Discounted Cash Flow Template Excel

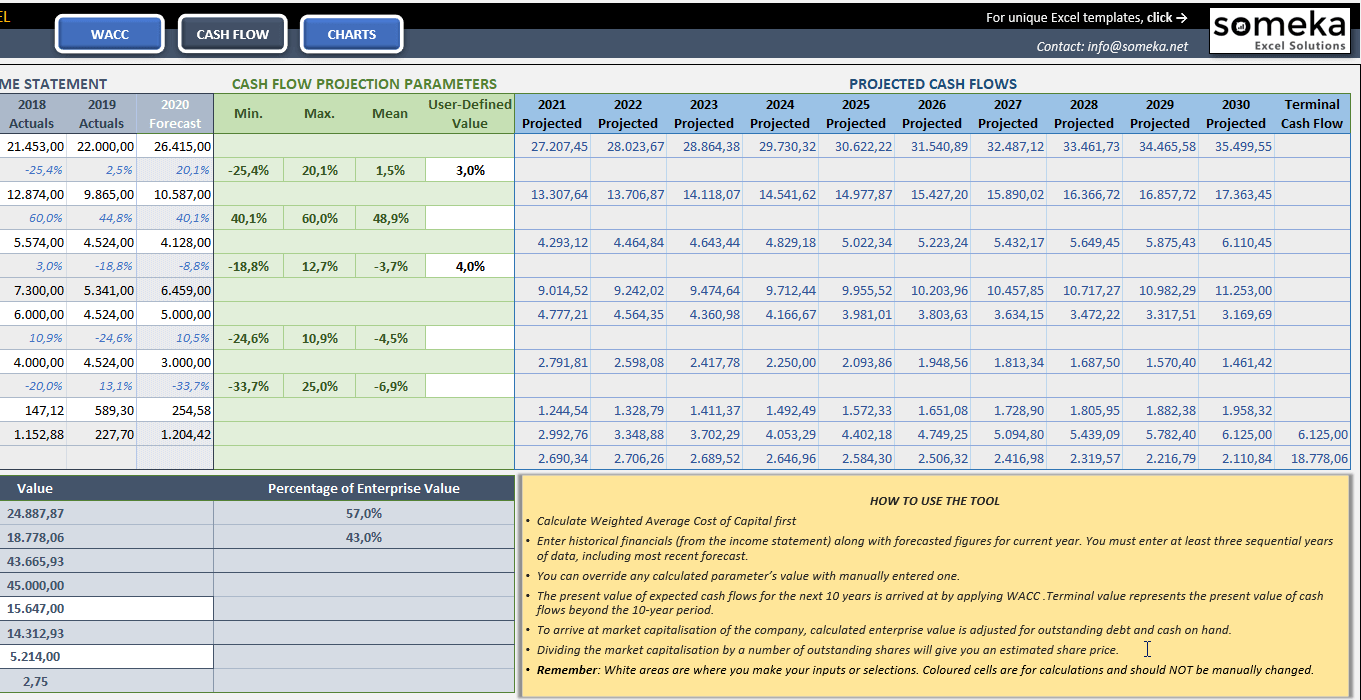

Discounted Cash Flow Template Excel - Web discounted cash flow (dcf) model template. Understand discounted cash flow principles and perform accurate valuations in excel. Web download wso's free discounted cash flow (dcf) model template below! Use excel formulas like =npv (discount rate, range of cash flows) to calculate the present value of those cash flows. This template allows you to build your own discounted cash flow model with different assumptions.

Understand discounted cash flow principles and perform accurate valuations in excel. By andy marker | september 20, 2021. Dcf is a widely used method for valuation, particularly for evaluating companies with strong projected future cash flow. Before calculating the discount rate, you’ll need to gather some essential information, including the future cash flows of the investment and the period over which those cash flows will occur. Web discounted cash flow (dcf) model template. Web learn how to quickly set up a discounted cash flow calculations in excel. Discounted cash flow is actually a valuation method that is used to forecast future gainings based on the present investment.

DCF Discounted Cash Flow Model Excel Template Eloquens

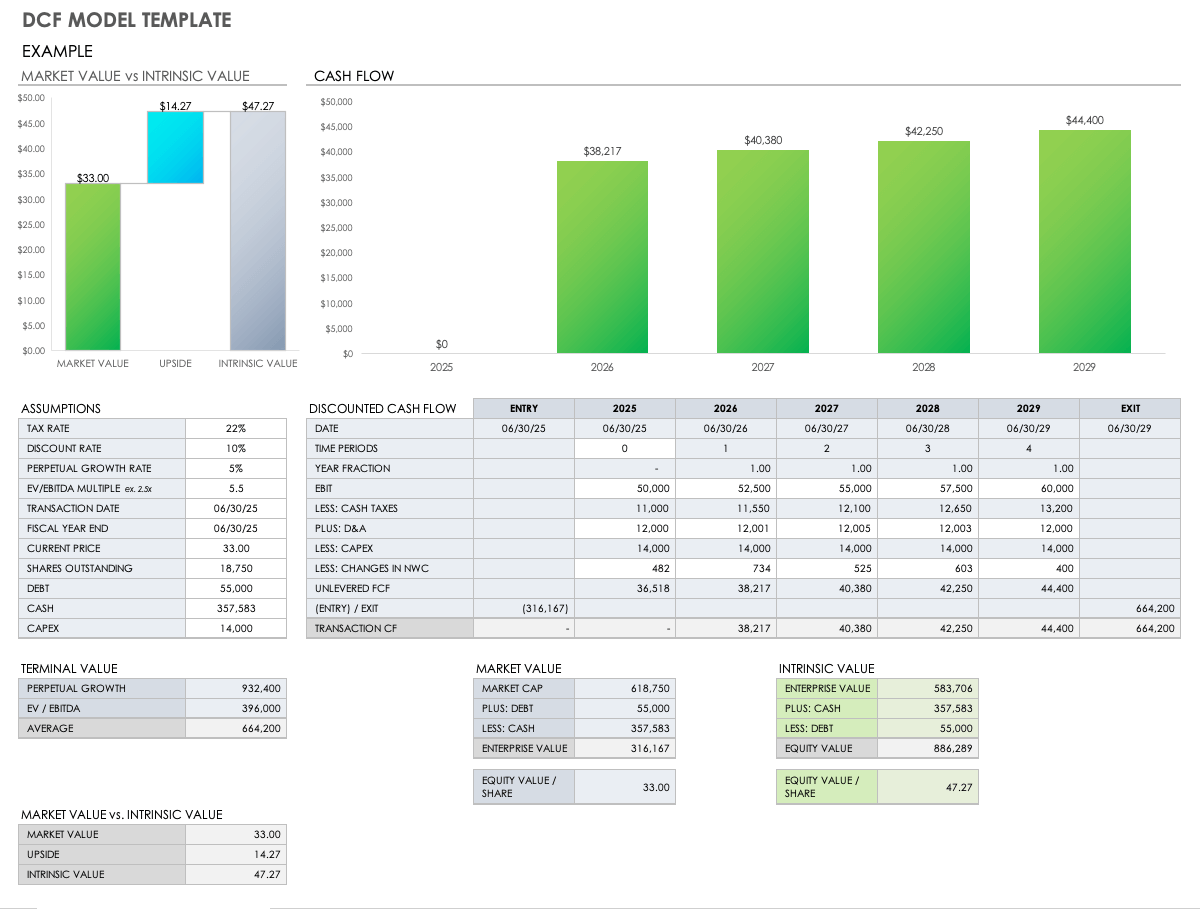

Web discounted cash flow valuation model: What is a dcf model? Web elevate your investment analysis with our free dcf model template. Discounted cash flow valuation template. The first step in calculating discounted cash flows is to gather the necessary cash flow data. By andy marker | september 20, 2021. Dcf = cf1 / (1+r)^1.

DCF Discounted Cash Flow Model Excel Template Eloquens

Do you need to calculate the present value of future cash flows or assess two options that will impact your cash flow over many years? Web discounted cash flow (dcf) model template. Determine an appropriate discount rate based on the risk of the investment. Web learn how to quickly set up a discounted cash flow.

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Dcf is a widely used method for valuation, particularly for evaluating companies with strong projected future cash flow. Discounted cash flow valuation template. Why opt for our simple dcf template? Web elevate your investment analysis with our free dcf model template. Designed for clarity and ease of use, making dcf analysis accessible for all. Web.

discounted cash flow excel template —

Consider a cash flow for every year. Excel, with its robust set of functions, serves as an excellent tool for. Web discounted cash flow (dcf) model template. Understand discounted cash flow principles and perform accurate valuations in excel. Web an editable excel template on discounted cash flow (dcf) is a tool that can help individuals.

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Why opt for our simple dcf template? The template uses the discounted cash flow (dcf) method, which discounts future cash. Tailored for both beginners and professionals. Web discounted cash flow valuation model: Web an editable excel template on discounted cash flow (dcf) is a tool that can help individuals and businesses evaluate the present value.

Discounted Cash Flow Excel Template Free DCF Valuation Model in Excel

Web our discounted cash flow valuation template is designed to assist you through the journey of valuation. This template allows you to build your own discounted cash flow model with different assumptions. Discounted cash flow valuation template. The present value of each discounted cash flow is then calculated. Web download our free discounted cash flow.

Free Discounted Cash Flow Templates Smartsheet

This includes identifying the time periods for which cash flows will occur and determining the amount of cash flow for each period. This template allows you to build your own discounted cash flow model with different assumptions. Web a discounted cash flow analysis is a cornerstone technique that considers the time value of money by.

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Web elevate your investment analysis with our free dcf model template. How to build a dcf model: Web a discounted cash flow analysis is a cornerstone technique that considers the time value of money by discounting expected future cash flows to their present value. Sum the discounted cash flows to find the investment’s npv. Web.

Free Discounted Cash Flow Templates Smartsheet

Dcf is a widely used method for valuation, particularly for evaluating companies with strong projected future cash flow. Why opt for our simple dcf template? Do you need to calculate the present value of future cash flows or assess two options that will impact your cash flow over many years? Web download our free discounted.

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Understanding the discount factor and the initial investment is crucial as these elements are foundational for. Get an accurate picture of your company’s true value — with projected future cash flows factored in — by. Web this involves dividing each cash flow by the appropriate discount factor, which is calculated as (1+discount~rate)^n (1+discount rate)n, where.

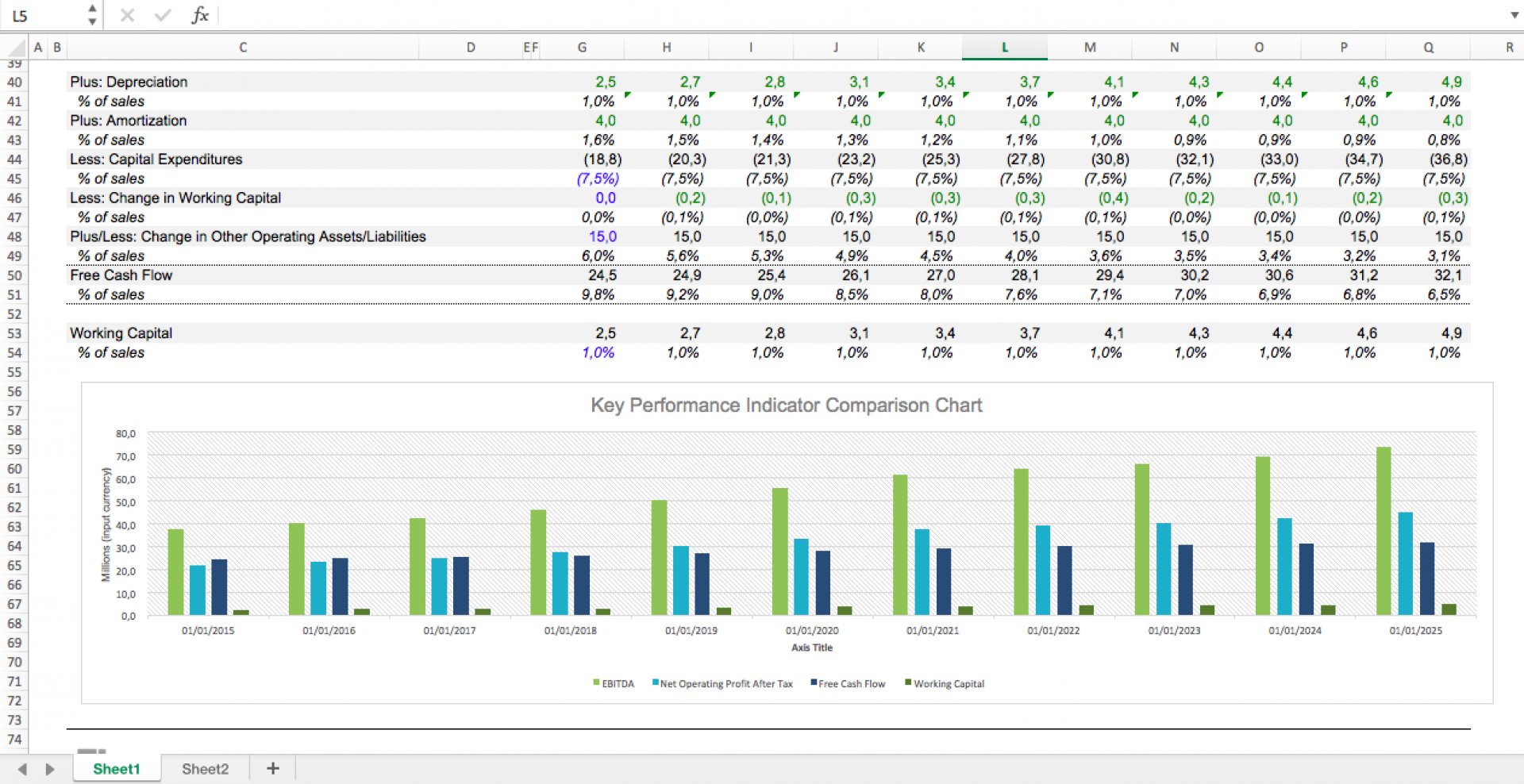

Discounted Cash Flow Template Excel The first step in calculating discounted cash flows is to gather the necessary cash flow data. The template comes with various scenarios along with sensitivity analysis. Why opt for our simple dcf template? Determine an appropriate discount rate based on the risk of the investment. Understanding the discount factor and the initial investment is crucial as these elements are foundational for.

To Calculate Dcf, You Discount Future Cash Flows Back To Their Present Value.

Understand discounted cash flow principles and perform accurate valuations in excel. Web the discounted cash flow (dcf) model is a valuation method, used to estimate the value of an investment based on its expected future cash flows. Web our discounted cash flow valuation template is designed to assist you through the journey of valuation. Web discounted cash flow (dcf) model template.

Web A Discounted Cash Flow Analysis Is A Cornerstone Technique That Considers The Time Value Of Money By Discounting Expected Future Cash Flows To Their Present Value.

Designed for clarity and ease of use, making dcf analysis accessible for all. What is a dcf model? Understanding the discount factor and the initial investment is crucial as these elements are foundational for. The template uses the discounted cash flow (dcf) method, which discounts future cash.

Dcf = Cf1 / (1+R)^1 + Cf2 / (1+R)^2 +.

Get an accurate picture of your company’s true value — with projected future cash flows factored in — by. Dcf is a widely used method for valuation, particularly for evaluating companies with strong projected future cash flow. So, this model calculates the present value of expected future cash flows using a discount rate. Web the dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic value of a stock.

Consider A Cash Flow For Every Year.

In my case, i have considered a $50,000 cash flow every year. Use our dcf model template for your financial valuations. The first step in calculating discounted cash flows is to gather the necessary cash flow data. Web dcf model, step 1: