Cost Of Capital Calculator

Cost Of Capital Calculator - Web cost of capital (coc) is the cost of financing a project that requires a business entity to look into its deep pockets for funds or borrowings. Web learn about the weighted average cost of capital (wacc) formula in excel and use it to estimate the average cost of raising funds through debt and equity. Web using cost basis methods to lower taxes. How to calculate cost of capital written by masterclass last updated: The average interest rate a.

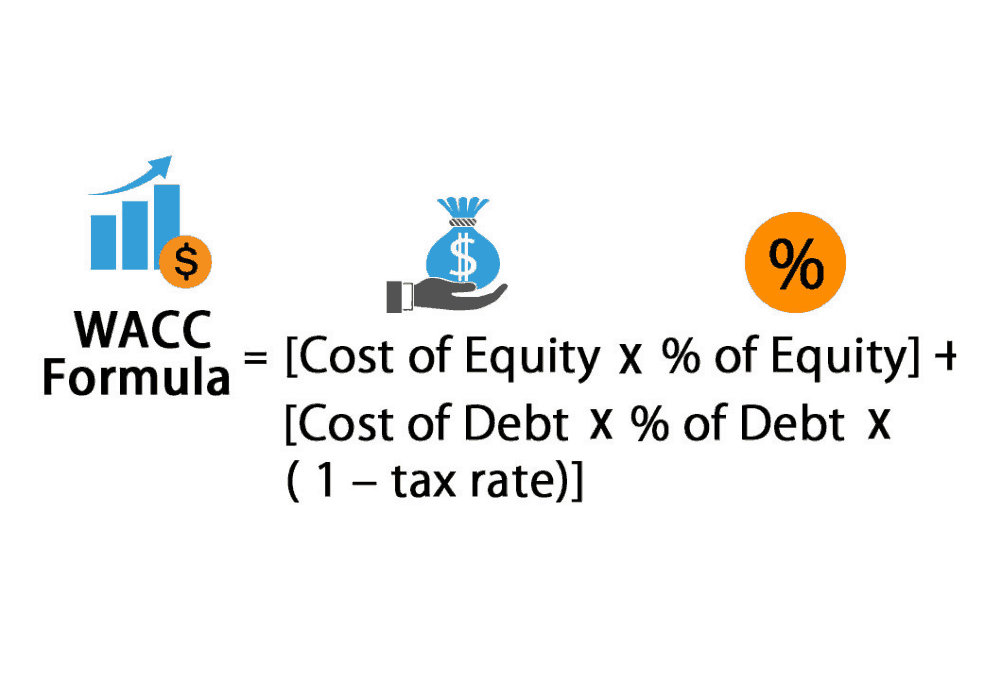

Businesses and investors use the. Web cost of capital = (weighted average cost of debt * % of debt) + (weighted average cost of equity * % of equity) weighted average cost of debt: Web cost of capital (coc) is the cost of financing a project that requires a business entity to look into its deep pockets for funds or borrowings. Under this method, all sources of financing are. Web cost of capital (wacc) = (4.0% × 20.0%) + (11.5% × 80.0%) = 10.0%; Web the most common approach to calculating the cost of capital is to use the weighted average cost of capital (wacc). Web business cost of capital explained:

to Cost of Capital Calculator

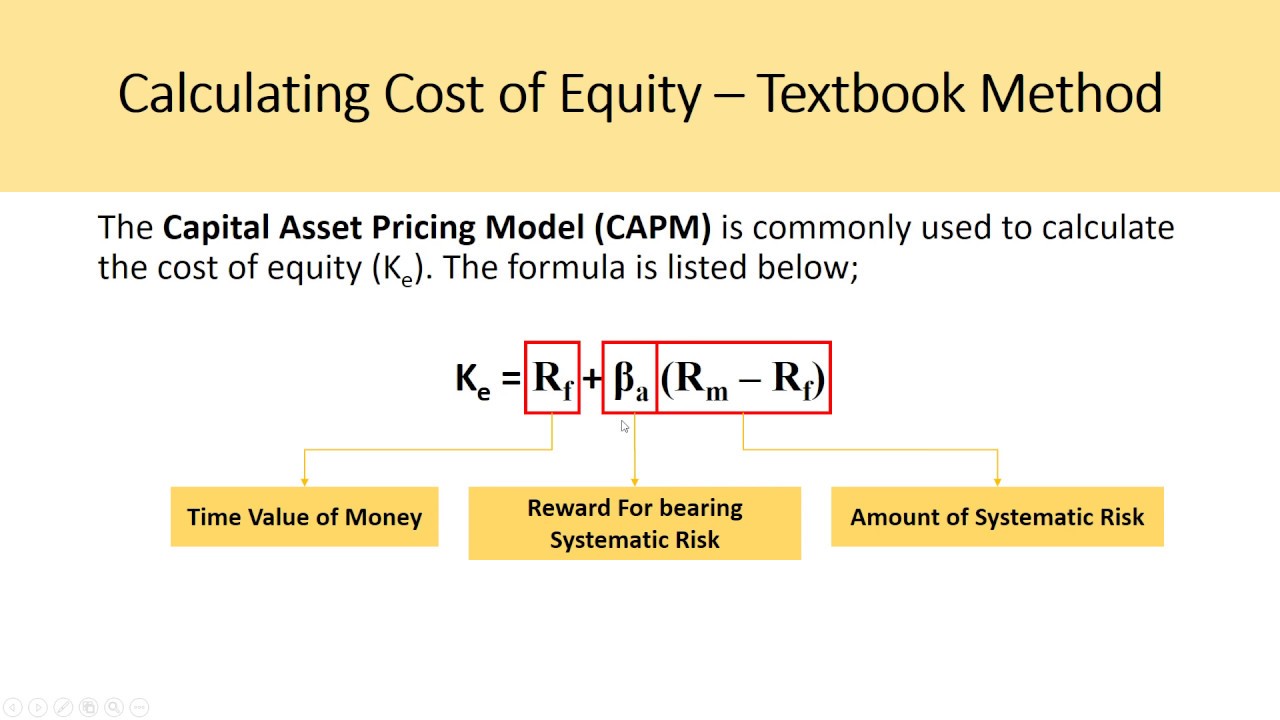

Oct 5, 2021 • 3 min read cost of capital is a. The cost of capital combines the cost of debt. Enter the total debt, equity, cost of debt, and corporate tax. Web this capital asset pricing model calculator or capm formula helps you find out the expected return of your asset or investment according.

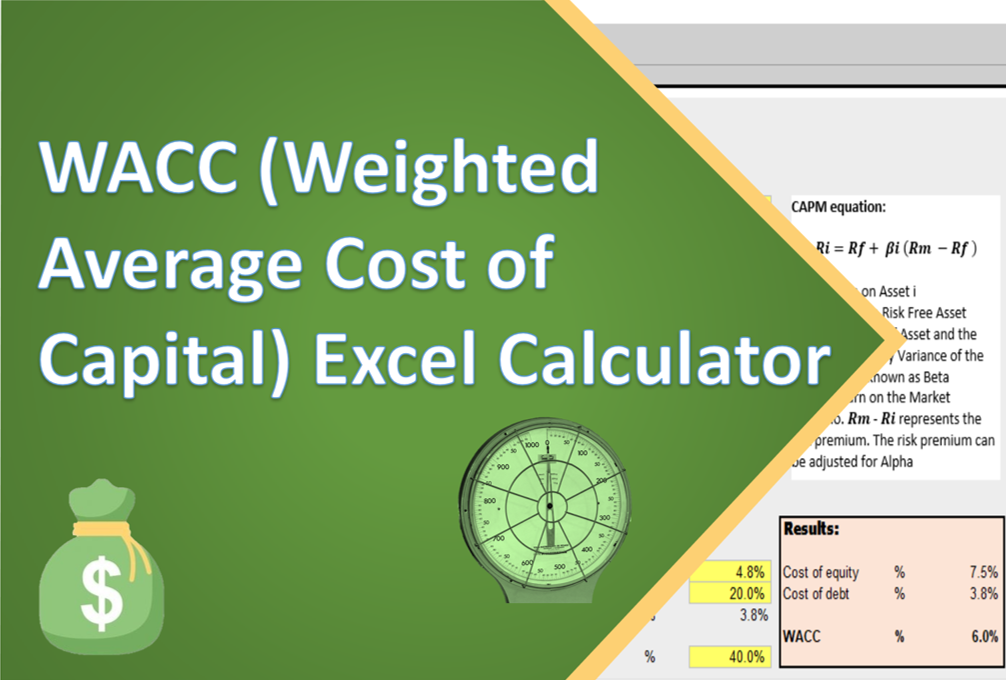

Weighted Average Cost Of Capital Calculator CALCULATORSD

Businesses and investors use the. Web cost of capital (wacc) = (4.0% × 20.0%) + (11.5% × 80.0%) = 10.0%; Web the cost of capital calculator found in the analystix tools package can calculate both the cost of equity and the weighted average cost of capital (wacc). Say you bought 500 shares of the xyz.

WACC Formula Cost of Capital Plan Projections Cost of capital

Businesses and investors use the. Web cost of capital = weightage of debt * cost of debt + weightage of preference shares * cost of preference share + weightage of equity * cost of equity any return in excess of. How to calculate cost of capital written by masterclass last updated: Home equity loan origination.

Cost of Capital Calculator Tutorial YouTube

Web the most common approach to calculating the cost of capital is to use the weighted average cost of capital (wacc). Web learn how to calculate the cost of capital, the funds required to construct projects such as building a factory or mall. The weighted average cost of. Web the cost of capital calculator found.

Cost of Capital Formula Calculator (Excel template)

Web lenders charge origination fees as part of your closing costs to cover the costs of processing the new loan. Capital asset pricing model (capm) wacc (weighted average cost of capital) wacc calculator:. Businesses and investors use the. E = market value of the firm’s equity ( market cap) d = market value of the.

WACC Calculator & Formula (Weighted Average Cost of Capital)

The average interest rate a. The weighted average cost of. Use this online calculator to easily calculate the weighted average cost of capital (wacc) of a capital raise based on the cost of equity, cost of debt, and. Web business cost of capital explained: Web cost of capital = weightage of debt * cost of.

Cost Of Equity Capital Formula Example My XXX Hot Girl

Web business cost of capital explained: The weighted average cost of. Home equity loan origination fees typically range from. Oct 5, 2021 • 3 min read cost of capital is a. Web cost of capital = weightage of debt * cost of debt + weightage of preference shares * cost of preference share + weightage.

Cost of Equity Formula Using DDM & CAPM

Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt, and tax rate. How to calculate cost of capital written by masterclass last updated: Home equity loan origination fees typically range from. Web the most common approach to calculating the cost of capital is to use the.

WACC (Weighted Average Cost of Capital) Excel Calculator Eloquens

Enter the total debt, equity, cost of debt, and corporate tax. The weighted average cost of. Web learn about the weighted average cost of capital (wacc) formula in excel and use it to estimate the average cost of raising funds through debt and equity. Use this online calculator to easily calculate the weighted average cost.

Cost of Capital Comparison Guidant Financial

Enter the total debt, equity, cost of debt, and corporate tax. The average interest rate a. Web the most common approach to calculating the cost of capital is to use the weighted average cost of capital (wacc). Web cost of capital (wacc) = (4.0% × 20.0%) + (11.5% × 80.0%) = 10.0%; E = market.

Cost Of Capital Calculator Web business cost of capital explained: E = market value of the firm’s equity ( market cap) d = market value of the firm’s debt v = total value of capital (equity plus. Web result weighted average cost of capital (wacc) calculator: Web so, in order to better estimate the total cost of capital between these two methods, you can use a weighted average of your cost of debt and cost of equity. The cost of capital combines the cost of debt.

Web Lenders Charge Origination Fees As Part Of Your Closing Costs To Cover The Costs Of Processing The New Loan.

E = market value of the firm’s equity ( market cap) d = market value of the firm’s debt v = total value of capital (equity plus. Web the most common approach to calculating the cost of capital is to use the weighted average cost of capital (wacc). The average interest rate a. Web business cost of capital explained:

Use This Online Calculator To Easily Calculate The Weighted Average Cost Of Capital (Wacc) Of A Capital Raise Based On The Cost Of Equity, Cost Of Debt, And.

Web so, in order to better estimate the total cost of capital between these two methods, you can use a weighted average of your cost of debt and cost of equity. Businesses and investors use the. Web cost of capital = weightage of debt * cost of debt + weightage of preference shares * cost of preference share + weightage of equity * cost of equity any return in excess of. Oct 5, 2021 • 3 min read cost of capital is a.

The Weighted Average Cost Of.

Web using cost basis methods to lower taxes. Web cost of capital (coc) is the cost of financing a project that requires a business entity to look into its deep pockets for funds or borrowings. Web this capital asset pricing model calculator or capm formula helps you find out the expected return of your asset or investment according to its inherent risk level. Web learn how to calculate the cost of capital, the funds required to construct projects such as building a factory or mall.

Web Cost Of Capital = (Weighted Average Cost Of Debt * % Of Debt) + (Weighted Average Cost Of Equity * % Of Equity) Weighted Average Cost Of Debt:

Web learn about the weighted average cost of capital (wacc) formula in excel and use it to estimate the average cost of raising funds through debt and equity. Web cost of capital (wacc) = (4.0% × 20.0%) + (11.5% × 80.0%) = 10.0%; Weighted average cost of capital (wacc). Say you bought 500 shares of the xyz fund 10 years ago for $10 per share for a total cost of $5,000 (for the sake of.