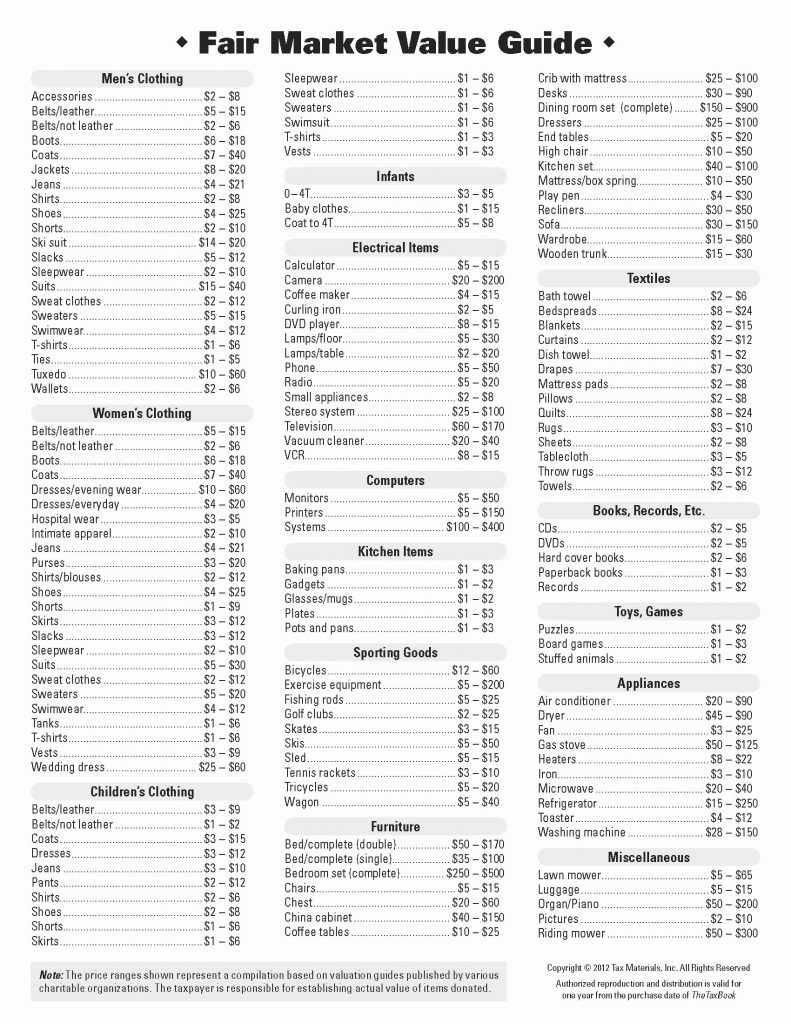

It includes low and high estimates. What percent of your account balance will you recommend for grants to charity each. If you do not itemize your taxes and you make a small charitable donation, it will likely not be tax deductible.for 2024, the standard deduction. Web charitable donation calculator this calculator helps you test different.

Excel Charitable Donation Spreadsheet —

It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund. You can deduct up to 60% of your. Web the calculator has many inherent limitations, and individual results may vary. If you do not itemize your taxes and you make a small charitable donation, it.

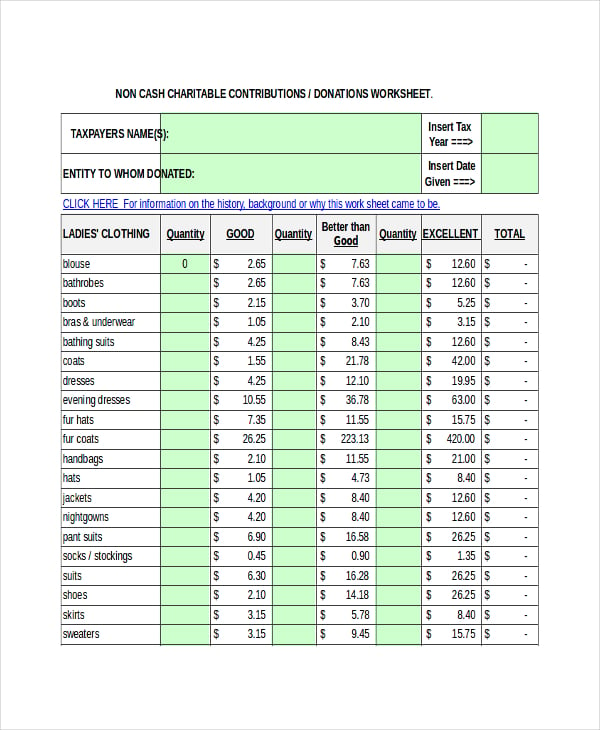

Non Cash Charitable Contributions Donations Worksheet

Enter the number of items you donate and get a table of values. Use our interactive tool to see how giving can help you save on. Enter the donation amount in the box below and press the calculate button. You may deduct charitable contributions of money or property made to qualified. The calculation of potential.

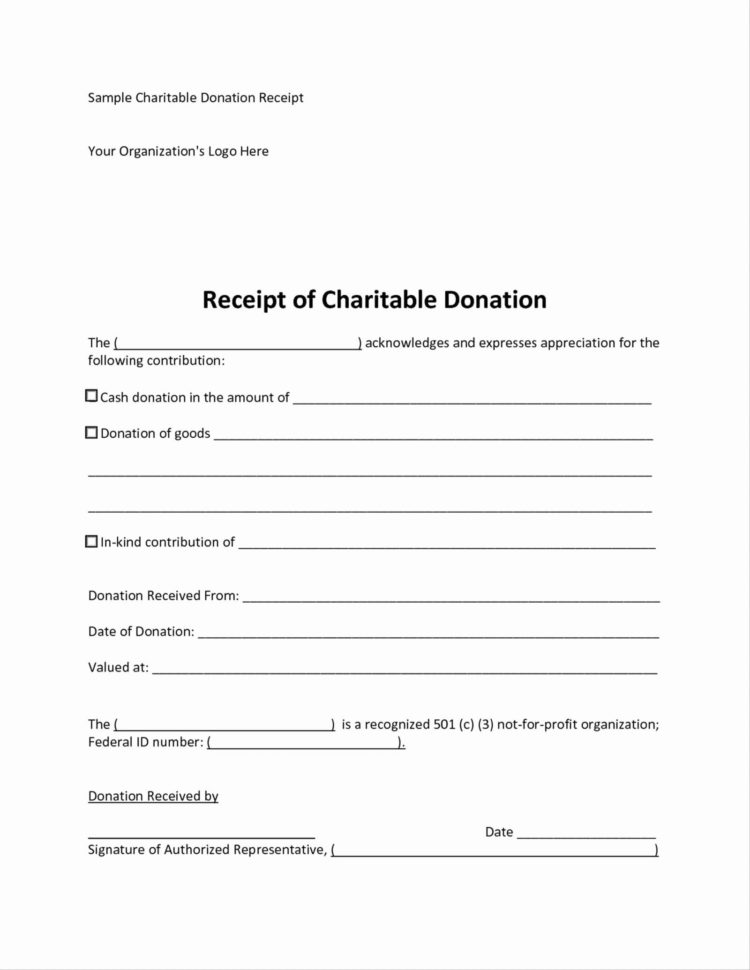

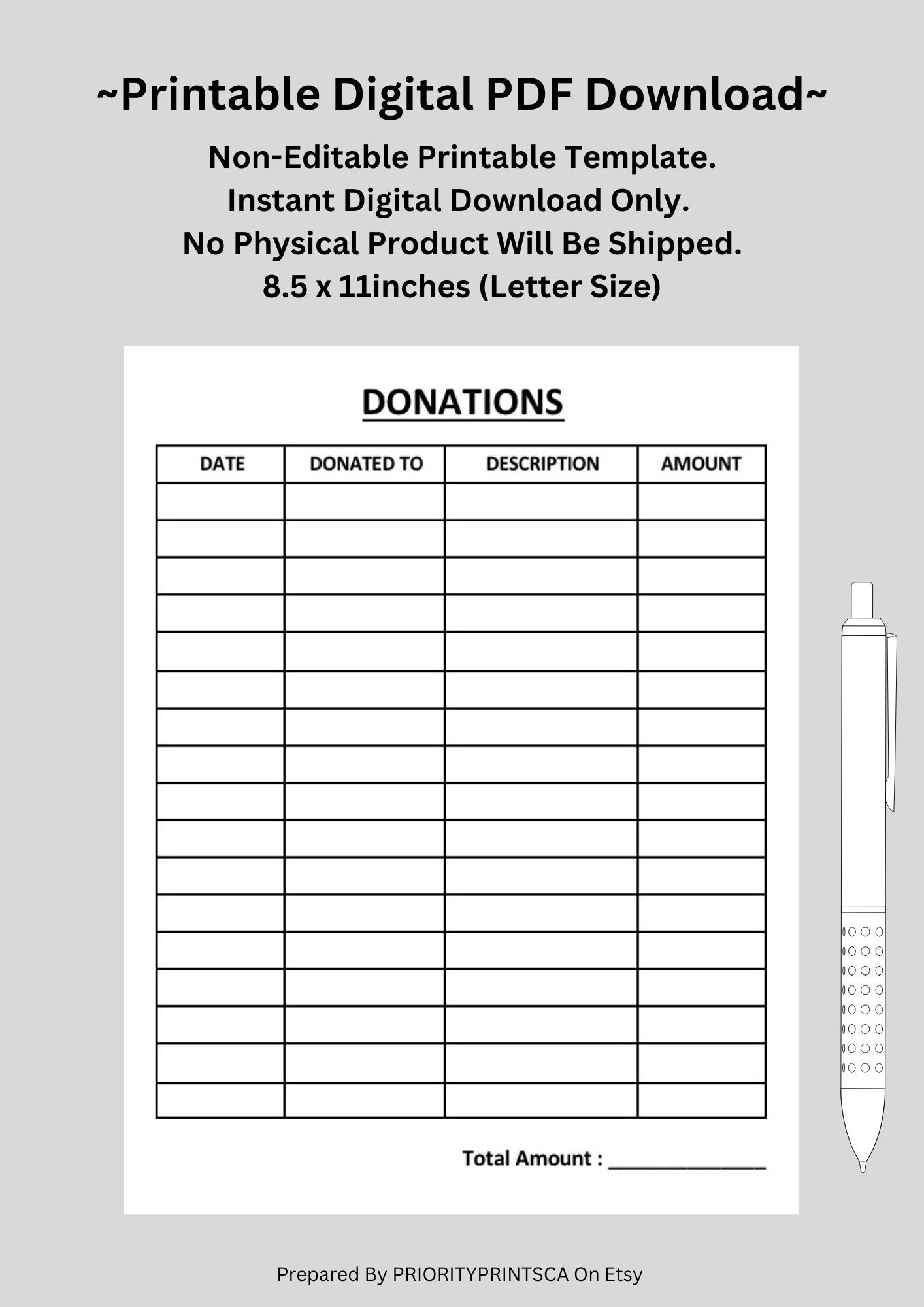

Printable Donation Form. Donation Tracker. Donation Log. Etsy

If you do not itemize your taxes and you make a small charitable donation, it will likely not be tax deductible.for 2024, the standard deduction. Web charitable contribution calculators & tools. This will reduce taxes in the tax. Enter the number of items you donate and get a table of values. Check out this tool.

Charitable Donation Spreadsheet throughout Charitable Donation

It includes low and high estimates. When a person makes a charitable donation, that donation can be deducted from the individual's income. Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. Web learn how to use the donation impact calculator to see how your donations support goodwill's programs.

Irs Donation Values Spreadsheet in Charitable Donation Worksheet And

The calculation of potential income tax savings from avoided capital gain realization is based. Web you subtract that to determine a deduction of $40. You may deduct charitable contributions of money or property made to qualified. Web the calculator will display the net cost of the donation and the tax savings. Web learn how to.

Charitable Donation Calculator It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund. The calculation of potential income tax savings from avoided capital gain realization is based. Web enter the number of years you will make these subsequent contributions to your account. Web charitable tax deduction calculator. Web here’s an example of how the limit works:

Any Donation You Made On Or By December 31, 2008 Will Qualify As A Deduction For 2008.

Cash contributions in 2023 and 2024 can make up 60% of your agi. Web charitable tax deduction calculator. If you do not itemize your taxes and you make a small charitable donation, it will likely not be tax deductible.for 2024, the standard deduction. Use our interactive tool to see how giving can help you save on.

On New Year's Day) Go Towards.

Web charitable contribution calculators & tools. Web enter the number of years you will make these subsequent contributions to your account. Web charitable giving tax deduction limits are set by the irs as a percentage of your income. These tools will help you better understand how to use charitable giving as part of your investment portfolio.

Enter The Number Of Items You Donate And Get A Table Of Values.

Web you subtract that to determine a deduction of $40. Web here’s an example of how the limit works: Only large donations are significant enough to deduct. Web charitable donation calculator this calculator helps you test different scenarios and develop a plan for your charitable giving.

Web The Calculator Has Many Inherent Limitations, And Individual Results May Vary.

It includes low and high estimates. What percent of your account balance will you recommend for grants to charity each. Any donations made in 2009 (even at 12:01 a.m. When a person makes a charitable donation, that donation can be deducted from the individual's income.