Corp To Corp Tax Calculator

Corp To Corp Tax Calculator - $5,737.50 (payroll tax) + $18,000 (income tax on salary) + $18,000 (income tax on distribution) = $41,737.50. Web total s corp tax estimator: $27,700 for married couples filing jointly or qualifying surviving spouse. Understanding how to use such tools is. If you decided 2023 was the year to tackle some home improvements, you could reap the reward of tax credits worth up to $3,200.

Web trustscore 4.8 | 17375 reviews overall rating 4.8 | 83839 reviews s corporation tax calculator there are several advantages to forming a business entity. From 1st april 2023, there will be three corporation tax rates: For the 2023 tax year, all employees must pay social security taxes on income below $160,200 (if your income is above $160,200, you’ll pay taxes up to that amount).6it’s super easy to calculate this tax. Web an s corporation is a tax status of the internal revenue code (irs) subchapter s elected by llc or corporation business owners by filing form 2553. Web our s corp tax calculator will estimate whether electing an s corp will result in a tax win for your business. Web corp to corp (c2c) implies that as an alternative to paying you, a person, you'll need to have an llc or corporation that another business will pay for your. Free estimate of your tax savings becoming an s corporation.

UK Corporation Tax Calculator Excel Template for Corporation Tax

Web s corp tax calculator. Enter your estimated annual business net income and the. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Web to determine whether an s corporation is right for your business, let’s start with explaining what an s.

Understanding Corporation Tax Calculator Free Sample, Example

The impact of romney’s proposed $17,000 cap the debate over. Web taxhub has the perfect calculator for you! Web check each option you'd like to calculate for. The tax rate on most classes of taxable income is 5%. Web corp to corp (c2c) implies that as an alternative to paying you, a person, you'll need.

Corporate Tax Calculator Template for Excel Excel Templates

Get rewarded for going green. Web two ways to defer taxes are: Web the standard deduction for 2023 is: For the 2023 tax year, all employees must pay social security taxes on income below $160,200 (if your income is above $160,200, you’ll pay taxes up to that amount).6it’s super easy to calculate this tax. Web.

Corporate Tax Calculator Fill Online, Printable, Fillable, Blank

Web 2023 personal income tax rates. $27,700 for married couples filing jointly or qualifying surviving spouse. Web to determine whether an s corporation is right for your business, let’s start with explaining what an s corporation is and then walk through how may save you money. Web updated july 7, 2020: From 1st april 2023,.

Corporation tax 2023 Everything you need to know Foxy Monkey

Free estimate of your tax savings becoming an s corporation. Web here are eight things that can make the experience of preparing and filing your taxes as easy, efficient and inexpensive as possible. Enter your estimated annual business net income and the. In august 2011, mitt romney was campaigning for president at the iowa state.

SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can

Enter your estimated annual business net income and the. $27,700 for married couples filing jointly or qualifying surviving spouse. Web incfile’s s corporation tax calculator can help you get an idea of the potential tax savings with an s corp. Web corp to corp (c2c) implies that as an alternative to paying you, a person,.

Ultimate Corporation Tax Calculator [2021]

Just take 12.4% of your employee’s income and set aside 6.2% for taxes. Web the tax relief for american families and workers act passed by the house of representatives on january 31 is a compromise between lawmakers who want to. Web updated july 7, 2020: Web the standard deduction for 2023 is: This calculator helps.

Tax CPA Tips S Corp v C Corp Which is Best?

If you decided 2023 was the year to tackle some home improvements, you could reap the reward of tax credits worth up to $3,200. Free estimate of your tax savings becoming an s corporation. Simulating the economic effects of romney’s tax plan. Before using the s corp tax calculator, you will need to:. Get rewarded.

Corporation Tax Calculator Excel Excel Templates

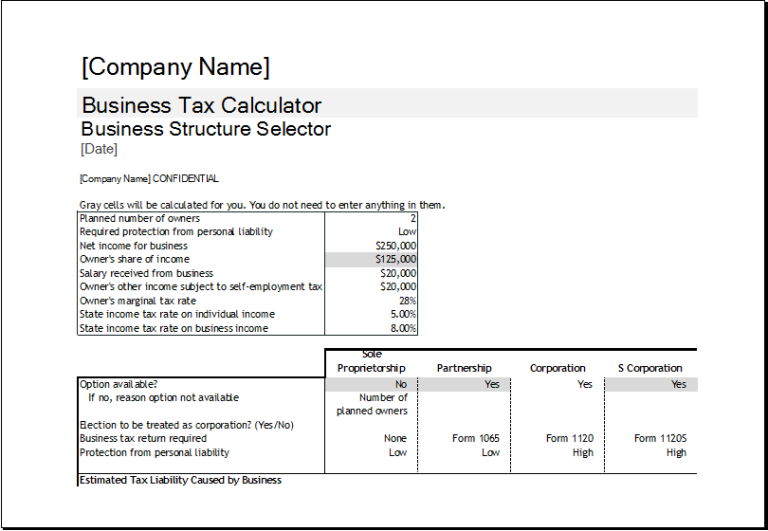

This calculator helps you understand the difference between filing taxes as a sole proprietor vs. The tax rate on most classes of taxable income is 5%. Understanding how to use such tools is. 19% (profits £50,000 or less), 26.5% (profits between £50,000 and £250,000), and 25%. Enter your tax profile to get your full tax.

Corporation Tax Calculator Includes Rates From 2023

From 1st april 2023, there will be three corporation tax rates: The impact of romney’s proposed $17,000 cap the debate over. The tax rate on most classes of taxable income is 5%. Use a holding company—transfer your company’s “safe income” (for tax purposes, any leftover cash earned through your business) to a holding. Web download.

Corp To Corp Tax Calculator From 1st april 2023, there will be three corporation tax rates: Note that llcs may also elect to be taxed as an s. If you decided 2023 was the year to tackle some home improvements, you could reap the reward of tax credits worth up to $3,200. This calculator helps you understand the difference between filing taxes as a sole proprietor vs. Use a holding company—transfer your company’s “safe income” (for tax purposes, any leftover cash earned through your business) to a holding.

The House Of Representatives Voted Wednesday To Approve A Roughly $80 Billion Deal To Expand The Federal Child Tax Credit.

Web adam maida / the atlantic. Just take 12.4% of your employee’s income and set aside 6.2% for taxes. This guide will walk you through the steps necessary to convert your business to an s corporation, and then show you how to. Web here’s what it means for you.

Web Download Fiscal Fact No.

Web taxhub has the perfect calculator for you! Web here are eight things that can make the experience of preparing and filing your taxes as easy, efficient and inexpensive as possible. Web check each option you'd like to calculate for. Understanding how to use such tools is.

Before Using The S Corp Tax Calculator, You Will Need To:.

Back taxes · tax preparation · business taxes If you decided 2023 was the year to tackle some home improvements, you could reap the reward of tax credits worth up to $3,200. S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. Web corp to corp (c2c) implies that as an alternative to paying you, a person, you'll need to have an llc or corporation that another business will pay for your.

$27,700 For Married Couples Filing Jointly Or Qualifying Surviving Spouse.

Web the tax relief for american families and workers act passed by the house of representatives on january 31 is a compromise between lawmakers who want to. $5,737.50 (payroll tax) + $18,000 (income tax on salary) + $18,000 (income tax on distribution) = $41,737.50. Web updated july 7, 2020: Web the standard deduction for 2023 is:

![SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can](https://i.ytimg.com/vi/UqujNM4IkFA/maxresdefault.jpg)

![Ultimate Corporation Tax Calculator [2021]](https://res.cloudinary.com/goforma/image/upload/v1615896965/calculators/corporation-tax-provision-calculator.png)