Employee Stock Purchase Plan Tax Calculator

Employee Stock Purchase Plan Tax Calculator - Web employee stock purchase plan calculator lowest stock price during period discount stock price at end of period dollar contribution per paycheck after six months you will. We cover how it works, how it's taxed, and how to incorporate it in your wealth building strategy. When you buy stock under an employee stock purchase plan (espp), the income isn’t taxable at the time you buy it. Web the idea that employees are allowed to purchase company stock at a discount is easy to understand, but actually calculating the gains and taxes from. If you enroll, you choose an.

Web espp returns and tax calculator. By understanding how to use it effectively, you can optimize your. Web options granted under an employee stock purchase plan or an incentive stock option (iso) plan are statutory stock options. Web the employee stock purchase plan (espp): Web an employee stock purchase plan (espp) is a fringe benefit offered to employees. Web an employee stock ownership plan (esop) is an irc section 401 (a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/ money purchase plan. Stock options that are granted.

Employee Stock Purchase Plans 101 Plancorp

Web employee stock purchase plan taxes. If you enroll, you choose an. Additionally, when shares are sold, you’ll. Web employee stock purchase plan (espp) calculator. When you buy stock under an employee stock purchase plan (espp), the income isn’t taxable at the time you buy it. Web the employee stock purchase plan (espp): Web the.

Employee Stock Purchase Plan (ESPP) Meaning, Example, Tax

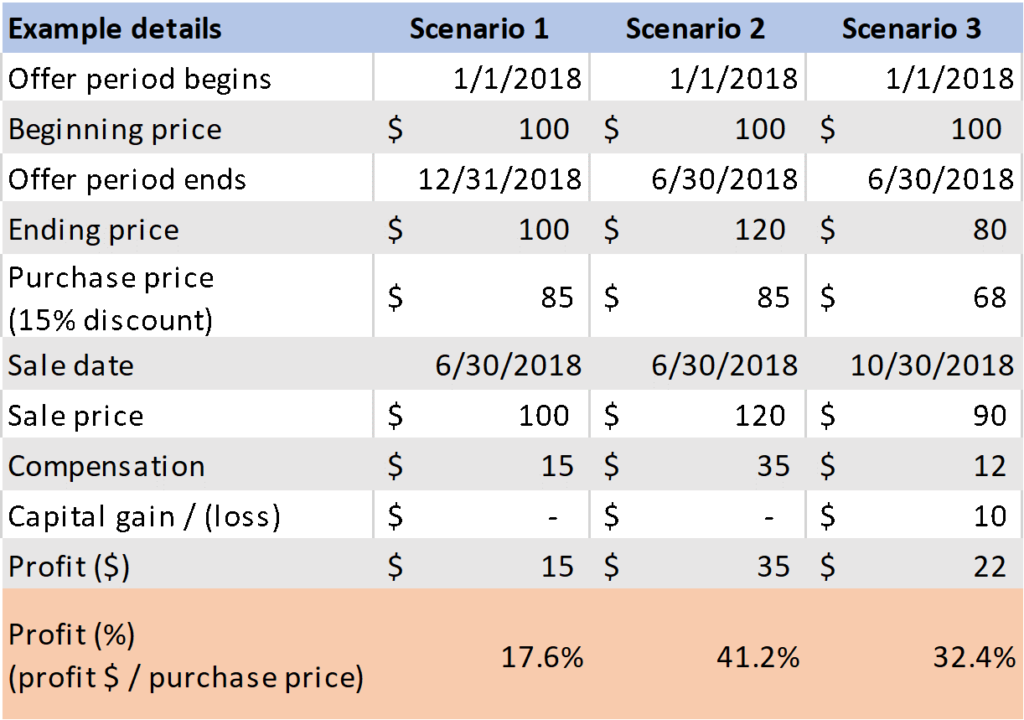

Web the idea that employees are allowed to purchase company stock at a discount is easy to understand, but actually calculating the gains and taxes from. Tax rules cap the amount of company stock an employee can accrue in an espp at $25,000 of the fair market value of the stock per. Web the employee.

Employee Stock Purchase Plan (ESPP) The 5 Things You Need to Know

The most significant implication for. Web employee stock purchase plan calculator lowest stock price during period discount stock price at end of period dollar contribution per paycheck after six months you will. Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming. Stock options that are granted. Paying tax too.

Employee Stock Purchase Plan (ESPP) Calculator * Level Up Financial

Web options granted under an employee stock purchase plan or an incentive stock option (iso) plan are statutory stock options. Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming. Web an employee stock purchase plan (espp) is a fringe benefit offered to employees. Web espp returns and tax calculator..

Employee Stock Purchase Plans (ESPPs) Understanding and maximizing a

If you enroll, you choose an. Qualified espps, known as qualified section 423 plans(to match the tax code), have to follow irs rules to receive favored treatment. Web the idea that employees are allowed to purchase company stock at a discount is easy to understand, but actually calculating the gains and taxes from. Stock options.

Understand Your Employee Stock Purchase Plan (ESPP) Strategy Guide

Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming. Stock options that are granted. Web employee stock purchase plan (espp) calculator. The business grants its workers an option to purchase the company's. Web this calculator assumes that your purchase price is calculated picking the lower stock price between the.

ESPP or Employee Stock Purchase Plan Eqvista

Web the number of shares of stock you acquired through the employee stock purchase plan. Webull.com has been visited by 100k+ users in the past month Tastytrade.com has been visited by 10k+ users in the past month Web espp stands for employee stock purchase plan, which is a type of plan that provides you with.

Employee Stock Purchase Plan Lam Benefits

Tastytrade.com has been visited by 10k+ users in the past month Web employee stock purchase plan (espp) calculator it is an online tool for tax calculation and used to determine your net gain after tax value on your espp based on grant date,. The most significant implication for. Tax rules cap the amount of company.

Employee Stock Purchase Plan (ESPP) Meaning, Examples

Tax rules cap the amount of company stock an employee can accrue in an espp at $25,000 of the fair market value of the stock per. This number is used to calculate your total cost basis and potential. Web shares of stock received or purchased through a stock plan are considered income and generally subject.

Employee Stock Purchase Plan Things To Know

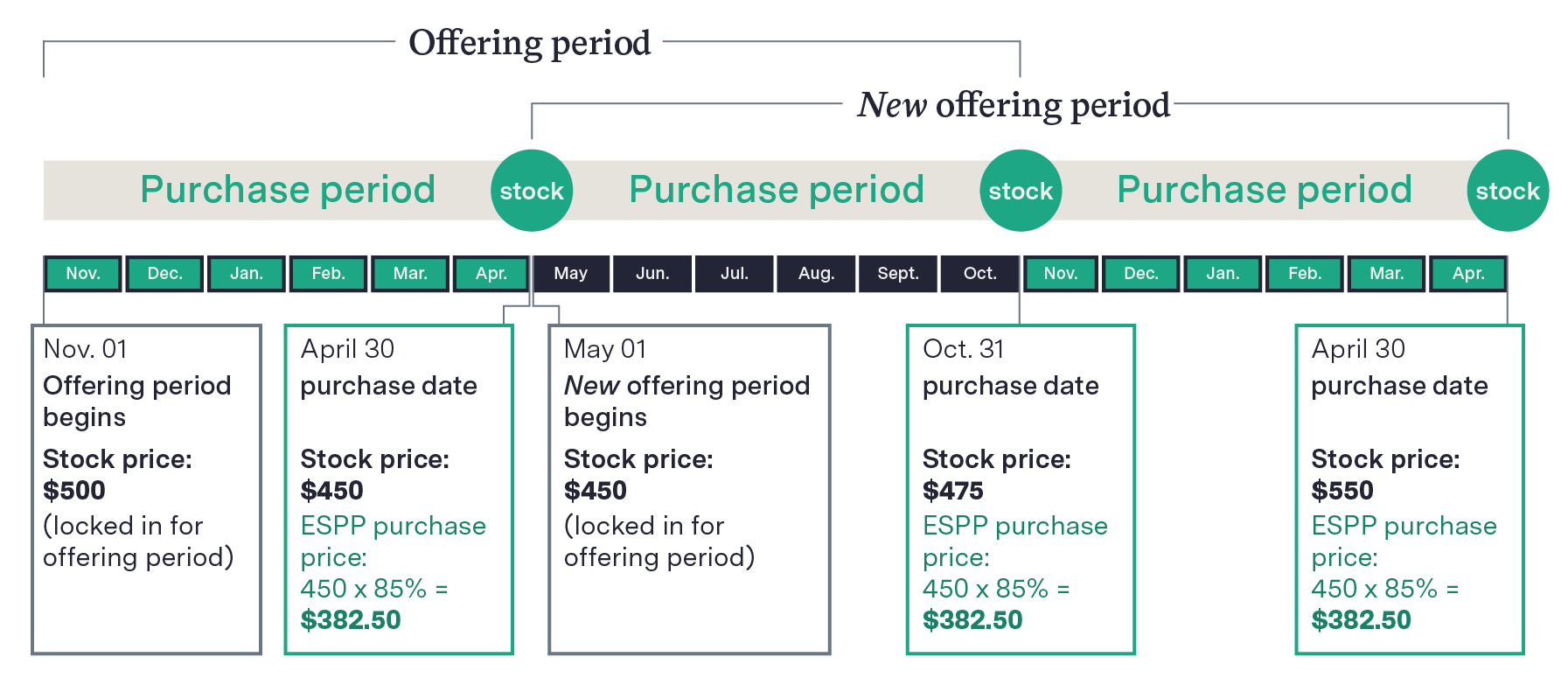

Web for tax calculations, the market price at the end of the offering period matters. Qualified espps, known as qualified section 423 plans(to match the tax code), have to follow irs rules to receive favored treatment. Web an employee stock purchase plan (espp) is a fringe benefit offered to employees. Webull.com has been visited by.

Employee Stock Purchase Plan Tax Calculator Web shares of stock received or purchased through a stock plan are considered income and generally subject to ordinary income taxes. Tastytrade.com has been visited by 10k+ users in the past month The most significant implication for. Web the employee stock purchase plan (espp): Web espp returns and tax calculator.

Navigating The Performance And Tax Implications Of Your Employee Stock Purchase Plan Can Be Overwhelming.

Web an employee stock ownership plan (esop) is an irc section 401 (a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/ money purchase plan. Below is an interactive espp calculator. Web this calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription period. Web the number of shares of stock you acquired through the employee stock purchase plan.

Qualified Espps, Known As Qualified Section 423 Plans(To Match The Tax Code), Have To Follow Irs Rules To Receive Favored Treatment.

Web the employee stock purchase plan (espp): Web options granted under an employee stock purchase plan or an incentive stock option (iso) plan are statutory stock options. Additionally, when shares are sold, you’ll. The most significant implication for.

Stock Options That Are Granted.

Web an employee stock purchase plan (espp) is a fringe benefit offered to employees. Web the idea that employees are allowed to purchase company stock at a discount is easy to understand, but actually calculating the gains and taxes from. The business grants its workers an option to purchase the company's. Web employee stock purchase plan (espp) calculator.

Tax Rules Cap The Amount Of Company Stock An Employee Can Accrue In An Espp At $25,000 Of The Fair Market Value Of The Stock Per.

When you buy stock under an employee stock purchase plan (espp), the income isn’t taxable at the time you buy it. Web shares of stock received or purchased through a stock plan are considered income and generally subject to ordinary income taxes. By understanding how to use it effectively, you can optimize your. This number is used to calculate your total cost basis and potential.