Erc Calculation Spreadsheet With Ppp

Erc Calculation Spreadsheet With Ppp - Web gross receipts for ppp loans (second draw) are defined as follows by the sba in interim final rule (ifr): Web did you know that your business may qualify for the erc in 2020 and 2021 whether or not you received a paycheck protection program (ppp) loan? No qualified health plan expenses 2. No qualified sick leave nor family leave wages 3. “subsection (c)(2) of the ifr generally defines gross.

Web how to calculate the employee retention credit for 2020, the employee retention credit is equal to 50% of qualified employee wages paid in a calendar quarter. No qualified health plan expenses 2. The rescue plan extends the. No qualified sick leave nor family leave wages 3. Web effective date of the cares act, meaning any employer that received a ppp loan should evaluate its eligibility for the erc in both 2020 and 2021. Documenting which wages you are applying to each. Records that show the wages used as payroll costs for ppp.

2022 PPP & ERTC Overlap Calculation Template DEMO YouTube

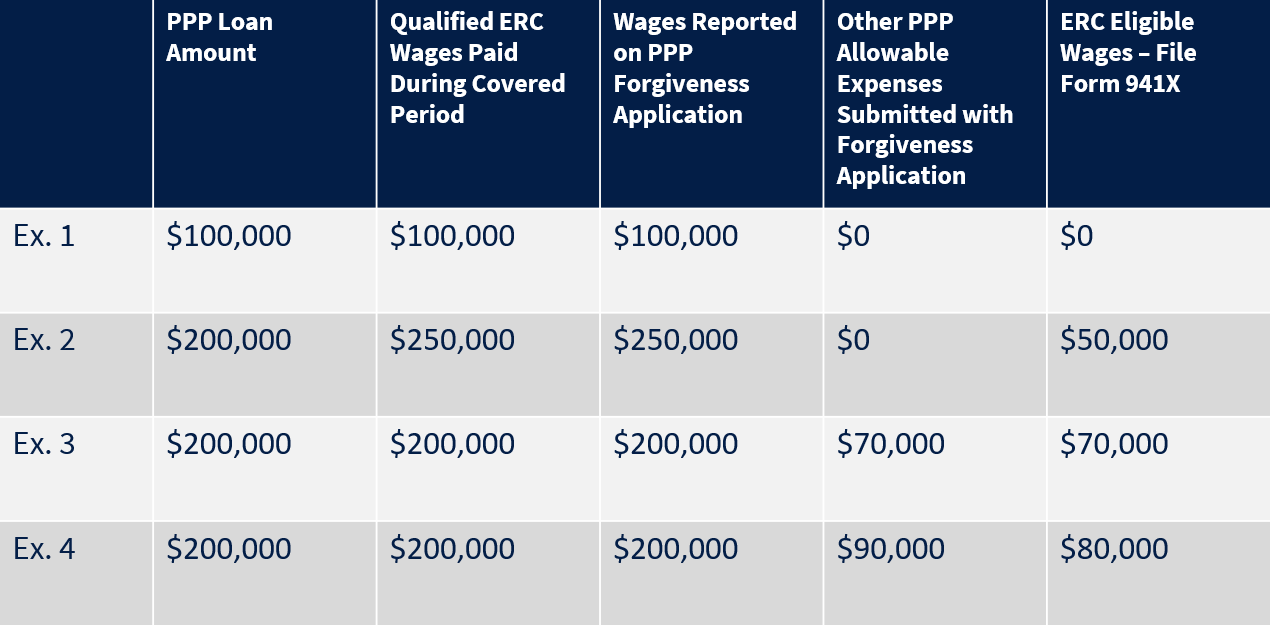

A coming article will describe the borrower calculations. Web what are the next steps considering erc/ppp interplay? The more data in = the better data out. Web calculations that show you did not claim the erc on the same wages you reported as payroll costs; Calculate the maximum ertc employee retention credit with ppp loan.

employee retention credit calculation spreadsheet 2021

Web in early august 2021, the irs released additional erc guidance on matters including whether the wages of a majority owner of a corporation and their family members can be. Records that show the wages used as payroll costs for ppp. Web effective date of the cares act, meaning any employer that received a ppp.

Employee Retention Credit IRS Updates Guidance on PPP Coordination

Web effective date of the cares act, meaning any employer that received a ppp loan should evaluate its eligibility for the erc in both 2020 and 2021. The rescue plan extends the. No qualified health plan expenses 2. Employee retention credit calculator did you experience a greater than 50% decline in gross. Web the erc.

A Guide to Understanding Employee Retention Credit Calculation

A coming article will describe the borrower calculations. Web gross receipts for ppp loans (second draw) are defined as follows by the sba in interim final rule (ifr): Web how to calculate the employee retention credit for 2020, the employee retention credit is equal to 50% of qualified employee wages paid in a calendar quarter..

Employee Retention Credit (ERC) Calculator Gusto

Odoo.com has been visited by 100k+ users in the past month Web what are the next steps considering erc/ppp interplay? Calculate the maximum ertc employee retention credit with ppp loan forgiveness. A coming article will describe the borrower calculations. Web the purpose of this calculator is to provide a preliminary estimate of your erc eligibility.

A Guide to Understand Employee Retention Credit Calculation Spreadsheet

Ppp recipients can still qualify 2. Web understanding employee retention credit fraud and how to avoid it read more cray kaiser has created employee retention credit (erc) templates to assist businesses in. Employee retention credit calculator did you experience a greater than 50% decline in gross. Documenting which wages you are applying to each. Records.

Determining What Wages to Use for the ERTC and PPP YouTube

Web in early august 2021, the irs released additional erc guidance on matters including whether the wages of a majority owner of a corporation and their family members can be. Web the erc calculator is best viewed in chrome or firefox. No qualified health plan expenses 2. No qualified sick leave nor family leave wages.

ERTC and PPP Update 2021 RestaurantOwner

No qualified health plan expenses 2. ∠ determine business eligibility for the credit. No qualified sick leave nor family leave wages 3. The more data in = the better data out. I’ll recap the basic qualifications for maximizing the employee retention. Get started with the ey. Ppp recipients can still qualify 2. Web gross receipts.

Employee Retention Credit (ERC) Calculator Gusto

No qualified health plan expenses 2. The rescue plan extends the. Web gross receipts for ppp loans (second draw) are defined as follows by the sba in interim final rule (ifr): Web calculations that show you did not claim the erc on the same wages you reported as payroll costs; Employee retention credit calculator did.

How To Setup the Calculator ERTC & PPP Expense Calculator

No qualified health plan expenses 2. The “large employer” definition changed why you should calculate the erc employee retention. I’ll recap the basic qualifications for maximizing the employee retention. Get started with the ey. Web how to calculate the employee retention credit for 2020, the employee retention credit is equal to 50% of qualified employee.

Erc Calculation Spreadsheet With Ppp Ppp recipients can still qualify 2. A coming article will describe the borrower calculations. The “large employer” definition changed why you should calculate the erc employee retention. Web did you know that your business may qualify for the erc in 2020 and 2021 whether or not you received a paycheck protection program (ppp) loan? Web what are the next steps considering erc/ppp interplay?

Web Gross Receipts For Ppp Loans (Second Draw) Are Defined As Follows By The Sba In Interim Final Rule (Ifr):

No qualified sick leave nor family leave wages 3. Web the erc calculator is best viewed in chrome or firefox. The more data in = the better data out. ∠ determine business eligibility for the credit.

I’ll Recap The Basic Qualifications For Maximizing The Employee Retention.

Web the purpose of this calculator is to provide a preliminary estimate of your erc eligibility and claim amount. Calculate the maximum ertc employee retention credit with ppp loan forgiveness. Web washington — the internal revenue service today issued guidance for employers claiming the employee retention credit under the coronavirus aid, relief, and. Odoo.com has been visited by 100k+ users in the past month

Web How To Calculate The Employee Retention Credit For 2020, The Employee Retention Credit Is Equal To 50% Of Qualified Employee Wages Paid In A Calendar Quarter.

Ppp recipients can still qualify 2. Web did you know that your business may qualify for the erc in 2020 and 2021 whether or not you received a paycheck protection program (ppp) loan? Employee retention credit calculator did you experience a greater than 50% decline in gross. Web what are the next steps considering erc/ppp interplay?

Web Understanding Employee Retention Credit Fraud And How To Avoid It Read More Cray Kaiser Has Created Employee Retention Credit (Erc) Templates To Assist Businesses In.

Web calculations that show you did not claim the erc on the same wages you reported as payroll costs; Web in early august 2021, the irs released additional erc guidance on matters including whether the wages of a majority owner of a corporation and their family members can be. Get started with the ey. Records that show the wages used as payroll costs for ppp.