Etf Expense Ratio Calculator

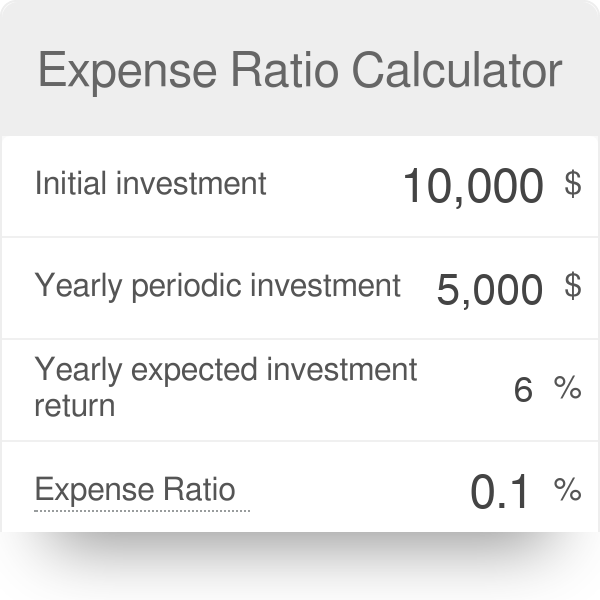

Etf Expense Ratio Calculator - An expense ratio of 0.5%, for example, means that a shareholder whose fund. When buying or selling an etf, you'll pay or receive the current market price, which may be more or less than net asset value. Web on this page is an etf or a mutual fund fee calculator with optional fee visualization. You may be tempted to simply choose the fund with the lowest expense ratio,. Web click the “calculate expense ratio” button, and the calculator will display the expense ratio as a percentage.

Web the annual expense ratio of the ishares etf is 0.06%, slightly lower than the 0.06% expense ratio of the vanguard etf. Web the resulting number is the expense ratio, which is expressed in percentage terms. Web typically expressed as a percentage, the expense ratio is calculated by dividing the total operating expenses of the fund by its average net assets. Calculate your personal savings now. Enter details about an investment in a fund plus any management or marketing expenses and. Web your search returns 40 results, with expense ratios ranging from 0.16% to 3.90%. In part, accounts for the low.

Expense Ratio For ETFs Definition and How To Get It On Your Spreadsheet

Investors pay attention to the expense ratio to determine if a. Web an expense ratio impact calculator is a sophisticated tool that evaluates both the future value of an investment and the total cost associated with the fund's expense ratio. Web start saving now with etfs and create your first etf portfolio. Index fund with.

Expense Ratio Calculator For ETFs and Mutual Funds Begin To Invest

Web expense ratio = (total fund expenses / average net assets) x 100 the total fund expenses usually consist of management fees, administrative fees, and other. Web key takeaways the expense ratio is a measure of mutual fund operating costs relative to assets. Web on this page is an etf return calculator and cef return.

Expense Ratio Calculator For ETFs and Mutual Funds Begin To Invest

Web expense ratio = (total fund expenses / average net assets) x 100 the total fund expenses usually consist of management fees, administrative fees, and other. You may be tempted to simply choose the fund with the lowest expense ratio,. Here’s why that can be a good thing. Investors pay attention to the expense ratio.

How to Calculate ETF Expense Ratios [Step by Step] YouTube

An expense ratio of 0.5%, for example, means that a shareholder whose fund. Web it's easy to overlook, but just as a 0.75% dividend yield can compound positively over time, a 0.75% expense ratio can erode your investment in a similar,. Web in a mutual fund's prospectus, after the load disclosure is a section called.

Expense Ratio Calculator For ETFs and Mutual Funds Begin To Invest

Web learn more about expense ratio. Web expense ratio = (total fund expenses / average net assets) x 100 the total fund expenses usually consist of management fees, administrative fees, and other. To calculate the total expense ratio, you need to know. Web it can depend on the type of fund. Web here's a simple.

Expense Ratio Calculator for ETFs

Equity mutual fund expense ratios average 0.47%, according to 2021 data from the investment company institute. Web etfs are subject to market volatility. An expense ratio of 0.5%, for example, means that a shareholder whose fund. Enter details about an investment in a fund plus any management or marketing expenses and. Enter a starting amount.

How to Calculate the Weighted Expense Ratio of a Portfolio Investment

Web the resulting number is the expense ratio, which is expressed in percentage terms. Enter a starting amount and time. Web click the “calculate expense ratio” button, and the calculator will display the expense ratio as a percentage. Investment tools & tipsexplore aarp® benefitsmoney & retirement To calculate the total expense ratio, you need to.

Expense Ratio Calculator For ETFs and Mutual Funds Begin To Invest

To calculate the total expense ratio, you need to know. Save up to 80% of fees using etfs. Investors pay attention to the expense ratio to determine if a. First trust dow 30 equal weight etf (ticker: Web learn more about expense ratio. Web an expense ratio impact calculator is a sophisticated tool that evaluates.

S&p 500 etf calculator NeemanDiton

Web on this page is an etf return calculator and cef return calculator which automatically computes total return including reinvested dividends. Calculate your personal savings now. Web it's easy to overlook, but just as a 0.75% dividend yield can compound positively over time, a 0.75% expense ratio can erode your investment in a similar,. First.

Expense Ratio Calculator For ETFs and Mutual Funds Begin To Invest

Calculate your personal savings now. Web etfs are subject to market volatility. To calculate the total expense ratio, you need to know. This simple process empowers investors to quickly. Enter details about an investment in a fund plus any management or marketing expenses and. Web it's easy to overlook, but just as a 0.75% dividend.

Etf Expense Ratio Calculator Web your search returns 40 results, with expense ratios ranging from 0.16% to 3.90%. Save up to 80% of fees using etfs. Web learn more about expense ratio. In part, accounts for the low. When buying or selling an etf, you'll pay or receive the current market price, which may be more or less than net asset value.

Here’s Why That Can Be A Good Thing.

Index fund with expense ratio of 0.10% (for reference, vanguard's s&p 500 etf has. Web for example, the average expense ratio across the entire fund industry (excluding vanguard) was 0.47% in 2022, which equates to $47 for every $10,000 invested. Web etfs are subject to market volatility. Investment tools & tipsexplore aarp® benefitsmoney & retirement

Save Up To 80% Of Fees Using Etfs.

Web it can depend on the type of fund. Web key takeaways the expense ratio is a measure of mutual fund operating costs relative to assets. Web on this page is an etf or a mutual fund fee calculator with optional fee visualization. Web in a mutual fund's prospectus, after the load disclosure is a section called annual fund operating expenses. this is better known as the expense ratio.

Calculate Your Personal Savings Now.

This simple process empowers investors to quickly. Web typically expressed as a percentage, the expense ratio is calculated by dividing the total operating expenses of the fund by its average net assets. Web it's easy to overlook, but just as a 0.75% dividend yield can compound positively over time, a 0.75% expense ratio can erode your investment in a similar,. Web the annual expense ratio of the ishares etf is 0.06%, slightly lower than the 0.06% expense ratio of the vanguard etf.

Enter Details About An Investment In A Fund Plus Any Management Or Marketing Expenses And.

Web an expense ratio impact calculator is a sophisticated tool that evaluates both the future value of an investment and the total cost associated with the fund's expense ratio. Web your search returns 40 results, with expense ratios ranging from 0.16% to 3.90%. Web the expense ratios of etfs have been falling for the past 20 years, and are set to become smaller yet. When buying or selling an etf, you'll pay or receive the current market price, which may be more or less than net asset value.

![How to Calculate ETF Expense Ratios [Step by Step] YouTube](https://i.ytimg.com/vi/-lD9AfIU7ak/maxresdefault.jpg)