Charitable Donation Tax Deduction Calculator

Charitable Donation Tax Deduction Calculator - How much can you deduct for the gently used goods you donate to. $27,700 for married couples filing jointly or qualifying surviving spouse. Each year they’ll receive a total. The profits will receive a charitable contribution deduction of $33,248 this year. The only benefits you receive are token items bearing the organization’s logo, like mugs.

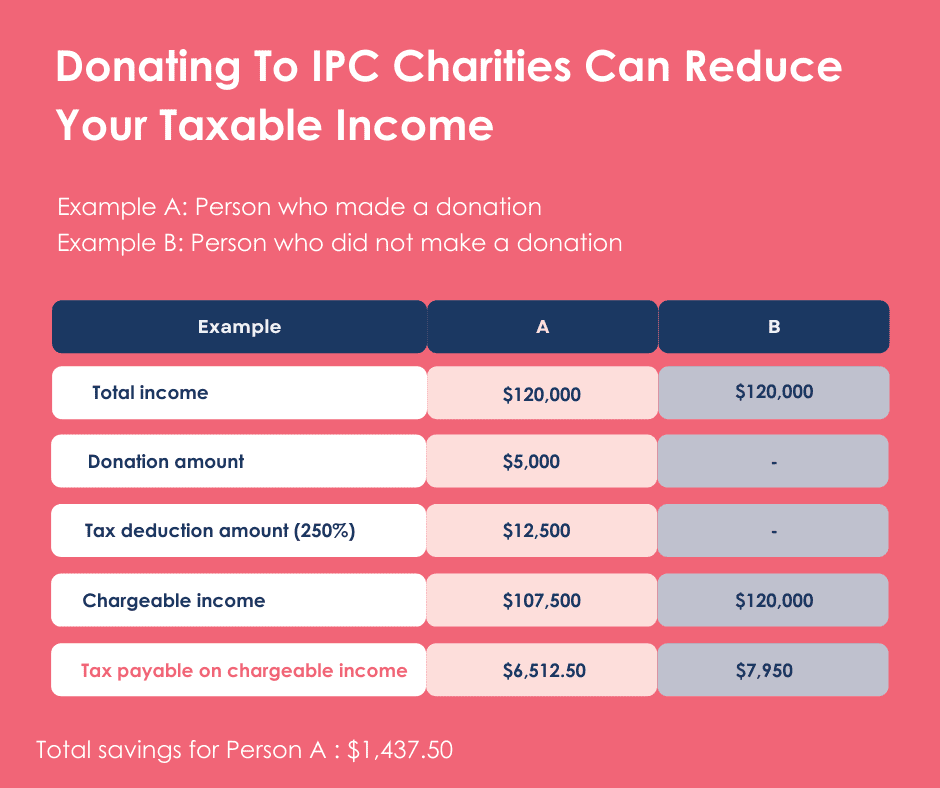

The payment is at least $52.50 for 2023. In the united states, both. Web discover the impact a charitable donation can have on your taxes. Web married, filing separately. Web charitable tax deduction calculator when a person makes a charitable donation, that donation can be deducted from the individual's income. The only benefits you receive are token items bearing the organization’s logo, like mugs. This calculator determines how much you could save based on your donation and place of residence.

Charitable Donations Tax Deduction Calculator

If you claim a deduction of $500 or more for a used item. Only large donations are significant enough to deduct. How much can you deduct for the gently used goods you donate to. The only benefits you receive are token items bearing the organization’s logo, like mugs. Web the charitable giving tax savings calculator.

The Basics of Tax Deductions for Charitable Donations

Web charitable tax deduction calculator when a person makes a charitable donation, that donation can be deducted from the individual's income. This will reduce taxes in the tax. If you claim a deduction of $500 or more for a used item. You may be surprised to learn that you can afford to be even more.

Maximize Tax Deductions for Charitable Donations TaxAct

It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund. Use our interactive tool to see how giving can help you save on. Donate for tax benefits2020 top rated nonprofit In the united states, both. $13,850 for single or married filing separately. Web the irs.

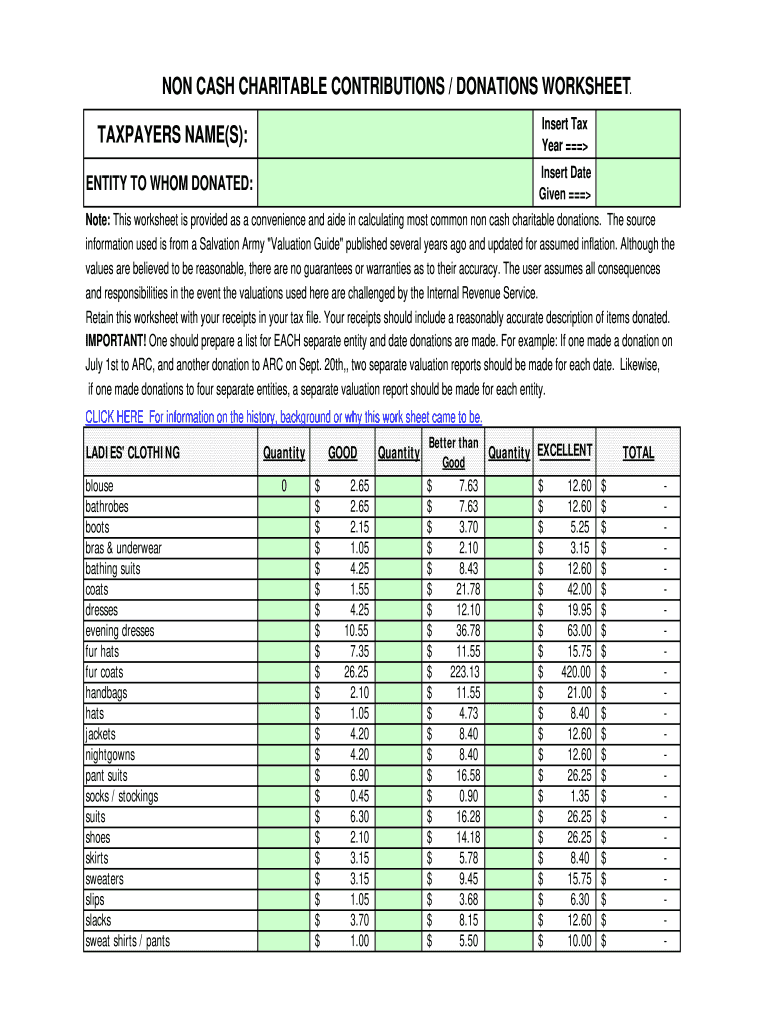

Donation Value Guide 2022 Spreadsheet Fill Online, Printable

If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). To get any benefit from itemizing, your deductible personal. $27,700 for married couples filing jointly or qualifying surviving spouse. Web in general, you can deduct up to 60% of your adjusted gross income via charitable donations,.

Charitable Giving Tax Savings Calculator Fidelity Charitable

Web a charitable donation is essentially a contribution, either in cash or property, given to a nonprofit organization to support its mission. $13,850 for single or married filing separately. The only benefits you receive are token items bearing the organization’s logo, like mugs. The profits will receive a charitable contribution deduction of $33,248 this year..

How to Maximize Your Charity Tax Deductible Donation WealthFit

Web married, filing separately. Web the internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t. Web charitable tax deduction calculator when a person makes a charitable donation, that donation can be deducted from the.

Reduce Your Tax With Charitable Tax Deductions

Web discover the impact a charitable donation can have on your taxes. Web the calculator will display the net cost of the donation and the tax savings. Web a charitable donation is essentially a contribution, either in cash or property, given to a nonprofit organization to support its mission. Web married, filing separately. If you.

Section 80G Deduction For Donations To Charitable Institutions Tax2win

Web when utilizing these resources, please review the assumptions to determine if results are applicable to your current tax situation. Web charitable tax deduction calculator when a person makes a charitable donation, that donation can be deducted from the individual's income. Cash contributions in 2023 and 2024 can make up 60% of your agi. It's.

Tax Deductible Donations Reduce Your Tax Charity Tax Calculator

Web a charitable donation is essentially a contribution, either in cash or property, given to a nonprofit organization to support its mission. Donate for tax benefits2020 top rated nonprofit Web discover the impact a charitable donation can have on your taxes. Web the irs says donated clothing and other household goods must be “in good.

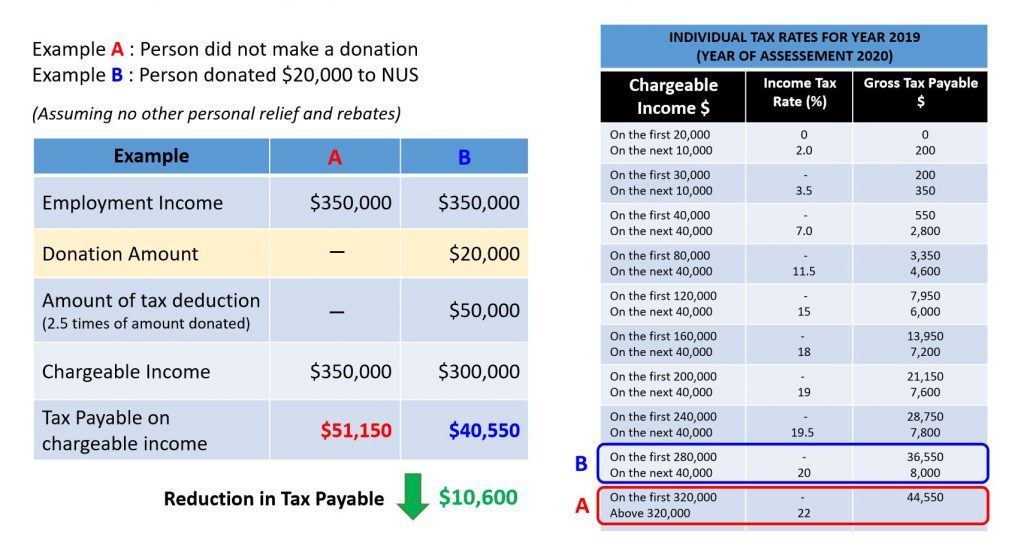

Donation Tax Calculator Giving NUS Yong Loo Lin School of Medicine

$27,700 for married couples filing jointly or qualifying surviving spouse. How much can you deduct for the gently used goods you donate to. The payment is at least $52.50 for 2023. Web monthly lifetime payments are to begin immediately. Each year they’ll receive a total. Web when utilizing these resources, please review the assumptions to.

Charitable Donation Tax Deduction Calculator The only benefits you receive are token items bearing the organization’s logo, like mugs. Web the internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t. Use our interactive tool to see how giving can help you save on. You may be surprised to learn that you can afford to be even more generous than you thought. Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to get over the.

Web The Outcome Is Different If The Couple Donate $24,000 Every Two Years Rather Than $12,000 Every Year.

Web the standard deduction for 2023 is: In the united states, both. Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to get over the. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60).

Only Large Donations Are Significant Enough To Deduct.

It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund. Web when utilizing these resources, please review the assumptions to determine if results are applicable to your current tax situation. The larger donation plus their $10,000 salt deduction means it makes. Web a charitable donation is essentially a contribution, either in cash or property, given to a nonprofit organization to support its mission.

Each Year They’ll Receive A Total.

The result is your charitable contribution deduction to charity x can’t exceed. This calculator determines how much you could save based on your donation and place of residence. If you claim a deduction of $500 or more for a used item. Web discover the impact a charitable donation can have on your taxes.

Web For The 2022 Tax Year, The Standard Deduction Is $12,950 For Single Filers And $25,900 For Married Couples Filing Jointly, And In 2023 That Will Increase To $13,850.

$13,850 for single or married filing separately. This will reduce taxes in the tax. Web the irs says donated clothing and other household goods must be “in good used condition or better.”. Donate for tax benefits2020 top rated nonprofit

:max_bytes(150000):strip_icc()/NoTaxesonDividendsandCapitalGainsforMillionsofAmericanHouseholds-56a5dcdd5f9b58b7d0dec9d5.jpg)