Esop Calculation Example

Esop Calculation Example - They are a type of employee compensation plan wherein employees can earn equity in the company over a. Web as an example, if your annual salary is $100,000 and the benefit level this year is 5%, your esop account balance would be credited with company stock shares worth $5,000. Web an employee stock ownership plan (esop) refers to an employee benefit plan that gives the employees an ownership stake in the company. Web total shares offered by esop: Web example in almost all cases you should calculate the size of your esop pool on a fully diluted basis.

Web formula for esop capital gain calculation. Web an esop is a type of employee benefit plan that acquires company stock and holds it in accounts for employees. Web for example, abc india private limited issued esop to mr. Web esop example in india includes those offered by flipkart, myntra, and other companies when they were starting up. The employer allocates a certain. They are a type of employee compensation plan wherein employees can earn equity in the company over a. Estimated capital gains tax owed when sold ($):

How Does an ESOP Work? Atlanta ESOP Advisory Applied Economics

Web an employee stock ownership plan (esop) is an irc section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan. As of 2023, we at the national center for employee ownership (nceo) estimate there are roughly 6,500. Web example in almost all cases you should calculate the.

Employee Stock Ownership Plan (ESOP) Definition How It Works

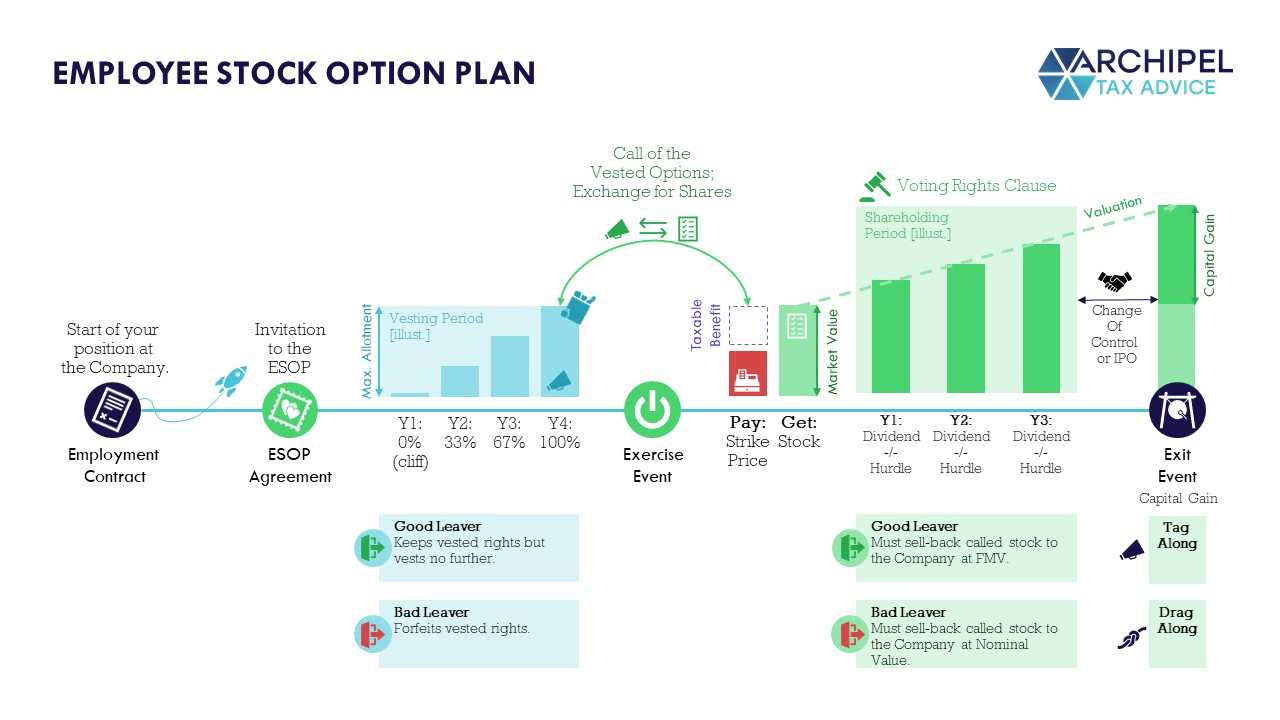

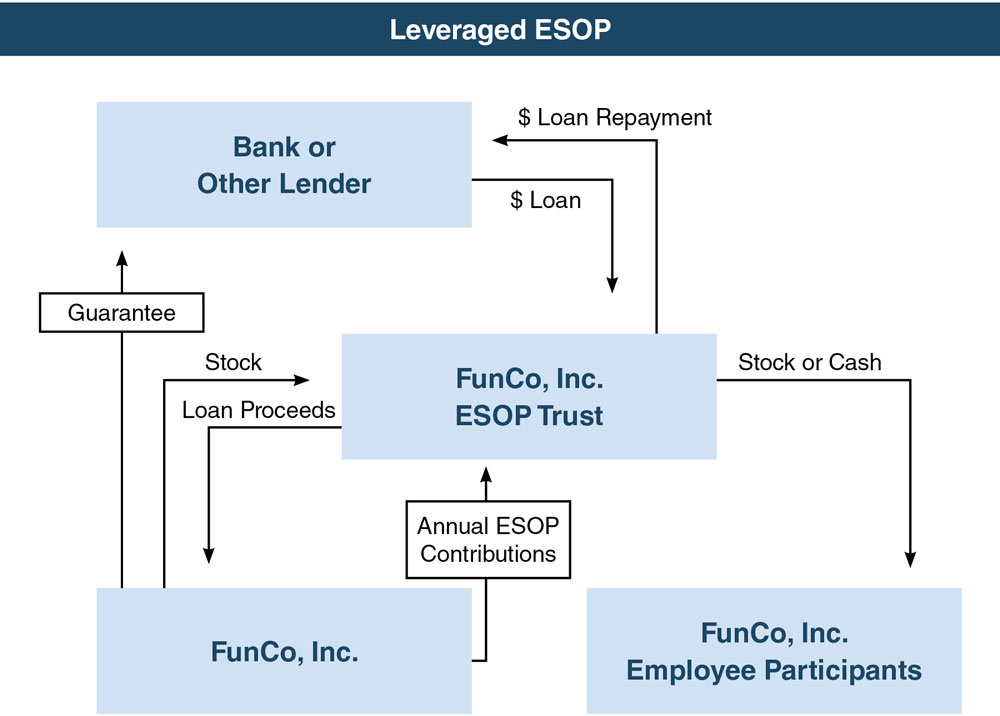

Web let us consider the following employee stock option plan for private companies example to understand how the concept works: Web 11.4.2 accounting for leveraged esops. The employer allocates a certain. The esop should be equal to 10% of all shares and options on issue. For the purposes of this example we have assumed that..

esop diversification examples Choosing Your Gold IRA

Meet tony stark, whose shares were. Instantly calculate the future repurchase obligation. Web for example, abc india private limited issued esop to mr. The employer allocates a certain. Web employee stock ownership plan (esop) facts esop map of the u.s. Web an employee stock ownership plan (esop) is an irc section 401(a) qualified defined contribution.

ESOPs The Basics and the Benefits Mercer Capital

Web formula for esop capital gain calculation. As of 2023, we at the national center for employee ownership (nceo) estimate there are roughly 6,500. Web 11.4.2 accounting for leveraged esops. Web an esop is a type of employee benefit plan that acquires company stock and holds it in accounts for employees. Web the step by.

How Does an ESOP Work? Atlanta ESOP Advisory Applied Economics

Web formula for esop capital gain calculation. Web let us consider the following employee stock option plan for private companies example to understand how the concept works: Web esops, short for employee stock ownership plans, are employee benefit plans that grant employees a stake in the ownership of their company. Web as an example, if.

ESOP Valuation 101 Beginners Guide Eqvista

Web this short guide demonstrates how founders should calculate the number of options to include in their esop pool. We consolidate all employee retirement target and estimated diversification events to provide. Web it may surprise you how significant your retirement accumulation may become with regular employer contributions to an employee stock option plan (esop). How.

ESOP Tax Advantages

Web formula for esop capital gain calculation. Calculate the value of the perquisite based on the following data: Web an employee stock ownership plan (esop) is an irc section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan. Web esops, short for employee stock ownership plans, are.

ESOPs our free template for an Employee Stock Option Plan. Archipel

Web an esop is a type of employee benefit plan that acquires company stock and holds it in accounts for employees. The esop should be equal to 10% of all shares and options on issue. The employer allocates a certain. Web 11.4.2 accounting for leveraged esops. Web example in almost all cases you should calculate.

Valuation of options under ESOP scheme iPleaders

Meet tony stark, whose shares were. How does an employee stock ownership plan (esop). Web an esop is a type of employee benefit plan that acquires company stock and holds it in accounts for employees. Web esop stands for employee stock ownership plans. Web esops, short for employee stock ownership plans, are employee benefit plans.

The ESOP An Alternative for Personal Liquidity and Ownership

Many people have misconceptions about esops, thinking, for. The employer allocates a certain. Estimated capital gains tax owed when sold ($): Web an employee stock ownership plan (esop) refers to an employee benefit plan that gives the employees an ownership stake in the company. How does an employee stock ownership plan (esop). Web an esop.

Esop Calculation Example Valuation is a method to find the worth of an asset. Instantly calculate the future repurchase obligation. Calculating your esop's capital gain is crucial to determining the tax you owe when you sell your esop shares. Web an employee stock ownership plan (esop) refers to an employee benefit plan that gives the employees an ownership stake in the company. Web this short guide demonstrates how founders should calculate the number of options to include in their esop pool.

Instantly Calculate The Future Repurchase Obligation.

Many people have misconceptions about esops, thinking, for. Web let us consider the following employee stock option plan for private companies example to understand how the concept works: As of 2023, we at the national center for employee ownership (nceo) estimate there are roughly 6,500. They are a type of employee compensation plan wherein employees can earn equity in the company over a.

Web Total Shares Offered By Esop:

Valuation is a method to find the worth of an asset. Web the step by step esop plan guide. Web an esop is a type of employee benefit plan that acquires company stock and holds it in accounts for employees. Web formula for esop capital gain calculation.

Estimated Capital Gains Tax Owed When Sold ($):

The employer allocates a certain. How does an employee stock ownership plan (esop). Calculate the value of the perquisite based on the following data: Web this short guide demonstrates how founders should calculate the number of options to include in their esop pool.

Web Esop Stands For Employee Stock Ownership Plans.

Web esops, short for employee stock ownership plans, are employee benefit plans that grant employees a stake in the ownership of their company. For the purposes of this example we have assumed that. Web as an example, if your annual salary is $100,000 and the benefit level this year is 5%, your esop account balance would be credited with company stock shares worth $5,000. Web an employee stock ownership plan (esop) is an irc section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan.

.png?width=3000&name=ESOP-Tax-Advantages-Chart (2).png)