Charity Donation Tax Deduction Calculator

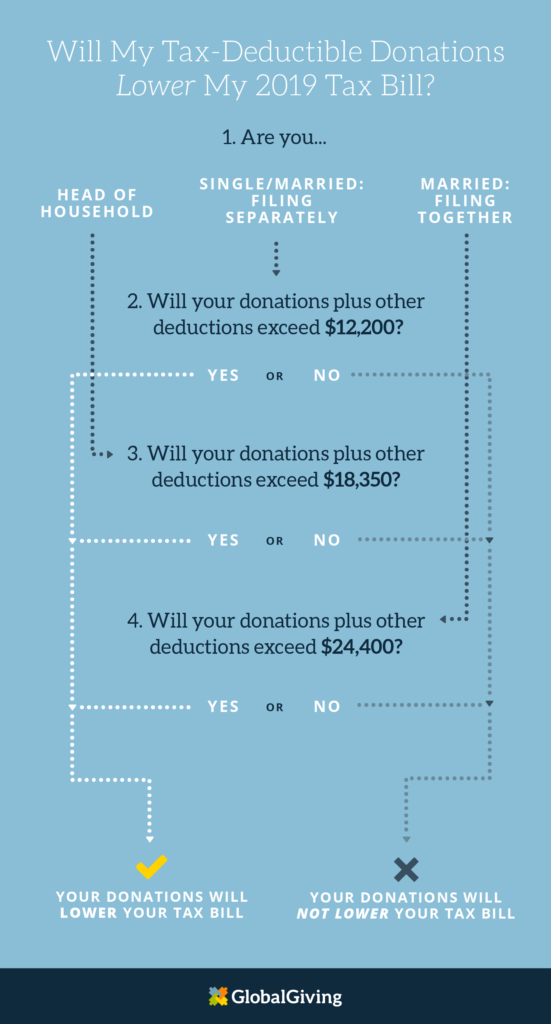

Charity Donation Tax Deduction Calculator - Simply select the types of clothing, household and/or. Web discover the impact a charitable donation can have on your taxes. Web here’s an example of how the limit works: $13,850 for single or married filing separately. Web the 2023 and 2024 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the agi limit of 60% for cash.

Web the standard deduction for 2023 is: Your charitable contributions may be deductible if you itemize. Web how to use itsdeductible. In the first section, calculate your federal and provincial or territorial tax credit. Cash contributions in 2023 and 2024 can make up 60% of your agi. You need to itemize your deduction if you want to. Web page last reviewed or updated:

How to Maximize Your Charity Tax Deductible Donation WealthFit

You may be surprised to learn that you can afford to be even more generous than you thought. Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to get over the. Web the outcome is different if the couple.

Everything You Need To Know About Your TaxDeductible Donation Learn

Only large donations are significant enough to deduct. Your charitable contributions may be deductible if you itemize. The organization must give you. These values are according to the salvation army. Web here’s an example of how the limit works: You need to itemize your deduction if you want to. Web use this tool to see.

Donation value guide 2022 spreadsheet Fill out & sign online DocHub

If you qualify, you can calculate your. Cash contributions in 2023 and 2024 can make up 60% of your agi. Web fair market value calculator use the slider to estimate the fair market value of an item. Web the 2023 and 2024 rules require donors to itemize their deductions to claim any charitable contribution deductions.

Tax Savings Donation Calculator Tax deductions, Money saving tips

Web calculate deduction limits: You need to itemize your deduction if you want to. Web you can deduct up to 60% of your adjusted gross income (agi) for cash contributions made to nonprofits. Web for the 2022 tax year, the standard deduction is $12,950 for single filers and $25,900 for married couples filing jointly, and.

Reduce Your Tax With Charitable Tax Deductions

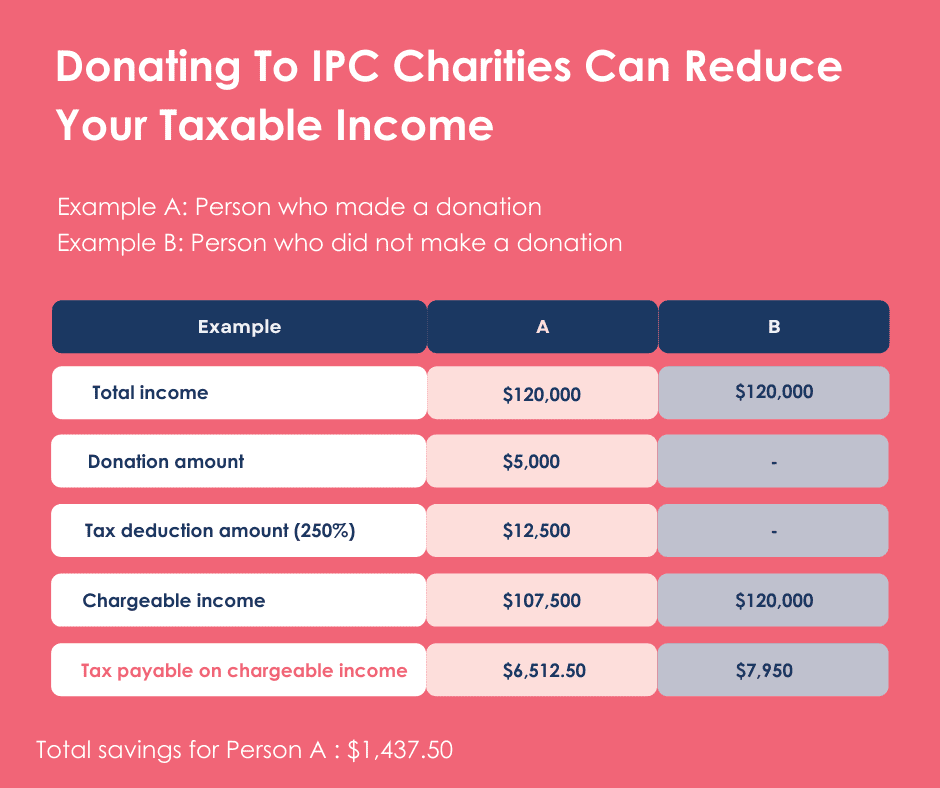

For 2020, the charitable limit was $300 per “tax unit” —. Web charitable tax deduction calculator when a person makes a charitable donation, that donation can be deducted from the individual's income. Web charitable giving tax deduction limits are set by the irs as a percentage of your income. Web fair market value calculator use.

Donation Tax Calculator Giving NUS Yong Loo Lin School of Medicine

Web the donation impact calculator is a great way to see how your donations support your goodwill’s programs and services. $27,700 for married couples filing jointly or qualifying surviving spouse. For 2020, the charitable limit was $300 per “tax unit” —. Ensure your total charitable contributions don’t exceed the applicable percentage of your agi for.

Section 80G Deduction For Donations To Charitable Institutions Tax2win

It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund. Web clothing you may be able to claim the below tax deductions for some common clothing items you donated. We’ll provide the fair market value for over +1700 items. Web the standard deduction for 2023.

Charitable Tax Deduction

Web fair market value calculator use the slider to estimate the fair market value of an item. Web when utilizing these resources, please review the assumptions to determine if results are applicable to your current tax situation. Only large donations are significant enough to deduct. This will reduce taxes in the tax. This calculator determines.

Charitable Giving Tax Savings Calculator Fidelity Charitable

Web charitable giving tax deduction limits are set by the irs as a percentage of your income. Web use this tool to see how charitable giving can help you save on taxes and how the “bunching” strategy can increase your savings. The organization must give you. Web the standard deduction for 2023 is: It's true.

Tax Deductible Donations Reduce Your Tax Charity Tax Calculator

Enter your filing status, income,. $13,850 for single or married filing separately. Web clothing you may be able to claim the below tax deductions for some common clothing items you donated. Only large donations are significant enough to deduct. Ensure your total charitable contributions don’t exceed the applicable percentage of your agi for property donations,.

Charity Donation Tax Deduction Calculator The organization must give you. Web here’s an example of how the limit works: Web for the 2022 tax year, the standard deduction is $12,950 for single filers and $25,900 for married couples filing jointly, and in 2023 that will increase to $13,850. For 2020, the charitable limit was $300 per “tax unit” —. Web calculate deduction limits:

Web How To Use Itsdeductible.

Web the calculator will display the net cost of the donation and the tax savings. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). Web calculate deduction limits: It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund.

Web When Donating To Charity, Ensure. Xpert Tax Service On Instagram:

Web use this tool to see how charitable giving can help you save on taxes and how the “bunching” strategy can increase your savings. This calculator determines how much you could save based on your donation and place of residence. Web here’s an example of how the limit works: These values are according to the salvation army.

Find Forms And Check If The Group You Contributed To Qualifies.

Web charitable giving tax deduction limits are set by the irs as a percentage of your income. For 2020, the charitable limit was $300 per “tax unit” —. Ensure your total charitable contributions don’t exceed the applicable percentage of your agi for property donations, depending on the. You need to itemize your deduction if you want to.

In General, You Can Deduct Up To 60% Of Your Adjusted Gross Income Via Charitable Donations, But You May Be Limited To 20%,.

Web page last reviewed or updated: In the first section, calculate your federal and provincial or territorial tax credit. You may be surprised to learn that you can afford to be even more generous than you thought. Web discover the impact a charitable donation can have on your taxes.