Estate Tax Calculator Illinois

Estate Tax Calculator Illinois - For tax year 2023, estates worth less than $4 million are exempt. Calculate how much you'll pay in property taxes on your home, given. Web home estate taxes filing estate taxes in illinois by illinois law, the illinois attorney general administers the illinois estate tax. The illinois attorney general handles the state’s estate taxes. Web in fact, rates in dupage county are about average for the state, with an average effective rate of 2.29%.

Illinois is one of 13 states with an estate tax. Web adjusted taxable estate at least but less than credit percent of excess over 0 40,000 0 0.0% 0 40,000 90,000 0 0.8% 40,000 90,000 140,000 400 1.6% 90,000 140,000 240,000. The illinois attorney general handles the state’s estate taxes. Web if your estate owes estate tax, how much will it actually owe? Web illinois estate tax. Each year, new forms are provided via the website for. Web for estates over $4 million, the tax rate is graduated with the upper level ($10.04 million and up) at 16 percent.

American Cities With the Highest Property Taxes [2023 Edition

Web honest and open government. Web in fact, rates in dupage county are about average for the state, with an average effective rate of 2.29%. Web the illinois estate tax will be determined using an interrelated calculation for 2021 decedents. However, if the estate is worth more than $4 million, there. Web the illinois estate.

2021 estate tax calculator

File with confidenceexpense estimatoreasy and accurateaudit support guarantee Web the illinois estate tax will be determined using an interrelated calculation for 2021 decedents. Estate taxes must be filed with the office of. Web in fact, rates in dupage county are about average for the state, with an average effective rate of 2.29%. Web when the.

How Do I Calculate My property Taxes In Illinois YouTube

Web for estates over $4 million, the tax rate is graduated with the upper level ($10.04 million and up) at 16 percent. By calculating the amount of illinois estate tax due for. You will only have taxes owed if your whole estate is over the threshold of $4. An illinois resident who dies with property.

2021 Estate Tax Calculator & Rates

Web the calculator can provide the amount of illinois estate tax due for different size estates. Web for estates over $4 million, the tax rate is graduated with the upper level ($10.04 million and up) at 16 percent. Web illinois estate tax. Calculate how much you'll pay in property taxes on your home, given. Ahead.

Illinois 1040 20172024 Form Fill Out and Sign Printable PDF Template

Ahead of their return to springfield next week, a bipartisan group of state lawmakers is calling for estate tax. Web home estate taxes filing estate taxes in illinois by illinois law, the illinois attorney general administers the illinois estate tax. To determine tax due, insert the amounts from lines 3. Web the calculator can provide.

UPDATED Illinois Property Taxes Center for Tax and Budget Accountability

By calculating the amount of illinois estate tax due for. Web the illinois estate tax will be determined using an interrelated calculation for 2023 decedents. You will only have taxes owed if your whole estate is over the threshold of $4. To easily calculate your tax, illinois provides an. An illinois resident who dies with.

How Illinois Property Taxes Are Calculated WOPROFERTY

Web in fact, rates in dupage county are about average for the state, with an average effective rate of 2.29%. Web illinois estate tax. Web honest and open government. Ahead of their return to springfield next week, a bipartisan group of state lawmakers is calling for estate tax. Each year, new forms are provided via.

Homeowners in collar counties pay highest property taxes in Illinois

Web that means if you die and your total estate is worth less than $4 million, illinois won’t collect any tax. You will only have taxes owed if your whole estate is over the threshold of $4. The calculator at the illinois attorney general’s website. Web for estates over $4 million, the tax rate is.

Homeowners in collar counties pay highest property taxes in Illinois

Web adjusted taxable estate at least but less than credit percent of excess over 0 40,000 0 0.0% 0 40,000 90,000 0 0.8% 40,000 90,000 140,000 400 1.6% 90,000 140,000 240,000. Web the illinois estate tax will be determined using an interrelated calculation for 2021 decedents. Web honest and open government. Ahead of their return.

Property taxes grow faster than Illinoisans’ ability to pay for them

Web this calculator is mainly intended for use by u.s. Web estate tax is a tax on your right to transfer property at your death, the irs says. Web home estate taxes filing estate taxes in illinois by illinois law, the illinois attorney general administers the illinois estate tax. For tax year 2023, estates worth.

Estate Tax Calculator Illinois The calculator at the illinois attorney general’s website. Web currently, any estate in illinois with a gross value of $4 million after inclusion of taxable gifts, is taxed in its entirety using a complex formula and is subject to a. Calculate how much you'll pay in property taxes on your home, given. Web when the math is done, if your estate is valued at about $5 million, this creates an effective tax rate of close to 29%. An illinois resident who dies with property located in illinois may be subject to income tax, the federal estate and gift tax, and the illinois estate tax.

However, If The Estate Is Worth More Than $4 Million, There.

To easily calculate your tax, illinois provides an. Web adjusted taxable estate at least but less than credit percent of excess over 0 40,000 0 0.0% 0 40,000 90,000 0 0.8% 40,000 90,000 140,000 400 1.6% 90,000 140,000 240,000. Web when the math is done, if your estate is valued at about $5 million, this creates an effective tax rate of close to 29%. Web in illinois, estate taxes kick in when the value of the estate exceeds a certain threshold, unlike federal estate taxes, which usually have a much higher exemption amount.

Web The Highest Possible Estate Tax In Illinois Is 16% As Of 2023.

Estate taxes must be filed with the office of. File with confidenceexpense estimatoreasy and accurateaudit support guarantee Web for estates over $4 million, the tax rate is graduated with the upper level ($10.04 million and up) at 16 percent. Illinois is one of 13 states with an estate tax.

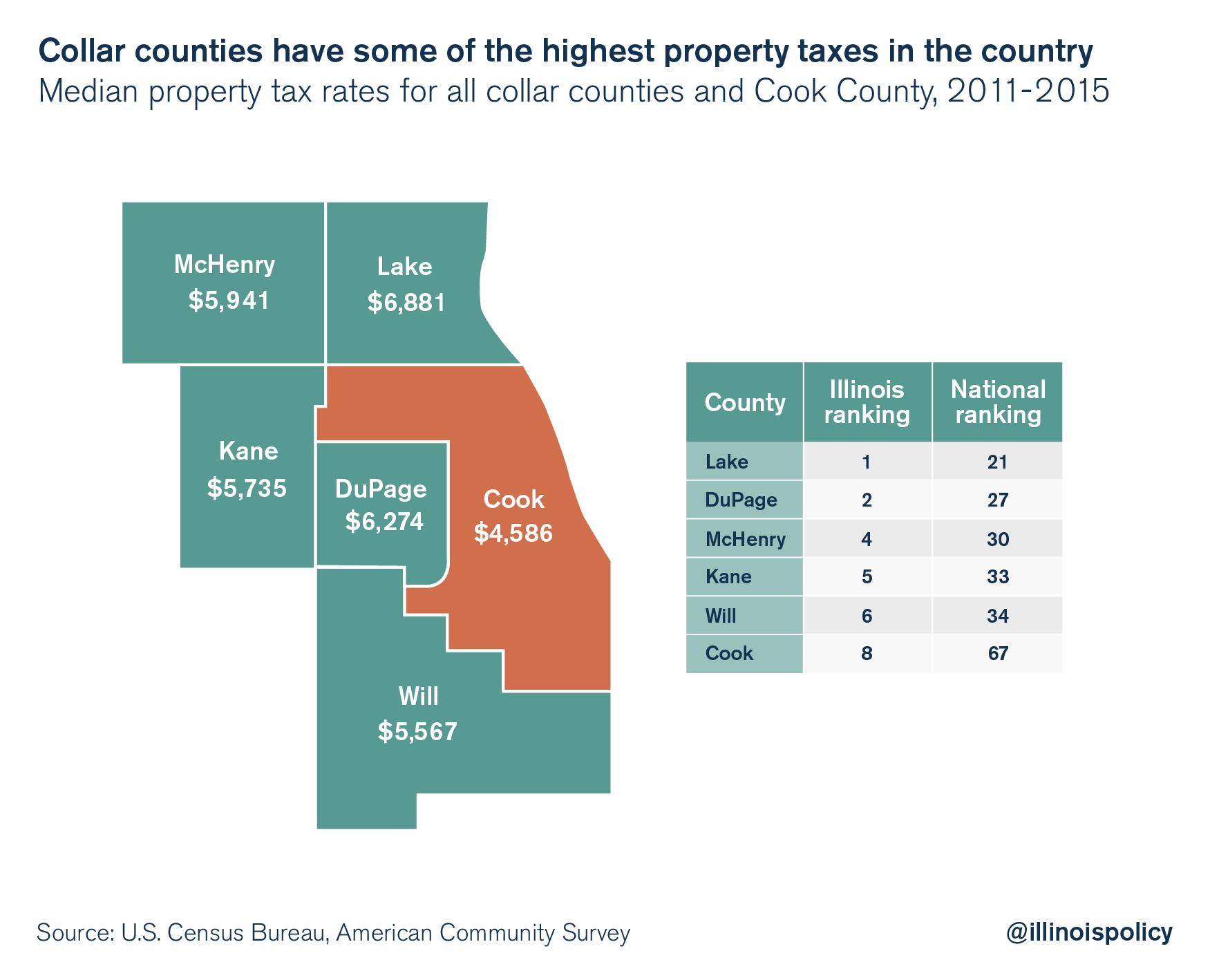

Web In Fact, Rates In Dupage County Are About Average For The State, With An Average Effective Rate Of 2.29%.

The calculator at the illinois attorney general’s website. Ahead of their return to springfield next week, a bipartisan group of state lawmakers is calling for estate tax. Web illinois estate tax. The maximum rate of 16% applies to estates valued at $10 million or more.

Web The Illinois Estate Tax Will Be Determined Using An Interrelated Calculation For 2021 Decedents.

By calculating the amount of illinois estate tax due for. Web the illinois estate tax rate is on a graduated scale, and the top tax rate is 16%. Web the calculator at the illinois attorney general’s website (www.illinoisattorneygeneral.gov) may be used for this computation. They're paid by the estate of the person who died before assets are distributed.