Donation Tax Write Off Calculator

Donation Tax Write Off Calculator - Web $105 wriboth of these are true: You can deduct up to 60% of your. Web the internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t. Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. Web fair market value calculator use the slider to estimate the fair market value of an item.

Web the internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t. Web $ your estimated savings is: This will reduce taxes in the tax. Web for the 2021 tax year, the charitable deduction is even better, at least for those who file a joint return. Web here’s how it works: You can deduct up to 60% of your. For example, if the charity.

Donation value guide 2022 spreadsheet Fill out & sign online DocHub

Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. You may be surprised to learn that you can afford to be even more generous than you thought. It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund. Web.

How to Maximize Your Charity Tax Deductible Donation WealthFit

Web to get started, download the goodwill donation valuation guide, which features estimates for the most commonly donated items. For 2020, the charitable limit was $300 per “tax unit” —. It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund. You may deduct charitable contributions.

Donation Tax Calculator Giving NUS Yong Loo Lin School of Medicine

This will reduce taxes in the tax. Find out how much the charity sold the car for use the price the charity sells your car for as the amount of your deduction. Use our interactive tool to see how giving can help you save on. It's true that if all you gave was $20 last.

How to Maximize Your Charity Tax Deductible Donation WealthFit

Use our interactive tool to see how giving can help you save on. This strategy allows you to claim the $20,000 gift as an itemized deduction on. You may be surprised to learn that you can afford to be even more generous than you thought. Decide if you’re going to itemize the pandemic provision that.

Maximize Tax WriteOffs by Tracking Donations thegoodstuff

You may deduct charitable contributions of money or property made to qualified organizations. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). The payment is at least $52.50 for 2023. Find out how much the charity sold the car for use the price the charity.

Maximize Tax WriteOffs by Tracking Donations thegoodstuff

It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund. 4/5 (216k reviews) If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). Web $ your estimated savings is: 1 and another $10,000 on dec. You.

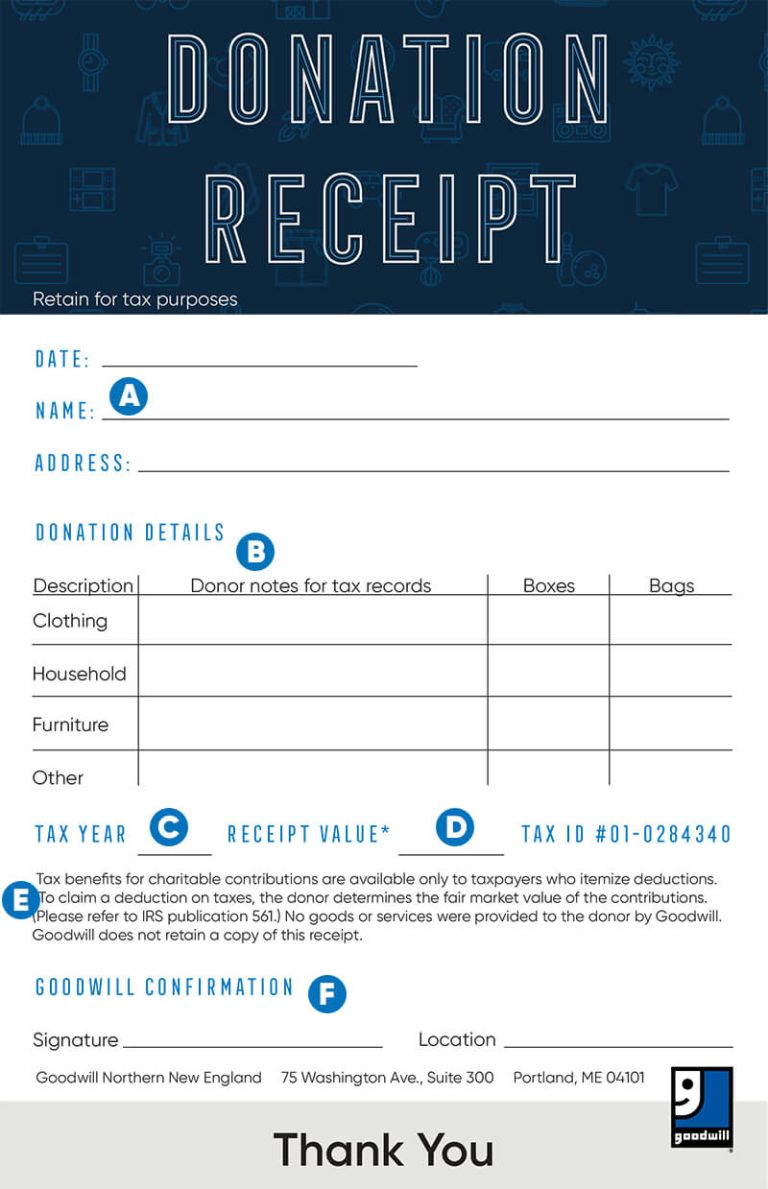

How to fill out a Goodwill Donation Tax Receipt Goodwill NNE

Web for the 2021 tax year, the charitable deduction is even better, at least for those who file a joint return. For example, if the charity. This strategy allows you to claim the $20,000 gift as an itemized deduction on. Web in general, you can deduct up to 60% of your adjusted gross income via.

How To Setup A Donation Station (Easy Tax Writeoffs with a FREE

Use our interactive tool to see how giving can help you save on. Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. Web here’s an example of how the limit works: Web $105 wriboth of these are true: Web fair market value calculator use the slider to estimate.

FREE 20+ Donation Receipt Templates in PDF Google Docs Google

Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. Web the calculator will display the net cost of the donation and the tax savings. Web $ your estimated savings is: 4/5 (216k reviews) It's true that if all you gave was $20 last year, claiming it won't give.

How To Setup A Donation Station (Easy Tax Writeoffs with a FREE

Web $105 wriboth of these are true: This will reduce taxes in the tax. It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund. Web for the 2021 tax year, the charitable deduction is even better, at least for those who file a joint return..

Donation Tax Write Off Calculator Web $105 wriboth of these are true: Web for the 2021 tax year, the charitable deduction is even better, at least for those who file a joint return. Web fair market value calculator use the slider to estimate the fair market value of an item. Find out how much the charity sold the car for use the price the charity sells your car for as the amount of your deduction. You can deduct up to 60% of your.

4/5 (216K Reviews)

1 and another $10,000 on dec. Web here’s an example of how the limit works: Only large donations are significant enough to deduct. For 2020, the charitable limit was $300 per “tax unit” —.

Web For The 2021 Tax Year, The Charitable Deduction Is Even Better, At Least For Those Who File A Joint Return.

Web the calculator will display the net cost of the donation and the tax savings. Web if you use any of today’s best online tax software, the program should fill out the required forms for you automatically after you answer questions about your. For the 2023 tax year, you can. Web $105 wriboth of these are true:

Web Here’s How It Works:

Web charitable tax deduction calculator when a person makes a charitable donation, that donation can be deducted from the individual's income. Web fair market value calculator use the slider to estimate the fair market value of an item. This strategy allows you to claim the $20,000 gift as an itemized deduction on. Web $ your estimated savings is:

Web To Get Started, Download The Goodwill Donation Valuation Guide, Which Features Estimates For The Most Commonly Donated Items.

Web the internal revenue service has a special new provision that will allow more people to easily deduct up to $300 in donations to qualifying charities this year, even if they don’t. You can deduct up to 60% of your. The payment is at least $52.50 for 2023. Web in general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50%, depending on the.