Employee Retention Tax Credit Calculator

Employee Retention Tax Credit Calculator - Wages paid to related individuals of. Web maximum credit of $5,000 per employee in 2020: With new law changes, nearly 80% of businesses qualify! Web get started with the ey employee retention credit calculator. Increased the maximum per employee to $7,000 per employee per quarter in 2021:

With new law changes, nearly 80% of businesses qualify! Web use our simple calculator to see if you qualify for the erc and if so, by how much. Web the calculator will estimate the benefit by quarter. Web get started with the ey employee retention credit calculator. Web for 2020, an employer could claim a credit of up to $5,000 per worker. Web maximum credit of $5,000 per employee in 2020: Eligible wages per employee max out at $10,000, so the maximum credit for.

Employee Retention Credit for 2020 and 2021 Gusto

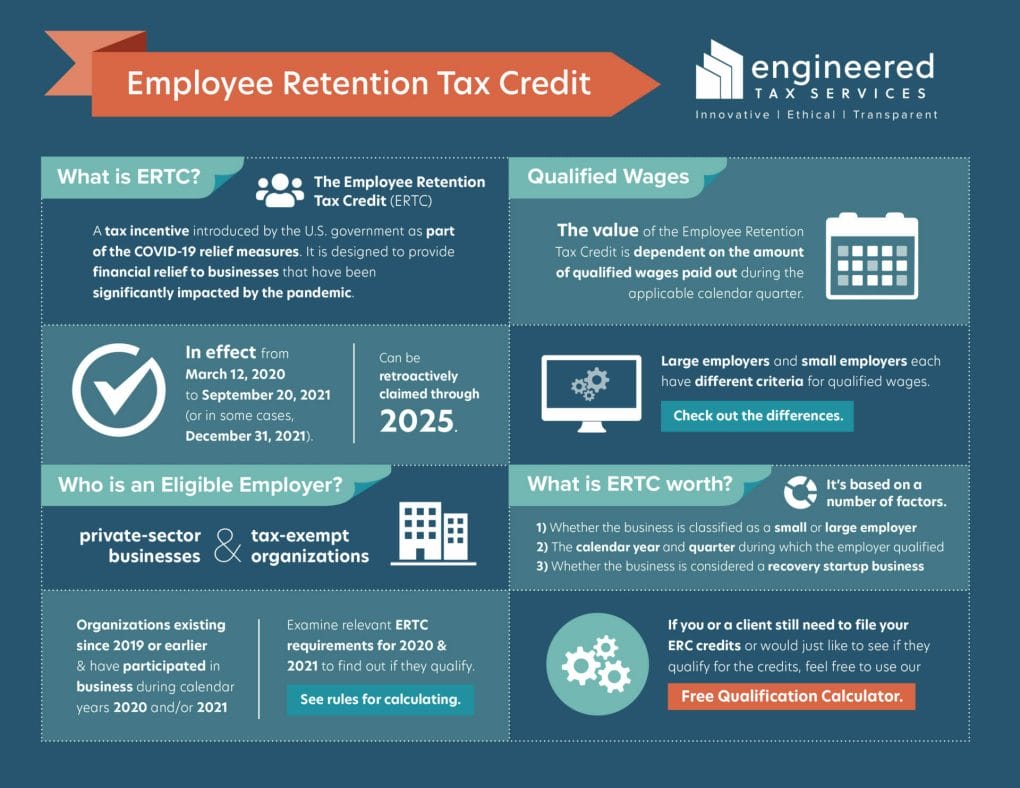

Web the employee retention credit (erc) was a refundable payroll tax credit for qualified wages paid to retained employees, originally from march 13, 2020, to dec. The employee retention credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to employees after march 12,.

Qualifying for Employee Retention Credit (ERC) Gusto

Essential guide for small businesses how to calculate employee retention credit (2023 guide) watch on when the coronavirus. Web calculate your estimated erc with just a few clicks. Simply enter your business information into. Web read on to learn who is eligible for the employee retention tax credit (erc), how to calculate erc based on.

Erc Credit Calculation Template

Maintained quarterly maximum defined in. Web maximum credit of $5,000 per employee in 2020: Intuit.com has been visited by 1m+ users in the past month Simply enter your business information into. Web use our simple calculator to see if you qualify for the erc and if so, by how much. Web get started with the.

Employee Retention Credit (ERC) Calculator Gusto

Web the credit applies to wages paid after march 12, 2020, and before january 1, 2021. Increased the maximum per employee to $7,000 per employee per quarter in 2021: # average wage per employee (capped at $10k / quarter): Web calculating your 2020 erc. Web read on to learn who is eligible for the employee.

How To Calculate Employee Retention Tax Credit For 2021 Live Rank Sniper

Maintained quarterly maximum defined in. Just enter your business details and get an immediate, personalized estimation of your. Web maximum credit of $5,000 per employee in 2020: Web employee retention credit calculator use the tool and erc calculator below to quickly find your estimated employee retention credit. Enter a few data points to receive a.

Employee Retention Credit (ERC) Calculator Gusto

Web read on to learn who is eligible for the employee retention tax credit (erc), how to calculate erc based on qualifying wages, how to claim it, and more. Web use our simple calculator to see if you qualify for the erc and if so, by how much. The employee retention credit is a refundable.

Employee Retention Tax Credit Free Qualification Calculator

Web the rules changed for 2021. For 2020, qualified wages and expenses are capped at $10,000 per employee for the year and the credit is up to. Web heros ertc has updated its services for smbs that want help from a cpa to calculate estimated employee retention tax credit returns and file the claim. Eligible.

Employee Retention Credit Worksheet 1

Increased the maximum per employee to $7,000 per employee per quarter in 2021: Web maximum credit of $5,000 per employee in 2020: Intuit.com has been visited by 1m+ users in the past month Just enter your business details and get an immediate, personalized estimation of your. Maintained quarterly maximum defined in. Simply enter your business.

employee retention credit calculation spreadsheet 2021

Web get started with the ey employee retention credit calculator. Intuit.com has been visited by 1m+ users in the past month With new law changes, nearly 80% of businesses qualify! The erc calculator will ask questions about the company's gross receipts and employee. Enter a few data points to receive a free estimate of your.

7Step ERC Calculation Worksheet (Employee Retention Credit)

The erc calculator will ask questions about the company's gross receipts and employee. Essential guide for small businesses how to calculate employee retention credit (2023 guide) watch on when the coronavirus. Web the credit applies to wages paid after march 12, 2020, and before january 1, 2021. Web the calculator will estimate the benefit by.

Employee Retention Tax Credit Calculator Web maximum credit of $5,000 per employee in 2020: Web read on to learn who is eligible for the employee retention tax credit (erc), how to calculate erc based on qualifying wages, how to claim it, and more. Web take the guesswork out of employee retention tax credit with our eligibility calculator! With new law changes, nearly 80% of businesses qualify! Web the rules changed for 2021.

What Is The Erc Tax.

Web for 2020, an employer could claim a credit of up to $5,000 per worker. Enter a few data points to receive a free estimate of your potential credit and fees for using the service. # average wage per employee (capped at $10k / quarter): Web heros ertc has updated its services for smbs that want help from a cpa to calculate estimated employee retention tax credit returns and file the claim.

Web Maximum Credit Of $5,000 Per Employee In 2020:

Eligible wages per employee max out at $10,000, so the maximum credit for. For 2020, qualified wages and expenses are capped at $10,000 per employee for the year and the credit is up to. Web take the guesswork out of employee retention tax credit with our eligibility calculator! With new law changes, nearly 80% of businesses qualify!

Maintained Quarterly Maximum Defined In.

Web the employee retention credit (erc) was a refundable payroll tax credit for qualified wages paid to retained employees, originally from march 13, 2020, to dec. Wages paid to related individuals of. Web get started with the ey employee retention credit calculator. The erc calculator will ask questions about the company's gross receipts and employee.

Essential Guide For Small Businesses How To Calculate Employee Retention Credit (2023 Guide) Watch On When The Coronavirus.

Web the rules changed for 2021. Web employee retention credit calculator use the tool and erc calculator below to quickly find your estimated employee retention credit. Web the calculator will estimate the benefit by quarter. Web calculate your estimated erc with just a few clicks.