Double Calendar Spread

Double Calendar Spread - Earn side hustle income trading options. In a normal calendar spread you sell and buy a call with the same strike. Web a double calendar spread is a trading strategy that exploits time differences in the volatility of an underlying asset. Option trading strategies offer traders and investors the opportunity to profit in ways not. 1.1k views 1 year ago #thinkorswim #optionstrading #calendarspread.

Web #optionstrategies #optionstrading #calendarspreads calendar spread play list: Option trading strategies offer traders and investors the opportunity to profit in ways not. The calendar spread is one of my favorite. 4.9k views 1 year ago. It involves opening two positions. Web a double calendar spread is a trading strategy that exploits time differences in the volatility of an underlying asset. Sell 1 january 110 call @1.00.

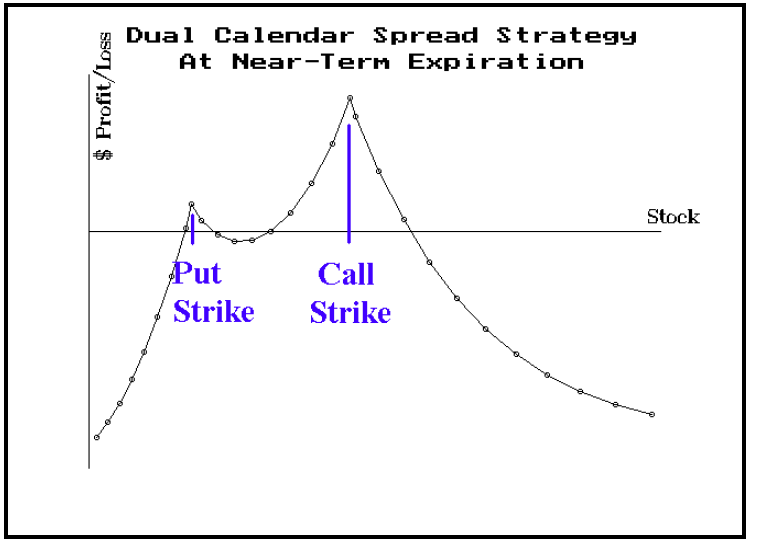

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

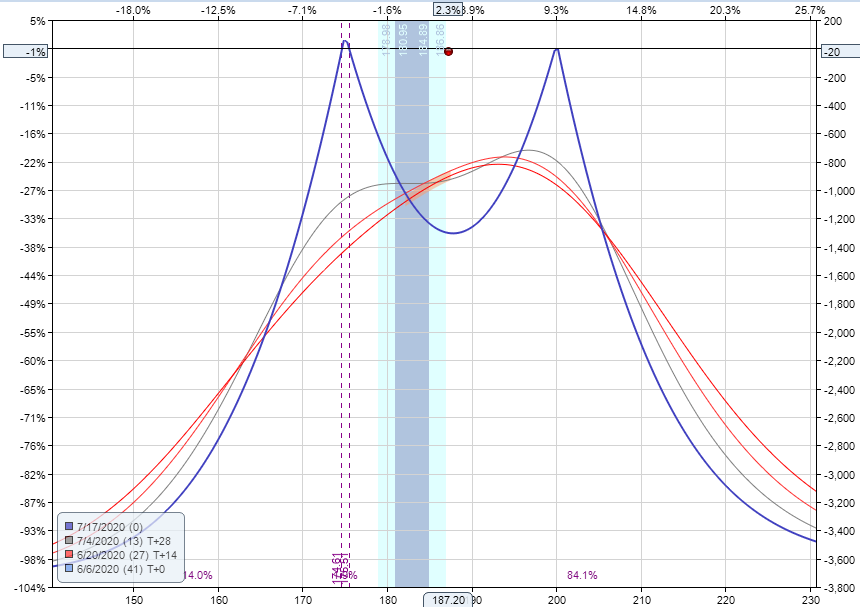

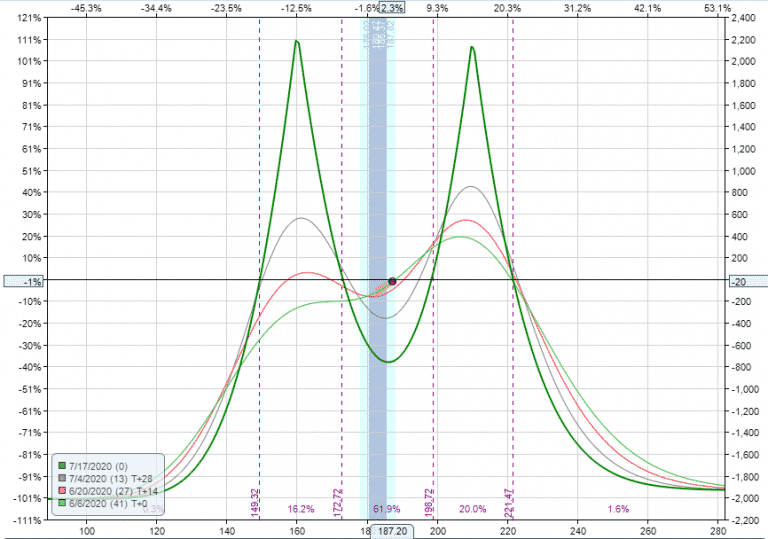

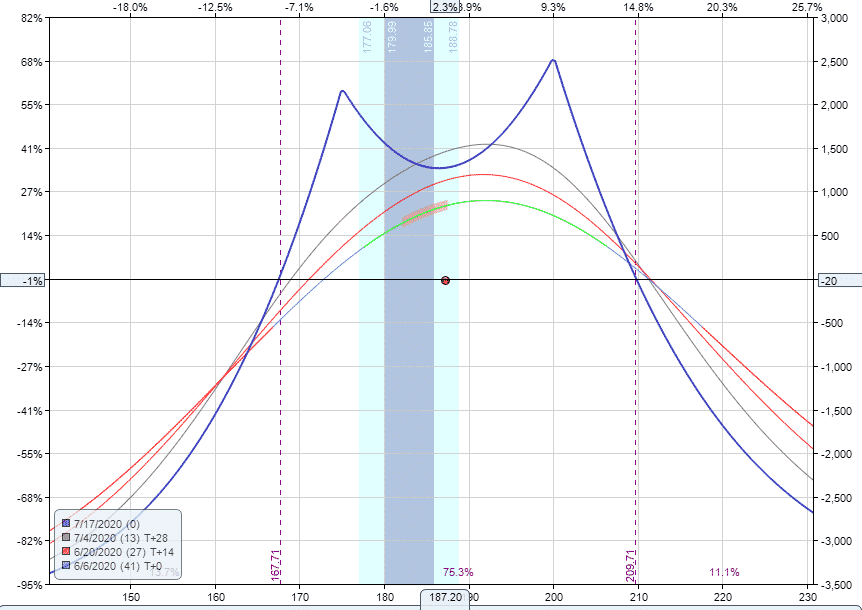

1.1k views 1 year ago #thinkorswim #optionstrading #calendarspread. A double calendar has positive vega so it is best entered in a low volatility environment. In this video i will be going over double calendar spreads which. Trading options is a great way for traders to earn consistent income that can supplement or replace job earnings..

Double Calendar Spreads Ultimate Guide With Examples

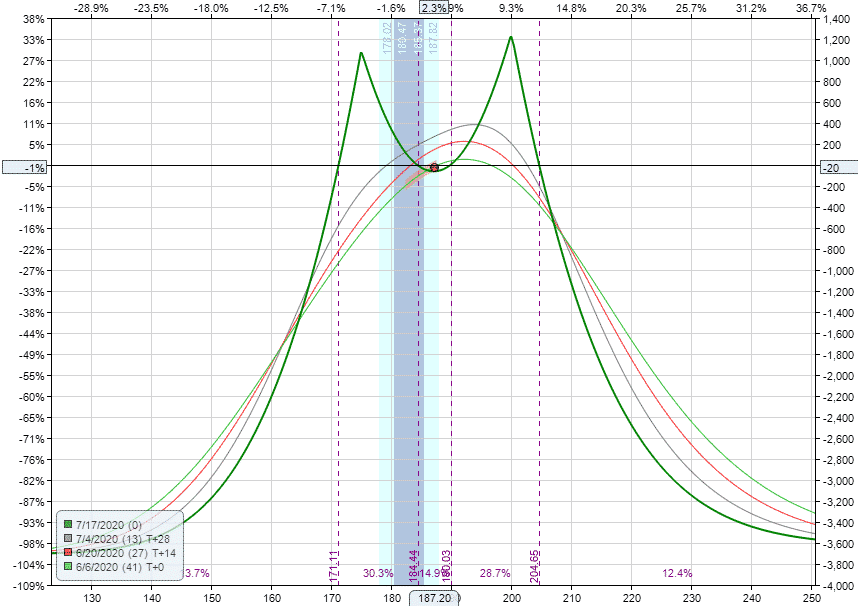

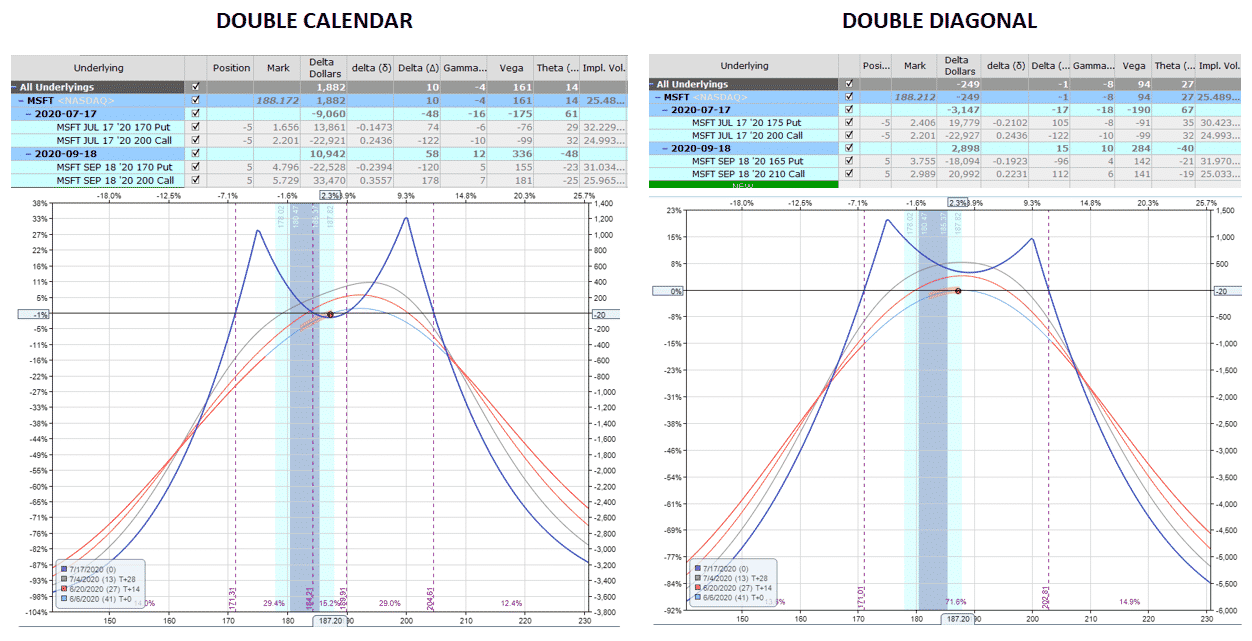

A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price. Web double calendar spreads. Contains the strategy video's related double calendar & put calndar spreads.htt. Photo by tommao wang on unsplash. Web updated october 31, 2021..

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

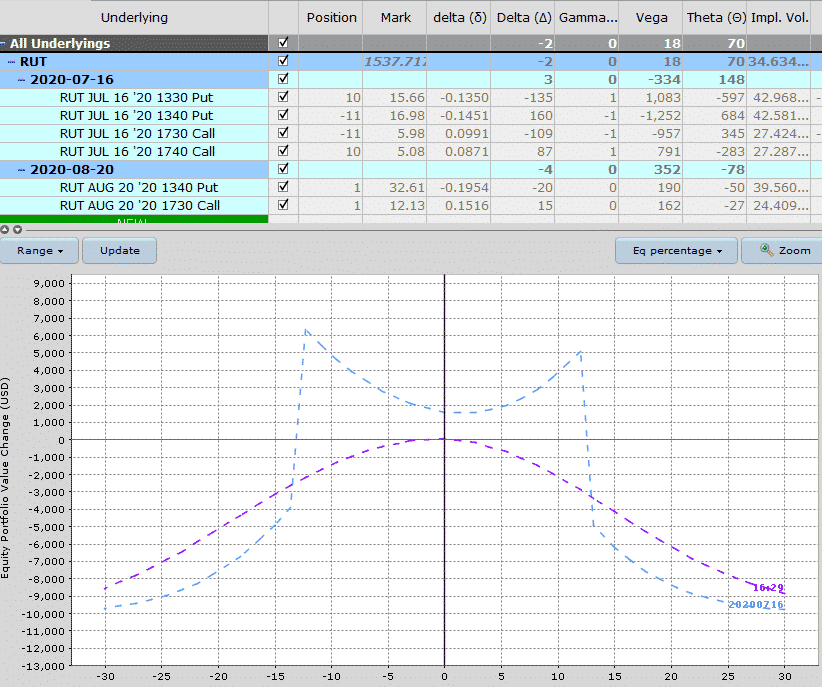

Trading options is a great way for traders to earn consistent income that can supplement or replace job earnings. Web let's analyze the double calendar spread. A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price..

Double Calendar Spreads Ultimate Guide With Examples

Web updated october 31, 2021. It benefits from an increase in. Web the double calendar spread is an offshoot of the very popular calendar (time) spread. The best weekly option strategies. Trading options is a great way for traders to earn consistent income that can supplement or replace job earnings. 4.9k views 1 year ago..

Double Calendar Spreads Ultimate Guide With Examples

Web the double calendar spread is an offshoot of the very popular calendar (time) spread. I'll share a position consisting of two calendar spreads, designed to profit from theta. The calendar spread is one of my favorite. This article discusses how traders can earn side hustle income trading double. Sell 1 january 90 put @1.00..

Double Calendar Spreads Ultimate Guide With Examples

Web let's analyze the double calendar spread. The calendar spread is one of my favorite. Traders believes that volatility is likely to. Web let's assume we enter the following double calendar position: It benefits from an increase in. The best weekly option strategies. In today's video i want to talk about the double calendar spread.

Double Calendar Spreads Ultimate Guide With Examples

Trading options is a great way for traders to earn consistent income that can supplement or replace job earnings. The best weekly option strategies. Web updated october 31, 2021. Web double calendar spreads. I'll share a position consisting of two calendar spreads, designed to profit from theta. 4.9k views 1 year ago. Web a double.

Double Calendar Spreads Ultimate Guide With Examples

In today's video i want to talk about the double calendar spread strategy that can be very powerful on robinhood and. The calendar spread is one of my favorite. Web the double calendar spread is an offshoot of the very popular calendar (time) spread. Web double calendar spreads. Contains the strategy video's related double calendar.

Pin on CALENDAR SPREADS OPTIONS

In a normal calendar spread you sell and buy a call with the same strike. Web today though we’re going to talk about double calendar spreads. Web updated october 31, 2021. Web let's analyze the double calendar spread. Trading options is a great way for traders to earn consistent income that can supplement or replace.

Double Calendar Spreads Ultimate Guide With Examples

1.1k views 1 year ago #thinkorswim #optionstrading #calendarspread. A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price. Web the double calendar spread is an offshoot of the very popular calendar (time) spread. It benefits from.

Double Calendar Spread Sell 1 january 90 put @1.00. In a normal calendar spread you sell and buy a call with the same strike. Web let's assume we enter the following double calendar position: Sell 1 january 110 call @1.00. It involves opening two positions.

Sell 1 January 90 Put @1.00.

I think they’re very interesting in how the mechanics work, and how they can be considered a. Web let's assume we enter the following double calendar position: Web today though we’re going to talk about double calendar spreads. In this video i will be going over double calendar spreads which.

Earn Side Hustle Income Trading Options.

A double calendar has positive vega so it is best entered in a low volatility environment. 1.1k views 1 year ago #thinkorswim #optionstrading #calendarspread. It involves opening two positions. The best weekly option strategies.

Traders Believes That Volatility Is Likely To.

4.9k views 1 year ago. In a normal calendar spread you sell and buy a call with the same strike. Trading options is a great way for traders to earn consistent income that can supplement or replace job earnings. Sell 1 january 110 call @1.00.

The Calendar Spread Is One Of My Favorite.

This article discusses how traders can earn side hustle income trading double. A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price. Buy 1 february 90 put @2.00. Contains the strategy video's related double calendar & put calndar spreads.htt.