Corporate Tax Rate Calculator

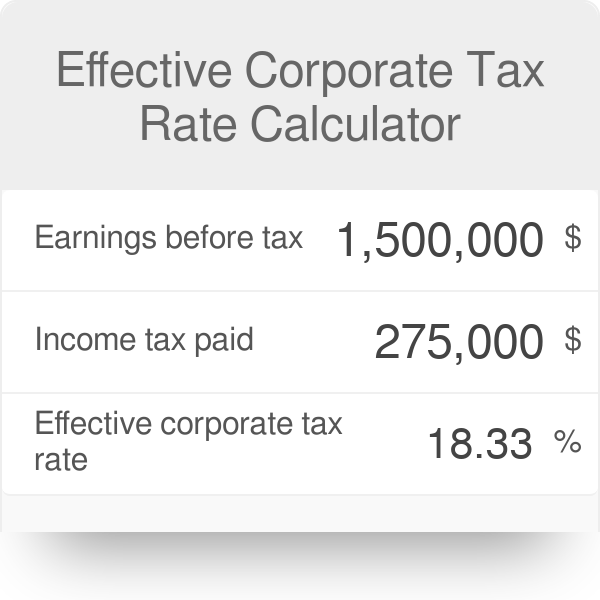

Corporate Tax Rate Calculator - Web free small business & llc tax estimates. Effective corporate tax rate = $714,000 / $3,400,000. Corporations, including qualified personal service corporations, figure their tax by multiplying taxable income by 21% (0.21). Prior to the tax cuts and jobs act, there were taxable income. Web personal tax calculator.

Plug these figures into the effective corporate tax rate calculator or formula and calculate. Web effective corporate tax rate calculator. Includes both state and federal. Web calculate your corporate income tax in canada for 2020 & 2021. Web 2023 personal income tax rates. Since then the rate peaked. Also levy taxes on corporate income,.

Corporate Tax Calculator

But 102 million didn’t, despite being. For personal income tax in canada, please refer to our personal income tax calculator. 19% (profits £50,000 or less), 26.5% (profits between £50,000 and £250,000), and 25%. Web effective corporate tax rate calculator. Web personal tax calculator. Corporations, including qualified personal service corporations, figure their tax by multiplying taxable.

Effective Tax Rate Formula Calculator (Excel Template)

The tax rate on most classes of taxable income is 5%. Web the current corporate tax rate (federal) is 21%, thanks to the tax cuts and jobs act of 2017. Web the irs has developed a calculator, called the tax withholding estimator, that accurately predicts how much federal taxes you will need to pay each.

GitHub Shieda1/EffectiveCorporateTaxRateCalculator

Just under 3.3 million federal taxpayers used free file in fiscal year 2022. Web so its effective tax rate was 19% ($3,331 / $17,259). And even if you get an. Web in our 2024 edition of us employment tax rates and limits you will find, as of january 25, 2024, the following: Calculate your combined.

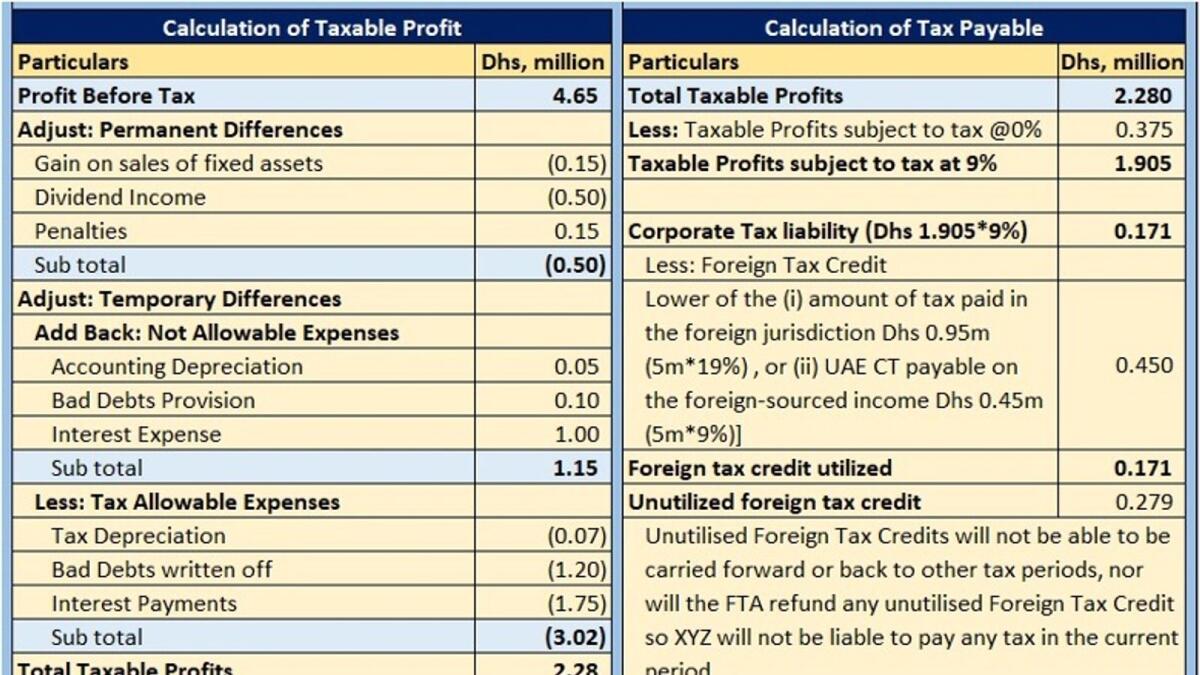

How to calculate corporate tax payable and adjust foreign tax credit

Corporations, including qualified personal service corporations, figure their tax by multiplying taxable income by 21% (0.21). But 102 million didn’t, despite being. Plug these figures into the effective corporate tax rate calculator or formula and calculate. Also levy taxes on corporate income,. Web free small business & llc tax estimates. And even if you get.

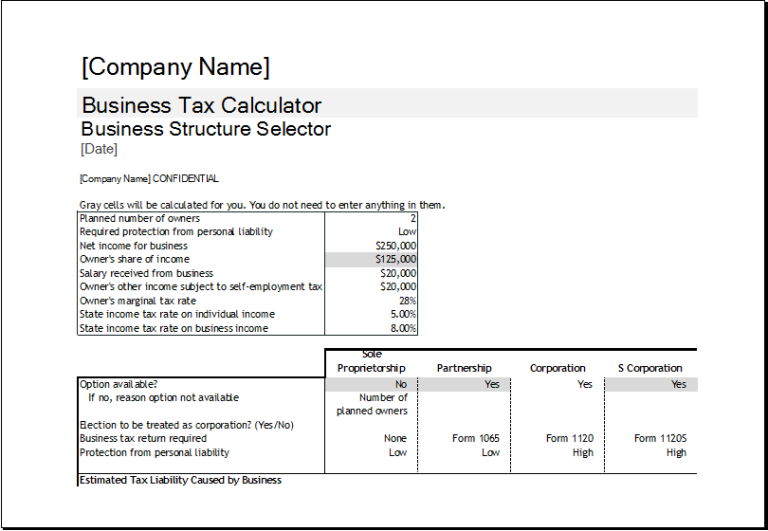

Corporation Tax Calculator Excel Excel Templates

Web the irs has developed a calculator, called the tax withholding estimator, that accurately predicts how much federal taxes you will need to pay each year, based. The ectr calculator takes into account a. Web so its effective tax rate was 19% ($3,331 / $17,259). After the general tax reduction, the net tax rate is.

Effective Tax Rate Formula and Calculator (StepbyStep)

Substituting the values from our example, we get: Since then the rate peaked. Your expenses are subtracted from your revenue and then the correct tax rate is applied. Enter your tax profile to discover bonus tax savings. Web £50,000 (the lower limit) £250,000 (the upper limit) if your accounting period is shorter than 12 months.

Corporate tax definition and meaning Market Business News

Web effective corporate tax rate = income tax paid / ebt. Web the basic rate of part i tax is 38% of your taxable income, 28% after federal tax abatement. Web the federal corporate income tax was fist implemented in 1909, when the uniform rate was 1% for all business income above $5,000. Web find.

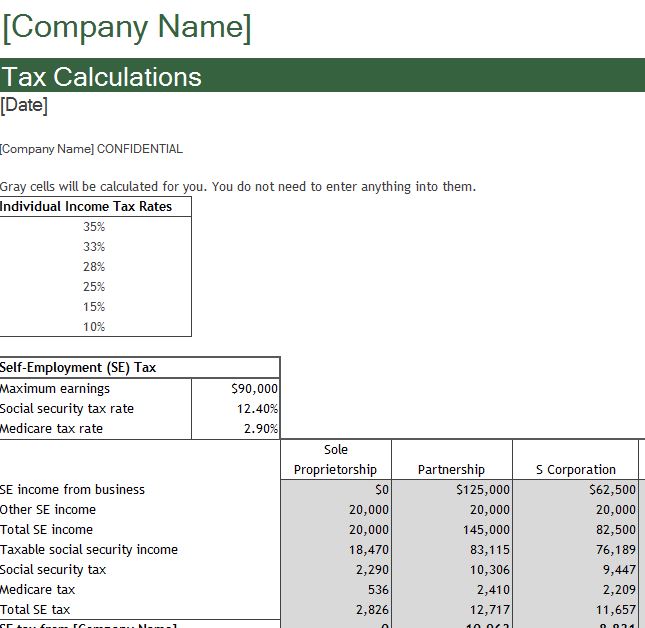

Corporate Tax Calculator Template for Excel Excel Templates

Effective corporate tax rate = $714,000 / $3,400,000. Substituting the values from our example, we get: The tax rate on most classes of taxable income is 5%. Web share of taxpayers using free file declined in 2022. How to calculate effective tax. Also levy taxes on corporate income,. And even if you get an. Social.

Effective tax rate formula AnnaliseRene

After the general tax reduction, the net tax rate is 15%. Your expenses are subtracted from your revenue and then the correct tax rate is applied. Web 2023 personal income tax rates. The tax rate on most classes of taxable income is 5%. If the corporation is a member of a. The ectr calculator takes.

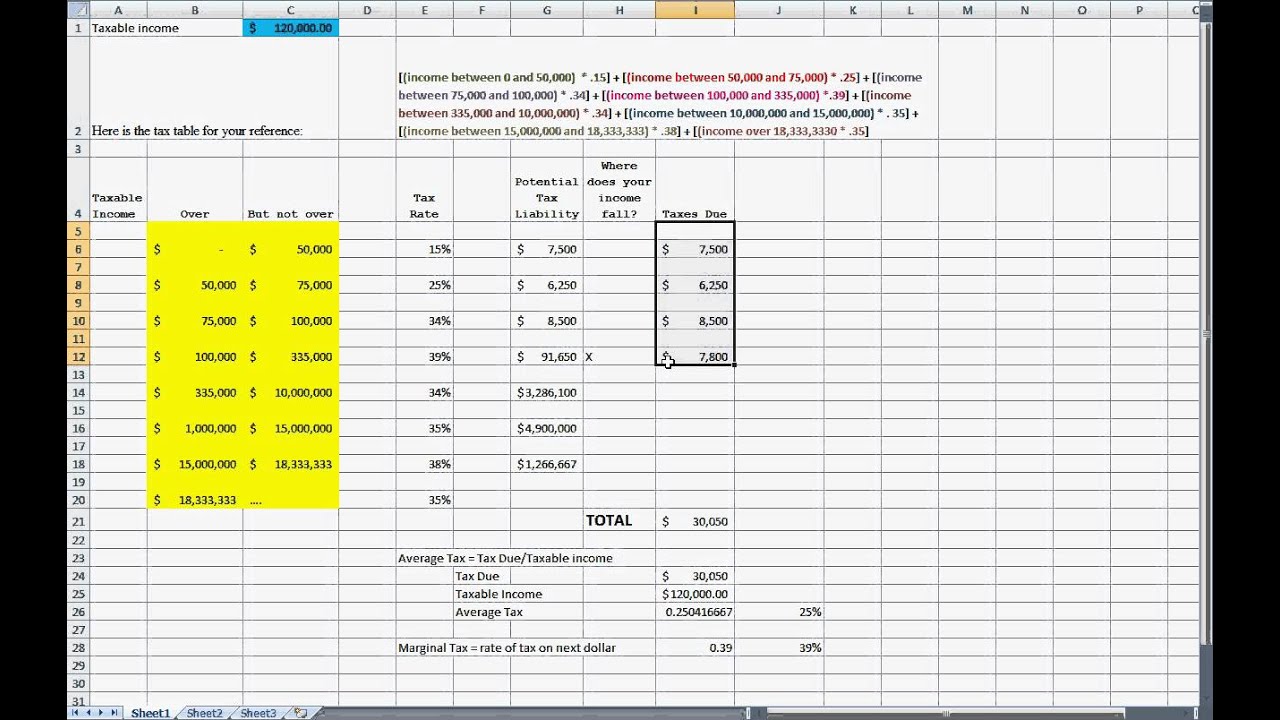

How to calculate corporate taxes due plus average tax rate and marginal

Web £50,000 (the lower limit) £250,000 (the upper limit) if your accounting period is shorter than 12 months these limits are proportionately reduced. Web effective corporate tax rate = income tax paid / ebt. Are the earnings left after deducting the cost of goods sold. Effective corporate tax rate = $714,000 / $3,400,000. Corporations, including.

Corporate Tax Rate Calculator Includes both state and federal. Prior to the tax cuts and jobs act, there were taxable income. The ectr calculator takes into account a. Enter your tax profile to discover bonus tax savings. Web furthermore, the share of income taxes paid by the top 1% increased from 33.2% in 2001 to 42.3% in 2020.

After The General Tax Reduction, The Net Tax Rate Is 15%.

From 1st april 2023, there will be three corporation tax rates: Web £50,000 (the lower limit) £250,000 (the upper limit) if your accounting period is shorter than 12 months these limits are proportionately reduced. Web in our 2024 edition of us employment tax rates and limits you will find, as of january 25, 2024, the following: Web effective corporate tax rate = income tax paid / ebt.

How To Calculate Effective Tax.

But 102 million didn’t, despite being. Web free small business & llc tax estimates. Effective corporate tax rate = $714,000 / $3,400,000. Enter your tax profile to discover bonus tax savings.

Also Levy Taxes On Corporate Income,.

19% (profits £50,000 or less), 26.5% (profits between £50,000 and £250,000), and 25%. Social security wage base for 2024. Web find the total tax expense listed above net income on the income statement. Includes both state and federal.

Just Under 3.3 Million Federal Taxpayers Used Free File In Fiscal Year 2022.

Calculate your combined federal and provincial tax bill in each province and territory. Web 2023 personal income tax rates. And even if you get an. Enter your estimated annual business net income and the.