Deferred Comp Calculator

Deferred Comp Calculator - Web a deferred compensation plan is another name for a 457 (b) retirement plan, or “457 plan” for short. It assumes that you participate in a single 457 (b) plan in 2024 with one employer. Web 457 savings calculator a 457 can be one of your best tools for creating a secure retirement. Web use this calculator to estimate how much your plan may accumulate for retirement. Withdrawing money from a qualified retirement account,.

Gainbridge.io has been visited by 10k+ users in the past month Enter your income, deductions, and contributions to see how much you can defer. Web roth analyzer see the potential tax advantages of contributing to a roth account. It provides you with two important advantages. Web get a 457 plan withdrawal calculator branded for your website! Web “deferred compensation plans are typically designed for high earners like executives in order to allow them to push off receiving a portion of their compensation. You only pay taxes on contributions and earnings when the money is withdrawn.

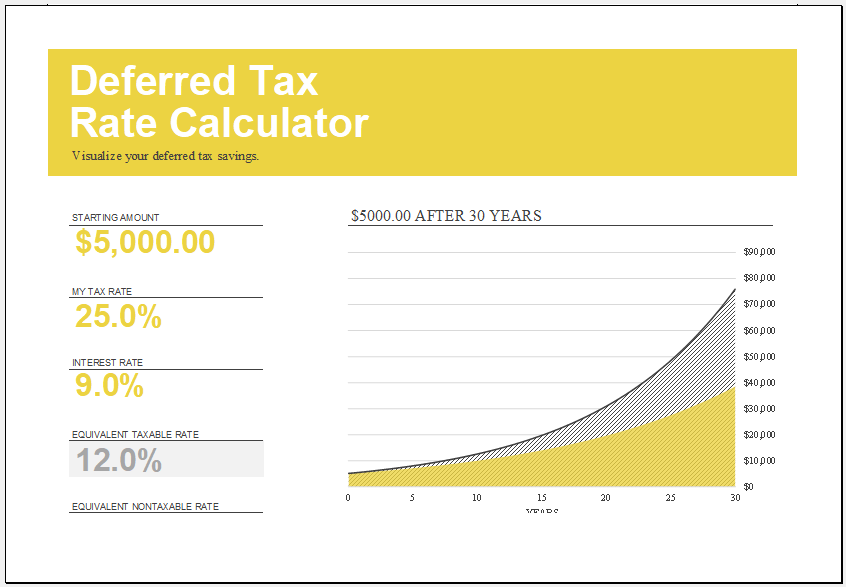

Deferred Tax Rate Calculator Template for Excel Excel Templates

Gainbridge.io has been visited by 10k+ users in the past month Web a deferred compensation plan is another name for a 457 (b) retirement plan, or “457 plan” for short. Deferred compensation plans are designed for state and municipal workers,. Web 457 savings calculator a 457 can be one of your best tools for creating.

What is Deferred Tax Liability (DTL)? Formula + Calculator

Colorful, interactive, simply the best financial calculators! Gainbridge.io has been visited by 10k+ users in the past month Web 457 savings calculator a 457 can be one of your best tools for creating a secure retirement. Web use this calculator to estimate how much your plan may accumulate for retirement. Enter your income, deductions, and.

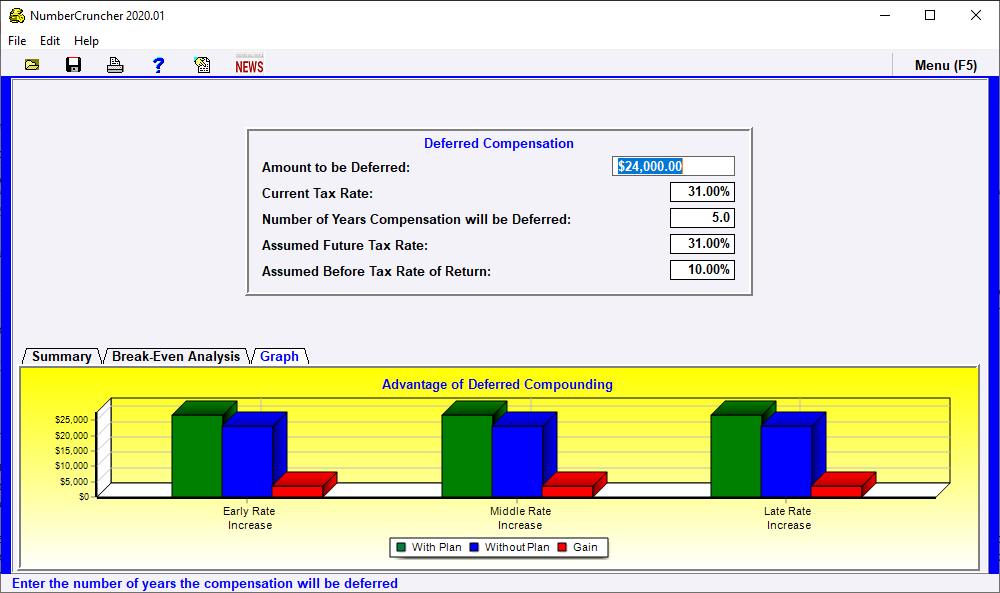

Deferred compensation plan calculator CorahAlafair

Web this calculator can help you estimate how much you’ll need to save in your deferred comp account in addition to your pension and social security income. Web a deferred compensation plan is another name for a 457 (b) retirement plan, or “457 plan” for short. Web 457 savings calculator a 457 can be one.

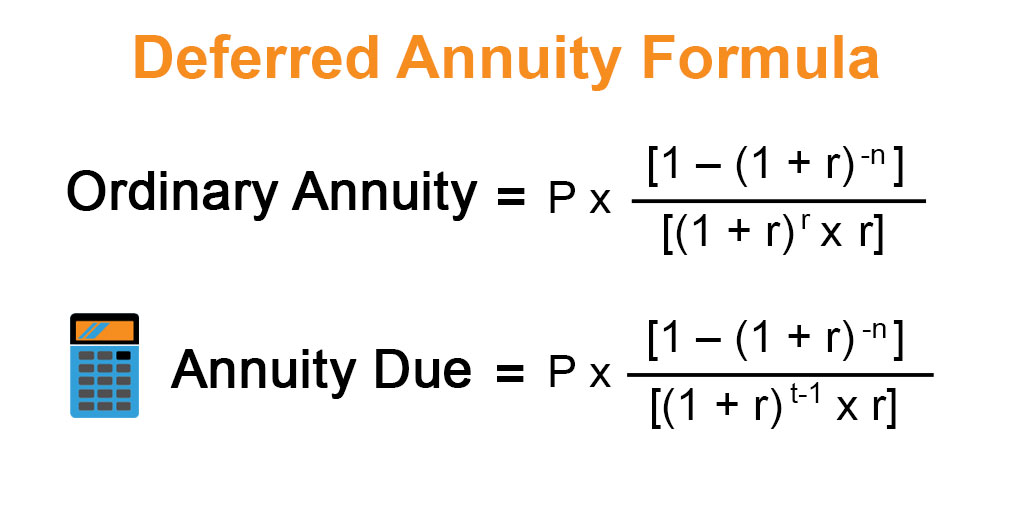

Deferred Annuity Calculator Deferred Annuity Calculator Explained

Web the new york city deferred compensation plan (dcp) allows eligible new york city employees a way to save for retirement through convenient payroll deductions. It provides you with two important advantages. It assumes that you participate in a single 457 (b) plan in 2024 with one employer. Web get a 457 plan withdrawal calculator.

How to Account for Deferred Compensation 7 Steps (with Pictures)

You only pay taxes on contributions and earnings when the money is withdrawn. Web calculate your deferred compensation plan with this online tool from principal financial group. Years until retirement (1 to 50) current annual income ($) annual salary increases (0% to 10%). Web 457 savings calculator a 457 can be one of your best.

Deferred Calculator SimpleTaxCalculator.xlsx Google Drive

It provides you with two important advantages. Web roth analyzer see the potential tax advantages of contributing to a roth account. Web learn about the benefits and drawbacks of deferred compensation plans, also called supplemental executive retirement plans or elective deferral plans. Web a deferred compensation plan is another name for a 457 (b) retirement.

Deferred Annuity Formula Calculator (Example with Excel Template)

Withdrawing money from a qualified retirement account,. Web 457 savings calculator a 457 can be one of your best tools for creating a secure retirement. Years until retirement (1 to 50) current annual income ($) annual salary increases (0% to 10%). Gainbridge.io has been visited by 10k+ users in the past month Web this calculator.

Deferred comp calculator MollieAilie

Web “deferred compensation plans are typically designed for high earners like executives in order to allow them to push off receiving a portion of their compensation. Dcp contributions can be dollar or percentage amounts. Colorful, interactive, simply the best financial calculators! Web roth analyzer see the potential tax advantages of contributing to a roth account..

Taxable vs TaxDeferred Calculator — VisualCalc

Web this calculator will help you determine the maximum contribution to your 457 (b) plan. Enter your income, deductions, and contributions to see how much you can defer. Dcp contributions can be dollar or percentage amounts. This calculator lets you estimate using percentages. Web get a 457 plan withdrawal calculator branded for your website! Web.

Deferred Deferred Compensation Leimberg, LeClair, & Lackner, Inc.

Web this calculator can help you estimate how much you’ll need to save in your deferred comp account in addition to your pension and social security income. Web a deferred compensation plan is another name for a 457 (b) retirement plan, or “457 plan” for short. The tool does not consider specific securities held by.

Deferred Comp Calculator Web the output of this calculator may vary with each use and is based on your input along with additional assumptions. Web 457 savings calculator a 457 can be one of your best tools for creating a secure retirement. Web new york state logo with text labelling the logo specific to deferred compensation plan a 457b plan for your future. Web this calculator will help you determine the maximum contribution to your 457 (b) plan. Web the new york city deferred compensation plan (dcp) allows eligible new york city employees a way to save for retirement through convenient payroll deductions.

Web New York State Logo With Text Labelling The Logo Specific To Deferred Compensation Plan A 457B Plan For Your Future.

Web use these calculators to estimate the cost of delay, savings boost, roth option, required minimum distribution, and retirement withdrawal for your deferred compensation plan. Web this calculator can help you estimate how much you’ll need to save in your deferred comp account in addition to your pension and social security income. Web use this calculator to estimate how much your plan may accumulate for retirement. You only pay taxes on contributions and earnings when the money is withdrawn.

Web Roth Analyzer See The Potential Tax Advantages Of Contributing To A Roth Account.

Years until retirement (1 to 50) current annual income ($) annual salary increases (0% to 10%). Web learn about the benefits and drawbacks of deferred compensation plans, also called supplemental executive retirement plans or elective deferral plans. It provides you with two important advantages. Web the early withdrawal calculator (the “tool”) allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account, including potential lost asset.

Web 457 Savings Calculator A 457 Can Be One Of Your Best Tools For Creating A Secure Retirement.

Web log into your dcp account to change your contributions. The tool does not consider specific securities held by you and. Web “deferred compensation plans are typically designed for high earners like executives in order to allow them to push off receiving a portion of their compensation. My health care estimator® get an idea of what your health care costs may be.

This Calculator Lets You Estimate Using Percentages.

Deferred compensation plans are designed for state and municipal workers,. Web the output of this calculator may vary with each use and is based on your input along with additional assumptions. It helps you determine the minimum amount you need to withdraw from your retirement. Gainbridge.io has been visited by 10k+ users in the past month