Convert 403B To Roth Ira Calculator

Convert 403B To Roth Ira Calculator - Converting it to a roth. Web a conversion can get you into a roth ira—even if your income is too high. Web the short answer is yes, you can convert a 403 (b) account to a roth ira. Web a backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Current marginal income tax rate that will apply to conversion amount.

See an estimate of the taxes. For example, if you move $100,000 into a roth 401 (k) and you're in the 22% tax bracket, you'll owe $22,000 in. Web the short answer is yes, you can convert a 403 (b) account to a roth ira. 501c (3) corps, including colleges, universities,. Web updated april 18, 2023 reviewed by andy smith if you are considering doing a roth ira conversion, you are likely wondering how much tax you'll end up paying. Please note that the marginal tax rate for your conversion may be higher than your. Web a conversion can get you into a roth ira—even if your income is too high.

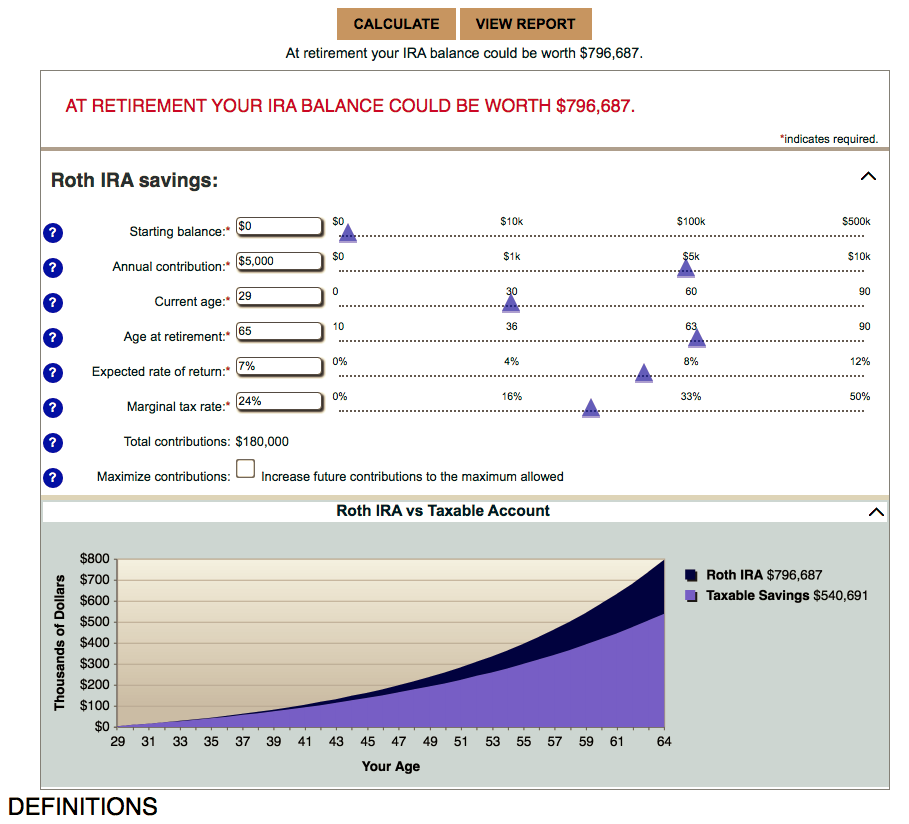

Roth 403b calculator EllisLujane

Web roth ira conversion calculator is converting to a roth ira the right move for you? Web bankrate.com provides a free convert ira to roth calculator and other 401k calculators to help consumers determine the best option for retirement savings. Contributing directly to a roth ira is restricted if your income is beyond. Depending on.

Roth Conversion Calculator Use Our Roth IRA Conversion Calculator For

Web otherwise stated, a conversion to a roth ira results in the taxation of any untaxed amounts converted from the traditional ira. Web a backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Web use our roth ira conversion calculator to compare the estimated future.

Roth 403b vs. Roth IRA Pros & Cons [EXPLAINED]

Web what's a roth ira conversion? Web use this calculator to see how converting your traditional ira to a roth ira could affect your net worth at retirement. Web use this free roth ira calculator to find out how much your roth ira contributions could be worth at retirement, calculate your estimated maximum annual contribution.

How to Use a Roth IRA Calculator Ready to Roth

501c (3) corps, including colleges, universities,. It is mainly intended for use by u.s. Converting it to a roth. 403 (b) rollover, you generally need to meet one of two criteria: Web how do you roll over a 403 (b) to an ira? Web otherwise stated, a conversion to a roth ira results in the.

How to Convert Traditional IRA Funds to Roth Solo 401k

Web the short answer is yes, you can convert a 403 (b) account to a roth ira. This calculator estimates the balances of roth ira savings and compares them with regular taxable account. Web bankrate.com provides a free convert ira to roth calculator and other 401k calculators to help consumers determine the best option for.

Roth IRA vs. 403b Which is Better? (2024)

For example, if you move $100,000 into a roth 401 (k) and you're in the 22% tax bracket, you'll owe $22,000 in. Web use this free roth ira calculator to find out how much your roth ira contributions could be worth at retirement, calculate your estimated maximum annual contribution in 2024,. Web updated april 18,.

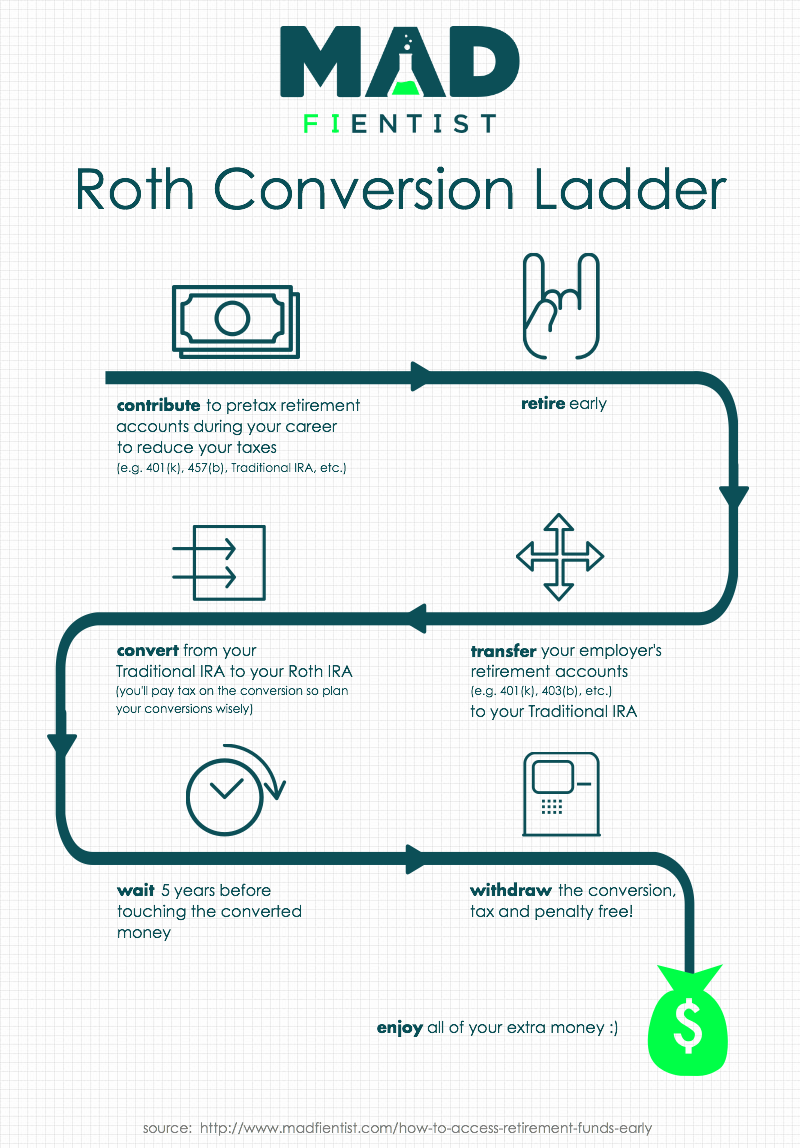

Roth Conversion Ladder and SEPP How to Access Your Retirement Accounts

This calculator estimates the balances of roth ira savings and compares them with regular taxable account. However, one of two conditions has to be met before you can do so. Web use our roth ira conversion calculator to compare the estimated future values of keeping your traditional ira vs. Depending on your situation, converting retirement.

403(b) vs Roth IRA What’s the Difference?

This calculator estimates the balances of roth ira savings and compares them with regular taxable account. Web this calculator that will help you to compare the estimated consequences of keeping your traditional ira as is, versus converting your traditional ira to a roth ira. Web 403b calculator is a tool for you to evaluate the.

How to Save More 403b vs Roth IRA • InvestLuck

Web a backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Web this calculator that will help you to compare the estimated consequences of keeping your traditional ira as is, versus converting your traditional ira to a roth ira. See an estimate of the taxes..

403(b) Plan vs Roth IRA Which One Is Better? [INFOGRAPHIC] Inside

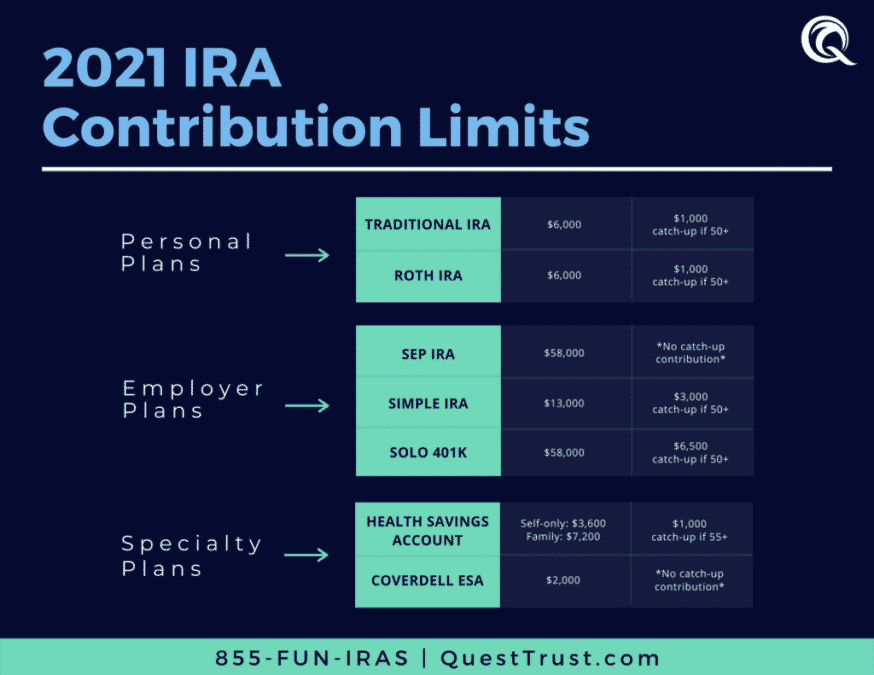

The rules allow a 403(b) plan to be converted to. You can determine the best contribution. Web the short answer is yes, you can convert a 403 (b) account to a roth ira. Web if the balance in your ira at the end of 2023 was $150,000, you’d need to divide $150,000 by 24.6 years..

Convert 403B To Roth Ira Calculator Web a backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. It is mainly intended for use by u.s. Contributing directly to a roth ira is restricted if your income is beyond. The rules allow a 403(b) plan to be converted to. Web use our roth ira conversion calculator to compare the estimated future values of keeping your traditional ira vs.

Web If The Balance In Your Ira At The End Of 2023 Was $150,000, You’d Need To Divide $150,000 By 24.6 Years.

Tastytrade.com has been visited by 10k+ users in the past month Web a conversion can get you into a roth ira—even if your income is too high. Web we recommend paying with cash from outside your ira for a couple of reasons: Web you'll owe income tax on any money you convert.

Please Note That The Marginal Tax Rate For Your Conversion May Be Higher Than Your.

An ameriprise financial advisor can help you evaluate. Contributing directly to a roth ira is restricted if your income is beyond. Web otherwise stated, a conversion to a roth ira results in the taxation of any untaxed amounts converted from the traditional ira. You have left your employer for a different job or.

Web Use This Free Roth Ira Calculator To Find Out How Much Your Roth Ira Contributions Could Be Worth At Retirement, Calculate Your Estimated Maximum Annual Contribution In 2024,.

For example, if you move $100,000 into a roth 401 (k) and you're in the 22% tax bracket, you'll owe $22,000 in. Web use our roth ira conversion calculator to compare the estimated future values of keeping your traditional ira vs. You can determine the best contribution. Depending on your situation, converting retirement savings that are currently in a traditional account to a roth retirement account may make sense.

501C (3) Corps, Including Colleges, Universities,.

Web what's a roth ira conversion? Web just because you do not have a traditional ira, does not mean that a roth conversion is not in the cards for you. The conversion is reported on form 8606,. This calculator estimates the balances of roth ira savings and compares them with regular taxable account.

![Roth 403b vs. Roth IRA Pros & Cons [EXPLAINED]](https://passiveincometoretire.com/wp-content/uploads/2022/06/roth-403b-vs-roth-ira.jpg)

![403(b) Plan vs Roth IRA Which One Is Better? [INFOGRAPHIC] Inside](https://i.pinimg.com/736x/2d/dc/3c/2ddc3c38e59119d3566e0ce24f7a3979.jpg)