Esop Tax Calculator

Esop Tax Calculator - Years to project growth (1 to 50) current annual salary ($) annual salary increases (0% to 10%). What is the purpose of using an esop. Zillow has 31 photos of this $250,000 4 beds, 2 baths, 2,384 square feet single family home located at 104 s grafton st, romney, wv 26757 built in 1950. Employee stock purchase scheme (esps) allows employees to buy shares at some. What information is needed for the calculator?

It’s needed to calculate and document any gain or. Exercising your esops will leave you with a sizeable tax bill. Web on selling the shares within a year of having bought them, the tax amount is as follows: Web this calculator is a tool for modeling possible esop and 401 (k) growth using the provided input values. They are taxed on their esop distributions(which sometimes is referred to in lay. Web calculate the value of the perquisite based on the following data: Web you can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources.

Introducing The ESOP Tax Advantage Calculator™ Employee Benefits Law

View a list of common esop taxation questions that. Web employee stock option plan (esop) is a scheme wherein the employees can buy the shares of the company at a discounted rate compared to the market price. Web on selling the shares within a year of having bought them, the tax amount is as follows:.

esop payout calculator Choosing Your Gold IRA

Get quick, clear insights into tax. Years to project growth (1 to 50) current annual salary ($) annual salary increases (0% to 10%). Esop participant employees do not pay tax on stock allocated to their accounts until they receive distributions. Web use this calculator to estimate how much your plan may accumulate in the future..

ESOP Tax Benefits Principal®

Web an employee stock ownership plan (esop) is an irc section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan. Web what is an esop? Web calculate the value of the perquisite based on the following data: Using the esop tax calculator can save you time. The.

ESOP Taxation Simplified ESOP Direct

Web learn more about how ses esop strategies can guide you through the complexity of exploring and installing an esop. How does the esop calculator work? Use this calculator to know just how much tax you will have to pay. Using the esop tax calculator can save you time. Web this was the average tax.

Tax Deferral on ESOPs What It Means for a Startup?

Web the esop tax calculator will automatically calculate your capital gain and provide you with an estimate of your tax liability. Web what is an esop calculator? Web esop perquisite tax calculator. An employee stock ownership plan (esop) is a business transition tool, an employee ownership vehicle, and a qualified retirement plan. Web on selling.

ESOPs in India Benefits, Tips, Taxation & Calculation Muds

Get quick, clear insights into tax. Web you can test out assumptions for your situation using our calculator. Exercising your esops will leave you with a sizeable tax bill. The average tax return for the 2020 tax year was $2,827, a 13.24 percent increase from the previous year. View a list of common esop taxation.

ESOP Taxation What startups should know? Eqvista

Using the esop tax calculator can save you time. Esop participant employees do not pay tax on stock allocated to their accounts until they receive distributions. The value of most individuals’ wealth falls below that. Our office is open to the public from 8:00 am until 4:00 pm, monday through friday. Web employee stock option.

ESOP Tax Advantages

The calculator shows you what the cost of your transaction might be and the associated tax benefits. They are taxed on their esop distributions(which sometimes is referred to in lay. Employee stock purchase scheme (esps) allows employees to buy shares at some. Tax = income tax slab rate x no. Esop participant employees do not.

Employee Stock Ownership Plans (ESOPs) and the Tax Act Valuation Research

Years to project growth (1 to 50) current annual salary ($) annual salary increases (0% to 10%). The value of most individuals’ wealth falls below that. Sale of shares if listed: Web learn more about how ses esop strategies can guide you through the complexity of exploring and installing an esop. Web in 2012, individuals.

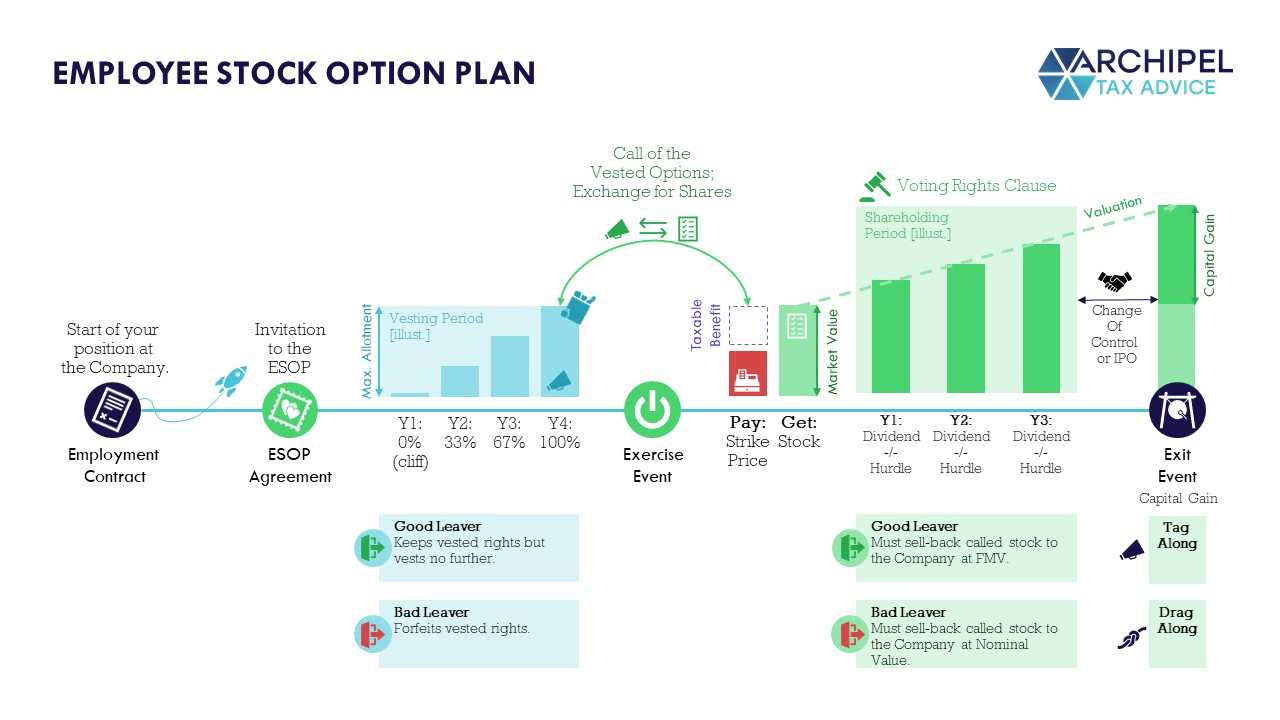

ESOPs our free template for an Employee Stock Option Plan. Archipel

Web calculate the value of the perquisite based on the following data: Web what is an esop? Use this calculator to know just how much tax you will have to pay. Web welcome to the hampshire county tax assessor's web site. It’s needed to calculate and document any gain or. Web you can test out.

Esop Tax Calculator Web welcome to the hampshire county tax assessor's web site. Web this was the average tax refund last filing season. Esop participant employees do not pay tax on stock allocated to their accounts until they receive distributions. Zillow has 31 photos of this $250,000 4 beds, 2 baths, 2,384 square feet single family home located at 104 s grafton st, romney, wv 26757 built in 1950. Use this calculator to know just how much tax you will have to pay.

Web Calculate The Value Of The Perquisite Based On The Following Data:

Sale of shares if listed: What information is needed for the calculator? The average tax return for the 2020 tax year was $2,827, a 13.24 percent increase from the previous year. Employee stock purchase scheme (esps) allows employees to buy shares at some.

Web What Is An Esop Calculator?

It’s needed to calculate and document any gain or. Web employee stock option plan (esop) is a scheme wherein the employees can buy the shares of the company at a discounted rate compared to the market price. Values can be set using the inputs on the left, and then the visual growth. Zillow has 31 photos of this $250,000 4 beds, 2 baths, 2,384 square feet single family home located at 104 s grafton st, romney, wv 26757 built in 1950.

Web Esop Perquisite Tax Calculator.

Use this calculator to know just how much tax you will have to pay. The calculator shows you what the cost of your transaction might be and the associated tax benefits. How does the esop calculator work? Years to project growth (1 to 50) current annual salary ($) annual salary increases (0% to 10%).

Web Welcome To The Hampshire County Tax Assessor's Web Site.

Get quick, clear insights into tax. An employee stock ownership plan (esop) is a business transition tool, an employee ownership vehicle, and a qualified retirement plan. Web you can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Web this calculator is a tool for modeling possible esop and 401 (k) growth using the provided input values.

.png?width=1200&name=ESOP-Tax-Advantages-Chart (2).png)