Charitable Remainder Trust Calculator

Charitable Remainder Trust Calculator - Our gift calculators show you how a gift to the american heart association provides benefits to you and your loved ones, while continuing to fight. 7520 interest rate (i.e., 120% of the federal midterm rate rounded to the nearest 0.2%) for the month of. Web the value of the remainder interest is normally determined by using the sec. Web this calculator indicates the charitable income tax deduction available to donors making a current contribution to a currently offered u.s. A great way to make a gift to oregon state university foundation, receive payments that may increase over time, and defer or.

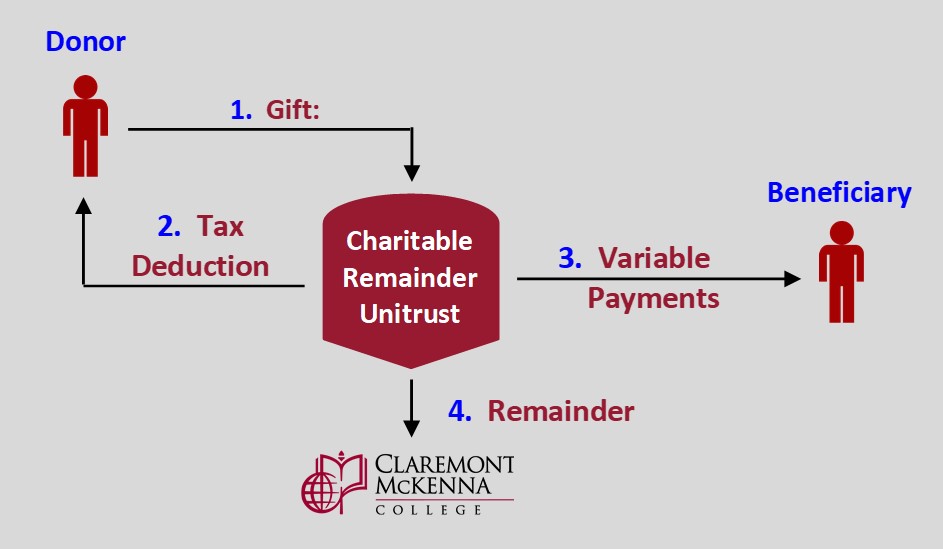

Web this charitable remainder trust calculator can help you estimate your fixed or variable payments. Web charitable remainder annuity trust calculator. Web learn how to create a charitable remainder trust that pays you income for life or a specific time period and donates the remainder to charity. Web the value of the remainder interest is normally determined by using the sec. Your calculation above is an. The donor receives an income stream from the trust for a term of. Web charitable remainder unitrust calculator.

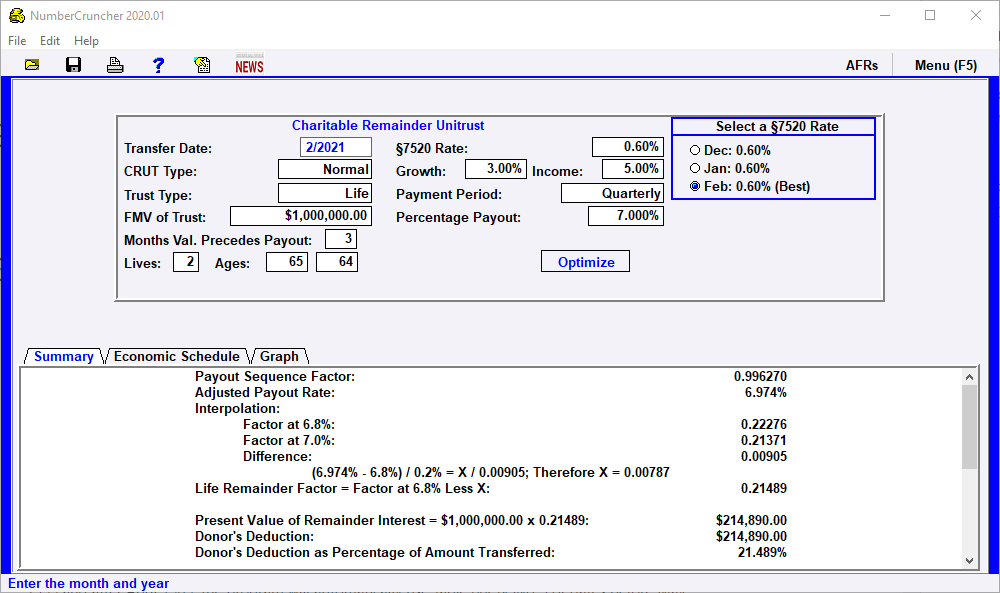

CRUT Charitable Remainder Unitrust Leimberg, LeClair, & Lackner, Inc.

A term certain charitable trust can last for a maximum of 20 years. Local estate planning or estate settlement representative. Web use this calculator to determine the charitable deduction for charitable remainder trusts, a popular giving approach that provides income for life and supports your charity of. Web charitable remainder trusts are an estate planning.

Charitable Remainder Trust Church Investors Fund

Legacy income trust ® (trust) and. Web this calculator indicates the charitable income tax deduction available to donors making a current contribution to a currently offered u.s. Web the calculator estimates the potential income tax charitable deduction based on the gift’s value, the expected payments to the individual beneficiary (ies) and the time. A great.

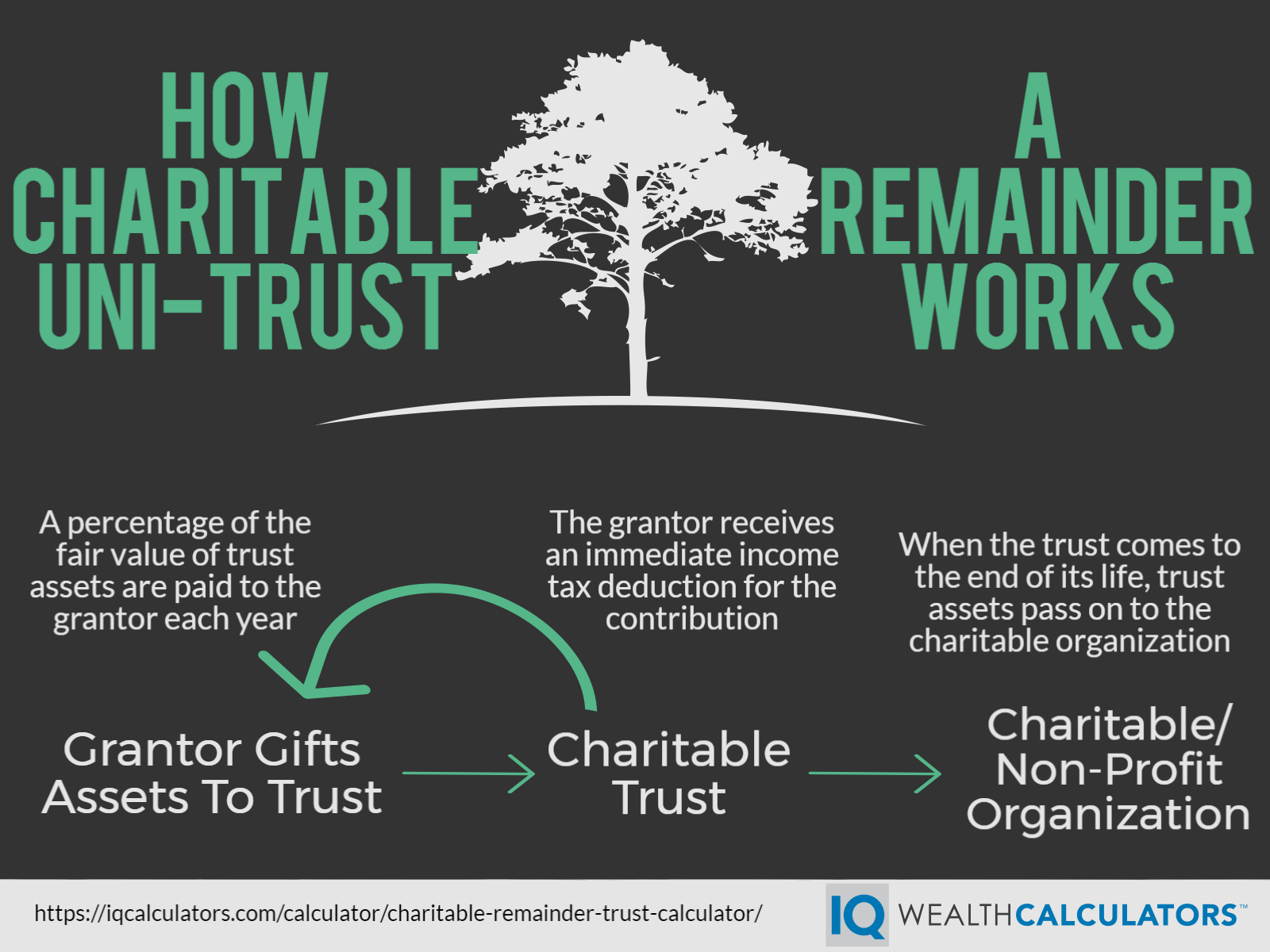

Charitable Remainder Trusts (CRT) Charitable Tools Explained DonorsTrust

Term certain means that the grantor predetermines how long the trust will last. Web charitable remainder trusts are an estate planning tool that might allow you to earn income while reducing both income tax now, as well as estate taxes after you pass away. Web the calculator estimates the potential income tax charitable deduction based.

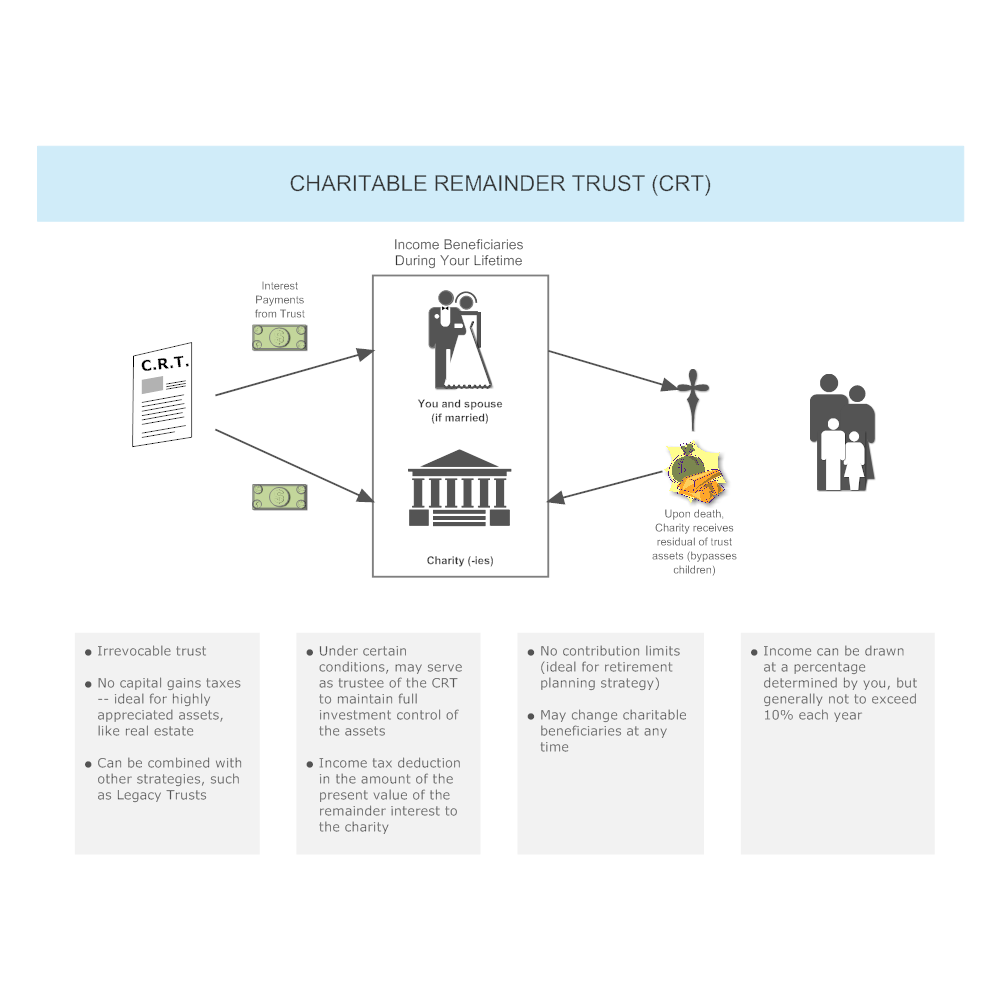

Charitable Remainder Trust (CRT)

Web learn how to create a charitable remainder trust that pays you income for life or a specific time period and donates the remainder to charity. Web this calculator determines the charitable deduction for these following gift types: Term certain, one life, and two life. Web charitable remainder unitrust calculator. Web a charitable remainder trust.

Charitable Remainder Trust Calculator CRUT Calculator

Web this calculator determines the charitable deduction for these following gift types: Legacy income trust ® (trust) and. Web charitable remainder trusts are an estate planning tool that might allow you to earn income while reducing both income tax now, as well as estate taxes after you pass away. If the trust is setup as.

Charitable remainder trust calculator NikiZsombor

A great way to make a gift to oregon state university foundation, receive payments that may increase over time, and defer or. Term certain means that the grantor predetermines how long the trust will last. Web this calculator indicates the charitable income tax deduction available to donors making a current contribution to a currently offered.

Charitable remainder trust calculator NikiZsombor

A term certain charitable trust can last for a maximum of 20 years. Term certain, one life, and two life. Web this calculator indicates the charitable income tax deduction available to donors making a current contribution to a currently offered u.s. A great way to make a gift to oregon state university foundation, receive payments.

Charitable Remainder Annuity Trust (CRAT) What It Is & How It Works

Charitable gift annuity, charitable remainder trust and more. The donor receives an income stream from the trust for a term of. A great way to make a gift to oregon state university foundation, receive payments that may increase over time, and defer or. A great way to make a gift to the family leader, receive.

Charitable remainder trust calculator NikiZsombor

Web learn how to create a charitable remainder trust that pays you income for life or a specific time period and donates the remainder to charity. Legacy income trust ® (trust) and. Web the calculator estimates the potential income tax charitable deduction based on the gift’s value, the expected payments to the individual beneficiary (ies).

Charitable remainder trust calculator NikiZsombor

Local estate planning or estate settlement representative. Our gift calculators show you how a gift to the american heart association provides benefits to you and your loved ones, while continuing to fight. Web the value of the remainder interest is normally determined by using the sec. Web a charitable remainder trust (crt) is an irrevocable.

Charitable Remainder Trust Calculator Web a charitable remainder trust (crt) is an irrevocable trust that generates income for you or your beneficiaries with the remainder of the donated assets going to your favorite charity. A great way to make a gift to oregon state university foundation, receive payments that may increase over time, and defer or. 7520 interest rate (i.e., 120% of the federal midterm rate rounded to the nearest 0.2%) for the month of. Charitable gift annuity, charitable remainder trust and more. A crt can provide a range of.

Our Gift Calculators Show You How A Gift To The American Heart Association Provides Benefits To You And Your Loved Ones, While Continuing To Fight.

Term certain means that the grantor predetermines how long the trust will last. Web charitable remainder unitrust calculator. Web charitable remainder annuity trust calculator. Web this calculator indicates the charitable income tax deduction available to donors making a current contribution to a currently offered u.s.

Web Use This Calculator To Determine The Charitable Deduction For Charitable Remainder Trusts, A Popular Giving Approach That Provides Income For Life And Supports Your Charity Of.

A crt can provide a range of. Web this charitable remainder trust calculator can help you estimate your fixed or variable payments. Charitable gift annuity, charitable remainder trust and more. Your calculation above is an.

Local Estate Planning Or Estate Settlement Representative.

Web charitable remainder annuity trust calculator. Web the calculator estimates the potential income tax charitable deduction based on the gift’s value, the expected payments to the individual beneficiary (ies) and the time. A term certain charitable trust can last for a maximum of 20 years. Web a charitable remainder trust (crt) is an irrevocable trust and a unique financial tool that benefits both individuals and charities.

Legacy Income Trust ® (Trust) And.

A great way to make a gift to ij, receive fixed payments, and defer or eliminate capital gains tax. Web charitable remainder trusts are an estate planning tool that can be used to claim tax breaks and set yourself up to receive income—all while giving money to. Web the value of the remainder interest is normally determined by using the sec. Web a charitable remainder trust (crt) is an irrevocable trust that generates income for you or your beneficiaries with the remainder of the donated assets going to your favorite charity.