Employee Stock Purchase Plan Calculator

Employee Stock Purchase Plan Calculator - As you might already know, espps are a benefit offered by some companies that allow employees to. If you enroll, you choose an. This way you can save for. To report the sale of shares, you’ll. Ten facts about the espp $25,000 limitation.

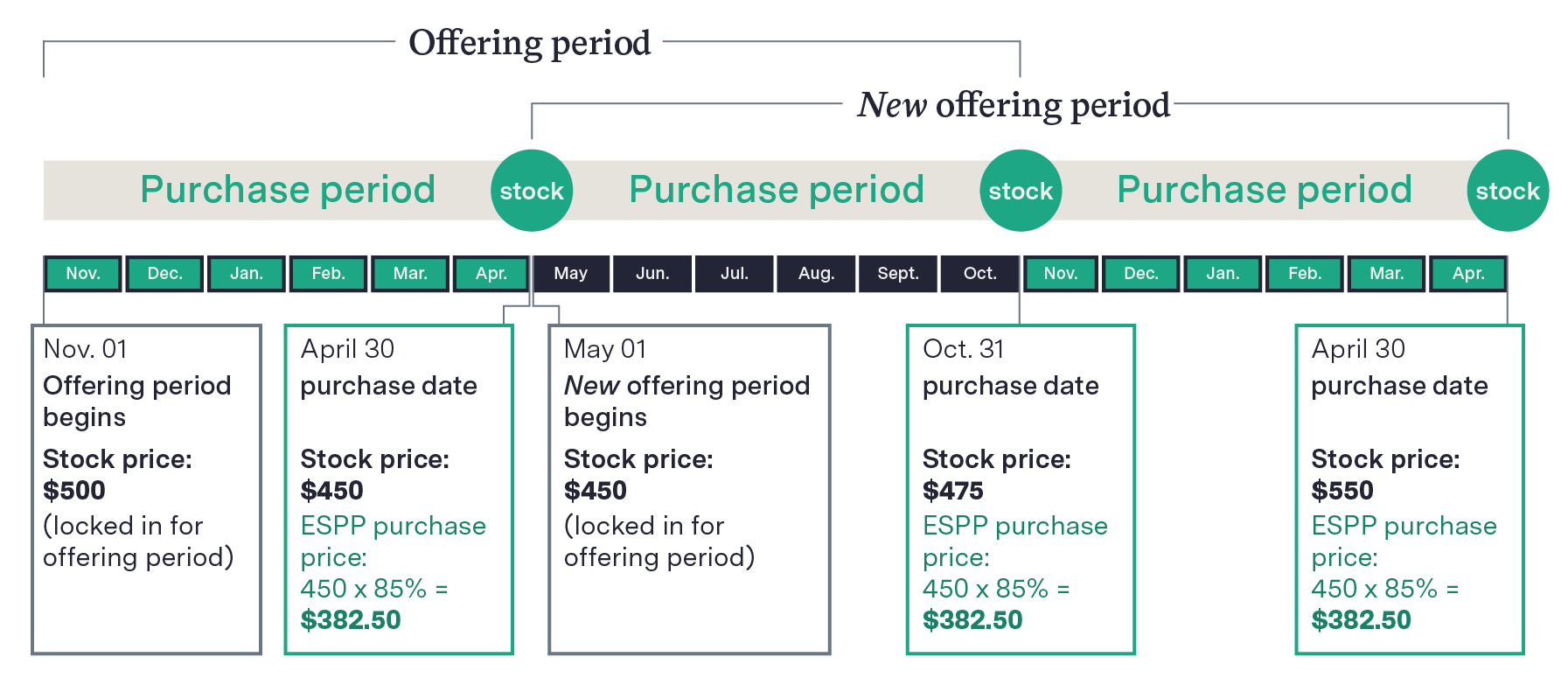

Follow these steps to calculate potential gains: Web espp calculator (employee stock purchase plan) watch on. To report the sale of shares, you’ll. Enter your company's plan details, stock symbols, share prices,. Web espp stands for employee stock purchase plan, which is a type of plan that provides you with a convenient way to buy your company stock. Tastytrade.com has been visited by 10k+ users in the past month Web lendtable provides you with a line of credit you can use to reimburse the contributions you make to max out your employee stock purchase plan.

ESPP Calculator (Employee Stock Purchase Plan) YouTube

Understanding the espp $25,000 limit (video) this blog entry. Web this calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription period. Web welcome to our employee stock purchase plan (espp) calculator! Web lendtable provides you with a line of credit.

Understand Your Employee Stock Purchase Plan (ESPP) Strategy Guide

Web espp stands for employee stock purchase plan, which is a type of plan that provides you with a convenient way to buy your company stock. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • october 19, 2023 6:57 pm. This way you can save for. Web.

Employee Stock Purchase Plans (ESPPs) Understanding and maximizing a

Web espp stands for employee stock purchase plan, which is a type of plan that provides you with a convenient way to buy your company stock. After six months, the employer uses the accumulated. Web this calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the.

Employee Stock Purchase Plan (ESPP) Meaning, Examples

If you enroll, you choose an. Understanding the espp $25,000 limit (video) this blog entry. By understanding how to use it effectively, you can optimize your. After six months, the employer uses the accumulated. Web understanding the $25,000 limit in seven slides. Info needed to use the estimator: Web one of the most common espp.

Employee Stock Purchase Plan (ESPP) Meaning, Example, Tax

As you might already know, espps are a benefit offered by some companies that allow employees to. Enter your company's plan details, stock symbols, share prices,. The most significant implication for. After six months, the employer uses the accumulated. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023.

Employee Stock Purchase Plan (ESPP) Calculator * Level Up Financial

Find out how much you can save, when you can retire, and how your espp impacts your. Web when an employee enrolls in an espp, contributions to the plan are made from regular payroll deductions. Understanding the espp $25,000 limit (video) this blog entry. Web one of the most common espp designs offers employees the.

Employee Stock Purchase Plan Things To Know

To report the sale of shares, you’ll. Web espp gain and tax calculator most tech companies offer employee stock purchase plans (espps) to their employees. Tastytrade.com has been visited by 10k+ users in the past month The most significant implication for. Web lendtable provides you with a line of credit you can use to reimburse.

Employee Stock Purchase Plans 101 Plancorp

Web the espp calculator is a valuable tool for employees participating in employee stock purchase plans. Find out how much you can save, when you can retire, and how your espp impacts your. This way you can save for. Web employee stock purchase plans. Enter your company's plan details, stock symbols, share prices,. Web understanding.

Employee Stock Purchase Plan Lam Benefits

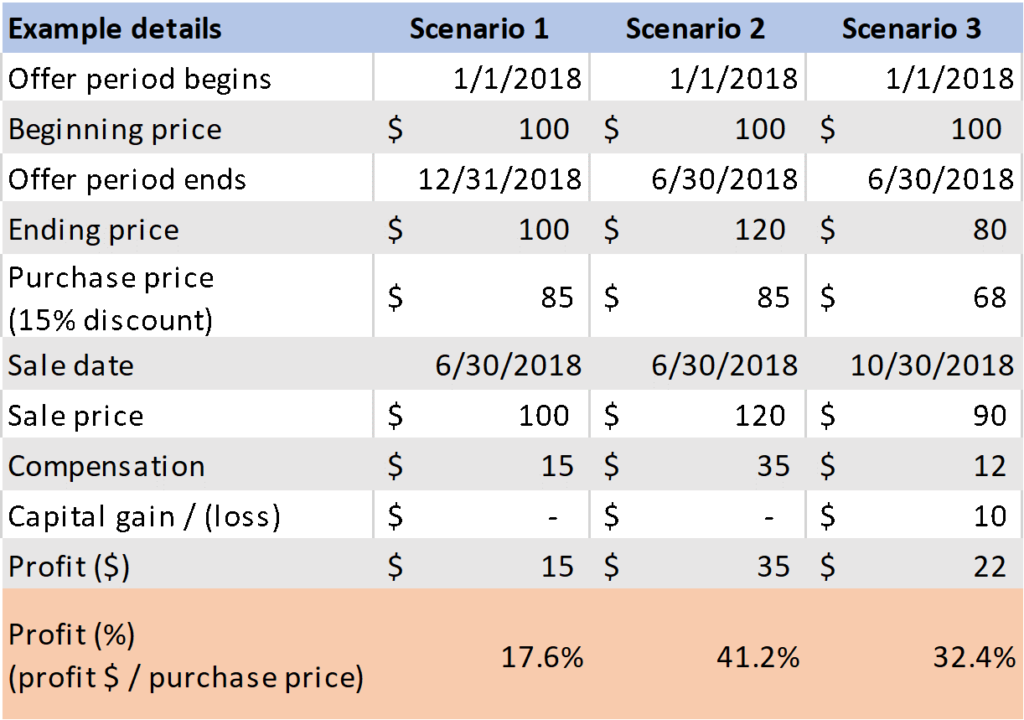

By understanding how to use it effectively, you can optimize your. Web one of the most common espp designs offers employees the opportunity to purchase shares at a discount (usually 5%, 10% or 15%) from whichever is lower: Web calculate the performance and tax implications of your employee stock purchase plan with this free online.

ESPP or Employee Stock Purchase Plan Eqvista

Web calculate the benefits of your employee stock purchase plan (espp) with this tool. The idea that employees are allowed to. Web employee stock purchase plans. Odoo.com has been visited by 100k+ users in the past month If you enroll, you choose an. Web espp calculator (employee stock purchase plan) watch on. As you might.

Employee Stock Purchase Plan Calculator Web calculate your net gain after tax value on your espp based on grant date, exercise date, shares, commission and tax details. The most significant implication for. Web when an employee enrolls in an espp, contributions to the plan are made from regular payroll deductions. If you enroll, you choose an. Web one of the most common espp designs offers employees the opportunity to purchase shares at a discount (usually 5%, 10% or 15%) from whichever is lower:

Web Lendtable Provides You With A Line Of Credit You Can Use To Reimburse The Contributions You Make To Max Out Your Employee Stock Purchase Plan.

Web one of the most common espp designs offers employees the opportunity to purchase shares at a discount (usually 5%, 10% or 15%) from whichever is lower: Enter the stock’s offering price per. Understanding the espp $25,000 limit (video) this blog entry. Web employee stock purchase plan calculator stock purchase price * discount percentage * number of shares * purchase price are you tired of trying to figure out your employee.

Written By A Turbotax Expert • Reviewed By A Turbotax Cpa Updated For Tax Year 2023 • October 19, 2023 6:57 Pm.

Web espp stands for employee stock purchase plan, which is a type of plan that provides you with a convenient way to buy your company stock. Web this calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription period. As you might already know, espps are a benefit offered by some companies that allow employees to. Web when an employee enrolls in an espp, contributions to the plan are made from regular payroll deductions.

Odoo.com Has Been Visited By 100K+ Users In The Past Month

Info needed to use the estimator: Web an employee stock purchase plan is a valuable benefit offered by some publicly traded companies. Web understanding the $25,000 limit in seven slides. Find out how much you can save, when you can retire, and how your espp impacts your.

It Allows Employees To Purchase Company Shares At A Discount — Often At.

If you enroll, you choose an. Enter your company's plan details, stock symbols, share prices,. Web the espp calculator is a valuable tool for employees participating in employee stock purchase plans. Ten facts about the espp $25,000 limitation.