Erc Calculation Worksheet

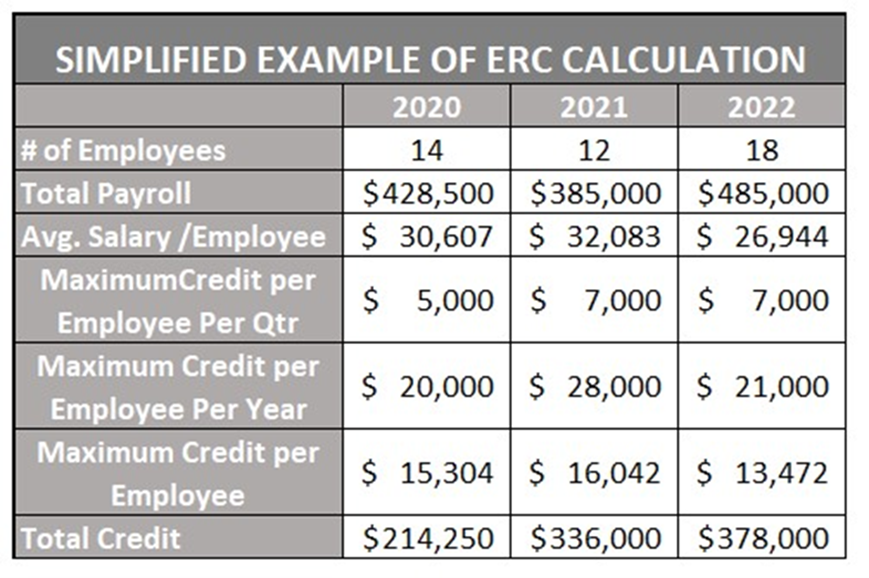

Erc Calculation Worksheet - Web the requests are dated jan. Beginning january 1, 2021, the cap is increased to $7,000 per employee per quarter. Web use our tax credit estimator to calculate your potential erc amount. Businesses are required to respond by feb. Create shortcut the rules to be eligible to take this.

Businesses are required to respond by feb. 16 or they will automatically be denied the credit. Confirm your eligibility the first eligibility situation for the employer retention credit is when a state or local government. The amount of the credit is 50% of the qualifying wages paid up to $10,000 in total. Web here’s how to calculate the erc tax credit: Web our erc calculator determines how much erc you are eligible to receive per quarter. Web calculation of the credit.

Qualifying for Employee Retention Credit (ERC) Gusto

Web an erc calculation worksheet can help determine how much relief you can expect. Web employee retention credit worksheet calculation. Web go to the calculator. The irs has created a worksheet to guide you through the calculation process. Click on the relevant tab at. Web the ey erc calculator: Web annual cap of $5,000 aggregate.

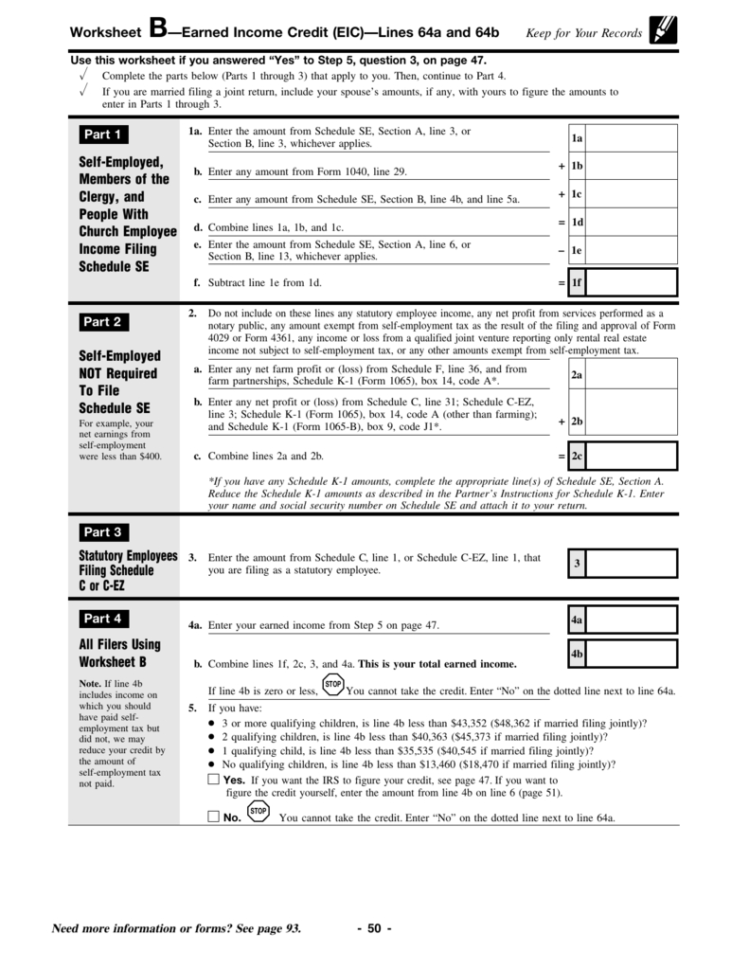

Earned Credit Worksheet —

Remember that all employers don’t qualify for the erc, and you. The irs has created a worksheet to guide you through the calculation process. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021. Click file > make a copy at the top right.

Employee Retention Credit (ERC) Calculator Gusto

Remember that all employers don’t qualify for the erc, and you. Web maximum credit of $5,000 per employee in 2020. A simple, guided tool to help businesses calculate their potential erc. Web employee retention credit worksheet calculation. Web here’s how to calculate the erc tax credit: The estimate is based on the data you input..

7Step ERC Calculation Worksheet (Employee Retention Credit)

Maintained quarterly maximum defined in. Remember that all employers don’t qualify for the erc, and you. You must enter a y. Web annual cap of $5,000 aggregate ($10,000 in qualified wages x 50%). Web the ey erc calculator: Confirm your eligibility the first eligibility situation for the employer retention credit is when a state or.

Employee Retention Credit (ERC) Calculator Gusto

A simple, guided tool to help businesses calculate their potential erc. Remember that all employers don’t qualify for the erc, and you. The amount of the credit is 50% of the qualifying wages paid up to $10,000 in total. Web employee retention credit worksheet calculation. Increased the maximum per employee to $7,000 per employee per.

ERC Credit Calculation Worksheet Free Calculator Online Employee

Web go to the calculator. A simple, guided tool to help businesses calculate their potential erc. Web an erc calculation worksheet can help determine how much relief you can expect. This approach is the latest attempt. Beginning january 1, 2021, the cap is increased to $7,000 per employee per quarter. Confirm your eligibility the first.

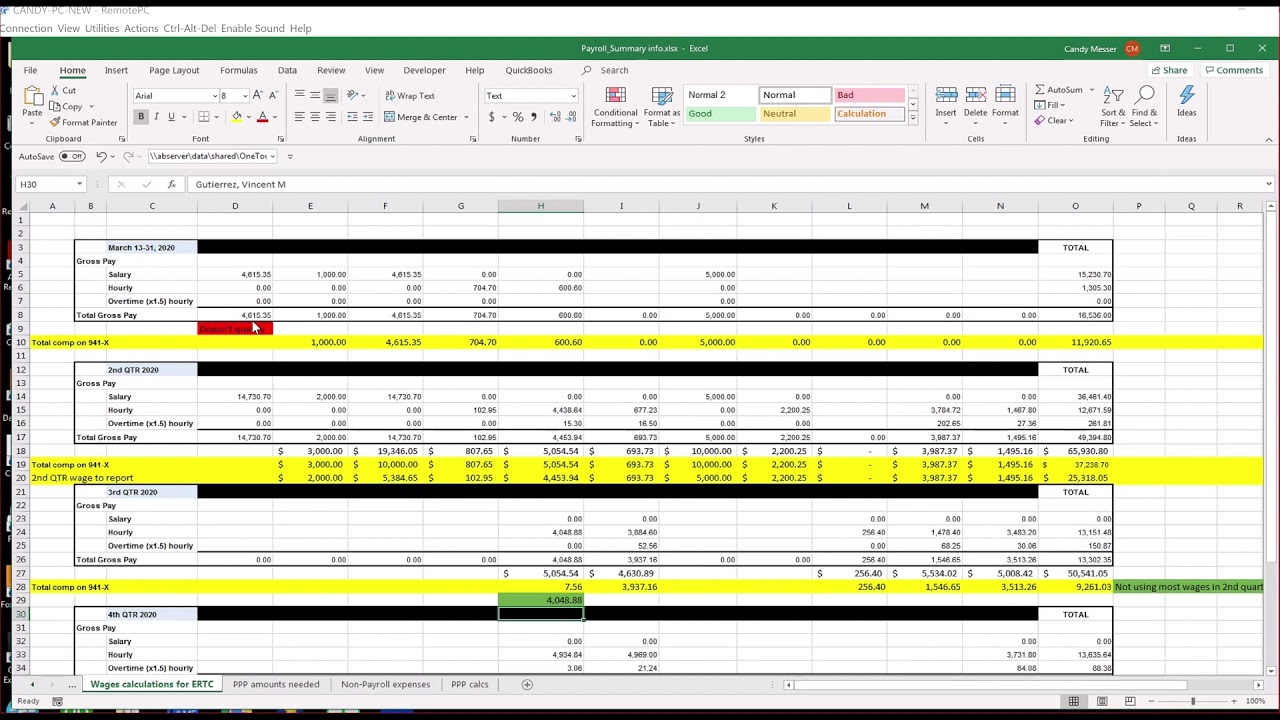

Erc Worksheet 2021 Excel Printable Word Searches

Web employee retention credit worksheet calculation. Maintained quarterly maximum defined in. The irs has created a worksheet to guide you through the calculation process. Web our erc calculator determines how much erc you are eligible to receive per quarter. Web maximum credit of $5,000 per employee in 2020. How to calculate the employee retention credit.

Last Chance to Recover ERC Tax Credit

This approach is the latest attempt. Click on the relevant tab at. Web annual cap of $5,000 aggregate ($10,000 in qualified wages x 50%). Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021. It is effective for wages paid after march 13. Increased.

ERC Calculator ERTC Funding

16 or they will automatically be denied the credit. Remember that all employers don’t qualify for the erc, and you. Web businesses are eligible to receive erc and ppp (but wages that are qualified for erc cannot have been paid with ppp funds) for tax year 2021, the. The irs has created a worksheet to.

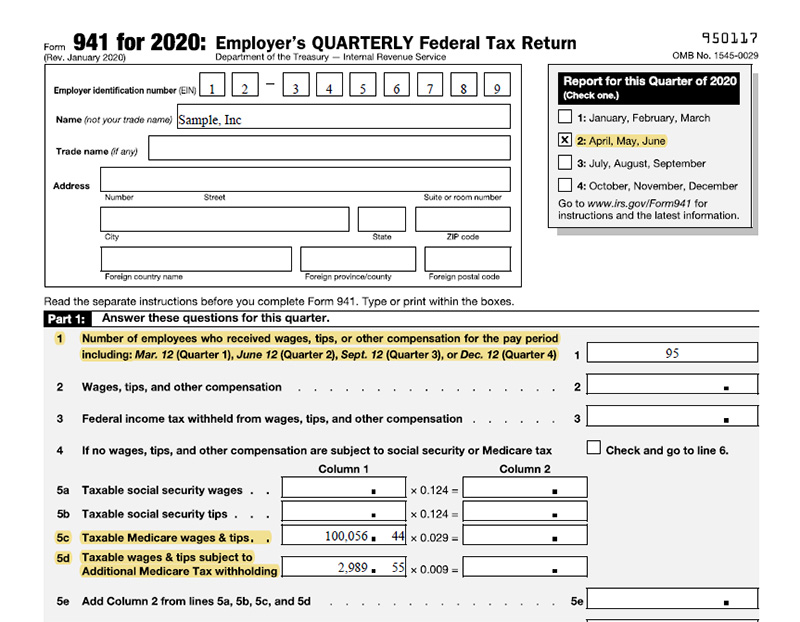

3 11 13 Employment Tax Returns Internal Revenue Service

Maintained quarterly maximum defined in. Web the erc calculator will ask questions about the company's gross receipts and employee counts in 2019, 2020 and 2021, as well as government orders that may have impacted. Web calculation of the credit. How to calculate the employee retention credit for 2020, the employee retention credit is. Remember that.

Erc Calculation Worksheet Web 70% of each retained employee's qualified wages per quarter (up to $10,000) =$7,000 per employee per quarter in 2021 ($21,000 per employee in 2021). The calculator helps you determine your. How to calculate the employee retention credit for 2020, the employee retention credit is. Web annual cap of $5,000 aggregate ($10,000 in qualified wages x 50%). This approach is the latest attempt.

Web Calculation Of The Credit.

How to calculate the employee retention credit for 2020, the employee retention credit is. Beginning january 1, 2021, the cap is increased to $7,000 per employee per quarter. Now you have your own version of the calculator. Web 70% of each retained employee's qualified wages per quarter (up to $10,000) =$7,000 per employee per quarter in 2021 ($21,000 per employee in 2021).

You Must Enter A Y.

Web maximum credit of $5,000 per employee in 2020. Click on the relevant tab at. Web an erc calculation worksheet can help determine how much relief you can expect. Businesses are required to respond by feb.

Web Businesses Are Eligible To Receive Erc And Ppp (But Wages That Are Qualified For Erc Cannot Have Been Paid With Ppp Funds) For Tax Year 2021, The.

Web here’s how to calculate the erc tax credit: The irs has created a worksheet to guide you through the calculation process. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021. Create shortcut the rules to be eligible to take this.

16 Or They Will Automatically Be Denied The Credit.

The amount of the credit is 50% of the qualifying wages paid up to $10,000 in total. Web the requests are dated jan. Increased the maximum per employee to $7,000 per employee per quarter in 2021. Web the ey erc calculator: