Ending Inventory Calculator Fifo

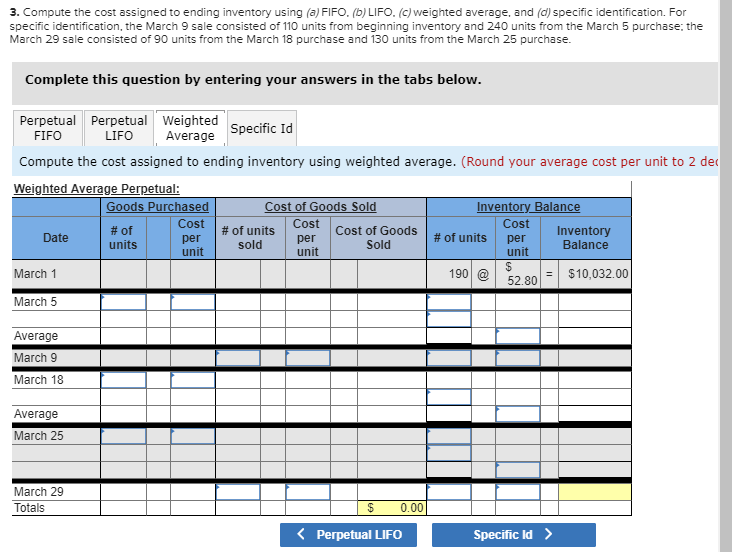

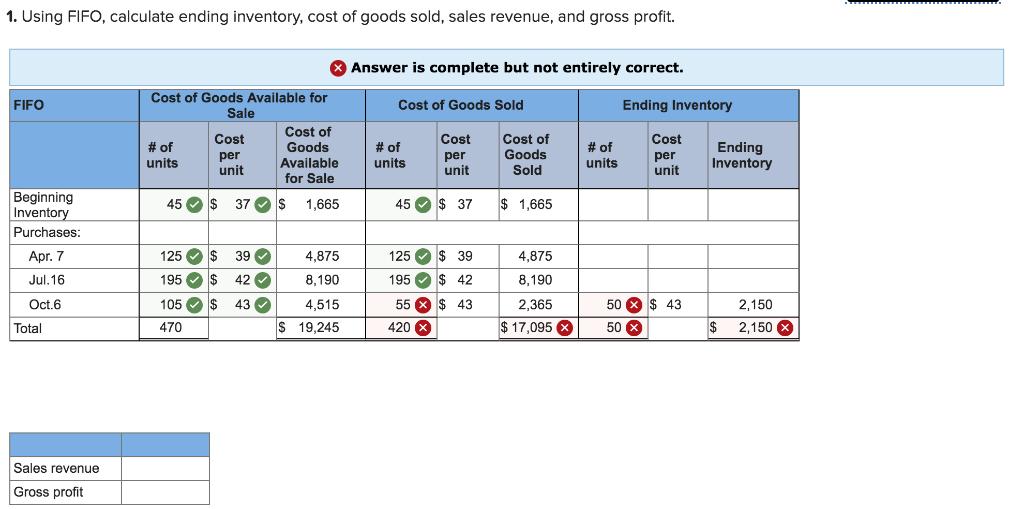

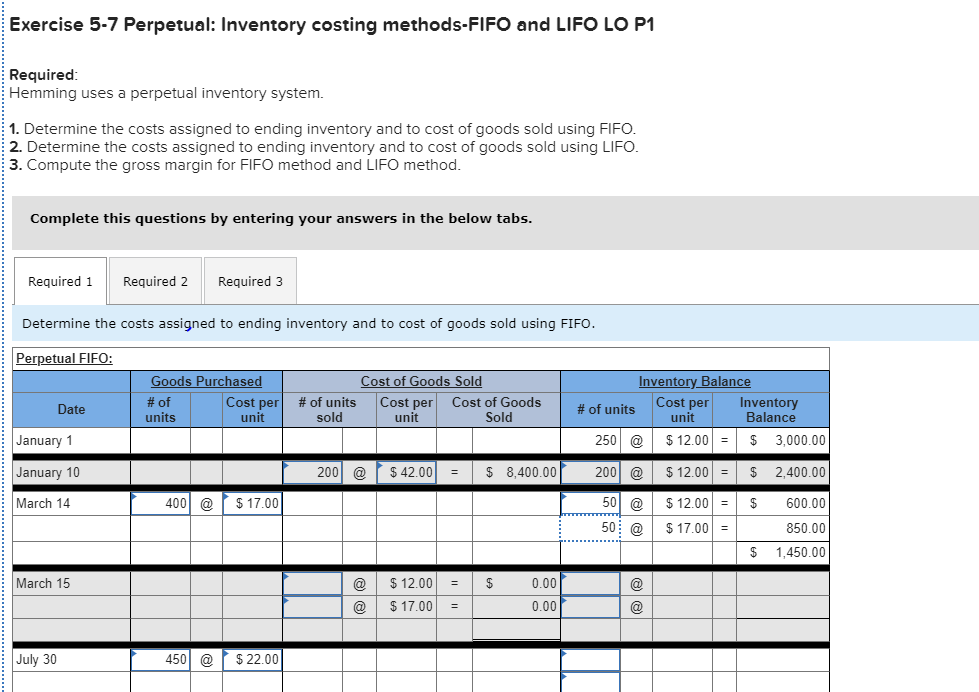

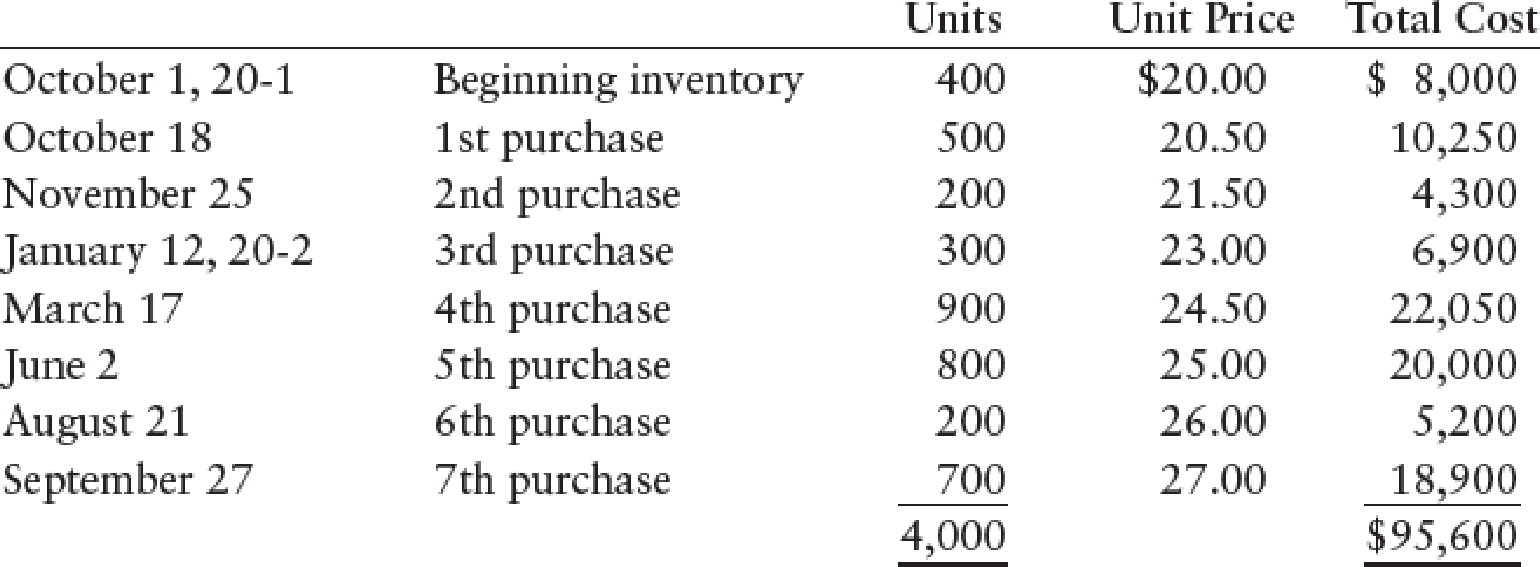

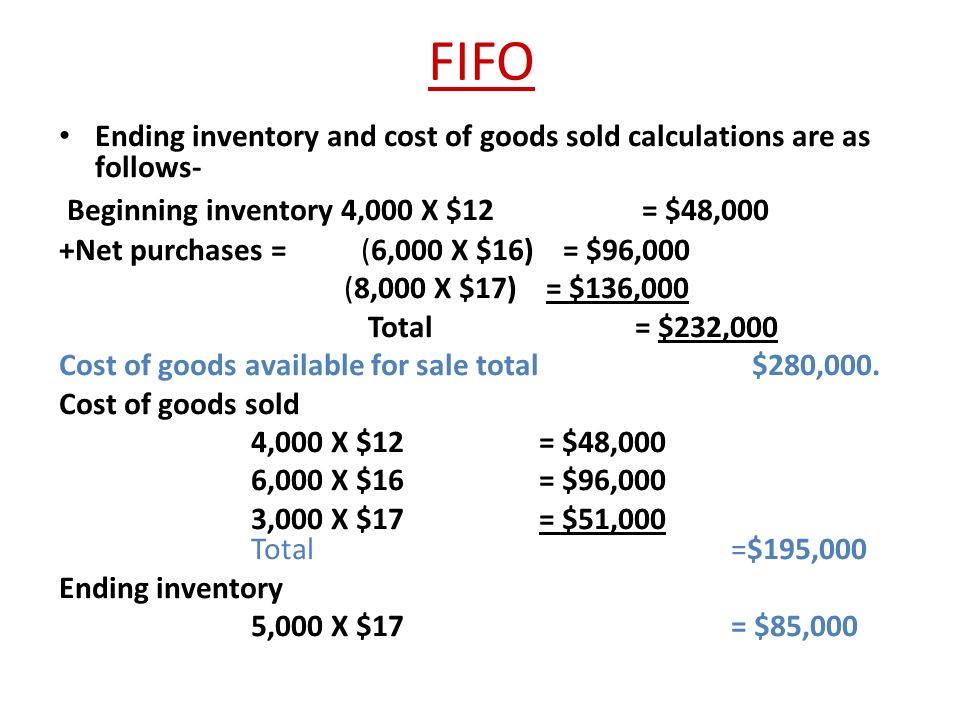

Ending Inventory Calculator Fifo - Web to break this down, check out the example below detailing how to calculate ending inventory using fifo below: So the ending inventory would be 70 shirts with a. Remember that the last units in (the newest ones) are sold. Web calculate the total amount to be assigned to the ending inventory on december 31 under each of the following methods: 1,000 units x $8 = $8,000.

Web fifo method calculates the ending inventory value by taking out the very first acquired items. Web this ending inventory calculator allows you to calculate the total worth of units in your inventory at the conclusion of an accounting epoch. Web to break this down, check out the example below detailing how to calculate ending inventory using fifo below: Web at its most basic level, ending inventory can be calculated by adding new purchases to beginning inventory, then subtracting the cost of goods sold (cogs). In our example, there are. You will be able to quickly and. Financial accounting | openstax 10.3 calculate the.

How To Get Ending Inventory Using Fifo

Web calculate the total amount to be assigned to the ending inventory on december 31 under each of the following methods: Web fifo lifo calculator is an online finance tool that finds the value of cogs and ending inventory on the average cost method. Web to calculate the ending inventory value, multiply the remaining unsold.

How To Calculate The Ending Inventory Using Fifo

The cogs calculation is as follows: Demand planning · parcel spend management · s&op · business intelligence Then, since inflation increases price over time, the ending. Web calculate the total amount to be assigned to the ending inventory on december 31 under each of the following methods: Web how to calculate ending inventory value using.

How To Calculate Inventory Using Fifo Method

Web the lifo calculator for inventory and costs of goods sold (cogs) is an intelligent tool that can help you calculate your current inventory value and the amount. The cogs calculation is as follows: Financial accounting | openstax 10.3 calculate the. Web below are the ending inventory valuations: In our example, there are. This means.

How To Compute Fifo Ending Inventory

This calculator gives a detailed table which. In our example, there are. Web to calculate your ending inventory you would factor in 20 shirts at the $5 cost and 50 shirts at the $6 price. So the ending inventory would be 70 shirts with a. Also, the number of inventory units remains the same at.

How To Compute Fifo Ending Inventory

Financial accounting | openstax 10.3 calculate the. This calculator gives a detailed table which. Web to calculate the ending inventory value, multiply the remaining unsold units with their respective unit costs, according to the fifo method. In our example, there are. Web to break this down, check out the example below detailing how to calculate.

How to Calculate Closing Inventory

So the ending inventory would be 70 shirts with a. It is the actual amount of products that are available for sale at the end of an auditing period. The cogs calculation is as follows: Web in the fifo method, the ending inventory is calculated by the order in which the items are listed in.

How To Find Ending Inventory For Fifo

Web to calculate the ending inventory value, multiply the remaining unsold units with their respective unit costs, according to the fifo method. Remember that the last units in (the newest ones) are sold. Web to calculate your ending inventory you would factor in 20 shirts at the $5 cost and 50 shirts at the $6.

How To Calculate The Ending Inventory Using Fifo

So the ending inventory would be 70 shirts with a. Web how to calculate ending inventory value using fifo? Web using the fifo method, kendo needs to utilize the older selling price of acquiring his inventory and then work from there. You will be able to quickly and. Financial accounting | openstax 10.3 calculate the..

How to Calculate Ending Inventory Using Absorption Costing Online

Web below are the ending inventory valuations: Financial accounting | openstax 10.3 calculate the. Also, the number of inventory units remains the same at the last of. Web in the fifo method, the ending inventory is calculated by the order in which the items are listed in the inventory. In simple terms, you just multiply.

Solved Calculate the cost of ending inventory using FIFO

Web at its most basic level, ending inventory can be calculated by adding new purchases to beginning inventory, then subtracting the cost of goods sold (cogs). In simple terms, you just multiply the cost of an item by its quantity to get the inventory value. Web to break this down, check out the example below.

Ending Inventory Calculator Fifo Web to calculate your ending inventory you would factor in 20 shirts at the $5 cost and 50 shirts at the $6 price. For an online store, 100 items cost the business $10.00. This means that the first item purchased is. The cogs calculation is as follows: Web in the fifo method, the ending inventory is calculated by the order in which the items are listed in the inventory.

It Is The Actual Amount Of Products That Are Available For Sale At The End Of An Auditing Period.

Web fifo lifo calculator is an online finance tool that finds the value of cogs and ending inventory on the average cost method. Demand planning · parcel spend management · s&op · business intelligence Web calculate the total amount to be assigned to the ending inventory on december 31 under each of the following methods: The cogs calculation is as follows:

Web The Lifo Calculator For Inventory And Costs Of Goods Sold (Cogs) Is An Intelligent Tool That Can Help You Calculate Your Current Inventory Value And The Amount.

This means that the first item purchased is. For an online store, 100 items cost the business $10.00. This calculator gives a detailed table which. Web to calculate your ending inventory you would factor in 20 shirts at the $5 cost and 50 shirts at the $6 price.

Also, The Number Of Inventory Units Remains The Same At The Last Of.

Web to break this down, check out the example below detailing how to calculate ending inventory using fifo below: Financial accounting | openstax 10.3 calculate the. Web using the fifo method, kendo needs to utilize the older selling price of acquiring his inventory and then work from there. In simple terms, you just multiply the cost of an item by its quantity to get the inventory value.

Web Fifo Method Calculates The Ending Inventory Value By Taking Out The Very First Acquired Items.

Remember that the last units in (the newest ones) are sold. Web in the fifo method, the ending inventory is calculated by the order in which the items are listed in the inventory. You will be able to quickly and. Web at its most basic level, ending inventory can be calculated by adding new purchases to beginning inventory, then subtracting the cost of goods sold (cogs).