Excel Discounted Cash Flow Template

Excel Discounted Cash Flow Template - Estimate value of future cash flows. Use our dcf model template for your financial valuations. Download the free dcf model template Web while there are many types of “free cash flow,” in a standard dcf model, you almost always use unlevered free cash flow (ufcf), also known as free cash flow to firm (fcff), because it produces the most consistent results and does not depend on the company’s capital structure. Web the dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic value of a stock.

Web an editable excel template on discounted cash flow (dcf) is a tool that can help individuals and businesses evaluate the present value of an investment based on its expected future cash flows. What is a dcf model? Web elevate your investment analysis with our free dcf model template. Web download simple cash flow template. Download the free dcf model template The template uses the discounted cash flow (dcf) method, which discounts future cash. Web our discounted cash flow valuation template is designed to assist you through the journey of valuation.

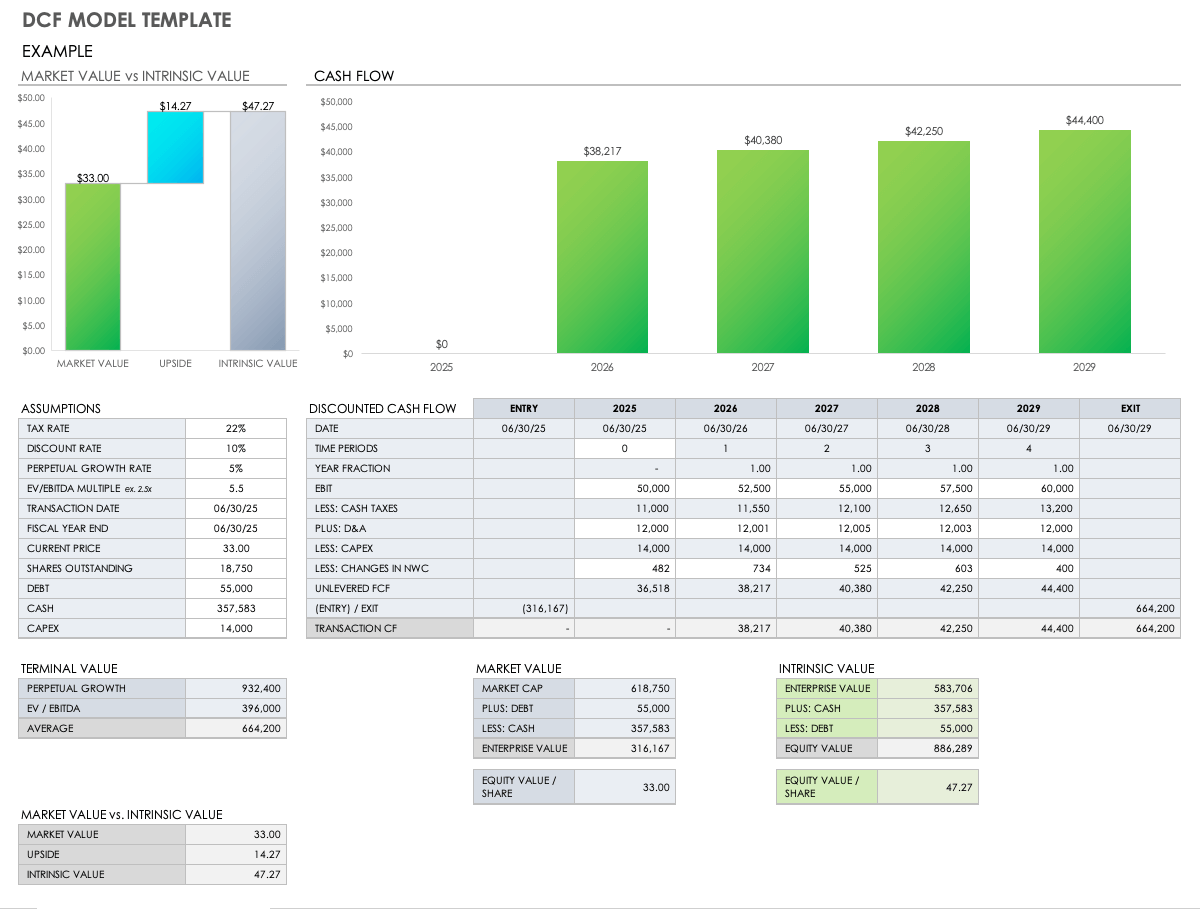

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Web elevate your investment analysis with our free dcf model template. Designed for clarity and ease of use, making dcf analysis accessible for all. Web fcff is a measure of the company’s ability to generate cash flow from its core business operations after accounting for necessary capital investments and taxes. Do you need to calculate.

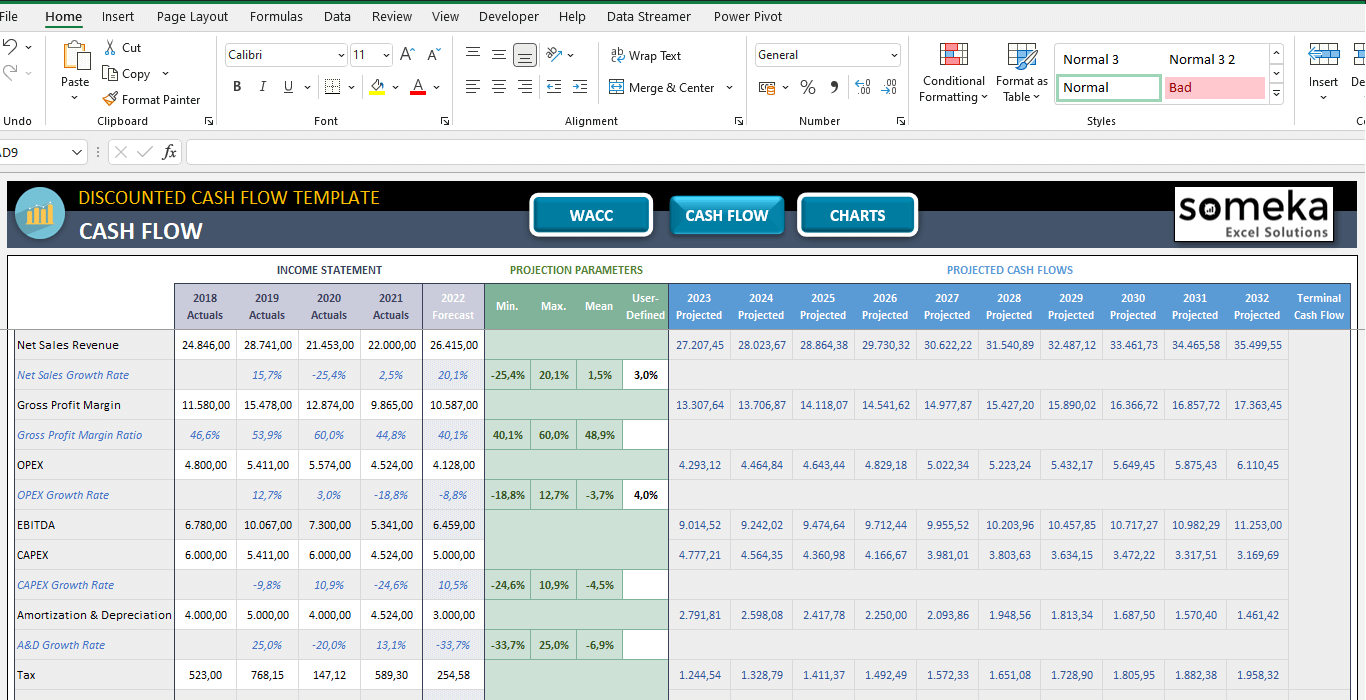

Discounted Cash Flow Excel Template DCF Valuation Template

When you delve into the world of dcf, you’ll find that it can provide insights into the future profitability of a project or business. Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free template, step by step. Web learn how to quickly.

DCF Discounted Cash Flow Model Excel Template Eloquens

It comes complete with an example of a dcf model so even beginners can get started quickly and accurately. Calculating unlevered free cash flows (fcf) key dcf assumptions. Capm and actual dividend methods. Discounted cash flow valuation template. Web while there are many types of “free cash flow,” in a standard dcf model, you almost.

Free Discounted Cash Flow Templates Smartsheet

Name the workbook, choose a place to save it, and click the save button. It comes complete with an example of a dcf model so even beginners can get started quickly and accurately. 4.7 ( 10 reviews ) dcf valuation spreadsheet in excel. Web download wso's free discounted cash flow (dcf) model template below! Sum.

Free Discounted Cash Flow Templates Smartsheet

4.7 ( 10 reviews ) dcf valuation spreadsheet in excel. What is discounted cash flow? Web calculating discounted cash flows (dcf) in excel is a powerful tool used by financial analysts to determine the value of an investment. Before calculating the discount rate, you’ll need to gather some essential information, including the future cash flows.

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free template, step by step. Web mastering the discounted cash flow (dcf) model in excel empowers you to make informed financial decisions. Web microsoft excel has made our work easier with the discounted cash.

discounted cash flow excel template —

It is often used in discounted cash flow (dcf) analysis to determine the intrinsic value of a company’s equity. When you delve into the world of dcf, you’ll find that it can provide insights into the future profitability of a project or business. Web learn how to quickly set up a discounted cash flow calculations.

Discounted Cash Flow Excel Template Free DCF Valuation Model in Excel

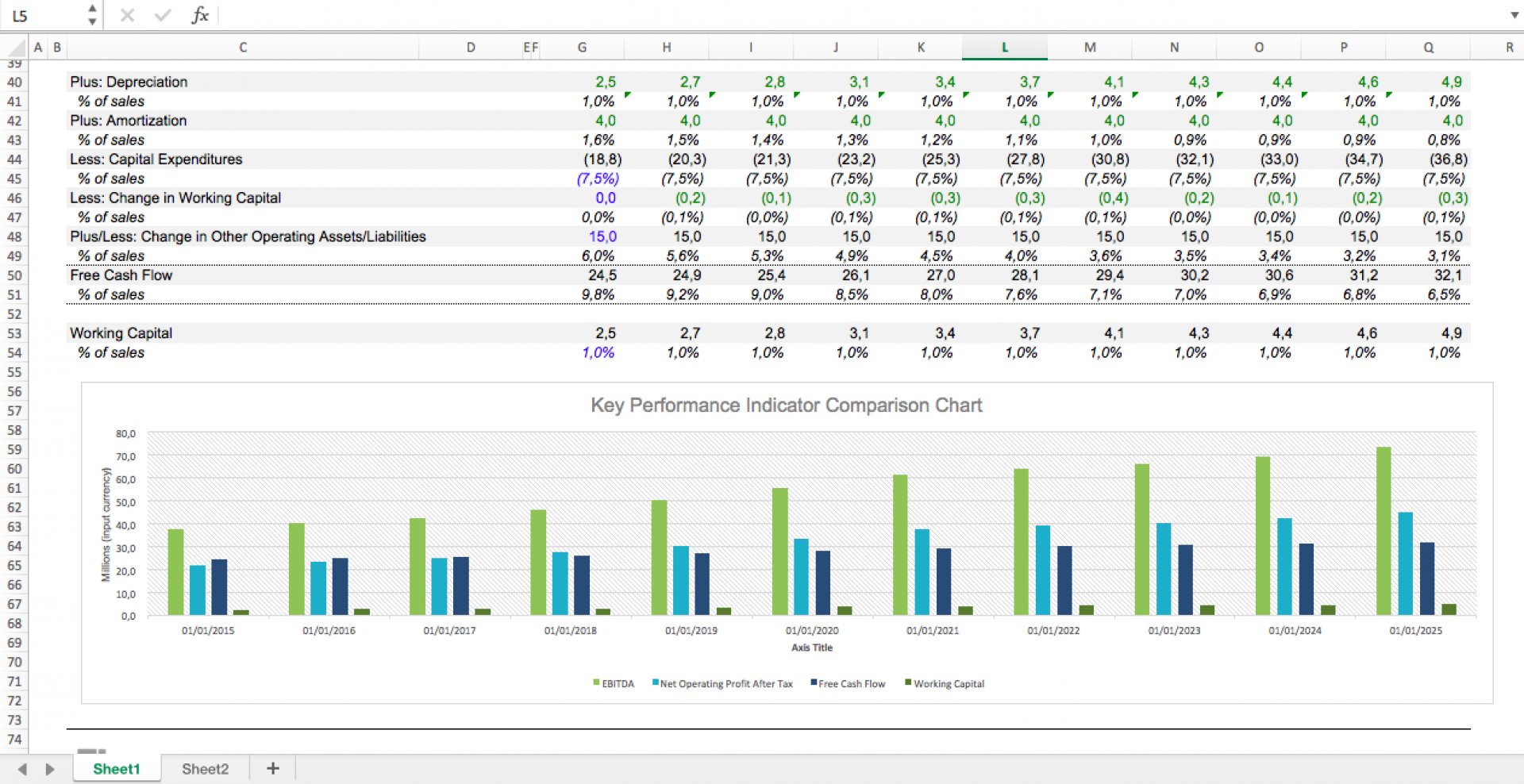

This template works for any length of time and allows you to compare different periods for a quick analysis of cash flows. Sum the discounted cash flows to find the investment’s npv. Web download wso's free discounted cash flow (dcf) model template below! Web determine an appropriate discount rate based on the risk of the.

Discounted Cash Flow Excel Template Free

The template comes with various scenarios along with sensitivity analysis. Download the free dcf model template Web the discounted cash flow (dcf) model is a valuation method, used to estimate the value of an investment based on its expected future cash flows. Web calculating discounted cash flows (dcf) in excel is a powerful tool used.

DCF Discounted Cash Flow Model Excel Template Eloquens

4.7 ( 10 reviews ) dcf valuation spreadsheet in excel. Tailored for both beginners and professionals. The discounted cash flow formula; Below is a preview of the dcf model template: Enter your name and email in the form and download the free template now! The discounted cash flow model, or “dcf model”, is a type.

Excel Discounted Cash Flow Template This template works for any length of time and allows you to compare different periods for a quick analysis of cash flows. Web on this page, you’ll find the following: Web this dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Web microsoft excel has made our work easier with the discounted cash flow formula. Discounted cash flow valuation template.

4.7 ( 10 Reviews ) Dcf Valuation Spreadsheet In Excel.

It is used to determine the value of a business or security. Web calculating discounted cash flows (dcf) in excel is a powerful tool used by financial analysts to determine the value of an investment. Web this dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. It comes complete with an example of a dcf model so even beginners can get started quickly and accurately.

The Discounted Cash Flow Formula;

Discounted cash flow templates, including customizable options that allow you to plug in your own numbers; Web an editable excel template on discounted cash flow (dcf) is a tool that can help individuals and businesses evaluate the present value of an investment based on its expected future cash flows. Web the discounted cash flow (dcf) model is a valuation method, used to estimate the value of an investment based on its expected future cash flows. It represents the value of an investor and his/her willingness to pay for an investment, with a.

Before Calculating The Discount Rate, You’ll Need To Gather Some Essential Information, Including The Future Cash Flows Of The Investment And The Period Over Which Those Cash Flows Will Occur.

Web on this page, you’ll find the following: Tailored for both beginners and professionals. Tips for doing a discounted cash flow analysis; Capm and actual dividend methods.

When You Delve Into The World Of Dcf, You’ll Find That It Can Provide Insights Into The Future Profitability Of A Project Or Business.

Below is a preview of the dcf model template: Web elevate your investment analysis with our free dcf model template. Web the dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic value of a stock. Web mastering the discounted cash flow (dcf) model in excel empowers you to make informed financial decisions.