Charitable Giving Deduction Calculator

Charitable Giving Deduction Calculator - This calculator determines how much you could save based on your donation and place of residence. These tools will help you better understand how to use charitable giving as part of your investment portfolio. Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to get over the. Vanguard.com has been visited by 100k+ users in the past month Web irs automatic charitable giving deduction.

Web discover the impact a charitable donation can have on your taxes. Web charitable contribution calculators & tools. Charitable contributions to qualified organizations may be deductible if you itemize deductions on schedule a (form 1040),. Only large donations are significant enough to deduct. $13,850 for single or married filing separately. One strategy is to make a contribution to the charity in. Web irs automatic charitable giving deduction.

Charitable Donations Tax Deduction Calculator

Identify tax advantages with the securities donation calculator or find an asset. In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%,. Web here’s an example of how the limit works: Web the day before the senate is set to begin voting.

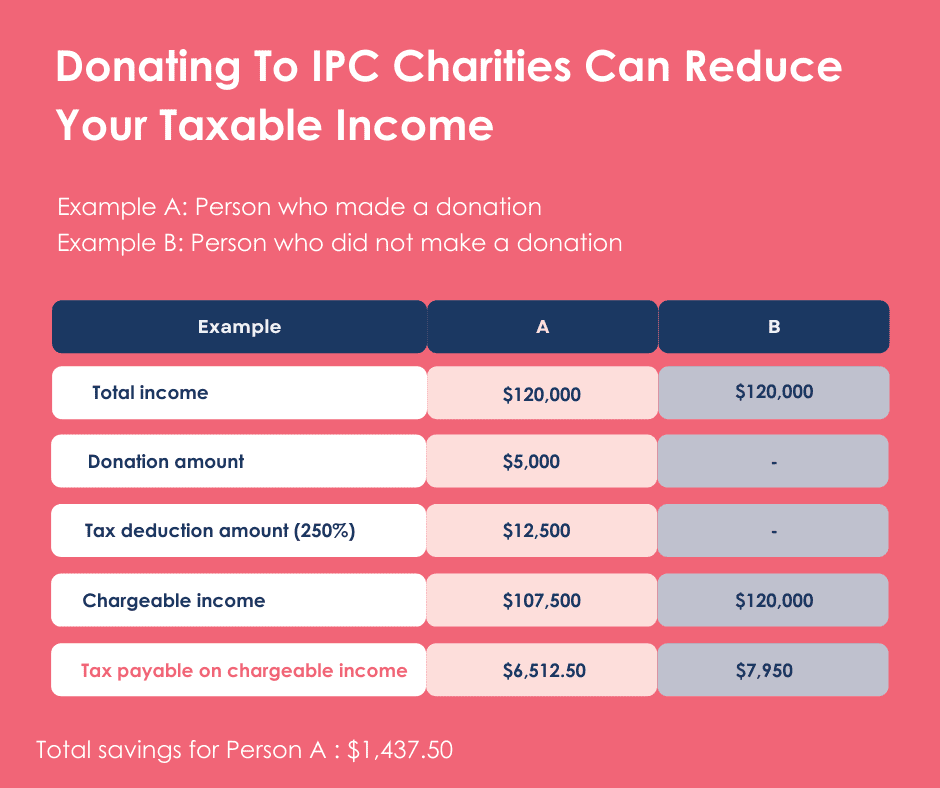

Reduce Your Tax With Charitable Tax Deductions

Web the calculator will display the net cost of the donation and the tax savings. Web discover the impact a charitable donation can have on your taxes. Single and married filing separate: Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. Web for the 2022 tax year, the.

How to Calculate Deductions for Charitable Donations Wendroff

Identify tax advantages with the securities donation calculator or find an asset. Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to get over the. You can deduct up to 60% of your. Web for the 2022 tax year,.

How to Maximize Your Charity Tax Deductible Donation WealthFit

Identify tax advantages with the securities donation calculator or find an asset. $27,700 for married couples filing jointly or qualifying surviving spouse. You can deduct up to 60% of your. Use our interactive tool to see how giving can help you save on. Web the charitable giving tax savings calculator demonstrates the tax savings power.

Charitable Remainder Trusts 3 Calculating Deductions YouTube

$27,700 for married couples filing jointly or qualifying surviving spouse. Filing status 2006 2007 2008; These tools will help you better understand how to use charitable giving as part of your investment portfolio. Web here’s an example of how the limit works: This will reduce taxes in the tax. Web the day before the senate.

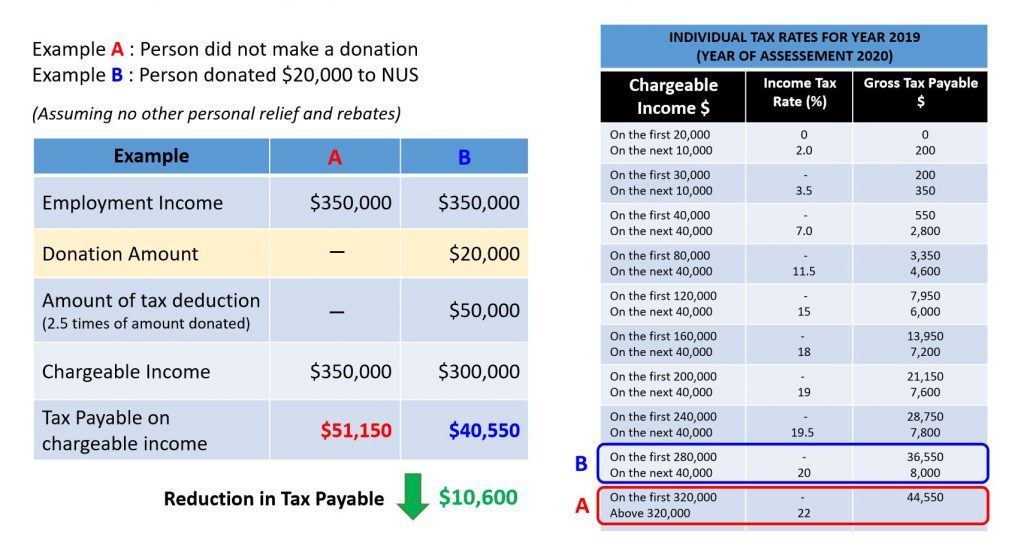

Donation Tax Calculator Giving NUS Yong Loo Lin School of Medicine

One strategy is to make a contribution to the charity in. These tools will help you better understand how to use charitable giving as part of your investment portfolio. Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to.

Charitable Giving Tax Savings Calculator Fidelity Charitable

One strategy is to make a contribution to the charity in. Web discover the impact a charitable donation can have on your taxes. Because their total deduction amount is below the. Web the day before the senate is set to begin voting on a $95.3 billion foreign aid package that would provide for israel and.

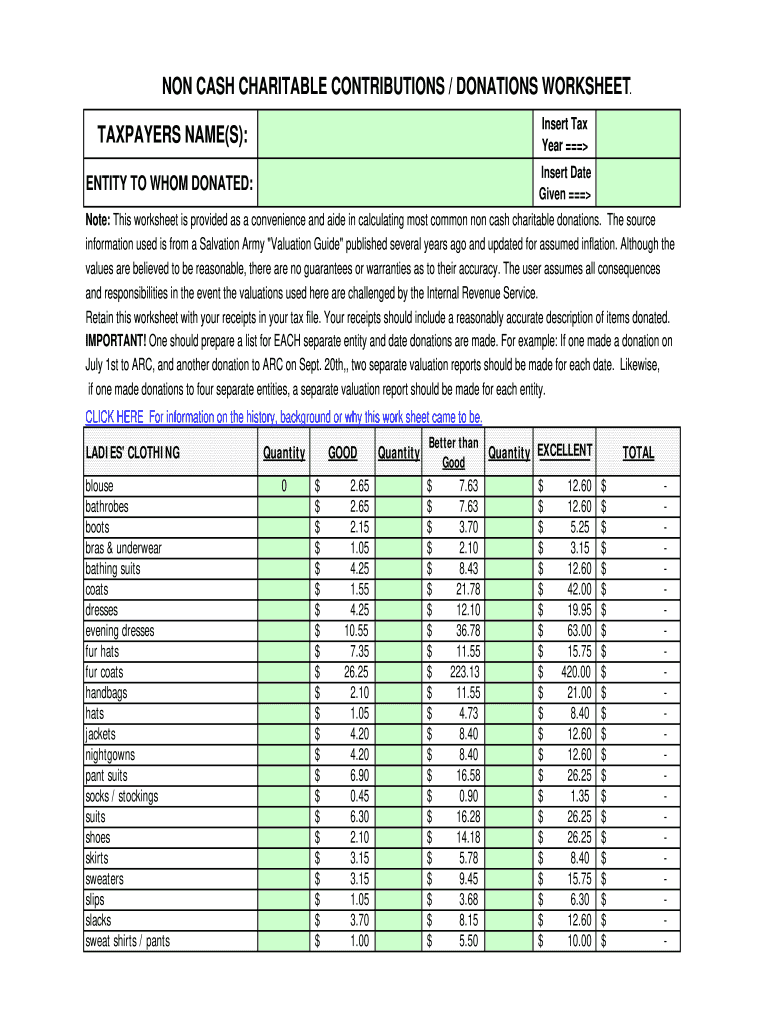

Donation value guide 2022 spreadsheet Fill out & sign online DocHub

You may be surprised to learn that you can afford to be even more generous than you thought. Web for the 2022 tax year, the standard deduction is $12,950 for single filers and $25,900 for married couples filing jointly, and in 2023 that will increase to $13,850. Vanguard.com has been visited by 100k+ users in.

iCLAT Calculator Determine IMMEDIATE Charitable Deduction & Resulting

$13,850 for single or married filing separately. This calculator determines how much you could save based on your donation and place of residence. Web here’s an example of how the limit works: Web charitable tax deduction calculator when a person makes a charitable donation, that donation can be deducted from the individual's income. Web for.

Charitable Tax Deduction

Because their total deduction amount is below the. Web the day before the senate is set to begin voting on a $95.3 billion foreign aid package that would provide for israel and ukraine, former president donald trump on. Charitable contributions to qualified organizations may be deductible if you itemize deductions on schedule a (form 1040),..

Charitable Giving Deduction Calculator Web the calculator will display the net cost of the donation and the tax savings. Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to get over the. Only large donations are significant enough to deduct. Web the standard deduction for 2023 is: Vanguard.com has been visited by 100k+ users in the past month

Use Our Interactive Tool To See How Giving Can Help You Save On.

One strategy is to make a contribution to the charity in. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). If you do not itemize your taxes and you make a small charitable donation, it will likely not be tax deductible.for 2024, the standard deduction. Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving.

$13,850 For Single Or Married Filing Separately.

Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to get over the. Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which will cost you at least $7,500. Web the standard deduction for 2023 is: Web the calculator will display the net cost of the donation and the tax savings.

Web Several Charitable Giving Strategies Generate An Additional Benefit:

Web charitable contribution calculators & tools. Web irs automatic charitable giving deduction. These tools will help you better understand how to use charitable giving as part of your investment portfolio. It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund.

This Calculator Determines How Much You Could Save Based On Your Donation And Place Of Residence.

Only large donations are significant enough to deduct. This will reduce taxes in the tax. Donated goods and fmv charitable contribution deductions are allowed. Identify tax advantages with the securities donation calculator or find an asset.