Employee Retention Credit Calculator

Employee Retention Credit Calculator - Under the coronavirus aid, relief, and economic security act (cares act), the employee retention credit (erc) provides a refundable payroll tax. Maintained quarterly maximum defined in. Qualified employers can receive up to. Continue using the same calculation as q1 and q2. This means your business could be eligible for $25,000 in the form of.

Learn about eligibility, claiming the. Valuation servicesbankruptcymergers & acquisitionsregulatory compliance Under the coronavirus aid, relief, and economic security act (cares act), the employee retention credit (erc) provides a refundable payroll tax. Web the erc is a refundable tax credit of up to $26,000 per qualified employee to eligible businesses that have kept their employees on payroll and/or incurred health plan. This means your business could be eligible for $25,000 in the form of. The employee retention credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to employees after march 12, 2020, and before january 1, 2021. The erc is a refundable payroll tax credit for employers who kept.

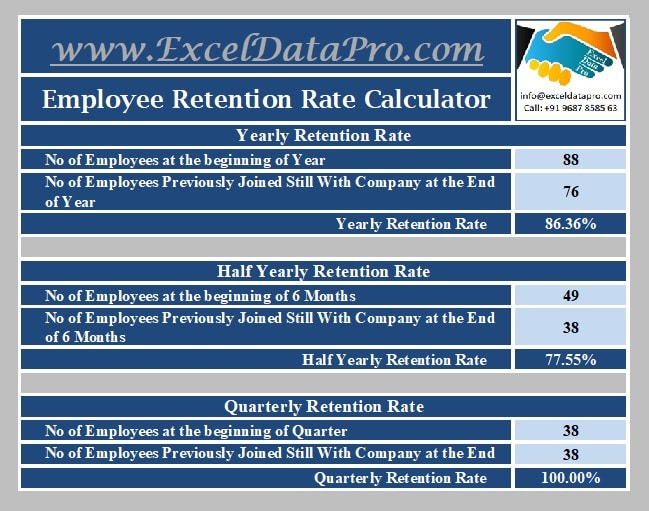

Download Employee Retention Rate Calculator Excel Template ExcelDataPro

Web learn how to calculate the employee retention credit (erc) for eligible employers that experienced a significant decline in gross receipts or certain closures. Qualified employers can receive up to. Web calculate if you qualify for the employee retention credit (erc) and how much you can get retroactively. For 2020, you’ll determine the ertc by.

7Step ERC Calculation Worksheet (Employee Retention Credit)

The employee retention credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to employees after march 12, 2020, and before january 1, 2021. Web the erc is a refundable tax credit of up to $26,000 per qualified employee to eligible businesses that have.

How To Calculate Employee Retention Tax Credit For 2021 Live Rank Sniper

Web washington — the internal revenue service today issued guidance for employers claiming the employee retention credit under the coronavirus aid, relief,. Web heros ertc has updated its services for smbs that want help from a cpa to calculate estimated employee retention tax credit returns and file the claim. Web let’s also assume that your.

5 Ways to Calculate the Employee Retention Credit

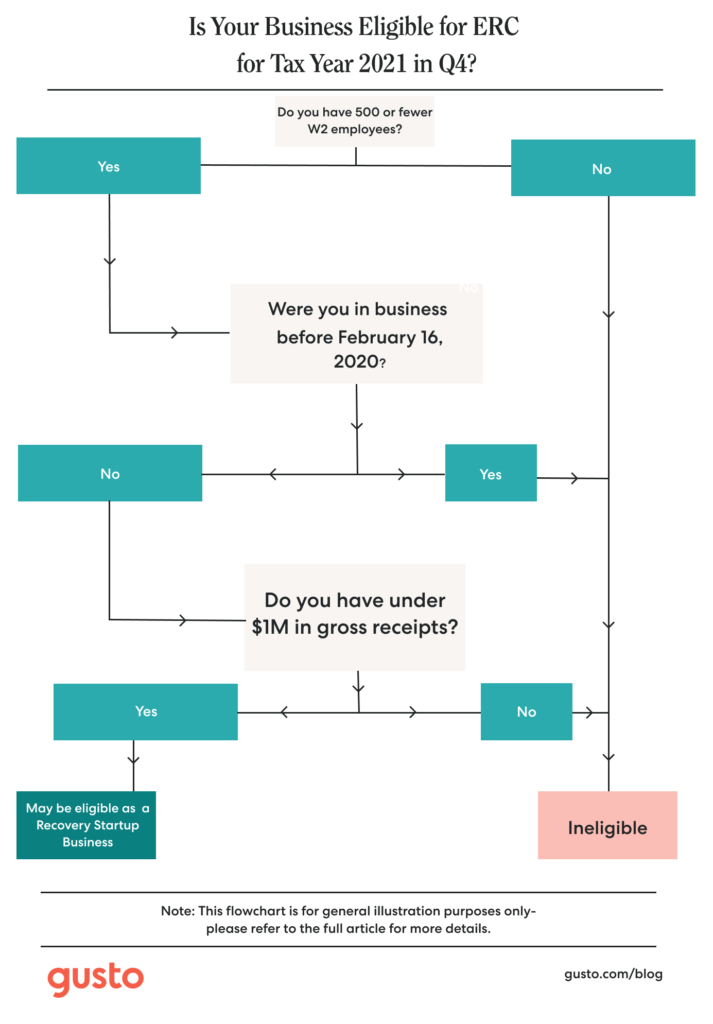

Web employee retention credit decision tree. Web the erc is a refundable tax credit of up to $26,000 per qualified employee to eligible businesses that have kept their employees on payroll and/or incurred health plan. The erc is a refundable payroll tax credit for employers who kept. Web calculating the employee retention tax credit (ertc).

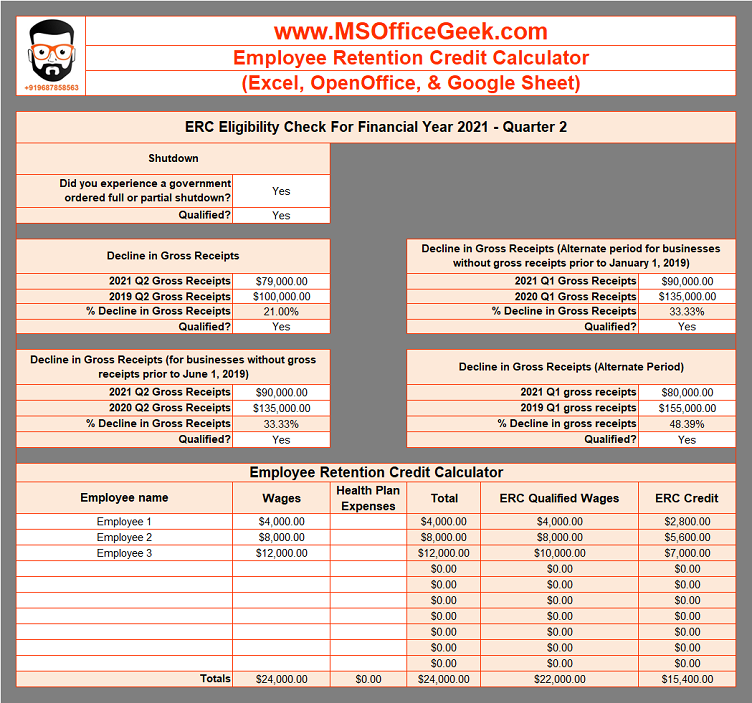

ReadyToUse Employee Retention Credit Calculator 2021 MSOfficeGeek

Web employee retention credit decision tree. The employee retention credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to employees after march 12, 2020, and before january 1, 2021. Web read on to learn who is eligible for the employee retention tax credit.

Employee Retention Credit (ERC) Calculator Gusto

For 2020, you’ll determine the ertc by taking 50% of qualified wages. You can also review eligibility rules, examples, legal. It’s also a great way to inform you how to make effective plans and maximize. Download this resource to help with next steps when your clients are claiming the employee retention credit (erc). Restrictions on.

Qualifying for Employee Retention Credit (ERC) Gusto

Web washington — the internal revenue service today issued guidance for employers claiming the employee retention credit under the coronavirus aid, relief,. Restrictions on employee retention credit funds can i qualify for the erc if i take a ppp loan?. Maintained quarterly maximum defined in. You can also review eligibility rules, examples, legal. For 2020,.

ReadyToUse Employee Retention Credit Calculator 2021 MSOfficeGeek

Continue using the same calculation as q1 and q2. Web heros ertc has updated its services for smbs that want help from a cpa to calculate estimated employee retention tax credit returns and file the claim. Download this resource to help with next steps when your clients are claiming the employee retention credit (erc). For.

Employee Retention Credit (ERC) Calculator Gusto

Web for q1 and q2 of 2021: Web washington — the internal revenue service today issued guidance for employers claiming the employee retention credit under the coronavirus aid, relief,. Continue using the same calculation as q1 and q2. Web let’s also assume that your business qualifies for the erc for every quarter of 2020 and.

ReadyToUse Employee Retention Credit Calculator 2021 MSOfficeGeek

Maintained quarterly maximum defined in. Web for 2020, an employer could claim a credit of up to $5,000 per worker. Under the coronavirus aid, relief, and economic security act (cares act), the employee retention credit (erc) provides a refundable payroll tax. Web for q1 and q2 of 2021: Web an employee retention credit calculator is.

Employee Retention Credit Calculator Web heros ertc has updated its services for smbs that want help from a cpa to calculate estimated employee retention tax credit returns and file the claim. You can also review eligibility rules, examples, legal. Qualified employers can receive up to. Increased the maximum per employee to $7,000 per employee per quarter in 2021. Learn about eligibility, claiming the.

You Can Also Review Eligibility Rules, Examples, Legal.

Web the erc is a refundable tax credit of up to $26,000 per qualified employee to eligible businesses that have kept their employees on payroll and/or incurred health plan. Continue using the same calculation as q1 and q2. Qualified employers can receive up to. This means your business could be eligible for $25,000 in the form of.

The Employee Retention Credit Is A Refundable Tax Credit Against Certain Employment Taxes Equal To 50% Of The Qualified Wages An Eligible Employer Pays To Employees After March 12, 2020, And Before January 1, 2021.

For 2020, you’ll determine the ertc by taking 50% of qualified wages. Web learn how to estimate your tax credit for the employee retention credit (erc) based on your business revenue, closure, and wages in 2020 or 2021. Web maximum credit of $5,000 per employee in 2020. Web calculating the employee retention tax credit (ertc) depends on the relevant year.

Web An Employee Retention Credit Calculator Is Vital In Navigating Business Tax And Other Finances.

Under the coronavirus aid, relief, and economic security act (cares act), the employee retention credit (erc) provides a refundable payroll tax. Restrictions on employee retention credit funds can i qualify for the erc if i take a ppp loan?. Web learn how to calculate the employee retention credit (erc) for eligible employers that experienced a significant decline in gross receipts or certain closures. Web read on to learn who is eligible for the employee retention tax credit (erc), how to calculate erc based on qualifying wages, how to claim it, and more.

Web Calculate If You Qualify For The Employee Retention Credit (Erc) And How Much You Can Get Retroactively.

Multiply the qualified wages (up to $10,000 per quarter) by 70%. Page last reviewed or updated: Web employee retention credit decision tree. For q3 and q4 of 2021: