Convertible Bond Calculator

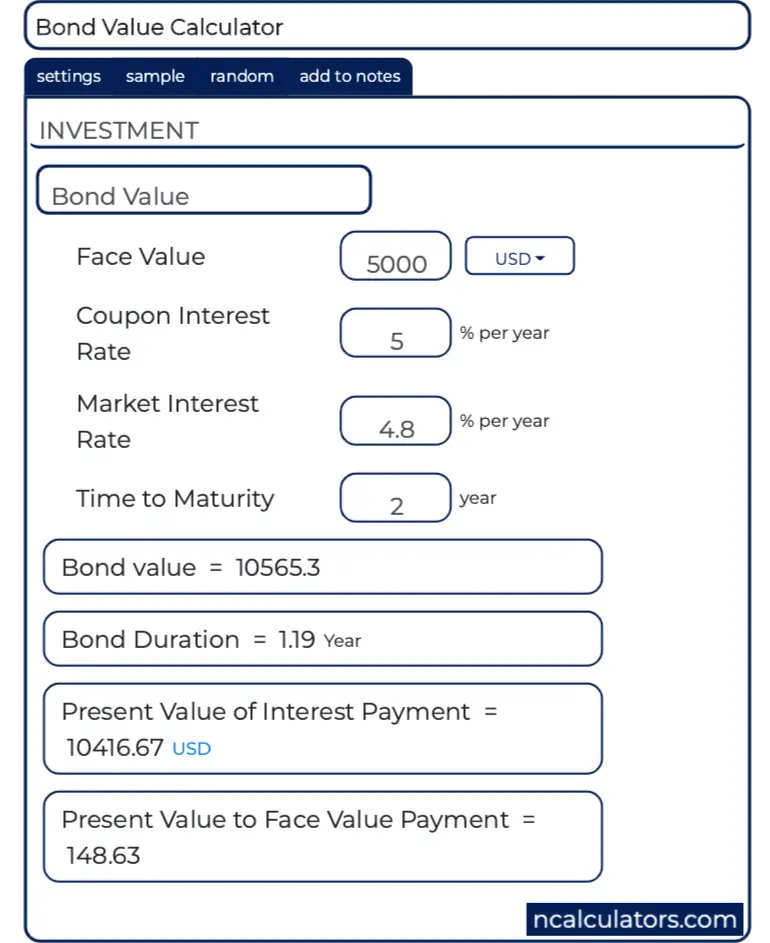

Convertible Bond Calculator - Web benefit by using our financial tools and the convertible note calculator to make better decisions for your company. Web the conversion ratio for this convertible bond is 10 shares for each $1000 par value held. Web key takeaways convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. Value of the convertible bond = max ( 90.3, 90 % × 100) max ( 90.3, 90) = $. C is coupon value, r is rate, n is year and.

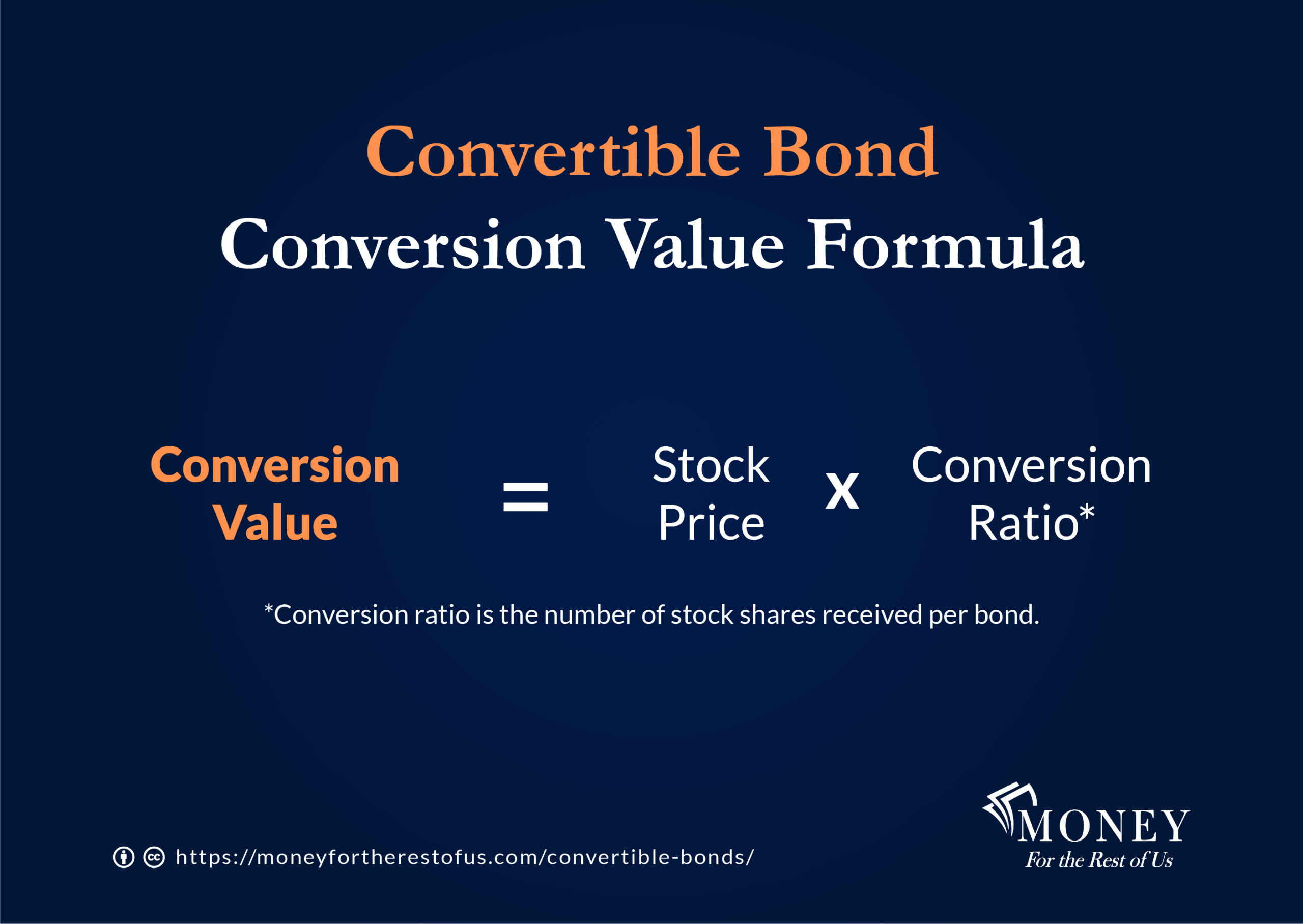

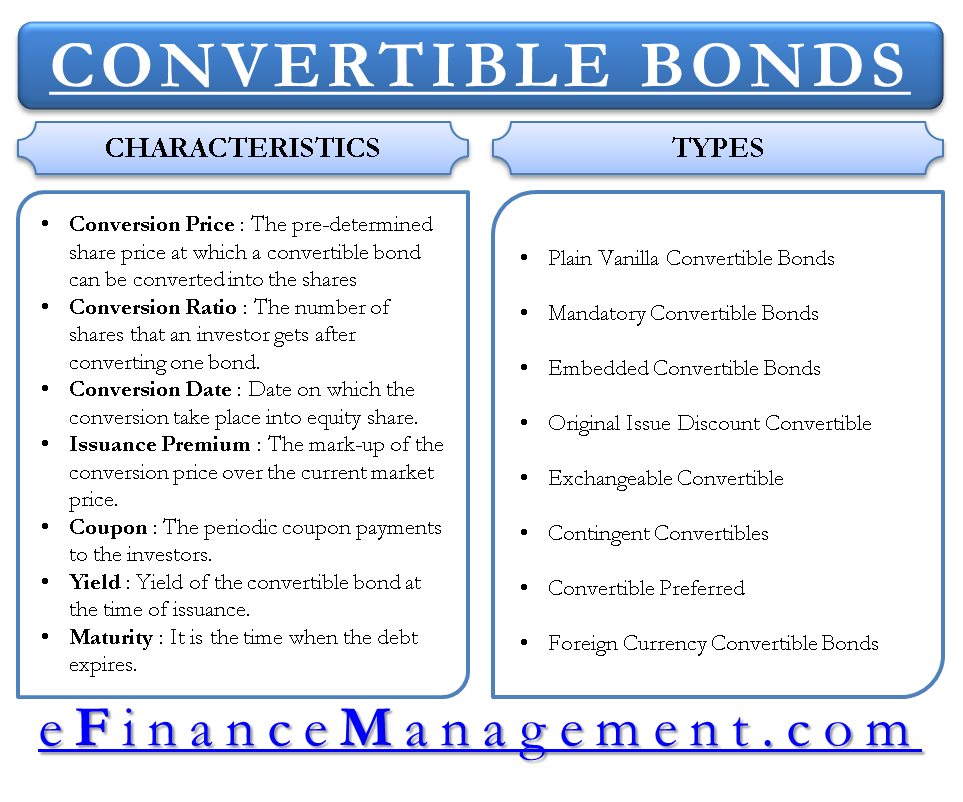

This means that if the price is over $100 per share (the exercise price or. We will multiply the face value of the bond by the coupon rate to do so. Calculate coupon amount the first step is to calculate the coupon amount. Web a convertible bond gives the holder the option to exchange (convert) the bond for a specified number of shares in the underlying company. Value of the convertible bond = max ( 90.3, 90 % × 100) max ( 90.3, 90) = $. Web the conversion ratio tells investors how many common shares they get in exchange for a convertible bond or stock. C = coupon rate of convertible bond p = par value of convertible bond r = rate on straight bond n =.

How To Calculate Conversion Ratio Of A Bond Haiper

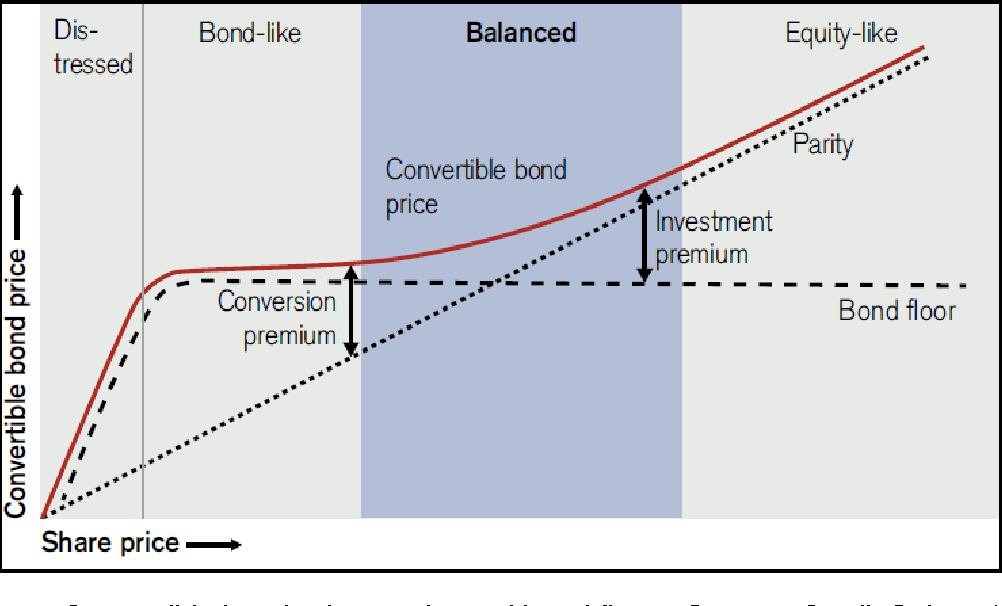

Value of the convertible bond = max ( 90.3, 90 % × 100) max ( 90.3, 90) = $. Web convertible bonds calculator what is a 'convertible bond'? Web key takeaways convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. Web value of convertible bond = independent value.

ConvertibleBond

Web how to calculate the conversion price for example, a bond has a conversion ratio of 5, which means the investor can trade one bond for five shares of. Web a convertible bond gives the holder the option to exchange (convert) the bond for a specified number of shares in the underlying company. Web benefit.

An Introduction to Convertible Bonds

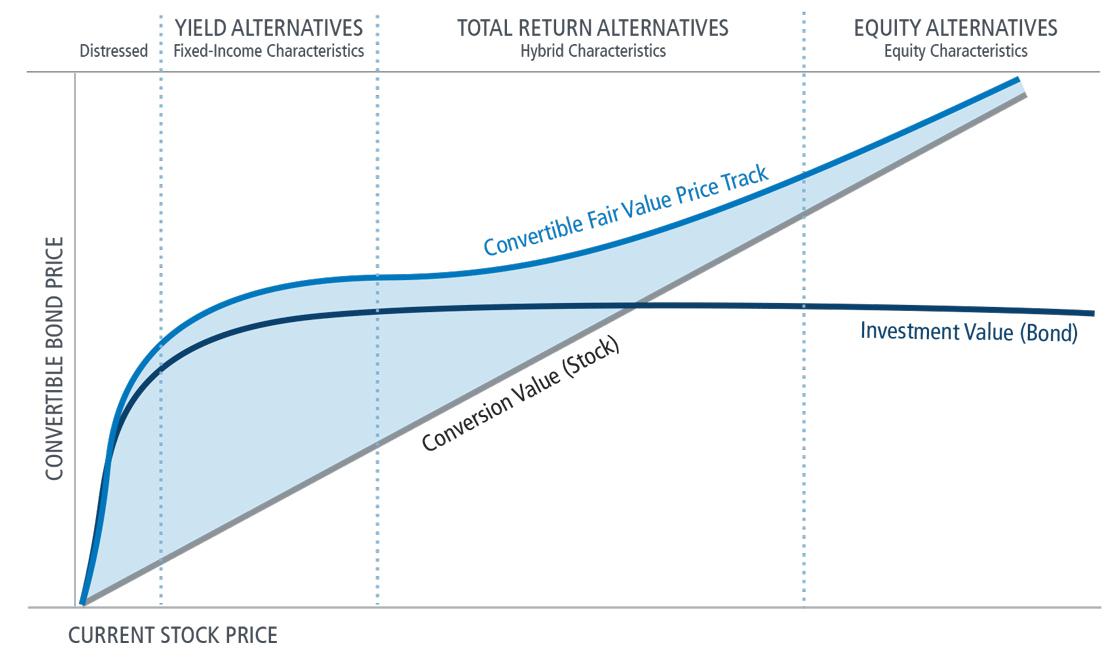

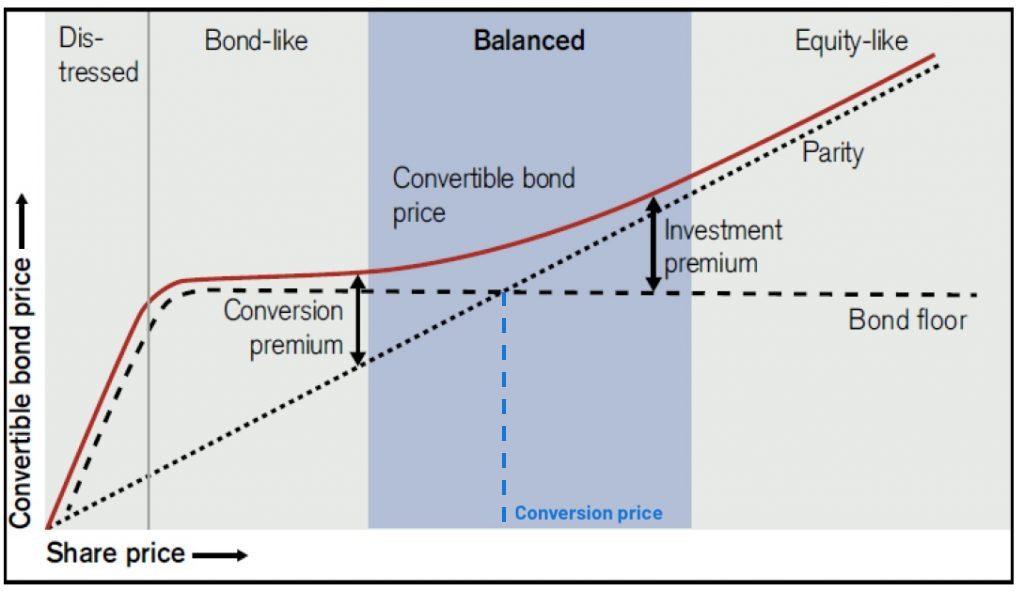

Read about bond valuation, particularly the. Web value of convertible bond = independent value of straight bond + independent value of conversion option. Web how to calculate the conversion price for example, a bond has a conversion ratio of 5, which means the investor can trade one bond for five shares of. The convertible bond.

Convertible Bonds Primer on Conversion Features

Web the conversion ratio for this convertible bond is 10 shares for each $1000 par value held. Web benefit by using our financial tools and the convertible note calculator to make better decisions for your company. Web how to calculate the value of convertible bond? The convertible bond can be calculated by using the below.

How To Calculate Floor Value Of Convertible Bond Viewfloor.co

The company sets the conversion ratio and. Web value of convertible bond = independent value of straight bond + independent value of conversion option. Calculate coupon amount the first step is to calculate the coupon amount. We will multiply the face value of the bond by the coupon rate to do so. Web stock dividend.

A CFA Level 2 Discussion About Convertible Bonds Formulas Explained

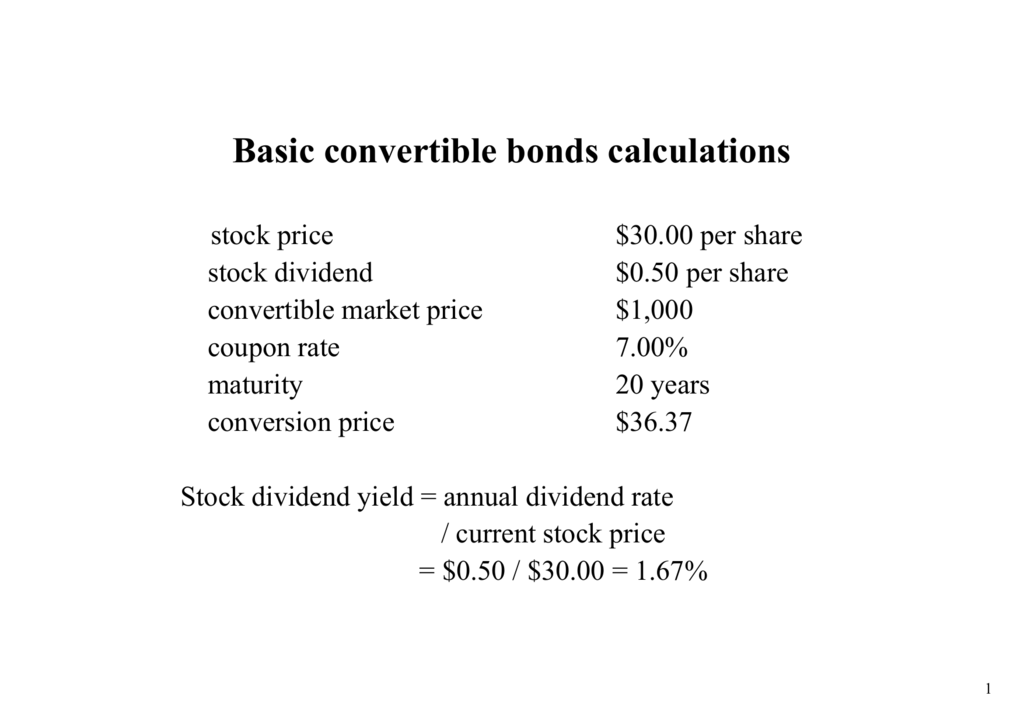

Web stock dividend yield = annual dividend rate / current stock price = $0.50 / $30.00 = 1.67% conversion ratio = number of shares for which one bond may be exchanged = par /. Web benefit by using our financial tools and the convertible note calculator to make better decisions for your company. Calculate coupon.

Basic convertible bonds calculations

Web stock dividend yield = annual dividend rate / current stock price = $0.50 / $30.00 = 1.67% conversion ratio = number of shares for which one bond may be exchanged = par /. Value of the convertible bond = max ( 90.3, 90 % × 100) max ( 90.3, 90) = $. Web benefit.

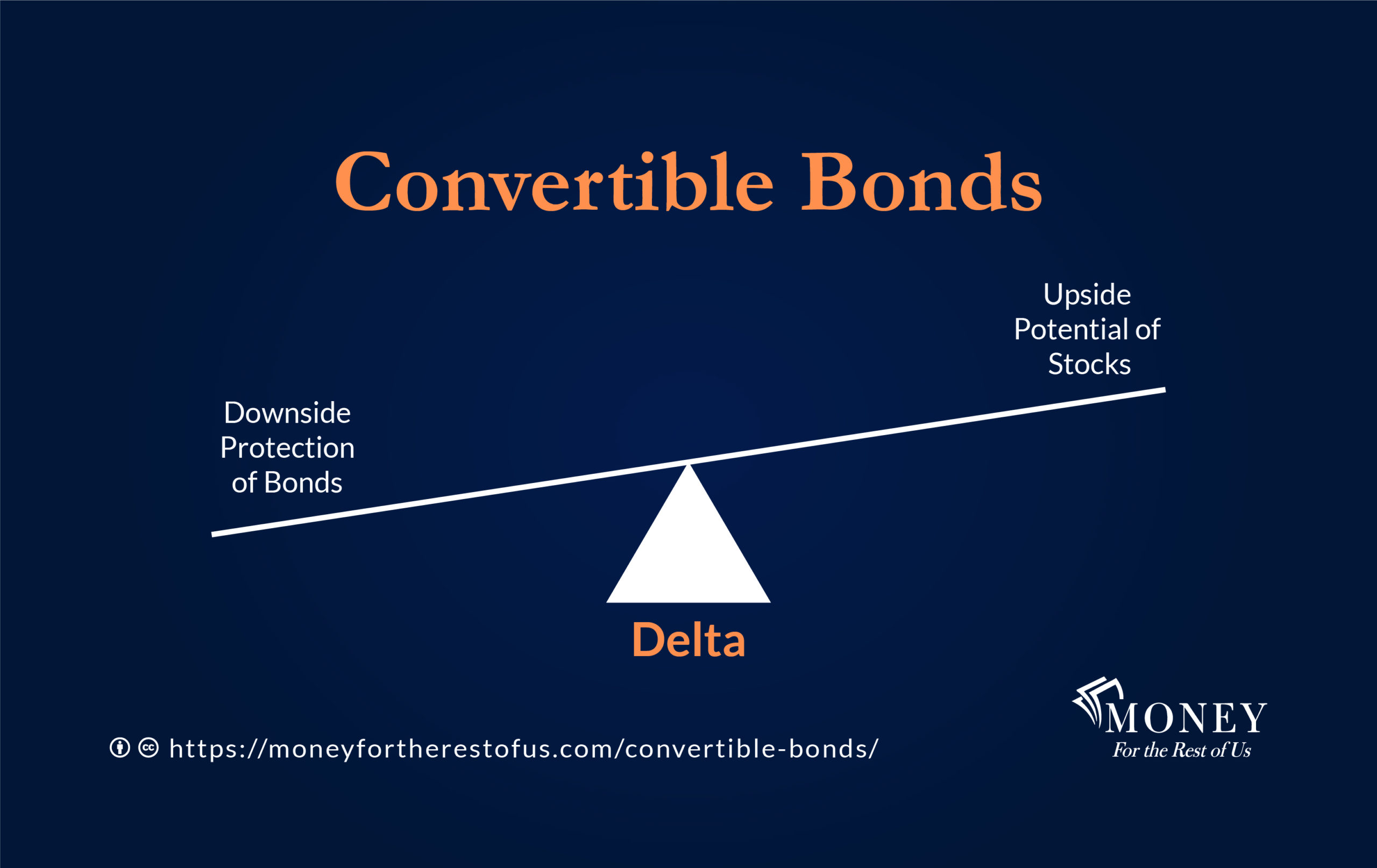

Convertible Bonds Everything You Need to Know Money For The Rest of Us

The convertible bond can be calculated by using the below formula: The financial worth of the securities obtained by exchanging a convertible security for its underlying assets. C is coupon value, r is rate, n is year and. A convertible bond is a type of debt security that can be converted into a predetermined amount.

How To Calculate Floor Value Of Convertible Bond Viewfloor.co

Read about bond valuation, particularly the. A convertible bond is a type of debt security that can be converted into a predetermined amount of the. C is coupon value, r is rate, n is year and. Web how to calculate the conversion price for example, a bond has a conversion ratio of 5, which means.

How To Calculate Conversion Price Of Convertible Bond Haiper

The company sets the conversion ratio and. Web convertible bonds calculator what is a 'convertible bond'? Web stock dividend yield = annual dividend rate / current stock price = $0.50 / $30.00 = 1.67% conversion ratio = number of shares for which one bond may be exchanged = par /. Web bond floor =.

Convertible Bond Calculator C = coupon rate of convertible bond p = par value of convertible bond r = rate on straight bond n =. Web value of convertible bond = independent value of straight bond + independent value of conversion option. The convertible bond can be calculated by using the below formula: This means that if the price is over $100 per share (the exercise price or. Web the conversion ratio tells investors how many common shares they get in exchange for a convertible bond or stock.

Value Of The Convertible Bond = Max(90.3,90%×100) Max(90.3,90) = $90.3 Min.

A convertible bond is a type of debt security that can be converted into a predetermined amount of the. Value of the convertible bond = max ( 90.3, 90 % × 100) max ( 90.3, 90) = $. Web how to calculate the value of convertible bond? This means that if the price is over $100 per share (the exercise price or.

Create Your Cap Table , Add Your Shareholders , Stock.

Calculate coupon amount the first step is to calculate the coupon amount. The financial worth of the securities obtained by exchanging a convertible security for its underlying assets. Web benefit by using our financial tools and the convertible note calculator to make better decisions for your company. Web a convertible bond gives the holder the option to exchange (convert) the bond for a specified number of shares in the underlying company.

The Convertible Bond Can Be Calculated By Using The Below Formula:

Web bond floor = ∑ t = 1 n c ( 1 + r ) t + p ( 1 + r ) n where: Web stock dividend yield = annual dividend rate / current stock price = $0.50 / $30.00 = 1.67% conversion ratio = number of shares for which one bond may be exchanged = par /. C = coupon rate of convertible bond p = par value of convertible bond r = rate on straight bond n =. Web the conversion ratio tells investors how many common shares they get in exchange for a convertible bond or stock.

Web Convertible Bonds Calculator What Is A 'Convertible Bond'?

C is coupon value, r is rate, n is year and. Read about bond valuation, particularly the. We will multiply the face value of the bond by the coupon rate to do so. Web how to calculate the conversion price for example, a bond has a conversion ratio of 5, which means the investor can trade one bond for five shares of.

:max_bytes(150000):strip_icc()/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)