Charitable Remainder Unitrust Trust Calculator

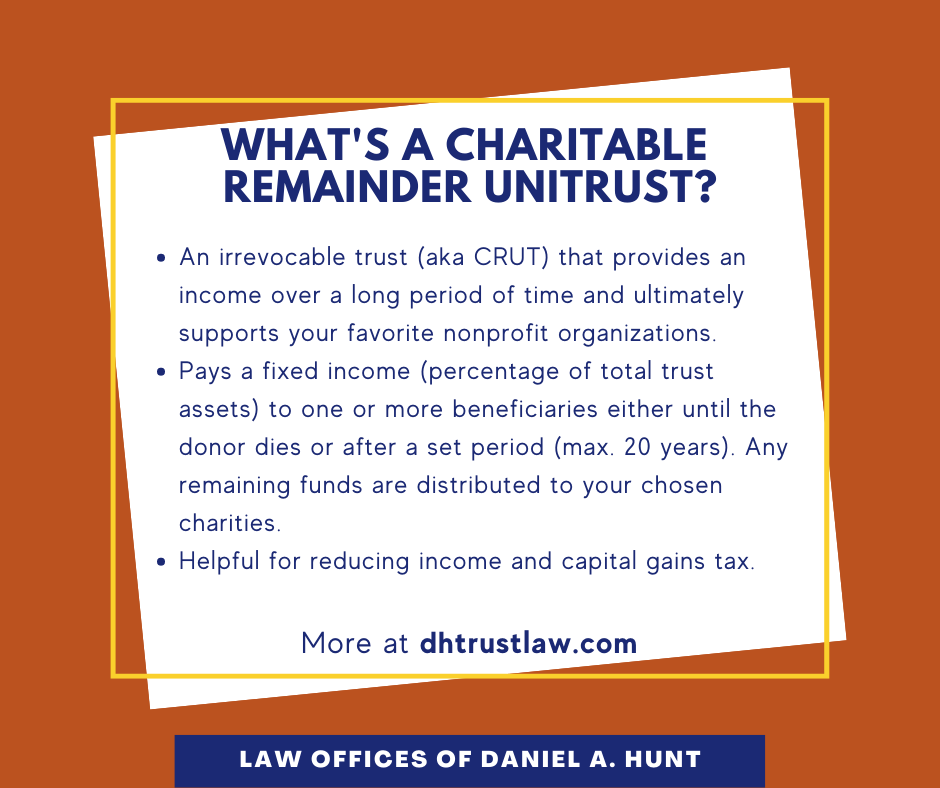

Charitable Remainder Unitrust Trust Calculator - Web a charitable remainder unitrust (also called a crut) is an estate planning tool that provides income to a named beneficiary during the grantor's life and then the remainder. A charitable remainder unitrust (crut) pays a percentage of the value of the trust each year to noncharitable beneficiaries. Web you can take care of yourself and take care of stanford with a charitable remainder unitrust. The charitable remainder unitrust provides annual payments of a specified percentage (at. If the trust is setup as one life or two life, then the trust term will last for the entirety.

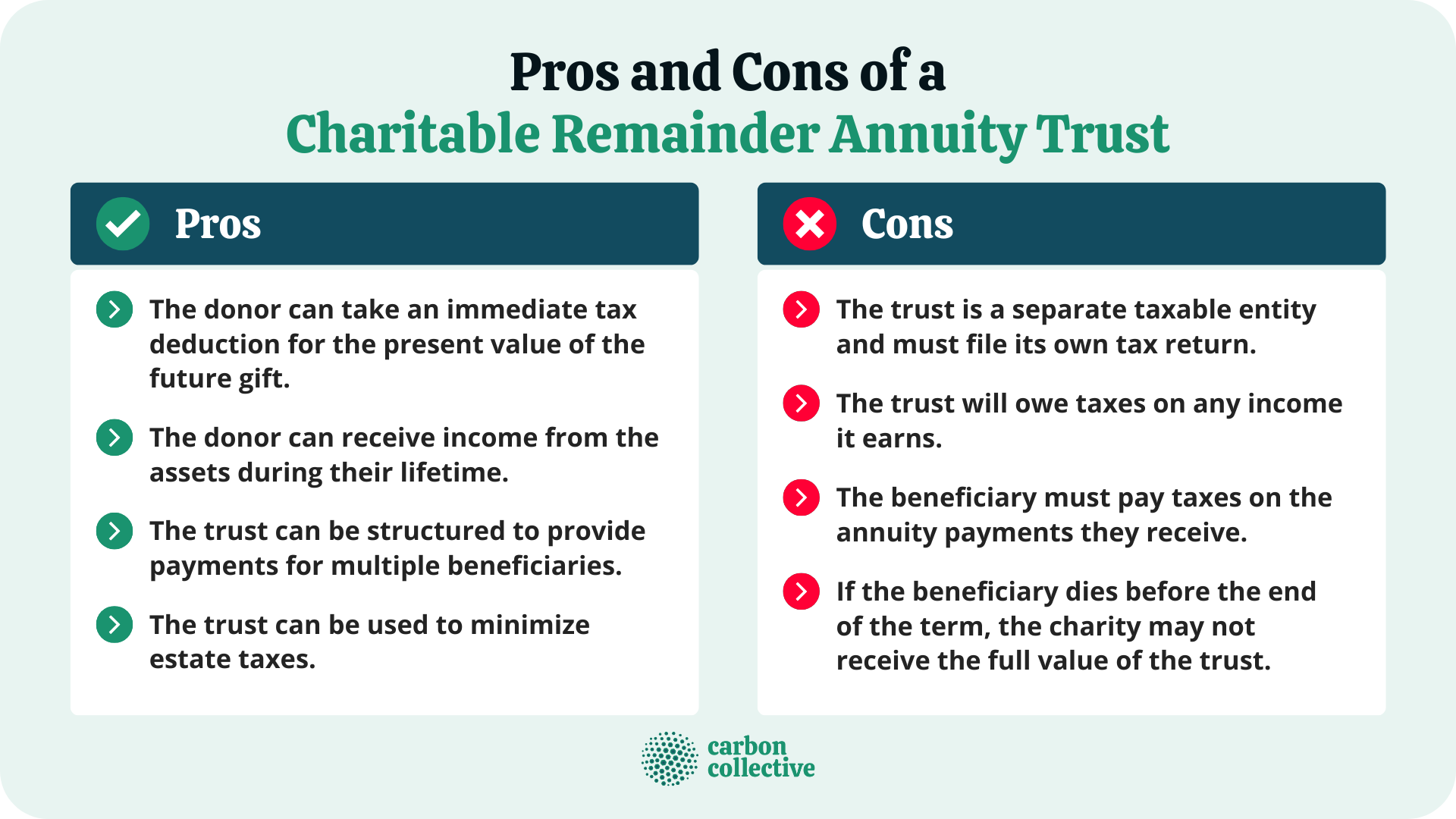

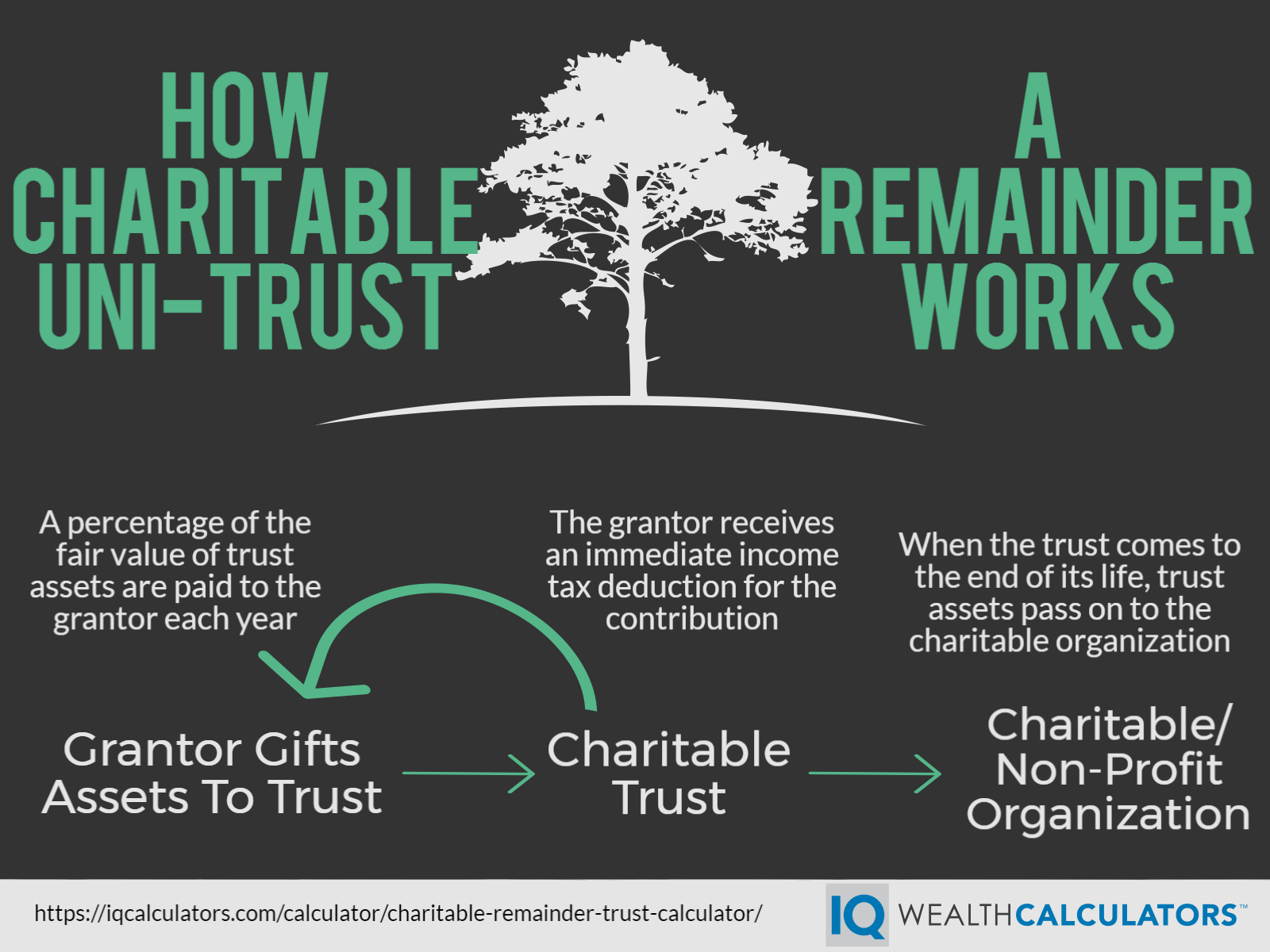

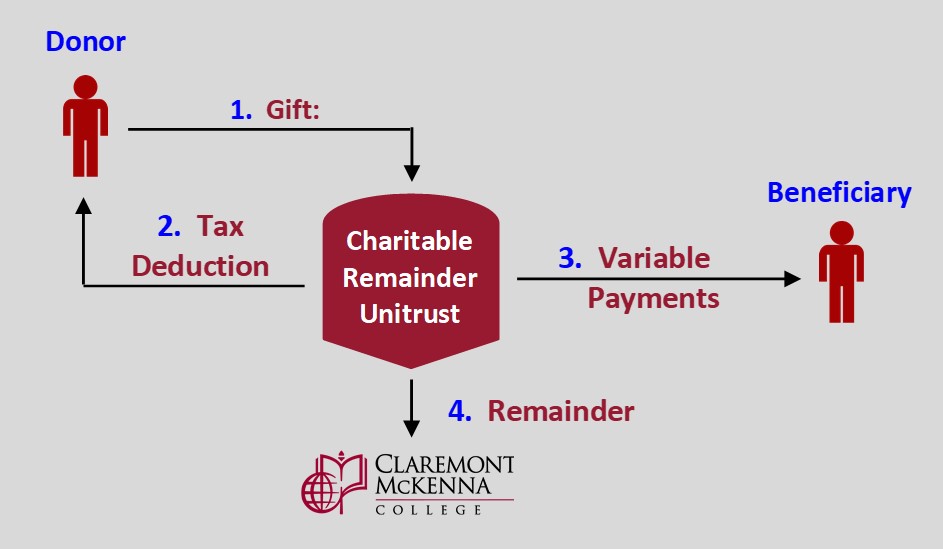

Web how it works. Web charitable remainder unitrust. Web if the present value of the remainder interest equals at least 10% of the value of assets transferred into the trust, the trust will qualify as a charitable remainder unitrust. Web a charitable remainder trust (crt) is an irrevocable trust that generates a potential income stream for you, as the donor to the crt, or other beneficiaries, with the. During the unitrust's term, the trustee invests the unitrust's assets. Legacy income trust ® (trust) and. Web a charitable remainder trust (crt) is an irrevocable trust, meaning it cannot be modified or terminated without the beneficiary’s permission.

CRUT Charitable Remainder Unitrust Leimberg, LeClair, & Lackner, Inc.

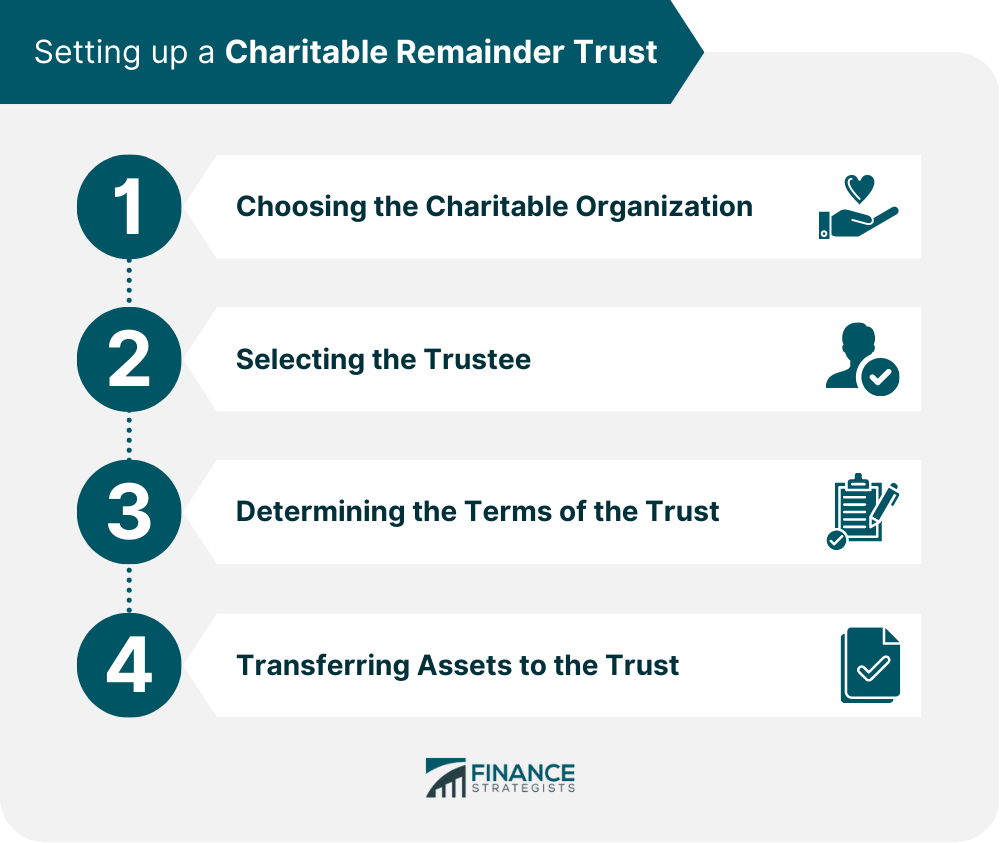

Web a charitable remainder trust (crt) is a gift of cash or other property to an irrevocable trust. Web associate vp and managing director, gift planning & real estate. In this arrangement, you irrevocably transfer assets to a trustee that invests the. Local estate planning or estate settlement representative. Web a charitable remainder unitrust (also.

What is a Charitable Remainder Unitrust (CRUT)?

If the trust is setup as one life or two life, then the trust term will last for the entirety. Web the payments can be either a fixed amount (known as a charitable remainder annuity trust, or crat) or a fixed percentage of the annual trust value. Charitable remainder unitrust (crut) the annual payment amount.

Charitable remainder trust calculator NikiZsombor

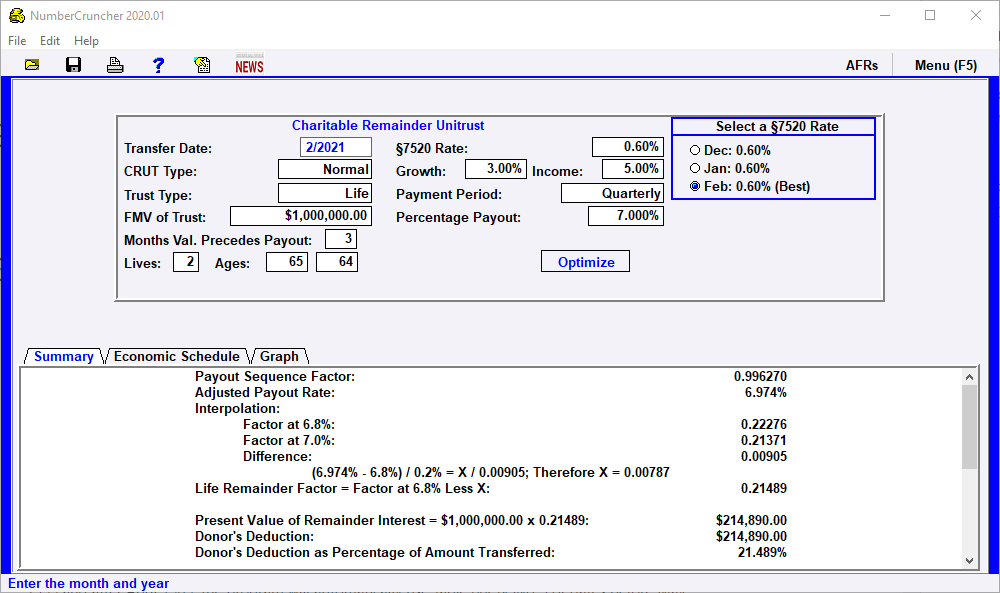

Web associate vp and managing director, gift planning & real estate. In this arrangement, you irrevocably transfer assets to a trustee that invests the. Web how it works. Web the methods for calculating a charitable remainder annnuity trust and a charitable remainder unitrust are different because the crut income stream fluctuates with. Web this calculator.

Charitable remainder trust calculator NikiZsombor

A charitable remainder unitrust (crut) pays a percentage of the value of the trust each year to noncharitable beneficiaries. Web the payments can be either a fixed amount (known as a charitable remainder annuity trust, or crat) or a fixed percentage of the annual trust value. In this arrangement, you irrevocably transfer assets to a.

Charitable Remainder Trust (CRT) Definition, Pros and Cons

The charitable remainder unitrust provides annual payments of a specified percentage (at. A charitable remainder unitrust (crut) pays a percentage of the value of the trust each year to noncharitable beneficiaries. A great way to make a gift to oregon state university foundation, receive payments that may increase over time, and defer or. Web you.

Charitable Remainder Unitrust (CRUT) What It Is & How It Works

Web the methods for calculating a charitable remainder annnuity trust and a charitable remainder unitrust are different because the crut income stream fluctuates with. During the unitrust's term, the trustee invests the unitrust's assets. Web charitable remainder unitrust. Web if the present value of the remainder interest equals at least 10% of the value of.

Charitable Remainder Annuity Trust (CRAT) What It Is & How It Works

A term certain charitable trust can last for a maximum of 20 years. Charitable remainder unitrust (crut) the annual payment amount is recalculated every year according to the value of the assets, which can. A charitable remainder unitrust (crut) pays a percentage of the value of the trust each year to noncharitable beneficiaries. If the.

Charitable Remainder Trust Calculator CRUT Calculator

If the trust is setup as one life or two life, then the trust term will last for the entirety. Charitable remainder unitrust (crut) the annual payment amount is recalculated every year according to the value of the assets, which can. Web charitable remainder unitrust. Web a charitable remainder trust (crt) is an irrevocable trust.

Charitable remainder trust calculator NikiZsombor

Local estate planning or estate settlement representative. Web here are the options. Charitable remainder unitrust (crut) the annual payment amount is recalculated every year according to the value of the assets, which can. Web charitable remainder unitrust calculator. A term certain charitable trust can last for a maximum of 20 years. Web associate vp and.

Charitable remainder trust calculator NikiZsombor

Web how it works. Charitable remainder unitrust (crut) the annual payment amount is recalculated every year according to the value of the assets, which can. Web charitable remainder unitrust calculator a great way to make a gift to the american cancer society, receive payments that may increase over time, and defer or eliminate. Web you.

Charitable Remainder Unitrust Trust Calculator If the trust is setup as one life or two life, then the trust term will last for the entirety. Web the payments can be either a fixed amount (known as a charitable remainder annuity trust, or crat) or a fixed percentage of the annual trust value. Charitable remainder unitrust (crut) the annual payment amount is recalculated every year according to the value of the assets, which can. Web a charitable remainder trust (crt) is an irrevocable trust, meaning it cannot be modified or terminated without the beneficiary’s permission. A term certain charitable trust can last for a maximum of 20 years.

Web Charitable Remainder Unitrust.

Local estate planning or estate settlement representative. During the unitrust's term, the trustee invests the unitrust's assets. If the trust is setup as one life or two life, then the trust term will last for the entirety. Web this calculator indicates the charitable income tax deduction available to donors making a current contribution to a currently offered u.s.

Web A Charitable Remainder Trust (Crt) Is A Gift Of Cash Or Other Property To An Irrevocable Trust.

Web a charitable remainder unitrust (also called a crut) is an estate planning tool that provides income to a named beneficiary during the grantor's life and then the remainder. Web how it works. Web a charitable remainder trust (crt) is an irrevocable trust, meaning it cannot be modified or terminated without the beneficiary’s permission. Web the payments can be either a fixed amount (known as a charitable remainder annuity trust, or crat) or a fixed percentage of the annual trust value.

Term Certain, One Life, And Two Life.

In this arrangement, you irrevocably transfer assets to a trustee that invests the. Web charitable remainder unitrust calculator a great way to make a gift to ij, receive payments that may increase over time, and defer or eliminate capital gains tax. Term certain means that the grantor predetermines how long the trust will last. Web here are the options.

A Term Certain Charitable Trust Can Last For A Maximum Of 20 Years.

Web the remainder value to charity must be at least 10% of the funding amount. A charitable remainder unitrust (crut) pays a percentage of the value of the trust each year to noncharitable beneficiaries. Web if the present value of the remainder interest equals at least 10% of the value of assets transferred into the trust, the trust will qualify as a charitable remainder unitrust. Legacy income trust ® (trust) and.