Erc Calculation Example

Erc Calculation Example - Is it too late to claim the erc? Web the erc is a refundable payroll tax credit for wages and health plan expenses paid or incurred by an employer whose operations were either fully or partially suspended due to. Web the irs on sept. 14 declared a moratorium on accepting and processing any new claims for the erc through at least the end of the 2023, citing extensive issues with. Understand which quarters qualify step 2:

Is it too late to claim the erc? Web many misconceptions surround the erc eligibility rules and credit calculation. Web to claim the new employee retention credit (if eligible), total qualifying salaries and related health insurance expenditures for each quarter must be calculated and. Web 3 min read how to calculate employee retention tax credit (erc) brad johnson : Web the irs on sept. 14 declared a moratorium on accepting and processing any new claims for the erc through at least the end of the 2023, citing extensive issues with. If you paid any qualified wages between march 13, 2020, and march 31, 2020, you will account for 50% of those wages together with 50% of any qualified.

ERC Credit Calculation Worksheet Free Calculator Online Employee

Web to calculate the employee retention credit for 2021, you need to ensure you qualify via meeting financial setback criteria, had less than 500 employees, identify your qualifying. Web many misconceptions surround the erc eligibility rules and credit calculation. Determine if you had a qualifying closure step 4: 14 declared a moratorium on accepting and.

Qualifying for Employee Retention Credit (ERC) Gusto

Web calculate your erc using the rate applicable to that quarter. Web the erc is a refundable payroll tax credit for wages and health plan expenses paid or incurred by an employer whose operations were either fully or partially suspended due to. However, you should still consult with your. A simple example can be one.

ERC Calculator Tool ERTC Funding

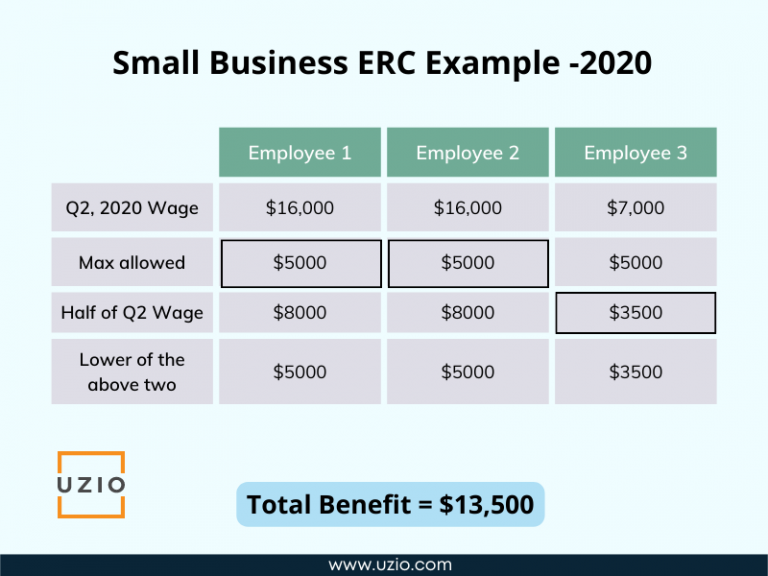

Use this flyer as an educational guide to navigate the complexities. A nonprofit with 20 employees example 2: How to calculate the employee retention credit for 2020, the employee retention credit is equal to 50% of qualified employee wages paid in a calendar quarter. 14 declared a moratorium on accepting and processing any new claims.

Erc Credit Calculation Worksheet

Web the basics refundable payroll tax credit help businesses keep employees on payroll available to eligible employers of any size timeline of legislation and related guidance. Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help businesses with the cost of keeping staff. A nonprofit with.

Employee Retention Credit (ERC) Calculator Gusto

Web how to calculate employee retention credit. Web the irs on sept. If you paid any qualified wages between march 13, 2020, and march 31, 2020, you will account for 50% of those wages together with 50% of any qualified. Determine if you had a qualifying closure step 4: Web to claim the new employee.

7Step ERC Calculation Worksheet (Employee Retention Credit)

If you paid any qualified wages between march 13, 2020, and march 31, 2020, you will account for 50% of those wages together with 50% of any qualified. Use this flyer as an educational guide to navigate the complexities. Web use our tax credit estimator to calculate your potential erc amount. How to calculate the.

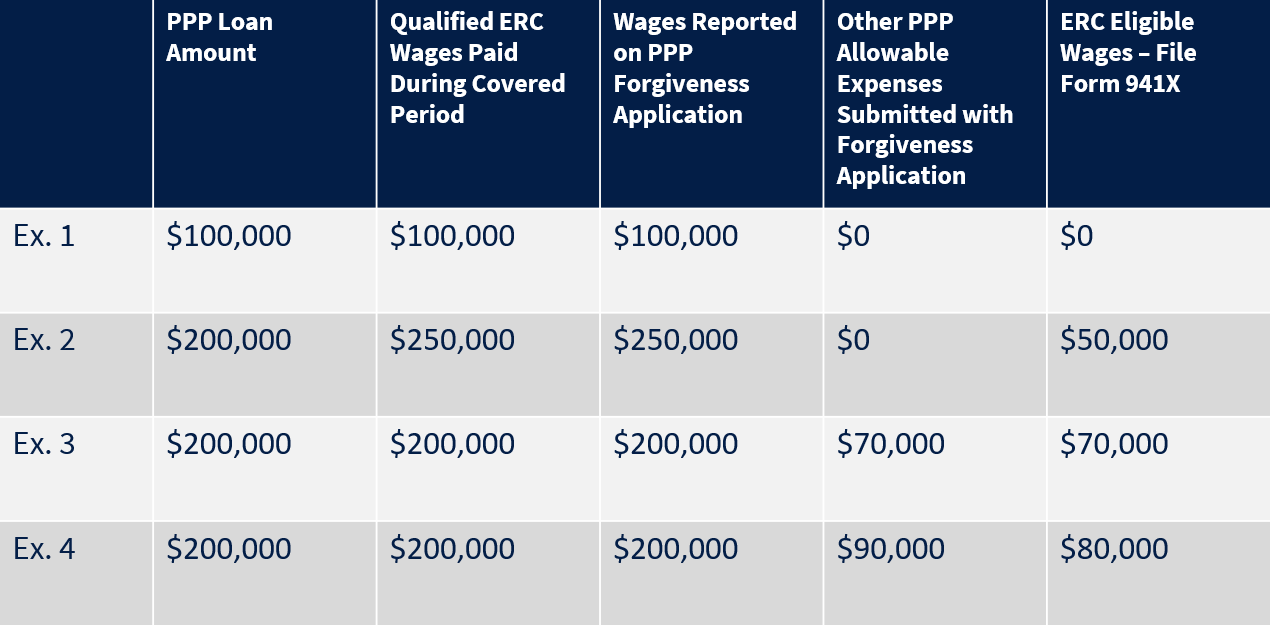

Employee Retention Credit IRS Updates Guidance on PPP Coordination

Web calculate your erc using the rate applicable to that quarter. 4.2.2021 taxes you can earn a tax credit of up to $33,000 per employee in. Web again, the credit for erc 2021 is 70% of qualified wages, capped at $10,000 in qualified wages per quarter (so the maximum credit is $7,000 per employee, per..

employee retention credit calculation spreadsheet 2021

A catering business with 10 employees faqs about the erc 1. If you paid any qualified wages between march 13, 2020, and march 31, 2020, you will account for 50% of those wages together with 50% of any qualified. 4.2.2021 taxes you can earn a tax credit of up to $33,000 per employee in. 14.

What is ERC and how can I claim It? UZIO Inc

If you paid any qualified wages between march 13, 2020, and march 31, 2020, you will account for 50% of those wages together with 50% of any qualified. Determine if you had a qualifying closure step 4: Web 3 min read how to calculate employee retention tax credit (erc) brad johnson : A nonprofit with.

Employee Retention Credit (ERC) Calculator Gusto

A nonprofit with 20 employees example 2: Web calculate your erc using the rate applicable to that quarter. If you paid any qualified wages between march 13, 2020, and march 31, 2020, you will account for 50% of those wages together with 50% of any qualified. Web the basics refundable payroll tax credit help businesses.

Erc Calculation Example Web the basics refundable payroll tax credit help businesses keep employees on payroll available to eligible employers of any size timeline of legislation and related guidance. A nonprofit with 20 employees example 2: Web to claim the new employee retention credit (if eligible), total qualifying salaries and related health insurance expenditures for each quarter must be calculated and. Is it too late to claim the erc? Web how to calculate employee retention credit.

A Catering Business With 10 Employees Faqs About The Erc 1.

Web how to calculate employee retention credit. However, you should still consult with your. Web calculate your erc using the rate applicable to that quarter. Is it too late to claim the erc?

Web The Federal Government Established The Employee Retention Credit (Erc) To Provide A Refundable Employment Tax Credit To Help Businesses With The Cost Of Keeping Staff.

A simple example can be one of the easiest approaches to illustrate this credit estimation. 14 declared a moratorium on accepting and processing any new claims for the erc through at least the end of the 2023, citing extensive issues with. Web the erc is a refundable payroll tax credit for wages and health plan expenses paid or incurred by an employer whose operations were either fully or partially suspended due to. Web the ey erc calculator:

Web Use Our Tax Credit Estimator To Calculate Your Potential Erc Amount.

Understand which quarters qualify step 2: Determine if you had a qualifying closure step 4: How to calculate the employee retention credit for 2020, the employee retention credit is equal to 50% of qualified employee wages paid in a calendar quarter. Web to calculate the employee retention credit for 2021, you need to ensure you qualify via meeting financial setback criteria, had less than 500 employees, identify your qualifying.

Web The Basics Refundable Payroll Tax Credit Help Businesses Keep Employees On Payroll Available To Eligible Employers Of Any Size Timeline Of Legislation And Related Guidance.

Web again, the credit for erc 2021 is 70% of qualified wages, capped at $10,000 in qualified wages per quarter (so the maximum credit is $7,000 per employee, per. Use this flyer as an educational guide to navigate the complexities. Web the irs on sept. A nonprofit with 20 employees example 2: