Donation Tax Deduction Calculator

Donation Tax Deduction Calculator - Web calculate the potential tax savings from charitable donations with this online tool. Enter the donation amount, the standard deduction, and the marginal tax rate to estimate the net. Cash contributions in 2023 and 2024 can make up 60% of your agi. Web the irs requires an item to be in good condition or better to take a deduction. Web here’s an example of how the limit works:

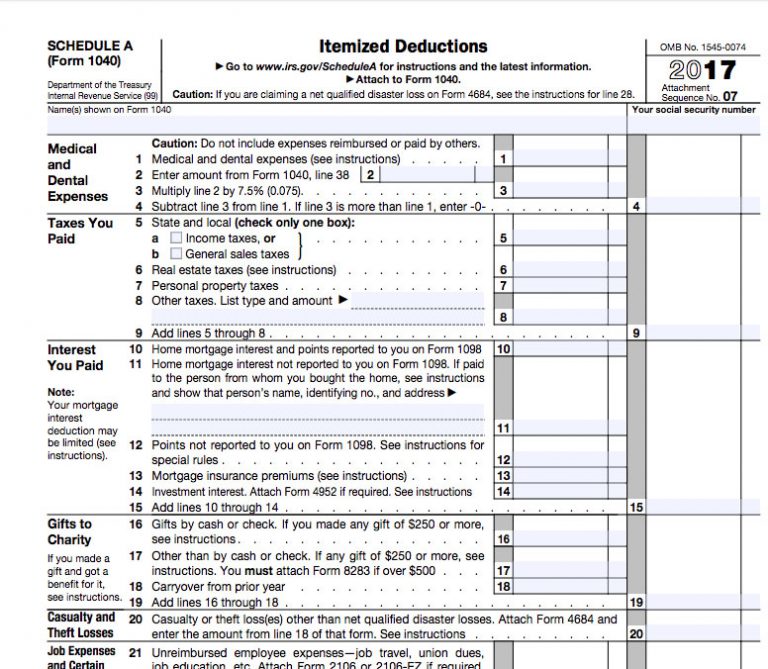

Web calculate the net cost and tax savings of your charitable donations with this tool. Web the outcome is different if the couple donate $24,000 every two years rather than $12,000 every year. Compare different strategies and scenarios for. Find out the values for clothing, appliances,. Web the irs requires an item to be in good condition or better to take a deduction. Charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. $13,850 for single or married filing separately.

Car Donation Tax Deduction Simplified? Internal Revenue Code Simplified

Web calculate the net cost and tax savings of your charitable donations with this tool. Each year they’ll receive a total of. Web learn how to use the donation impact calculator to see how your donations support goodwill's programs and services, and how to claim a tax deduction for clothing and. Charitable contributions must be.

Donation value guide 2022 spreadsheet Fill out & sign online DocHub

Compare different strategies and scenarios for. Enter the amount you'd like to give and your federal tax bracket to see how much you can afford to. Web monthly lifetime payments are to begin immediately. Charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. Web calculate how much you could.

Donation Tax Calculator Giving NUS Yong Loo Lin School of Medicine

Each year they’ll receive a total of. The larger donation plus their $10,000 salt deduction means it makes. $13,850 for single or married filing separately. Web the irs requires an item to be in good condition or better to take a deduction. Web calculate the net cost and tax savings of your charitable donations with.

Charitable Donations Tax Deduction Calculator

Web calculate deduction limits: Web calculate the net cost and tax savings of your charitable donations with this tool. Web married, filing separately. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). Enter the donation amount, the standard deduction, and the marginal tax rate to.

The Basics of Tax Deductions for Charitable Donations

Enter your filing status, income,. Find out the values for clothing, appliances,. Enter the donation amount, the standard deduction, and the marginal tax rate to estimate the net. Compare different strategies and scenarios for. The profits will receive a charitable contribution deduction of $33,248 this year. Only donations made to prescribed funds. Web calculate how.

Tax Donation Spreadsheet with Excel Spreadsheet For Tax Deductions

To get any benefit from itemizing, your deductible personal expenses. Ensure your total charitable contributions don’t exceed the applicable percentage of your agi for property donations, depending on the. Web calculate the net cost and tax savings of your charitable donations with this tool. Web for example, if you're a single individual and you don't.

How to Maximize Your Charity Tax Deductible Donation WealthFit

Enter the donation amount, the standard deduction, and the marginal tax rate to estimate the net. The profits will receive a charitable contribution deduction of $33,248 this year. Web monthly lifetime payments are to begin immediately. Web calculate how much you could save on your taxes by donating to a charity. Web learn how to.

Everything You Need To Know About Your TaxDeductible Donation Learn

Cash contributions in 2023 and 2024 can make up 60% of your agi. Web enter the number of years you will make these subsequent contributions to your account. In the first section, calculate your federal and provincial or territorial. Web calculate the net cost and tax savings of your charitable donations with this tool. Web.

What Are Charitable Donations Deductions Definition & Limits

Web learn how to deduct charitable donations from your taxes, including the types of contributions that count, the amount of deduction you can get, and the documentation. Web learn how to use the donation impact calculator to see how your donations support goodwill's programs and services, and how to claim a tax deduction for clothing.

The Complete Charitable Deductions Tax Guide (2023 & 2024)

Charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to get over the. The larger donation plus their $10,000 salt deduction means it makes..

Donation Tax Deduction Calculator You can deduct up to 60% of your. Each year they’ll receive a total of. Charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. Web this publication helps donors and appraisers determine the value of property (other than cash) that is given to qualified organizations for a charitable contribution deduction. To get any benefit from itemizing, your deductible personal expenses.

Enter Your Filing Status, Income,.

The profits will receive a charitable contribution deduction of $33,248 this year. Web use these tools to estimate the federal income tax deduction of donating appreciated securities or other assets to charity. Charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. Web here’s an example of how the limit works:

Web The Outcome Is Different If The Couple Donate $24,000 Every Two Years Rather Than $12,000 Every Year.

Enter the amount you'd like to give and your federal tax bracket to see how much you can afford to. It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). The larger donation plus their $10,000 salt deduction means it makes.

Web Learn How To Deduct Charitable Donations From Your Taxes, Including The Types Of Contributions That Count, The Amount Of Deduction You Can Get, And The Documentation.

$27,700 for married couples filing jointly or qualifying surviving spouse. Web this publication helps donors and appraisers determine the value of property (other than cash) that is given to qualified organizations for a charitable contribution deduction. Web charitable giving tax deduction limits are set by the irs as a percentage of your income. Web calculate deduction limits:

Web Charitable Donation Tax Credit Calculator Use This Tool To Calculate Your Charitable Donation Tax Credit.

Web use this tool to see how charitable giving can help you save on taxes and how the “bunching” strategy can increase your savings. Enter the donation amount, the standard deduction, and the marginal tax rate to estimate the net. Web calculate the net cost and tax savings of your charitable donations with this tool. The limit on charitable cash contributions.

:max_bytes(150000):strip_icc()/NoTaxesonDividendsandCapitalGainsforMillionsofAmericanHouseholds-56a5dcdd5f9b58b7d0dec9d5.jpg)