Charitable Tax Deduction Calculator

Charitable Tax Deduction Calculator - Web tax savings calculator let us help you assess how a charitable contribution may impact your tax liability. Web here’s an example of how the limit works: Freetaxusa.com has been visited by 100k+ users in the past month Legacy income trust ® (trust) and. Web for the 2022 tax year, the standard deduction is $12,950 for single filers and $25,900 for married couples filing jointly, and in 2023 that will increase to $13,850.

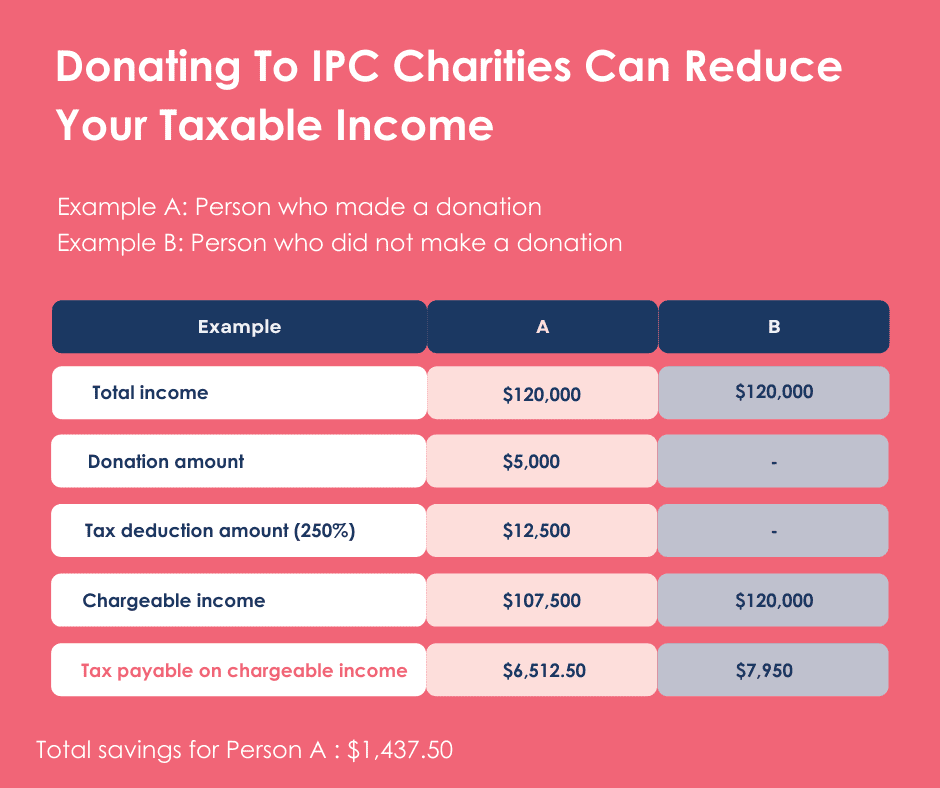

Web this calculator indicates the charitable income tax deduction available to donors making a current contribution to a currently offered u.s. Use our interactive tool to see how giving can help you save on. The only benefits you receive are token items bearing the organization’s logo, like. Web 2% of the payment $105 wriboth of these are true: Each year they’ll receive a total. Web the calculator will display the net cost of the donation and the tax savings. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60).

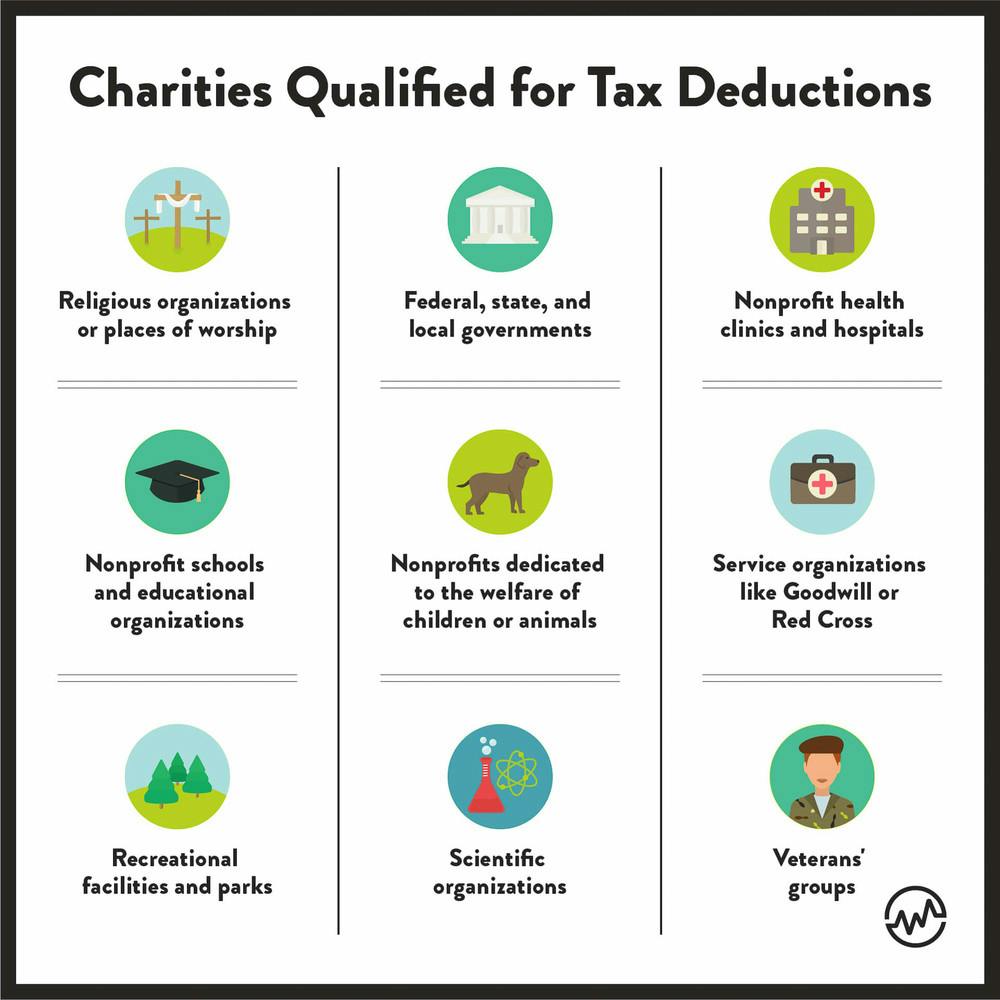

How to Maximize Your Charity Tax Deductible Donation WealthFit

In the united states, both. Cash contributions in 2023 and 2024 can make up 60% of your agi. The only benefits you receive are token items bearing the organization’s logo, like. Use our interactive tool to see how giving can help you save on. Web 2023 personal income tax rates. Web a charitable donation is.

The Complete 2022 Charitable Tax Deductions Guide

Potential donors should consult their tax advisors regarding their own unique circumstances. Web here’s an example of how the limit works: Web 2% of the payment $105 wriboth of these are true: $13,850 for single or married filing separately. To start, let’s calculate the. The payment is at least $52.50 for 2023. Web to receive.

What Are Charitable Donations Deductions Definition & Limits

Each year they’ll receive a total. Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to get over the. $13,850 for single or married filing separately. Web fidelity's charitable contribution calculators help you better understand how to use charitable.

Charitable Donations Tax Deduction Calculator

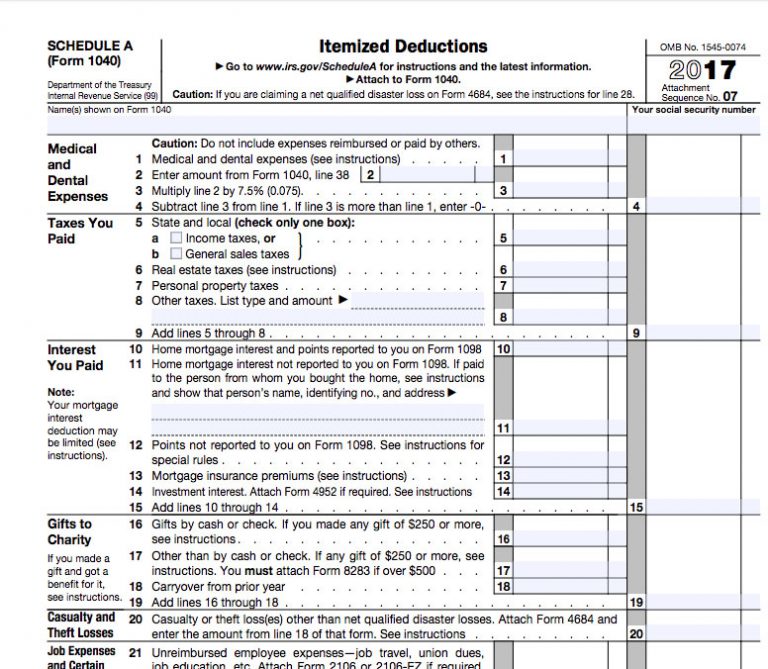

The standard deduction for 2023 is: Web monthly lifetime payments are to begin immediately. Web to receive a charitable tax deduction on your annual income taxes, you must itemize your deductions rather than choosing to take the standard deduction. Cash contributions in 2023 and 2024 can make up 60% of your agi. Freetaxusa.com has been.

How to Maximize Your Charity Tax Deductible Donation WealthFit

Web standard deduction amounts. Web in general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50%, depending on the. In the united states, both. Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving..

Reduce Your Tax With Charitable Tax Deductions

Freetaxusa.com has been visited by 100k+ users in the past month Get started to see how you can save estimated contribution amount $. Web charitable giving tax deduction limits are set by the irs as a percentage of your income. Web for example, if you're a single individual and you don't pay quite enough in,.

Charitable Tax Deductions by State Tax Foundation

The tax rate on most classes of taxable income is 5%. Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. Web for example, say that stacey and dana typically donate $12,000 to charity, but they have paid off their mortgage and their state and local tax deduction, or.

Donation Tax Calculator Giving NUS Yong Loo Lin School of Medicine

The profits will receive a charitable contribution deduction of $33,248 this year. Web 2% of the payment $105 wriboth of these are true: Only large donations are significant enough to deduct. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). Web 2023 personal income tax.

Charitable Giving Tax Savings Calculator Fidelity Charitable

Only large donations are significant enough to deduct. Legacy income trust ® (trust) and. Web tax savings calculator let us help you assess how a charitable contribution may impact your tax liability. Web standard deduction amounts. The only benefits you receive are token items bearing the organization’s logo, like. Web the calculator will display the.

The Complete 2022 Charitable Tax Deductions Guide

The standard deduction for 2023 is: Web this charitable deduction calculator can help plan ahead by calculating potential tax savings from charitable contributions. Web for example, say that stacey and dana typically donate $12,000 to charity, but they have paid off their mortgage and their state and local tax deduction, or salt, is capped at..

Charitable Tax Deduction Calculator Web tax savings calculator let us help you assess how a charitable contribution may impact your tax liability. Web the calculator will display the net cost of the donation and the tax savings. In the united states, both. Web in general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50%, depending on the. Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to get over the.

Web This Calculator Is Intended For Informational Purposes Only.

If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). The only benefits you receive are token items bearing the organization’s logo, like. The tax rate on most classes of taxable income is 5%. Web for example, say that stacey and dana typically donate $12,000 to charity, but they have paid off their mortgage and their state and local tax deduction, or salt, is capped at.

The Profits Will Receive A Charitable Contribution Deduction Of $33,248 This Year.

Freetaxusa.com has been visited by 100k+ users in the past month You may be surprised to learn that you can afford to be even more generous than you thought. Web here’s an example of how the limit works: Get started to see how you can save estimated contribution amount $.

Web For The 2022 Tax Year, The Standard Deduction Is $12,950 For Single Filers And $25,900 For Married Couples Filing Jointly, And In 2023 That Will Increase To $13,850.

To start, let’s calculate the. Web this calculator indicates the charitable income tax deduction available to donors making a current contribution to a currently offered u.s. Each year they’ll receive a total. Web fidelity's charitable contribution calculators help you better understand how to use charitable giving as part of your investment portfolio.

It's True That If All You Gave Was $20 Last Year, Claiming It Won't Give You A Big Tax Refund.

This calculator determines how much you could save based on your donation and place of residence. Web this charitable deduction calculator can help plan ahead by calculating potential tax savings from charitable contributions. The standard deduction for 2023 is: Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to get over the.