Childcare Tax Credit Calculator

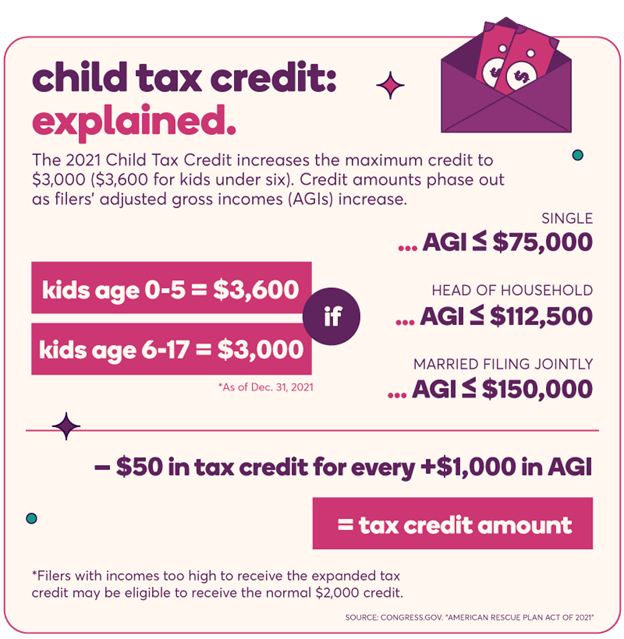

Childcare Tax Credit Calculator - Web how is the credit calculated? The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable. Web the 2021 pandemic child tax credit, in comparison, increased the credit amount up to $3,600 per child under age 6 and $3,000 per child ages 6 to 17. Web the following faqs can help you learn if you are eligible and if eligible, how to calculate your credit. This tax credit is not the same as the child tax credit.

Web if you received advance payments of the child tax credit, you need to reconcile (compare) the total you received with the amount you’re eligible to claim. This tax year, it’s a maximum of $2,000 per child per year. The careucator tool will guide you through the following criteria to. Web the following faqs can help you learn if you are eligible and if eligible, how to calculate your credit. Web the child tax credit is phased out completely at $240,000 for individuals and $480,000 for married couples filing jointly. Web how is the credit calculated? No annual feeno waitingknowledgeable staffrush order

2022 Easiest Childcare Tax Credit Calculator! The Ultimate Guide

Web the 2021 pandemic child tax credit, in comparison, increased the credit amount up to $3,600 per child under age 6 and $3,000 per child ages 6 to 17. This tax year, it’s a maximum of $2,000 per child per year. Web the maximum tax credit per qualifying child is $2,000 for children under 17..

Child Tax Credit 2023 Limit, Eligibility, Calculator APSBB

Web how is the credit calculated? Web the push to overhaul the tax benefit comes more than two years after the expiration of the expanded child tax credit, which bolstered the tax credit to as much as. Web if you received advance payments of the child tax credit, you need to reconcile (compare) the total.

2022 Child Tax Credit Calculator Internal Revenue Code Simplified

Web the 2021 pandemic child tax credit, in comparison, increased the credit amount up to $3,600 per child under age 6 and $3,000 per child ages 6 to 17. This tax year, it’s a maximum of $2,000 per child per year. If you paid for your child’s or a dependent’s care while you worked or.

Child Care Credit Calculator

Web how is the credit calculated? Web in detail, the latest child tax credit scheme allows each family to claim up to $3,600 for every child below the age of 6, and up to $3,000 for every child below the age. Web the changes proposed earlier this week would retroactively boost the maximum refundable tax.

Child Care Tax Credit Calculator Slobodnakultura

Web the 2021 pandemic child tax credit, in comparison, increased the credit amount up to $3,600 per child under age 6 and $3,000 per child ages 6 to 17. This tax year, it’s a maximum of $2,000 per child per year. Web child and dependent care tax credit. That much shorter than the. Web the.

Child Tax Credit (CTC) Update 2024

Web the house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit that would make the program more. This tax year, it’s a maximum of $2,000 per child per year. Web the american rescue plan increased the child tax credit from $2,000 per child to $3,000.

Advanced Child Tax Credit Explained Haynie & Company

Further information is found below and in irs publication 503,. If you search online for information on the child tax. This tax year, it’s a maximum of $2,000 per child per year. Web the following faqs can help you learn if you are eligible and if eligible, how to calculate your credit. Web how is.

2021 Child Tax Credit Calculator Internal Revenue Code Simplified

The irs just in the first week of filing this tax season sent 2.6 million refunds. This tax year, it’s a maximum of $2,000 per child per year. Web the changes proposed earlier this week would retroactively boost the maximum refundable tax break to $1,800 per qualifying child for 2023, up from the. Web if.

Ontario Childcare Tax Credit. Refundable tax credit for

Web the child and dependent care tax credit enhancement act of 2024 increases the financial assistance provided to families for child care expenses. Web child and dependent care tax credit. Web how is the credit calculated? Web child & dependent care tax credit & calculator (2021, 2022) did you spend any money on childcare expenses.

Child Care Tax Credit Calculator Paradox

Here's how to calculate how much you'll get. Further information is found below and in irs publication 503,. You can get some of that back by claiming. Web if you want to see how large your credit will be, simply answer the four questions in the calculator below and we'll give you a customized estimate.

Childcare Tax Credit Calculator Web if you received advance payments of the child tax credit, you need to reconcile (compare) the total you received with the amount you’re eligible to claim. Web 1:09 the new child tax credit will provide $3,000 for children ages 6 to 17 and $3,600 for those under age 6. Web how is the credit calculated? The irs just in the first week of filing this tax season sent 2.6 million refunds. For the refundable portion of the credit (or the additional child tax credit), you may receive up to.

Here's How To Calculate How Much You'll Get.

Web the push to overhaul the tax benefit comes more than two years after the expiration of the expanded child tax credit, which bolstered the tax credit to as much as. This tax credit is not the same as the child tax credit. The careucator tool will guide you through the following criteria to. Web £ amount contributed by government £ quick links vat calculator sign into your account check if your eligible tax free childcare website registered childcare providers tax.

Web How Is The Child Care Tax Credit Calculated?

The irs just in the first week of filing this tax season sent 2.6 million refunds. Web the american rescue plan increased the child tax credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the. That much shorter than the. If you paid for your child’s or a dependent’s care while you worked or looked for a job, you may be eligible for a credit on.

When The Trump Tax Cuts Expire In 2025, The Credit Is Scheduled To Return To Its Previous Level Of.

You can get some of that back by claiming. If you search online for information on the child tax. Web if you want to see how large your credit will be, simply answer the four questions in the calculator below and we'll give you a customized estimate of (1) the. Web how is the credit calculated?

Web The Following Faqs Can Help You Learn If You Are Eligible And If Eligible, How To Calculate Your Credit.

No annual feeno waitingknowledgeable staffrush order Web 1:09 the new child tax credit will provide $3,000 for children ages 6 to 17 and $3,600 for those under age 6. Web the changes proposed earlier this week would retroactively boost the maximum refundable tax break to $1,800 per qualifying child for 2023, up from the. Web the child and dependent care tax credit enhancement act of 2024 increases the financial assistance provided to families for child care expenses.