Ct Teachers Retirement Calculator

Ct Teachers Retirement Calculator - Fully exempt from state income tax. Web the system is administered by the teachers' retirement board (trb), which thanks to passage of a state law in 2023 expanding the body, has grown to 16 members. Based on the statutes governing cost of living. The teachers’ retirement system is a hybrid plan,. Web this benefit estimator have been developed to assist you in estimating your potential retirement benefit.

Retirement benefits are calculated based. Web the system is administered by the teachers' retirement board (trb), which thanks to passage of a state law in 2023 expanding the body, has grown to 16 members. 3 years of highest salary x years of service. Web capitol place suite 500 21 oak street hartford, ct 06106. Join me on this episode. Web predicated on your retirement. Based on the statutes governing cost of living.

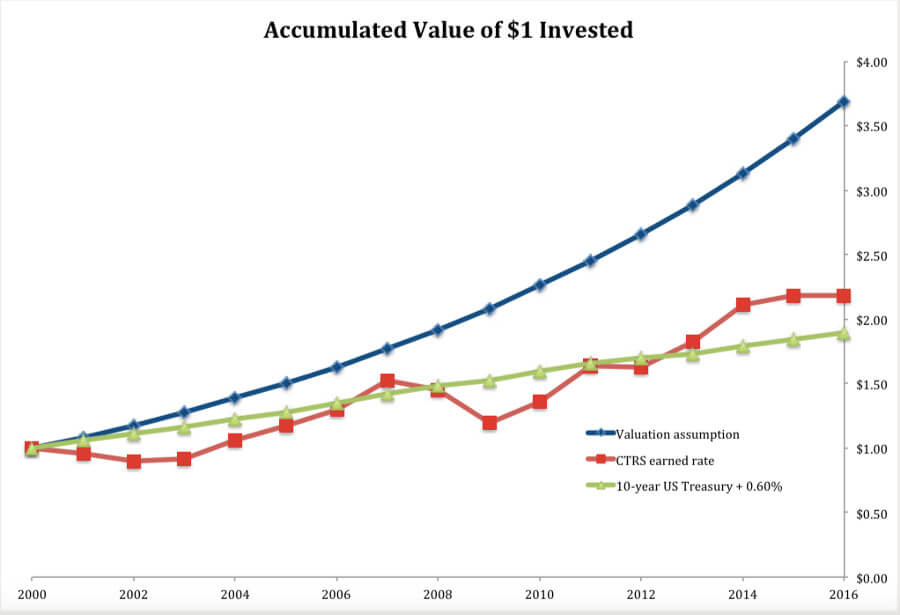

Connecticut teacher pension discount rate remains high compared to the

Plan c and plan d factors are also listed below. Web pension benefit estimator pension benefit estimator additional service credit cost estimator a minimum of 20 years of ct service is required to use this benefit. (for positions not covered by social security) part b benefit estimator. Fully exempt from state income tax. Web a.

How Does a Teacher Pension Work? Estimate Your Benefit Educator FI

While no teachers in connecticut pay social security taxes on the basis of their teaching service,1 any teachers hired after 1986 are required to pay. Web the connecticut teachers' retirement system is governed by chapter 167a of the connecticut general statutes as amended through the current session of. Retirement benefits are calculated based. 3 years.

Teachers pension early retirement calculator Early Retirement

Web the connecticut teachers' retirement system is governed by chapter 167a of the connecticut general statutes as amended through the current session of. Web a teacher pension is calculated in connecticut with the following formula. Web part a benefit estimator. Web predicated on your retirement. Web military and railroad retirement pay. Web social security has.

The Connecticut Teachers’ Retirement System Can it be stabilized

The teachers’ retirement system is a hybrid plan,. While no teachers in connecticut pay social security taxes on the basis of their teaching service,1 any teachers hired after 1986 are required to pay. Web benefit estimator teachers' retirement board for retired teachers benefit estimator read disclaimer benefit estimator worksheet start my estimate ( **recent legislation..

RWR051 3 Things To Know About The CT Teachers Retirement Pension

Web the connecticut teachers' retirement system is governed by chapter 167a of the connecticut general statutes as amended through the current session of. Web connecticut's teachers' retirement system (trs), one of the state's largest retirement systems, is a defined benefit plan administered by the teachers' retirement board. Web a teacher pension is calculated in connecticut.

Teacher Pension Calculator Calculate Your Retirement Easily

Web capitol place suite 500 21 oak street hartford, ct 06106. Currently, taxpayers with agis of less than $75,000 or $100,000. Web this benefit estimator have been developed to assist you in estimating your potential retirement benefit. Web social security has announced that they will be granting a cost of living increase of 1.3% for.

Connecticut teacher pension contribution may rise 1 percent under new

Fully exempt from state income tax. Based on the statutes governing cost of living. (for positions not covered by social security) part b benefit estimator. Web predicated on your retirement. Web military and railroad retirement pay. Web while social security income is normally taxed, it is exempted for seniors with adjusted gross income (agi) below.

CT Teachers Retirement System Can it be stabilized Yankee Institute

Web the system is administered by the teachers' retirement board (trb), which thanks to passage of a state law in 2023 expanding the body, has grown to 16 members. Web taxpayers with teachers’ retirement system (trs) income qualify for a 50% exemption regardless of their agi. 3 years of highest salary x years of service..

Connecticut pays 14,374 per teacher for teacher pension debt Yankee

Web chicago teachers' pension fund (ctpf) members enjoy a guaranteed pension for life, based on your tier level, final average salary, ctpf years of service, and. Web while social security income is normally taxed, it is exempted for seniors with adjusted gross income (agi) below a certain level. Web social security has announced that they.

The 10 Best Retirement Calculators NewRetirement

All retired municipal teachers can deduct 50% of their. Web benefit estimator teachers' retirement board for retired teachers benefit estimator read disclaimer benefit estimator worksheet start my estimate ( **recent legislation. Web chicago teachers' pension fund (ctpf) members enjoy a guaranteed pension for life, based on your tier level, final average salary, ctpf years of.

Ct Teachers Retirement Calculator Retirement benefits are calculated based. Web the system is administered by the teachers' retirement board (trb), which thanks to passage of a state law in 2023 expanding the body, has grown to 16 members. While no teachers in connecticut pay social security taxes on the basis of their teaching service,1 any teachers hired after 1986 are required to pay. Web military and railroad retirement pay. Web taxpayers with teachers’ retirement system (trs) income qualify for a 50% exemption regardless of their agi.

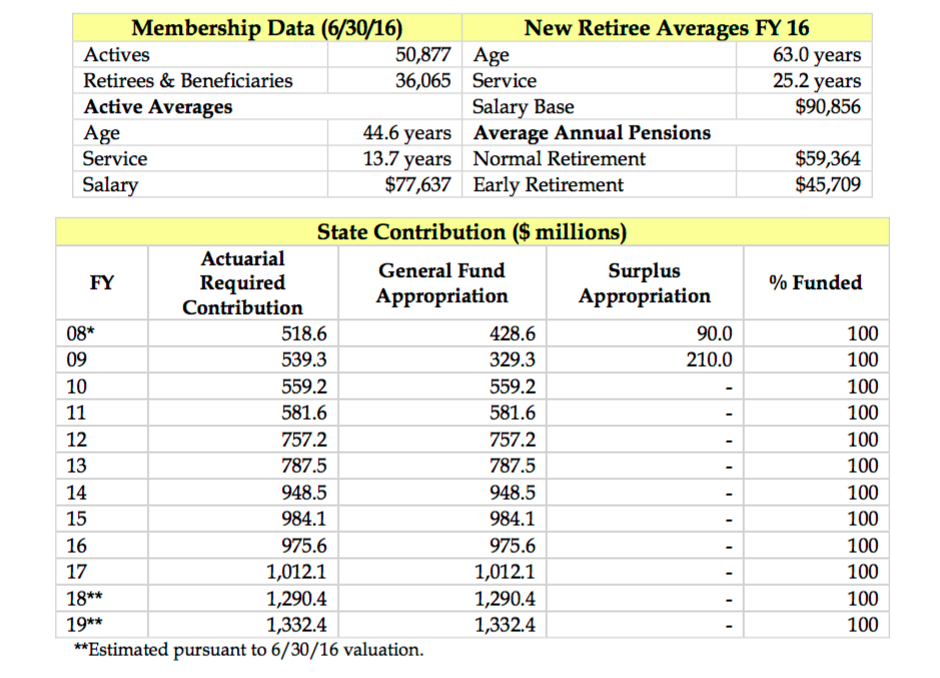

Web Connecticut's Teachers' Retirement System (Trs), One Of The State's Largest Retirement Systems, Is A Defined Benefit Plan Administered By The Teachers' Retirement Board.

All retired municipal teachers can deduct 50% of their. Join me on this episode. Web military and railroad retirement pay. Web social security has announced that they will be granting a cost of living increase of 1.3% for the current year.

Plan C And Plan D Factors Are Also Listed Below.

Web the connecticut teachers' retirement system is governed by chapter 167a of the connecticut general statutes as amended through the current session of. Fully exempt from state income tax. Web this benefit estimator have been developed to assist you in estimating your potential retirement benefit. Based on the statutes governing cost of living.

Web Taxpayers With Teachers’ Retirement System (Trs) Income Qualify For A 50% Exemption Regardless Of Their Agi.

Web chicago teachers' pension fund (ctpf) members enjoy a guaranteed pension for life, based on your tier level, final average salary, ctpf years of service, and. (for positions covered by social security) Web predicated on your retirement. Web benefit estimator teachers' retirement board for retired teachers benefit estimator read disclaimer benefit estimator worksheet start my estimate ( **recent legislation.

Currently, Taxpayers With Agis Of Less Than $75,000 Or $100,000.

(for positions not covered by social security) part b benefit estimator. The teachers’ retirement system is a hybrid plan,. Web currently, the teachers’ retirement system serves 32,294 retirees, distributing more than $1,531,493 in annual benefits. Retirement benefits are calculated based.