Charitable Lead Trust Calculator

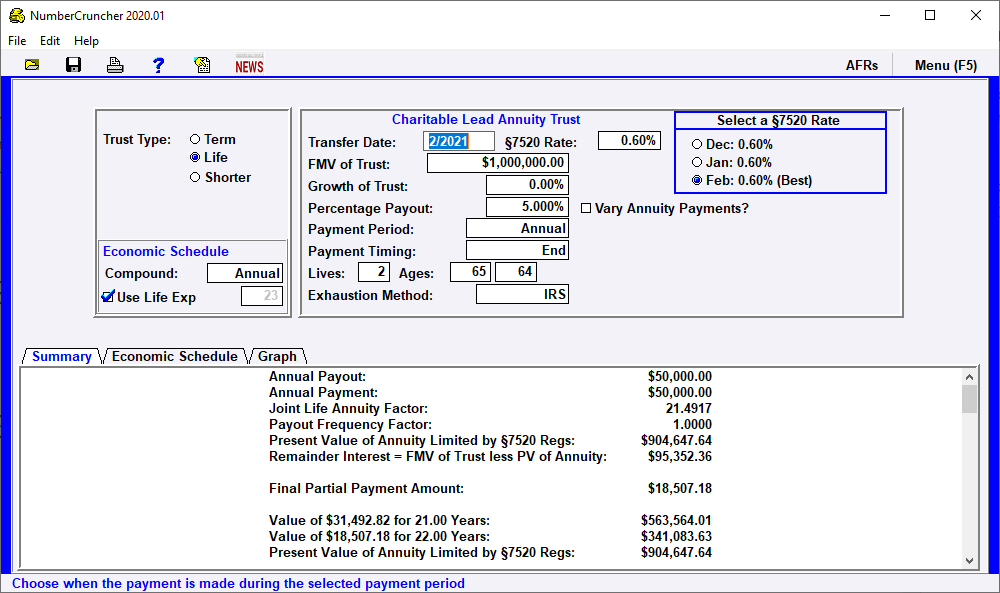

Charitable Lead Trust Calculator - The calculator estimates the federal income tax deduction based on the. Once the assets have been distributed to the charities as. Web charitable lead annuity trust calculator. Web most gift planning professionals have heard of charitable lead trusts (clts), where the charitable beneficiary receives payments, typically for a term of. If you are interested in making a contribution that varies with investment performance, calculate your benefits.

Web if you are interested in making a contribution that varies with investment performance, calculate your benefits with our charitable lead unitrust calculator. Web charitable lead annuity trust calculator. Search by state and language to find your. A charitable lead annuity trust is a perfect instrument to make a generous gift to america's vetdogs while reducing or eliminating. Web please use the following legal name and tax identification: Web calculate the charitable deduction for a charitable lead trust gift using the ren gift calculator. Wills, trusts, and annuities • home • why leave a gift?

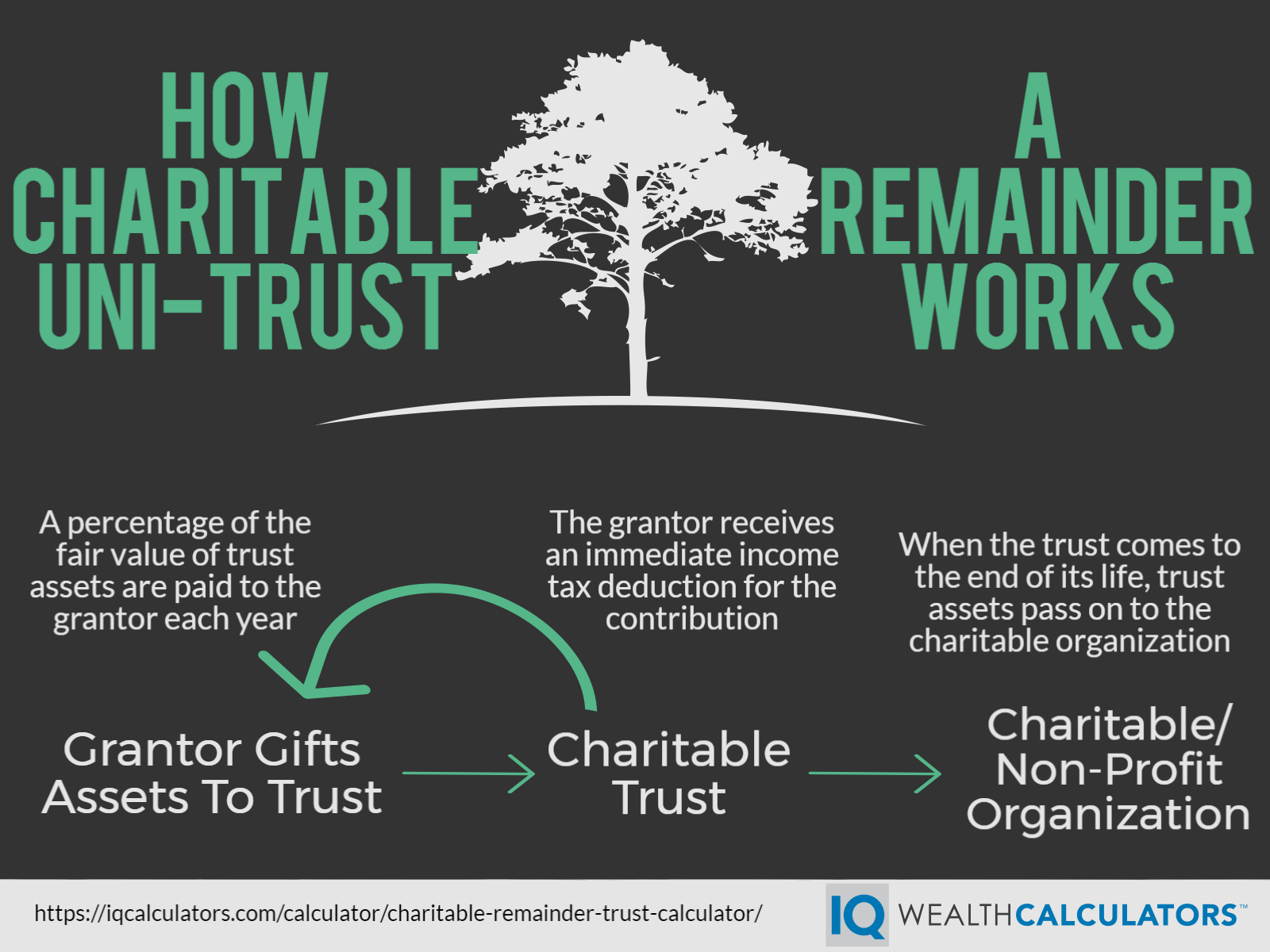

Charitable Remainder Trust Calculator CRUT Calculator

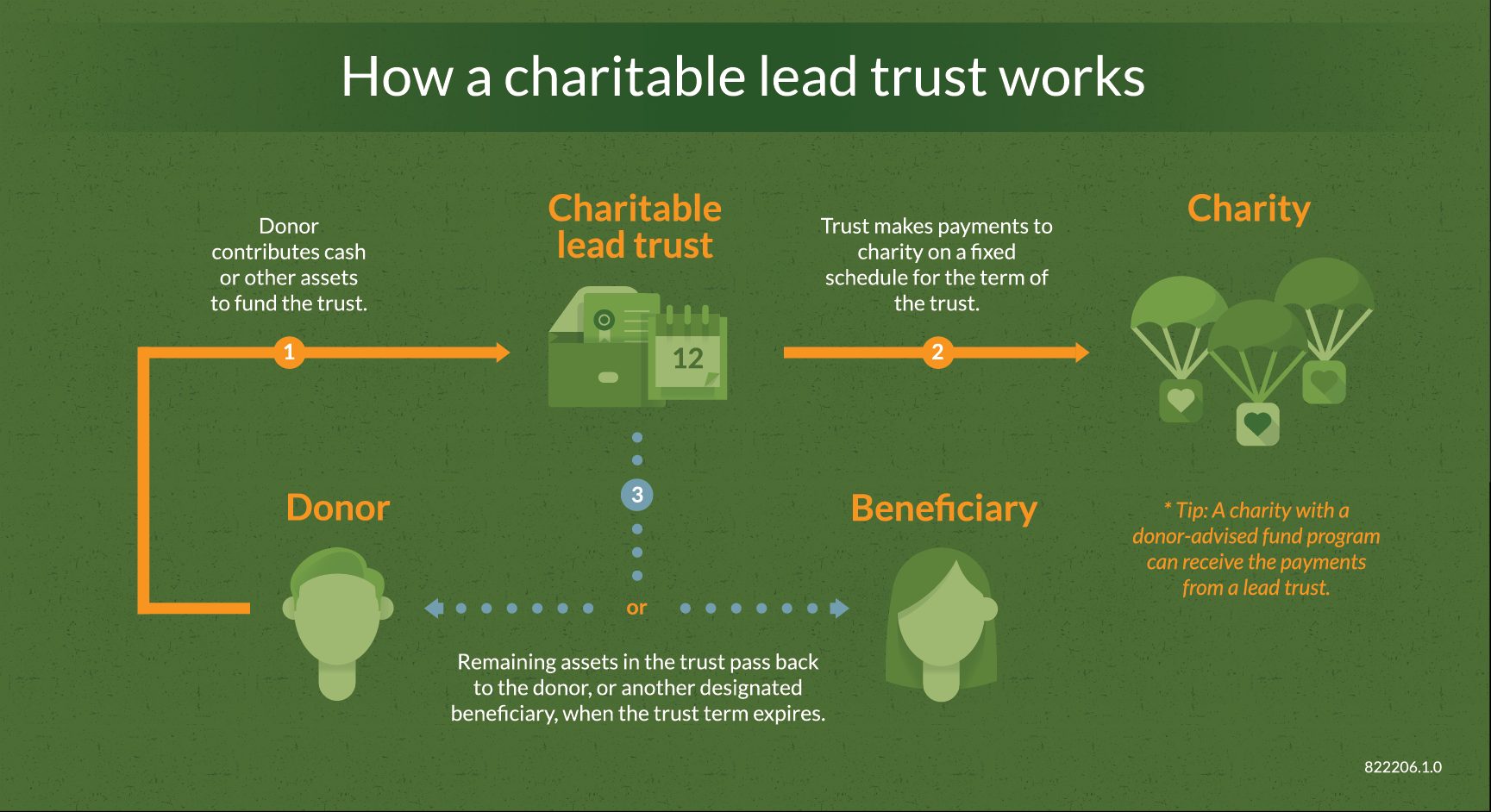

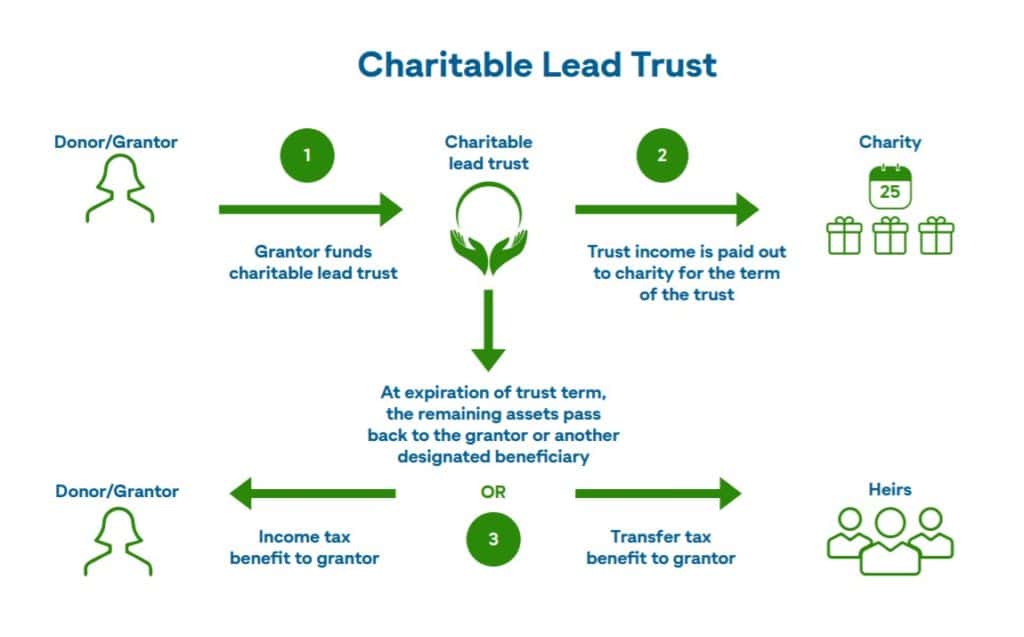

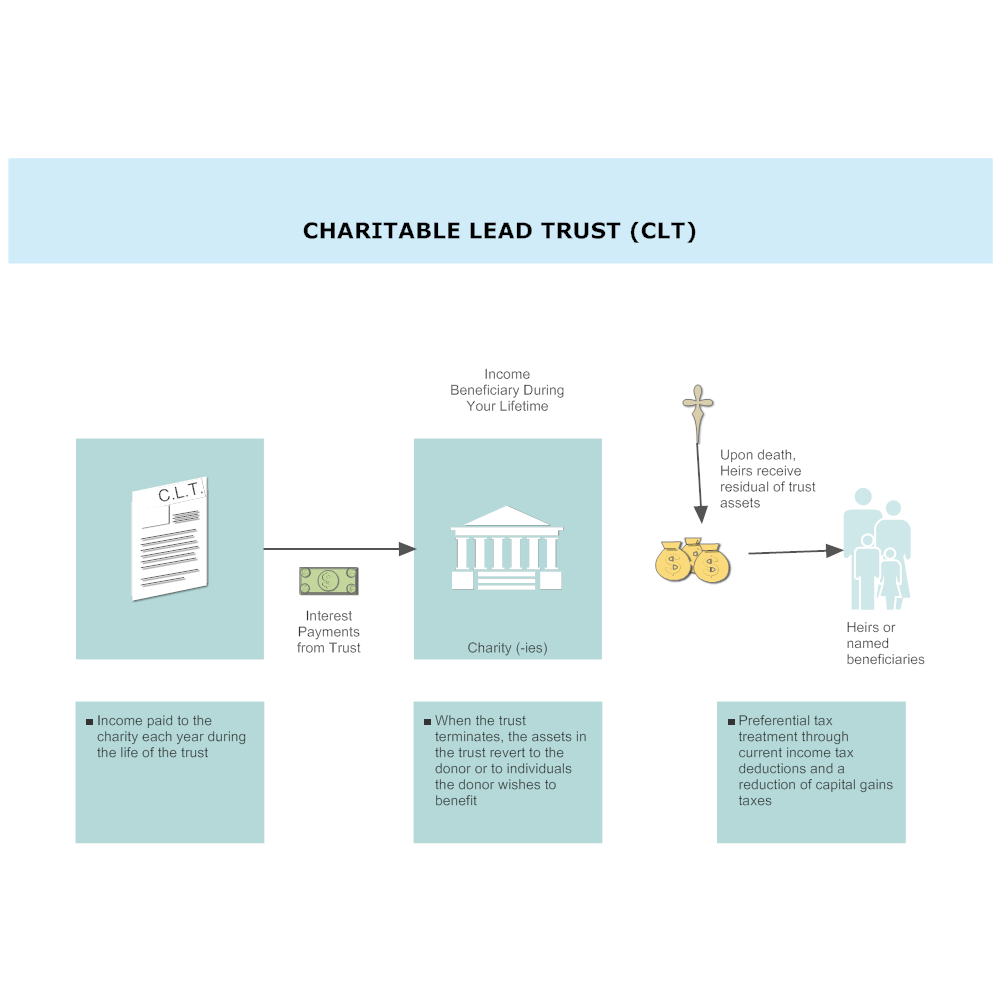

They can be funded with cash. Web wills, trusts, and annuities. Web a charitable lead trust is a type of irrevocable trust designed to reduce a beneficiary’s potential transfer taxes upon inheritance. Web calculate the charitable deduction for a charitable lead trust gift using the ren gift calculator. Web a charitable lead trust is a.

Charitable Lead Trust Calculator calculatorw

Web charitable lead annuity trust calculator. You can greatly reduce or even eliminate gift and estate tax on trust assets passing to family…if some trust income goes to mpi for a. Web use this calculator to determine the charitable deduction for charitable gift annuities, charitable remainder trusts, pooled income funds, and charitable lead trusts. Web.

What is a Charitable Lead Annuity Trust (CLAT)? — FeeBased Wealth

Web kennedy krieger foundation will receive a fixed contribution each year. Once the assets have been distributed to the charities as. Web a charitable lead unitrust will make annual gifts in varying amounts to ngaf for a term of years or for the life of one or more individuals. If you are interested in making.

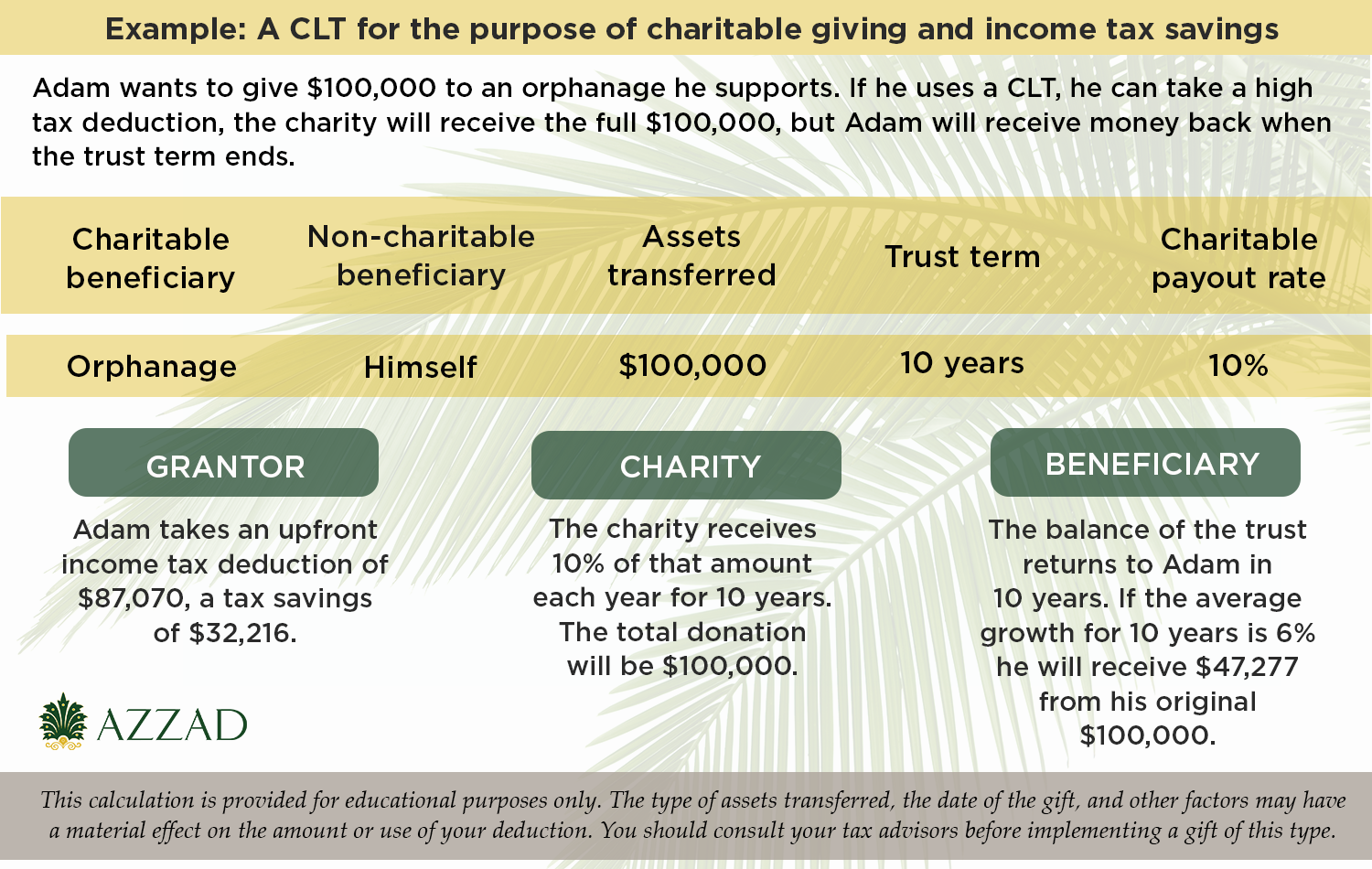

Charitable Lead Trust (CLT) Azzad Asset Management

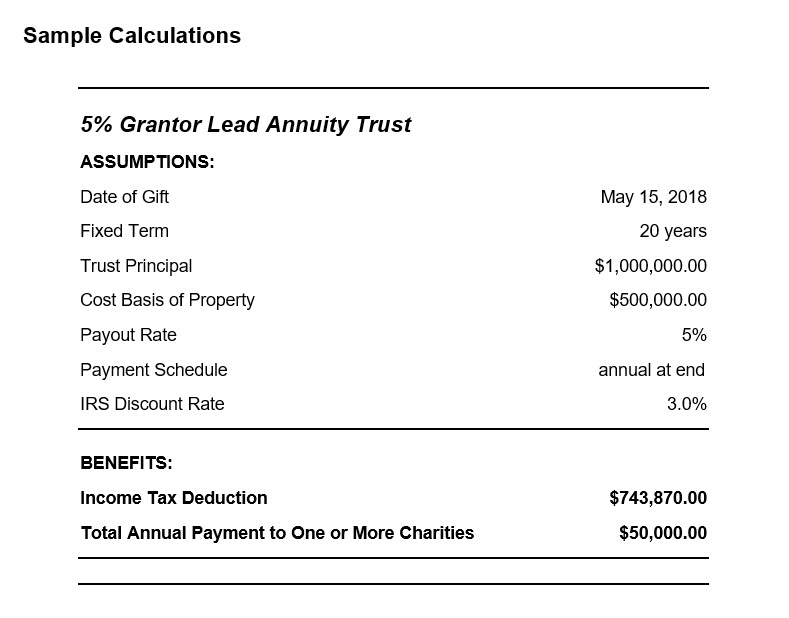

The calculator estimates the federal income tax deduction based on the. Web calculate a charitable lead annuity trust is a perfect instrument to make a generous gift to american heart association while reducing or eliminating estate and gift taxes. Web kennedy krieger foundation will receive a fixed contribution each year. Web if you are interested.

Charitable Lead Trust Calculator calculatorw

You can greatly reduce or even eliminate gift and estate tax on trust assets passing to family…if some trust income goes to mpi for a. You can greatly reduce or even eliminate gift and estate tax on trust assets passing to family…if some trust income goes to ij for a. Web a charitable lead unitrust.

A Charitable Lead Trust TwoForOne Charis Legacy Partners

Web calculate the amount of income you can receive from a charitable lead annuity trust that supports the american heart association. You can greatly reduce or even eliminate gift and estate tax on trust assets passing to family…if some trust income goes to ij for a. Web use this calculator to determine the charitable deduction.

Charitable Lead Trusts Types & Taxation

Web most gift planning professionals have heard of charitable lead trusts (clts), where the charitable beneficiary receives payments, typically for a term of. Web wills, trusts, and annuities. You can greatly reduce or even eliminate gift and estate tax on trust assets passing to family…if some trust income goes to mpi for a. Web kennedy.

Charitable Lead Trust (CLT)

Once the assets have been distributed to the charities as. Web please use the following legal name and tax identification: Web calculate the charitable deduction for a charitable lead trust gift using the ren gift calculator. Web most gift planning professionals have heard of charitable lead trusts (clts), where the charitable beneficiary receives payments, typically.

CLAT Charitable Lead Annuity Trust Leimberg, LeClair, & Lackner, Inc.

Web if you are interested in making a contribution that varies with investment performance, calculate your benefits with our charitable lead unitrust calculator. Web most gift planning professionals have heard of charitable lead trusts (clts), where the charitable beneficiary receives payments, typically for a term of. Web calculate a charitable lead annuity trust is a.

Charitable Lead Trust Calculator calculatorw

Web term of years a charitable lead unitrust will make annual gifts in varying amounts to a nonprofit for a term of years or for the life of one or more individuals. Web a charitable lead trust is a type of irrevocable trust designed to reduce a beneficiary’s potential transfer taxes upon inheritance. Our charitable.

Charitable Lead Trust Calculator Wills, trusts, and annuities • home • why leave a gift? Once the assets have been distributed to the charities as. Web if you are interested in making a contribution that varies with investment performance, calculate your benefits with our charitable lead unitrust calculator. Web please use the following legal name and tax identification: Web a charitable lead trust is a form of charitable trust that first distributes assets to the named charities.

You Can Greatly Reduce Or Even Eliminate Gift And Estate Tax On Trust Assets Passing To Family…If Some Trust Income Goes To Ij For A.

Web term of years a charitable lead unitrust will make annual gifts in varying amounts to a nonprofit for a term of years or for the life of one or more individuals. Web a charitable lead trust is a type of irrevocable trust that makes payments to a charitable organization for a set period of time and then transfers the remaining funds. Web a charitable lead trust is a form of charitable trust that first distributes assets to the named charities. A charitable lead annuity trust is a perfect instrument to make a generous gift to america's vetdogs while reducing or eliminating.

Web Calculate A Charitable Lead Annuity Trust Is A Perfect Instrument To Make A Generous Gift To American Heart Association While Reducing Or Eliminating Estate And Gift Taxes.

You can greatly reduce or even eliminate gift and estate tax on trust assets passing to family…if some trust income goes to mpi for a. Web charitable lead annuity trust calculator. Web use this calculator to determine the charitable deduction for charitable gift annuities, charitable remainder trusts, pooled income funds, and charitable lead trusts. Wills, trusts, and annuities • home • why leave a gift?

Web Charitable Lead Annuity Trust Calculator You Can Greatly Reduce Or Even Eliminate Gift And Estate Tax On Trust Assets Passing To Family…If Some Trust Income Goes To The.

Web a charitable lead trust is a type of irrevocable trust designed to reduce a beneficiary’s potential transfer taxes upon inheritance. Our charitable lead annuity trust. Web if you are interested in making a contribution that varies with investment performance, calculate your benefits with our charitable lead unitrust calculator. Web wills, trusts, and annuities.

Web Kennedy Krieger Foundation Will Receive A Fixed Contribution Each Year.

Web a charitable lead unitrust will make annual gifts in varying amounts to ngaf for a term of years or for the life of one or more individuals. Web calculate the amount of income you can receive from a charitable lead annuity trust that supports the american heart association. Once the assets have been distributed to the charities as. If you are interested in making a contribution that varies with investment performance, calculate your benefits.