Dividend Discount Model Calculator

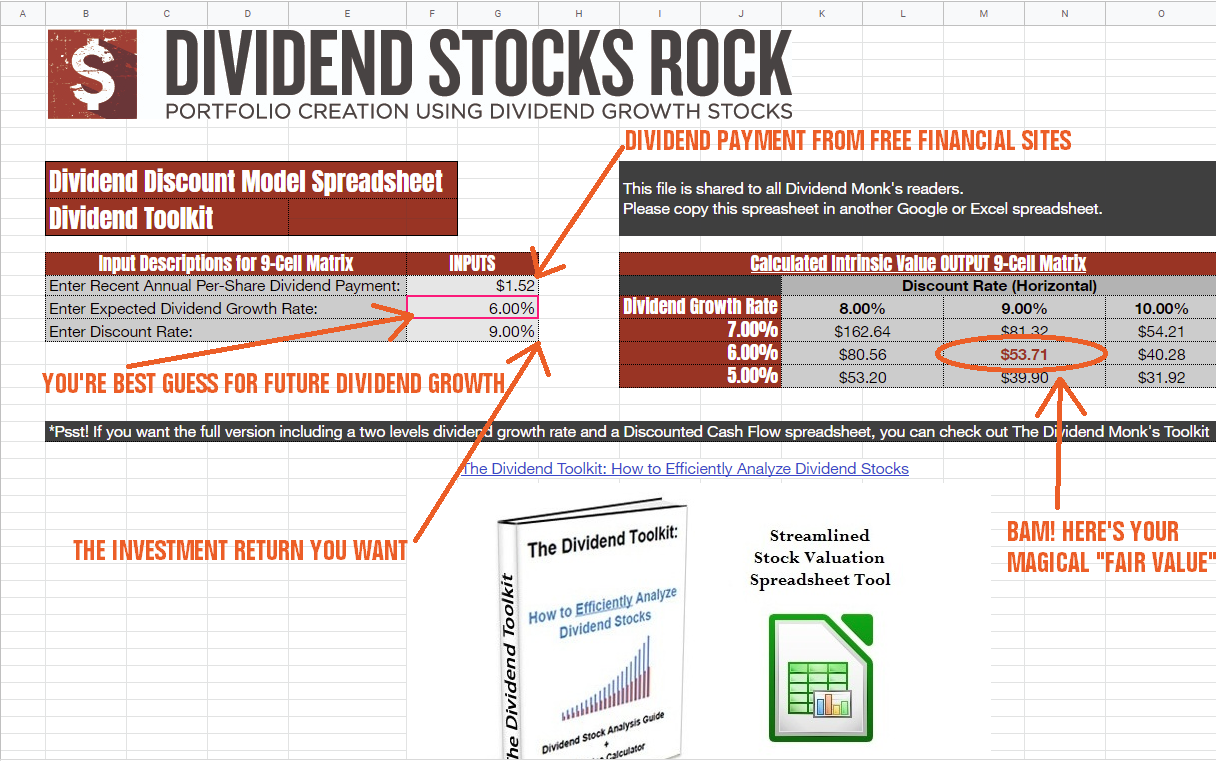

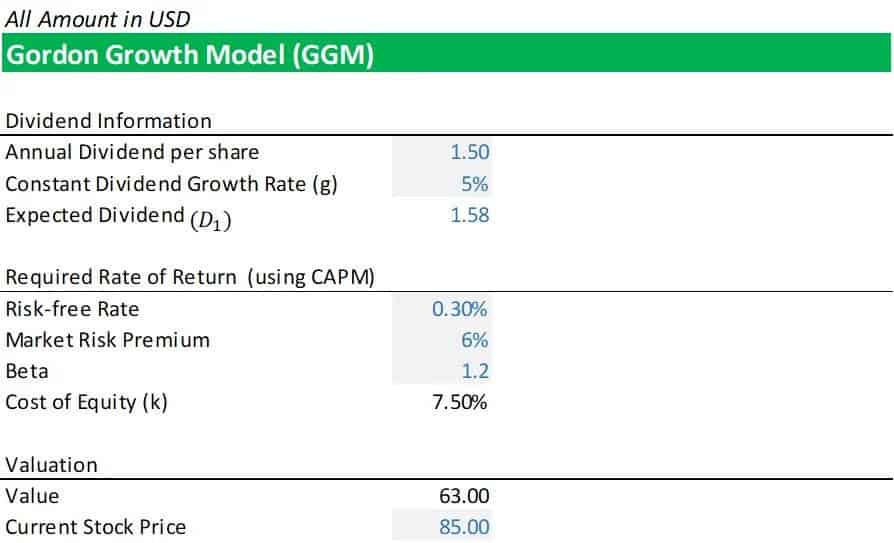

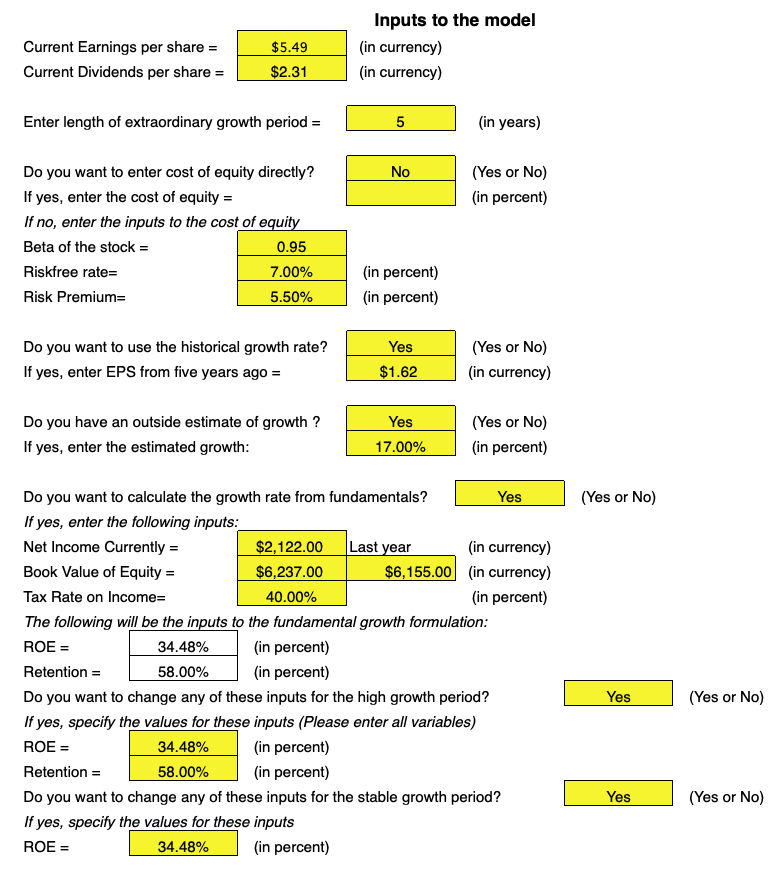

Dividend Discount Model Calculator - Web different ways to calculate dividend discount model. Web estimate the true value of a stock using the dividend discount approach with this online calculator. Two primary methods are the dividend discount model (ddm) and the. Enter the dividend payout ratio, return on equity, dividends per share, risk. Web an appropriate discount rate is estimated to be 6%.

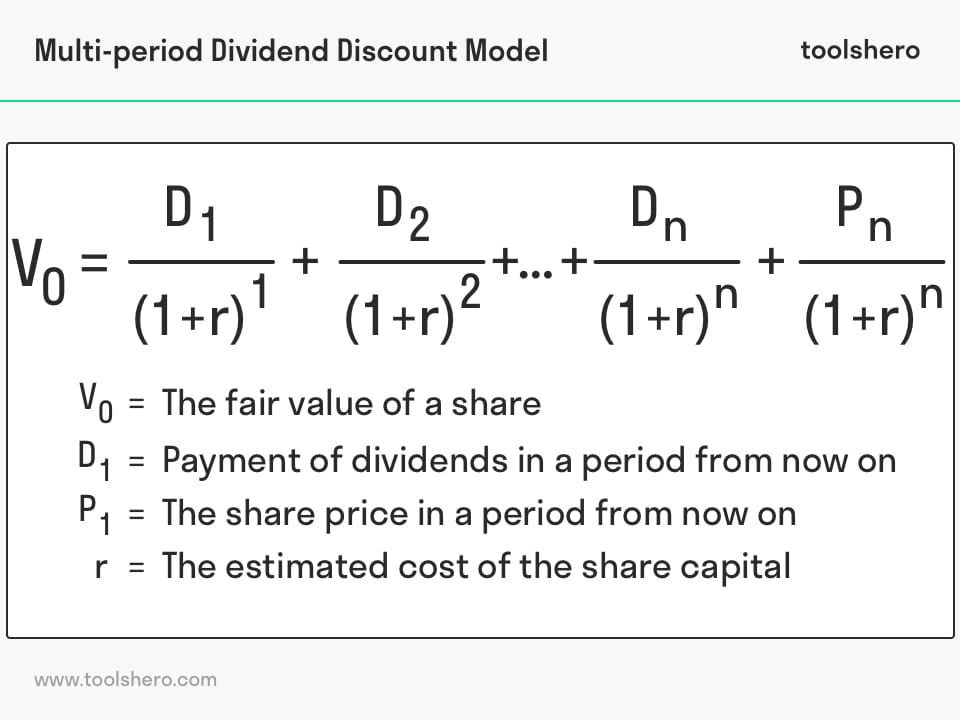

Web since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: There are different ways to calculate the ddm, each with its own advantages, disadvantages, and accuracy level. Web this dividend discount model calculator is a simple tool that lets you calculate stock value based on the dividend discount model formula (ddm formula for. Web this page contains a dividend discount model calculator to estimate the net present value of an investment based on the future flow of dividends. How to apply the gordon. How to use dividend discount models to value dividend stocks; Web the dividend discount model calculator is used to calculate the value of a stock based on the dividend discount model.

Discounted Dividend Model (DDM) Toolshero

Dividend discount model dividend discount. It's best used with other. Web since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: Web ddm, or dividend discount model, is used to value a stock, based on the premise that it should be equal to the.

Dividend Discount Model (DDM) Definition, Formula, and Cons

Web the dividend discount model, or ddm, is a valuation model to estimate a stock's price by discounting its future dividends to a present value. Web this page contains a dividend discount model calculator to estimate the net present value of an investment based on the future flow of dividends. Web what is the dividend.

Dividend Discount Model Formula and Examples of DDM

It's best used with other. Enter the dividend payout ratio, return on equity, dividends per share, risk. Web the dividend discount model works off the idea that the fair value of an asset is the sum of its future cash flows discounted back to fair value with an. Web what is the dividend discount model?.

How I Use The Dividend Discount Model To Make Smart Investing Decisions

Web dividend discount model formula: Dividend discount model dividend discount. There are different ways to calculate the ddm, each with its own advantages, disadvantages, and accuracy level. Web an appropriate discount rate is estimated to be 6%. Learn how to use the ddm formula, the. This model assumes that the present. Two primary methods are.

Dividend Discount Model Gordon Growth Model eFinancialModels

This model assumes that the present. Investment tools & tipsfinance calculatorspersonal finance & taxesveterans resources Web an appropriate discount rate is estimated to be 6%. Enter the dividend payout ratio, return on equity, dividends per share, risk. Web dividend discount model formula: Web the dividend discount model works off the idea that the fair value.

Google Finance Dividend Yield A Guide Wisesheets Blog

Web there are several objective methods through which the calculator performs these calculations; Web this dividend discount model calculator is a simple tool that lets you calculate stock value based on the dividend discount model formula (ddm formula for. Web the dividend discount model ( ddm) calculator tool is designed to estimate the intrinsic value.

The Complete Guide to the Dividend Discount Model (DDM)

Web the dividend discount model, or ddm, is a valuation model to estimate a stock's price by discounting its future dividends to a present value. Enter the dividend payout ratio, return on equity, dividends per share, risk. Web different ways to calculate dividend discount model. Two primary methods are the dividend discount model (ddm) and.

What is Dividend Discount Model (DDM)? Formula + Calculator

Using the dividend discount model formula: Investment tools & tipsfinance calculatorspersonal finance & taxesveterans resources Web ddm, or dividend discount model, is used to value a stock, based on the premise that it should be equal to the sum of its current and future cash flows (but after. This model assumes that the present. Web.

Dividend Discount Model (Formula, Example) Calculate Stock Value

Learn how to use the ddm formula, the. Web different ways to calculate dividend discount model. Web what is the dividend discount model? It's best used with other. Web the dividend discount model (ddm) is a method of valuing a company's stock price based on the assumption that the current fair price equals the sum.

Demonstration Dividend Discount Model (DDM) YouTube

Web there are several objective methods through which the calculator performs these calculations; Web estimate the true value of a stock using the dividend discount approach with this online calculator. Web dividend discount model formula: Dividend discount model dividend discount. Web since the dividend discount model is based on equity value, not enterprise value, the.

Dividend Discount Model Calculator Web dividend discount model formula: Web the dividend discount model calculator is used to calculate the value of a stock based on the dividend discount model. The ddm is a financial model used to estimate the value of a company and its stock price. Web the dividend discount model works off the idea that the fair value of an asset is the sum of its future cash flows discounted back to fair value with an. Web since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity:

It's Best Used With Other.

Web different ways to calculate dividend discount model. Web the dividend discount model calculator is used to calculate the value of a stock based on the dividend discount model. Web estimate the true value of a stock using the dividend discount approach with this online calculator. Web dividend discount model calculator is an online tool that calculates the value of equity shares in terms of present value.

Enter The Dividend Payout Ratio, Return On Equity, Dividends Per Share, Risk.

This model assumes that the present. Web there are several objective methods through which the calculator performs these calculations; Dividend discount model dividend discount. Investment tools & tipsfinance calculatorspersonal finance & taxesveterans resources

Web Since The Dividend Discount Model Is Based On Equity Value, Not Enterprise Value, The Discount Rate Is The Cost Of Equity:

Web the dividend discount model works off the idea that the fair value of an asset is the sum of its future cash flows discounted back to fair value with an. Learn how to use the ddm formula, the. How to use dividend discount models to value dividend stocks; The ddm is a financial model used to estimate the value of a company and its stock price.

Web Estimate The Value Of A Stock Based On Its Future Dividend Payments Using The Dividend Discount Model (Ddm), A Technique That Accounts For Dividends, Growth Rate, And.

Web the dividend discount model ( ddm) calculator tool is designed to estimate the intrinsic value of a stock based on its expected future dividends. Web estimate the intrinsic value of a stock based on its future dividend payments using the dividend discount model (ddm) calculator. Web how to estimate the perpetual dividend growth rate in dividend discount models; Web what is the dividend discount model?