Deferred Payment Loan Calculator

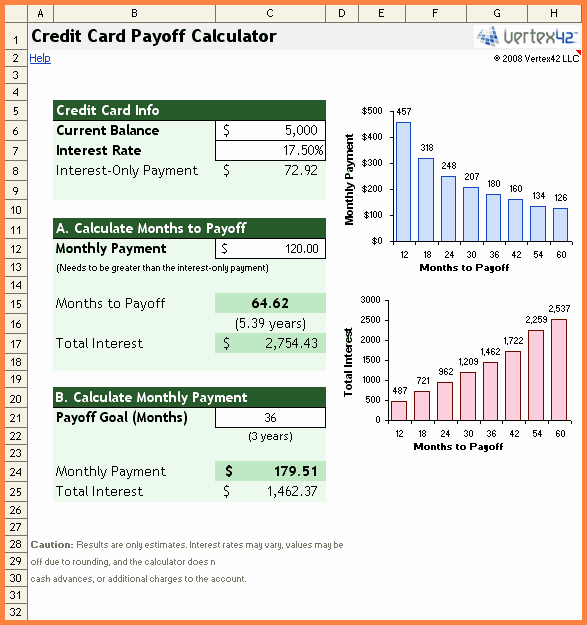

Deferred Payment Loan Calculator - However, you will not be required to make payments. A deferred payment loan is a loan structure where no payments are made during the loan period. Web this method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. After answering the question what does deferred payment mean?, let's see how to use the deferred payment loan calculator: As a first step, you need to set the loan inputs :

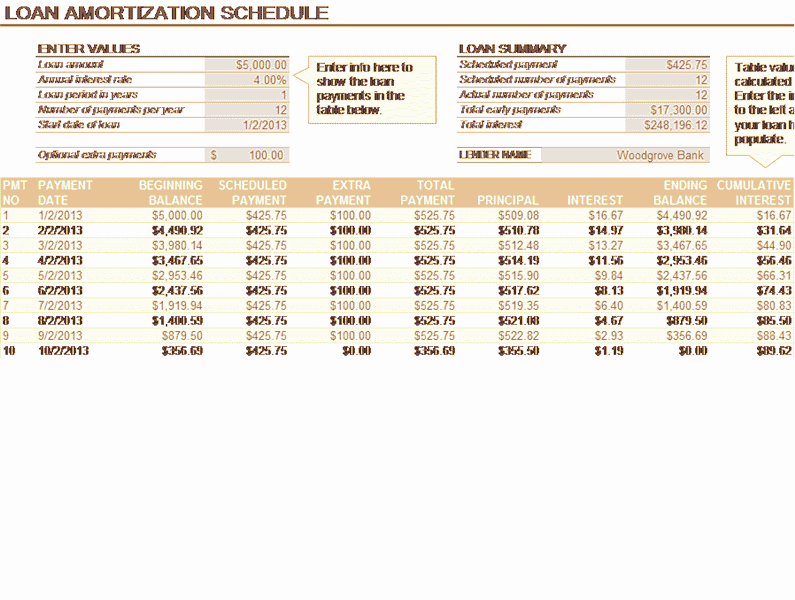

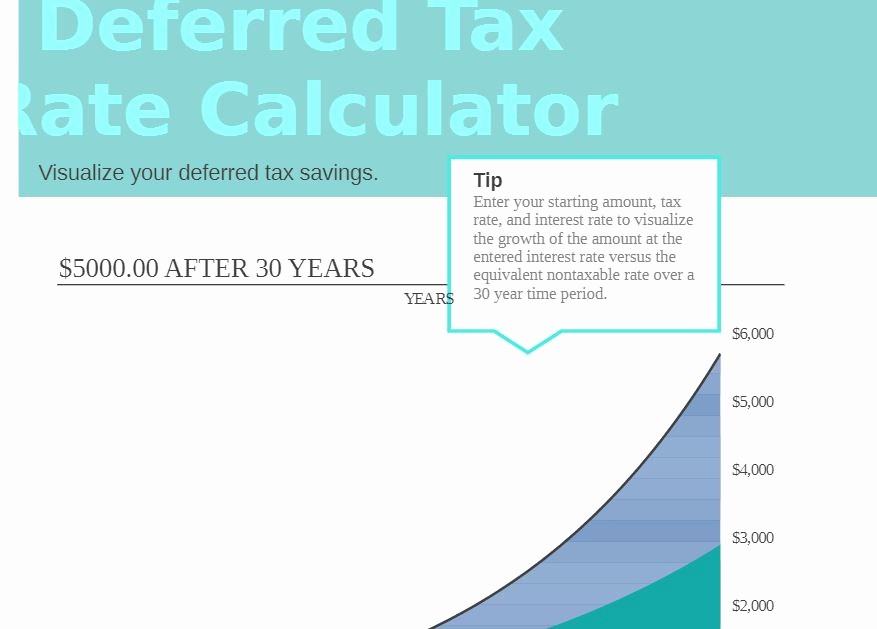

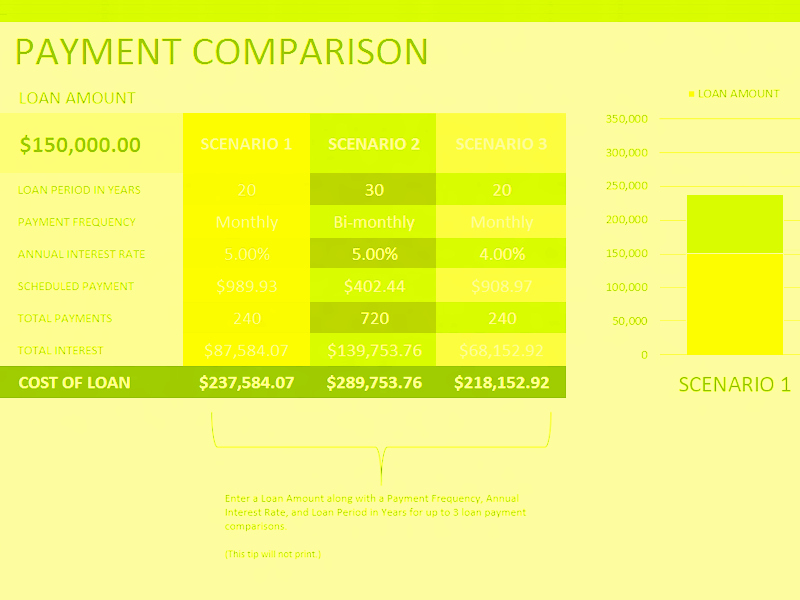

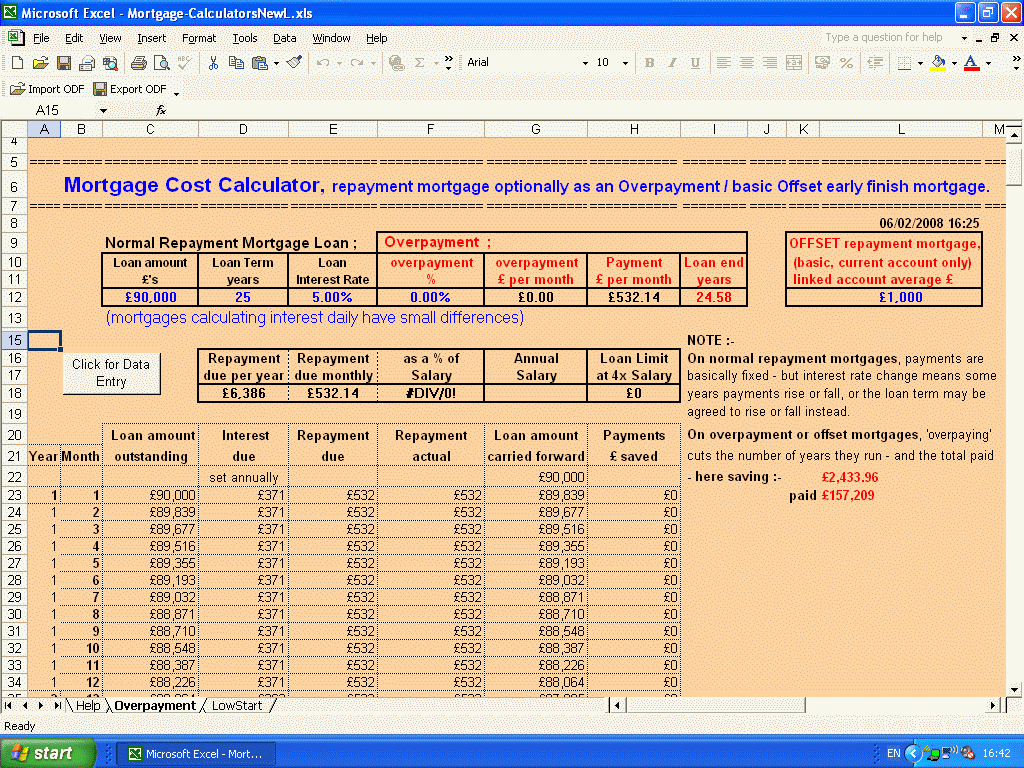

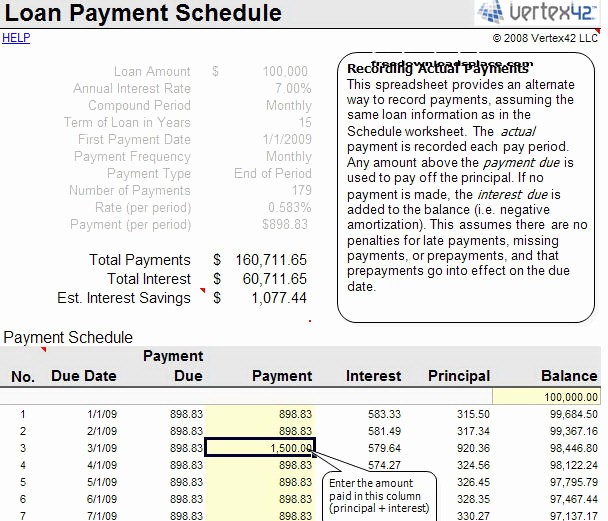

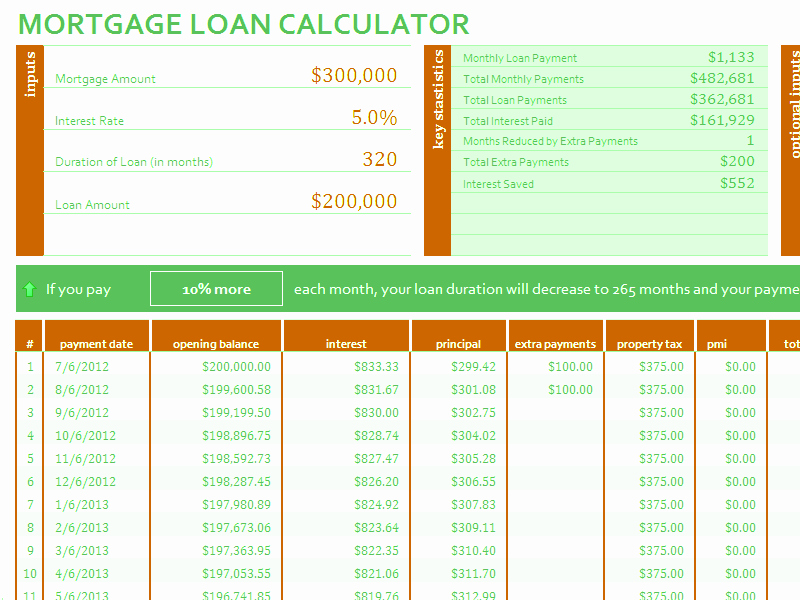

Web free personal loan calculator that returns the monthly payment, real loan cost, and the apr after considering the fee, insurance, interest of a personal loan. Web for example, you can see how your monthly payment is adjusted after the loan deferment or how much interest you need to pay if your loan is deferred. Web our calculator shows you the total cost of a loan, expressed as the annual percentage rate, or apr. By deferring a student loan balance of $35,000 with an average interest rate of 6.0% for a period of 12 months , you will increase your student. Find your ideal payment by changing. Use this calculator to help you determine the impact of a deferred payment on a loan. A deferred payment loan is a loan structure where no payments are made during the loan period.

50 Deferred Payment Loan Calculator Excel Template

Web during the deferment period, interest may continue to accrue on certain types of loans; By deferring a student loan balance of $35,000 with an average interest rate of 6.0% for a period of 12 months , you will increase your student. Web use this calculator to help you determine the impact of a deferred.

50 Deferred Payment Loan Calculator Excel

As a first step, you need to set the loan inputs : Advertiser disclosure how does personal loan deferment work? Select your deferment period, loan amount, interest rate. Web this calculator provides an estimate of how much interest will be owed if payments on an unsubsidized loan (e.g., unsubsidized federal stafford loan, federal plus loan).

50 Deferred Payment Loan Calculator Excel

Web this cost of deferment calculator analyzes the cost of suspending payments on your student loans for a period of time using a deferment or forbearance. Web deferred interest mortgages and graduated payment mortgages are types of home loans that allow you to make low monthly payments that may not fully cover the. Enter the.

50 Deferred Payment Loan Calculator Excel

Advertiser disclosure how does personal loan deferment work? Web free personal loan calculator that returns the monthly payment, real loan cost, and the apr after considering the fee, insurance, interest of a personal loan. As a first step, you need to set the loan inputs : Returning a lump sum due at maturity. Select your.

50 Deferred Payment Loan Calculator Excel

Advertiser disclosure how does personal loan deferment work? Select your deferment period, loan amount, interest rate. Web use this loan calculator to determine your monthly payment for any loan. Web our calculator shows you the total cost of a loan, expressed as the annual percentage rate, or apr. This calculator can also estimate how. Web.

50 Deferred Payment Loan Calculator Excel

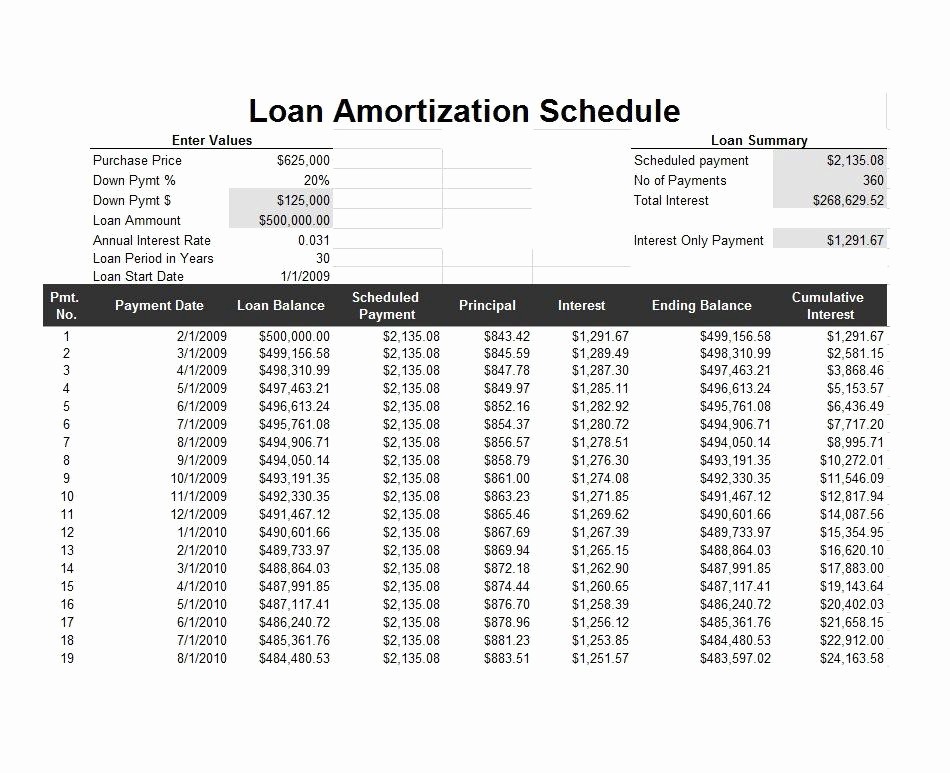

Returning a lump sum due at maturity. Web calculate loan payments, loan amount, interest rate or number of payments. Web use this loan calculator to determine your monthly payment, interest rate, number of months or principal amount on a loan. By deferring a student loan balance of $35,000 with an average interest rate of 6.0%.

50 Deferred Payment Loan Calculator Excel

This calculator can also estimate how. Use our loan calculator to estimate the total amount due at maturity and the total interest you'll pay for a deferred payment loan based on your. Web calculate the amount due at loan maturity, total interest, and principal for a deferred payment loan. Returning a lump sum due at.

50 Deferred Payment Loan Calculator Excel

After answering the question what does deferred payment mean?, let's see how to use the deferred payment loan calculator: Web this method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. Advertiser disclosure how does personal loan.

50 Deferred Payment Loan Calculator Excel

Returning a lump sum due at maturity. Find your ideal payment by changing. Web use this loan calculator to determine your monthly payment for any loan. Web this calculator provides an estimate of how much interest will be owed if payments on an unsubsidized loan (e.g., unsubsidized federal stafford loan, federal plus loan) are. Web.

50 Deferred Payment Loan Calculator Excel

Select your deferment period, loan amount, interest rate and term to calculate your. Advertiser disclosure how does personal loan deferment work? This calculator can also estimate how. Returning a lump sum due at maturity. You can also see how your loan amortizes, or how much is paid down, over the payoff period. Web this calculator.

Deferred Payment Loan Calculator Web this cost of deferment calculator analyzes the cost of suspending payments on your student loans for a period of time using a deferment or forbearance. By deferring a student loan balance of $35,000 with an average interest rate of 6.0% for a period of 12 months , you will increase your student. After answering the question what does deferred payment mean?, let's see how to use the deferred payment loan calculator: Web deferred interest mortgages and graduated payment mortgages are types of home loans that allow you to make low monthly payments that may not fully cover the. A deferred payment loan is a loan structure where no payments are made during the loan period.

Web Free Personal Loan Calculator That Returns The Monthly Payment, Real Loan Cost, And The Apr After Considering The Fee, Insurance, Interest Of A Personal Loan.

A deferred payment loan is a loan structure where no payments are made during the loan period. By deferring a student loan balance of $35,000 with an average interest rate of 6.0% for a period of 12 months , you will increase your student. Use this calculator to try different loan scenarios for affordability by varying. Enter the loan amount, term, interest rate, and compound frequency.

Use This Calculator To Help You Determine The Impact Of A Deferred Payment On A Loan.

Use our loan calculator to estimate the total amount due at maturity and the total interest you'll pay for a deferred payment loan based on your. Web during the deferment period, interest may continue to accrue on certain types of loans; Web this calculator provides an estimate of how much interest will be owed if payments on an unsubsidized loan (e.g., unsubsidized federal stafford loan, federal plus loan) are. Web our calculator shows you the total cost of a loan, expressed as the annual percentage rate, or apr.

Web For Example, You Can See How Your Monthly Payment Is Adjusted After The Loan Deferment Or How Much Interest You Need To Pay If Your Loan Is Deferred.

This calculator can also estimate how. Select your deferment period, loan amount, interest rate and term to calculate your. As a first step, you need to set the loan inputs : Web use this calculator to help you determine the impact of a deferred payment on a loan.

Returning A Lump Sum Due At Maturity.

Select your deferment period, loan amount, interest rate. Enter the loan amount, term and interest rate in the fields. However, you will not be required to make payments. Advertiser disclosure how does personal loan deferment work?