Ertc Tax Credit Calculator

Ertc Tax Credit Calculator - Web for 2021, there is a maximum credit of $7,000 per eligible employee, per quarter. We help business owners navigate the complex filing process to receive the. Web heros ertc has updated its services for smbs that want help from a cpa to calculate estimated employee retention tax credit returns and file the claim. Web employee retention calculator [beta] erc software helps you estimate the amount of refund that your business maybe entitled to receive, if you had employees and or were. Web you can use this tool with someone who is considering claiming the credit or with someone who has already submitted a claim to the irs.

Web estimate the credit for the employee retention credit (erc) created by the cares act to incentivize businesses to continue paying employees. Eligibility and credit amount vary depending on when the business impacts occurred. Web we provide a free ertc estimated refund calculator to help you maximize your refund. Navigate the complex filing process to receive the largest eligible rebate amount for you. Web calculate your tax credit amount if you’re going off of 2020 wages, your erc is 50% of the qualified wages discussed above—you can get a maximum erc of $5,000. Enter the number of employees,. The erc is a refundable payroll tax credit for employers who kept.

1st Q filing alert Unexpected ways your business may qualify for

Web the employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll. Web calculate your tax credit amount if you’re going off of 2020 wages, your erc is 50% of the qualified wages discussed above—you can get a maximum erc of $5,000. Navigate the.

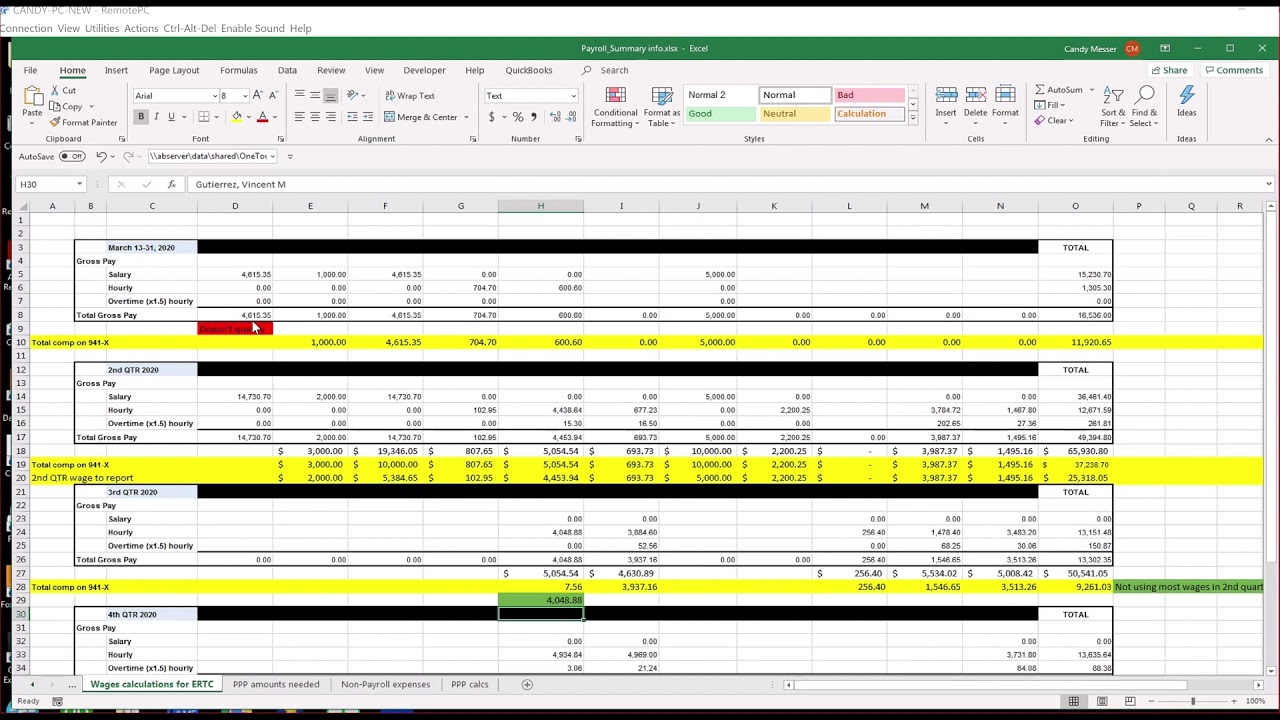

Erc Credit Calculation Template

Web we provide a free ertc estimated refund calculator to help you maximize your refund. We help business owners navigate the complex filing process to receive the. Web you can use this tool with someone who is considering claiming the credit or with someone who has already submitted a claim to the irs. Web calculate.

ERTC Calculator Calculate Your Potential Refund Online

Web estimate the credit for the employee retention credit (erc) created by the cares act to incentivize businesses to continue paying employees. Web calculate your tax credit amount if you’re going off of 2020 wages, your erc is 50% of the qualified wages discussed above—you can get a maximum erc of $5,000. But understanding your.

Employee Retention Credit (ERC) Calculator Gusto

Navigate the complex filing process to receive the largest eligible rebate amount for you. Web take the guesswork out of employee retention tax credit with our eligibility calculator! Web calculate your tax credit amount if you’re going off of 2020 wages, your erc is 50% of the qualified wages discussed above—you can get a maximum.

Erc Tax Credit Worksheet

Want to determine if you qualify for the employee retention tax credit? Web estimate the credit for the employee retention credit (erc) created by the cares act to incentivize businesses to continue paying employees. Web we provide a free ertc estimated refund calculator to help you maximize your. Web for 2021, the cap is set.

Employee Retention Credit (ERC) Calculator Gusto

The erc is a refundable payroll tax credit for employers who kept. Our team of experts can help your business claim the employee retention credit (ertc). Web take the guesswork out of employee retention tax credit with our eligibility calculator! Eligibility and credit amount vary depending on when the business impacts occurred. Web the employee.

ERTC Calculator from Jamie Trull » Powered by ThriveCart

Want to determine if you qualify for the employee retention tax credit? Eligibility and credit amount vary depending on when the business impacts occurred. Web we provide a free ertc estimated refund calculator to help you maximize your refund. The 2021 credit is computed at a rate of 70% of qualified wages paid, up to.

Simple ERTC Tax Credit Calculator For Startups & NonProfits Maximizes

The erc is a refundable payroll tax credit for employers who kept. The erc is not available to individuals. But understanding your potential credit amount can be a. Web the ertc, which employers can still apply for in 2023, provides a refund of up to $5,000 per employee for 2020 and $7,000 per employee per.

ERC Calculator Tool ERTC Funding

Web we provide a free ertc estimated refund calculator to help you maximize your. Web the ertc, which employers can still apply for in 2023, provides a refund of up to $5,000 per employee for 2020 and $7,000 per employee per quarter in 2021. Want to determine if you qualify for the employee retention tax.

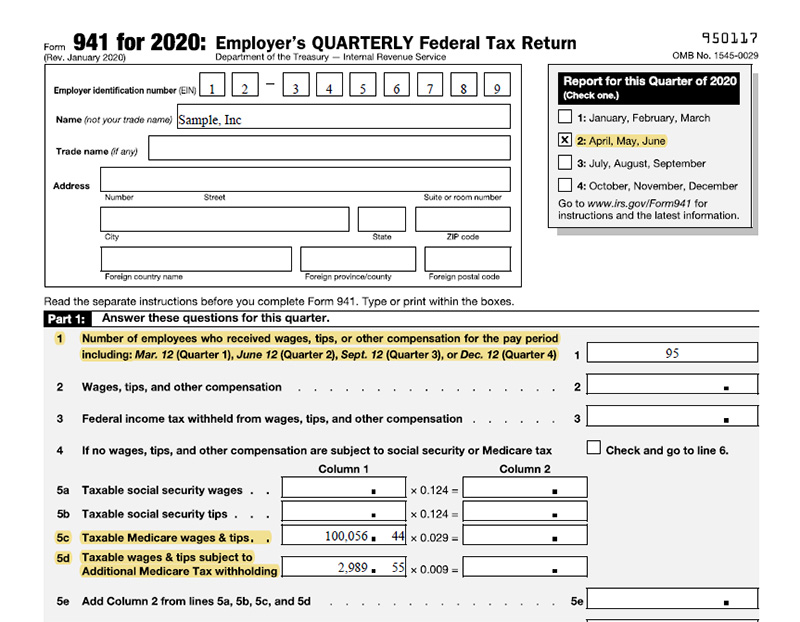

7Step ERC Calculation Worksheet (Employee Retention Credit)

This tax credit is not a loan and is a. Web learn how to estimate your tax credit for the employee retention credit (erc) based on your business revenue, closure, and wages in 2020 or 2021. Web the ey erc calculator: Web maintained quarterly maximum defined in relief act ($7,000 per employee per calendar quarter).

Ertc Tax Credit Calculator Web maintained quarterly maximum defined in relief act ($7,000 per employee per calendar quarter) recovery startup businesses are limited to a $50,000 credit per calendar. Web we provide a free ertc estimated refund calculator to help you maximize your. Eligibility and credit amount vary depending on when the business impacts occurred. But understanding your potential credit amount can be a. Just enter your business details and get an immediate, personalized estimation of your.

Web The Ey Erc Calculator:

Eligibility and credit amount vary depending on when the business impacts occurred. Web calculate your tax credit amount if you’re going off of 2020 wages, your erc is 50% of the qualified wages discussed above—you can get a maximum erc of $5,000. This tax credit is not a loan and is a. Web calculate if you qualify for the employee retention credit (erc) and how much you can get retroactively.

Use The Tax Credit Calculator To Get Started On Maximizing Your.

The erc is not available to individuals. The erc is a refundable payroll tax credit for employers who kept. Want to determine if you qualify for the employee retention tax credit? Web we provide a free ertc estimated refund calculator to help you maximize your.

Enter The Number Of Employees,.

Web estimate the credit for the employee retention credit (erc) created by the cares act to incentivize businesses to continue paying employees. Web you can use this tool with someone who is considering claiming the credit or with someone who has already submitted a claim to the irs. But understanding your potential credit amount can be a. Web learn how to estimate your tax credit for the employee retention credit (erc) based on your business revenue, closure, and wages in 2020 or 2021.

Web Take The Guesswork Out Of Employee Retention Tax Credit With Our Eligibility Calculator!

Web the ertc, which employers can still apply for in 2023, provides a refund of up to $5,000 per employee for 2020 and $7,000 per employee per quarter in 2021. Web for 2021, the cap is set at $21,000, meaning businesses could receive up to $26,000 per employee if the claim is filed correctly. We help business owners navigate the complex filing process to receive the. Our team of experts can help your business claim the employee retention credit (ertc).