Erc Calculation Spreadsheet

Erc Calculation Spreadsheet - A simple, guided tool to help businesses calculate their potential erc. No qualified sick leave nor family leave. Web cray kaiser has created employee retention credit (erc) templates to assist businesses in applying for erc credit. Web on pages 22 and 23 of the irs form 941 instructions, there is a spreadsheet for calculation of the erc for 2021 that can be used to compute the erc. Web compare business revenue in 2019 to the period for which erc is claimed.

Web on pages 22 and 23 of the irs form 941 instructions, there is a spreadsheet for calculation of the erc for 2021 that can be used to compute the erc. No qualified sick leave nor family leave. What is the erc tax credit? Web 中文 (简体) the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help businesses with the cost of keeping. Web if you experience a loss of 90 percent or more, you qualify as a severely distressed employer and may be eligible for the credit even if you have over 500. No qualified health plan expenses 2. Web use the tool and erc calculator below to quickly find your estimated employee retention credit.

A Guide to Understand Employee Retention Credit Calculation Spreadsheet

What is the erc tax credit? Web guide to understand employee retention credit calculation spreadsheet for 2021 tax year. The erc calculator will ask questions about the company's gross receipts and employee. Web if you experience a loss of 90 percent or more, you qualify as a severely distressed employer and may be eligible for.

employee retention credit calculation spreadsheet 2021

Web use our simple calculator to see if you qualify for the erc and if so, by how much. The erc calculator will ask questions about the company's gross receipts and employee. Beginning january 1, 2021, the cap is increased to $7,000 per employee per quarter. To figure out exactly how much you can claim,.

Erc Credit Calculation Template

The erc calculator will ask questions about the company's gross receipts and employee. For 2020, qualified wages and expenses are capped at $10,000 per employee for the year and the credit is up to 50 percent of that amount, so you can claim up to $5,000 worth of credits per employee (again, for the entire.

Employee Retention Credit (ERC) Calculator Gusto

To figure out exactly how much you can claim, use the calculator! Web if you experience a loss of 90 percent or more, you qualify as a severely distressed employer and may be eligible for the credit even if you have over 500. To help determine if you qualify for the erc, the tool will.

A Guide to Understanding Employee Retention Credit Calculation

A coming article will describe the borrower calculations. Web compare business revenue in 2019 to the period for which erc is claimed. Calculate your erc using the rate applicable to that quarter. Please read the following notes on the erc spreadsheet: Find them on our website. Web calculate your 2021 erc for each employee: The.

7Step ERC Calculation Worksheet (Employee Retention Credit)

Find them on our website. What is the erc tax credit? Web a guide to understand employee retention credit calculation spreadsheet 2021 the erc gives businesses an opportunity to lowers remuneration. Beginning january 1, 2021, the cap is increased to $7,000 per employee per quarter. Web cray kaiser has created employee retention credit (erc) templates.

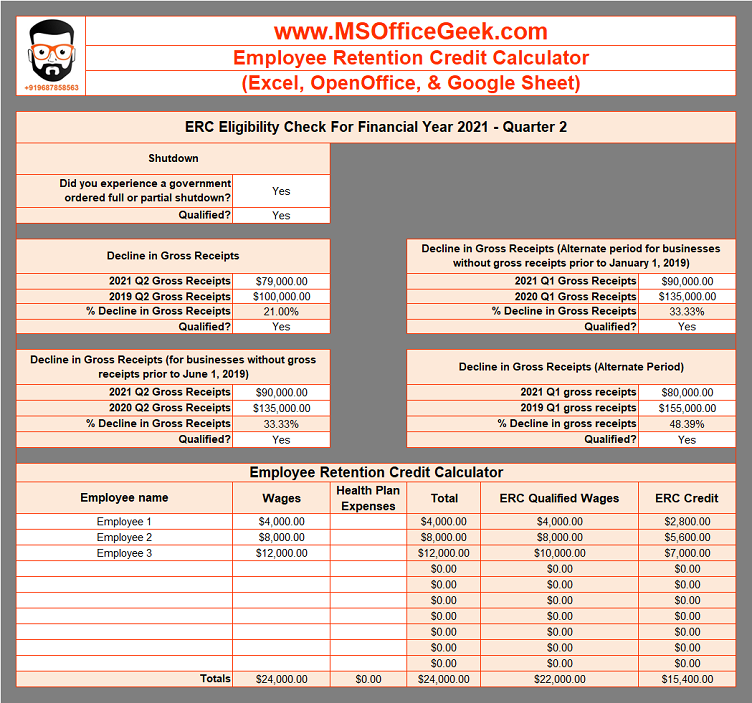

ReadyToUse Employee Retention Credit Calculator 2021 MSOfficeGeek

Web annual cap of $5,000 aggregate ($10,000 in qualified wages x 50%). Web use our simple calculator to see if you qualify for the erc and if so, by how much. The qualified wages limit is $10,000 per employee per quarter (not year), and you can take up to 70% of those. The more data.

A Guide to Understand Employee Retention Credit Calculation Spreadsheet

Calculate your erc using the rate applicable to that quarter. Web 中文 (简体) the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help businesses with the cost of keeping. Receive your credit by either getting an advance payment or claiming a refund. The qualified wages limit is.

Employee Retention Credit (ERC) Calculator Gusto

To help determine if you qualify for the erc, the tool will ask you to compare your business. The more data in = the better data out. What is the erc tax credit? Web use the tool and erc calculator below to quickly find your estimated employee retention credit. Web calculate your total qualified wages..

Erc Credit Calculation Worksheet

No qualified sick leave nor family leave. Web the ey erc calculator: What is the erc tax credit? Web guide to understand employee retention credit calculation spreadsheet for 2021 tax year. Web calculate your 2021 erc for each employee: The more data in = the better data out. Web calculate your total qualified wages. Create.

Erc Calculation Spreadsheet To figure out exactly how much you can claim, use the calculator! A coming article will describe the borrower calculations. Web 中文 (简体) the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help businesses with the cost of keeping. Web cray kaiser has created employee retention credit (erc) templates to assist businesses in applying for erc credit. Create shortcut the rules to be eligible to take this.

For 2020, Qualified Wages And Expenses Are Capped At $10,000 Per Employee For The Year And The Credit Is Up To 50 Percent Of That Amount, So You Can Claim Up To $5,000 Worth Of Credits Per Employee (Again, For The Entire Year).

Web use the tool and erc calculator below to quickly find your estimated employee retention credit. Calculate your erc using the rate applicable to that quarter. Web the ey erc calculator: To help determine if you qualify for the erc, the tool will ask you to compare your business.

Web Annual Cap Of $5,000 Aggregate ($10,000 In Qualified Wages X 50%).

No qualified sick leave nor family leave. Web use our simple calculator to see if you qualify for the erc and if so, by how much. Web calculate your total qualified wages. A coming article will describe the borrower calculations.

Web Cray Kaiser Has Created Employee Retention Credit (Erc) Templates To Assist Businesses In Applying For Erc Credit.

Find them on our website. Please read the following notes on the erc spreadsheet: Web the purpose of this calculator is to provide a preliminary estimate of your erc eligibility and claim amount. Web compare business revenue in 2019 to the period for which erc is claimed.

Web If You Experience A Loss Of 90 Percent Or More, You Qualify As A Severely Distressed Employer And May Be Eligible For The Credit Even If You Have Over 500.

Receive your credit by either getting an advance payment or claiming a refund. The more data in = the better data out. A simple, guided tool to help businesses calculate their potential erc. Web guide to understand employee retention credit calculation spreadsheet for 2021 tax year.