Expected Return Of Portfolio Calculator

Expected Return Of Portfolio Calculator - Web updated july 31, 2023 expected return formula expected return can be defined as the probable return for a portfolio held by investors based on past returns, or it can also be. Σ → summation notation p (i) → probability of outcome r (i) → return in outcome expected return. Web a tool to assess the potential performance of an investment based on the probability distribution of asset returns. (35% x 6%) + (25% x 7%) + (40% x 10%) = 7.85% Enter the probability, return on stock a, and return on.

Web expected return = (w1 * r1) + (w2 * r2) +.……… + (wn * rn) w i = weight of each investment in the portfolio r i = rate of return of each investment in the portfolio table. Expected return of portfolio = 0.2(15%) +. Web based on the respective investments in each component asset, the portfolio’s expected return can be calculated as follows: Web we've added a default return of 6%, which is fairly conservative — feel free to adjust it to match your expectations for your own investment portfolio. Web 60% (2%) + 20% (−1%) + 20% (0.5%) = 1.1% in general, the realized (or historical) return on a portfolio rp can be calculated as: Web a tool to assess the potential performance of an investment based on the probability distribution of asset returns. Enter the probability, return on stock a, and return on.

Expected Return Formula Calculator (Excel template)

Expected return of portfolio = 0.2(15%) +. Web based on the respective investments in each component asset, the portfolio’s expected return can be calculated as follows: Then press enters to get your expected rate of return. Web 60% (2%) + 20% (−1%) + 20% (0.5%) = 1.1% in general, the realized (or historical) return on.

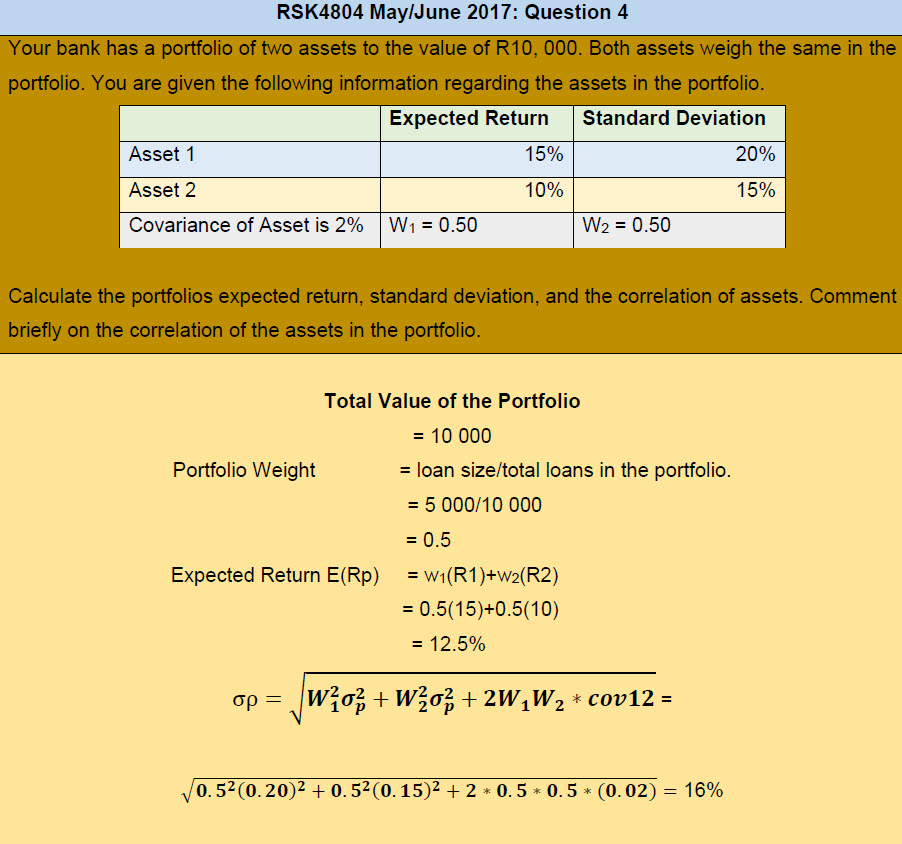

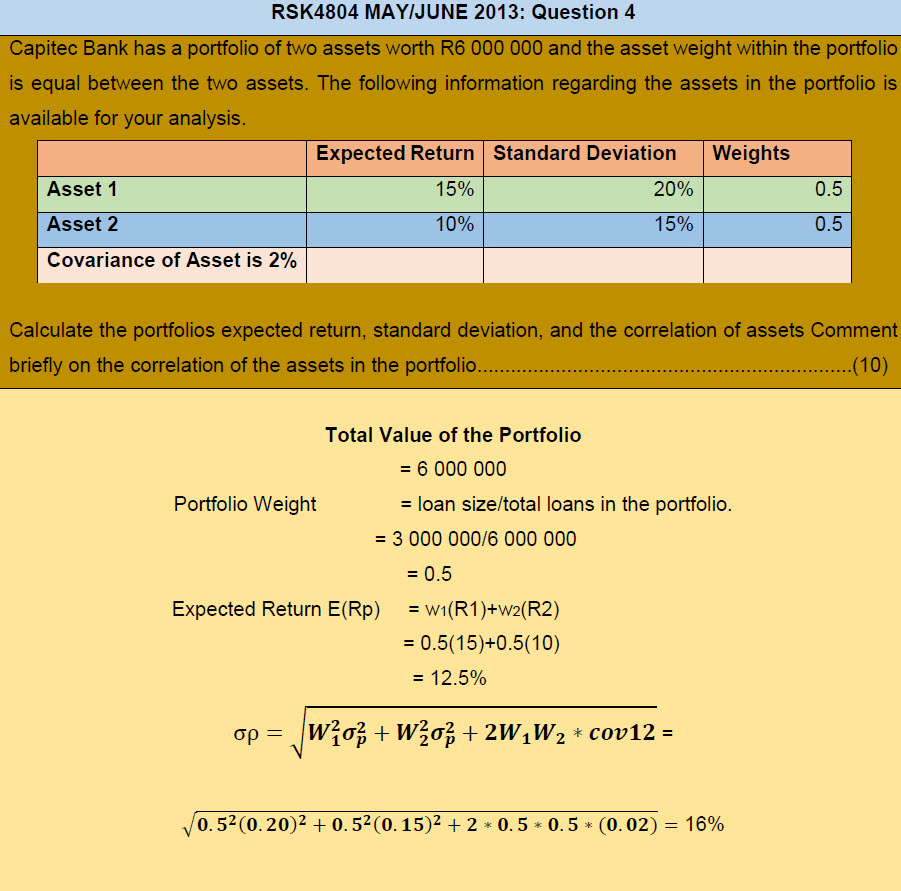

Calculate the portfolios expected return. Theron Group Blog

Rp = ∑wi ri where wi is the investment weight. In this formula, “r” equals rate of return, while “w” is equivalent to the asset weight. Expected return of portfolio = 0.2(15%) +. Web 60% (2%) + 20% (−1%) + 20% (0.5%) = 1.1% in general, the realized (or historical) return on a portfolio rp.

Calculate the portfolio expected return. Theron Group Blog

Web the expected return of the overall portfolio would be 7.85%. What is the formula of expected. Web based on the respective investments in each component asset, the portfolio’s expected return can be calculated as follows: Web in cell f2, enter the formula = (b2*c2)+ (d2*e2). Web 60% (2%) + 20% (−1%) + 20% (0.5%).

Portfolio Return Formula Calculator (Examples With Excel Template)

Web if you want your number as a percentage, multiply it by 100: Σ → summation notation p (i) → probability of outcome r (i) → return in outcome expected return. If you are working with more than two potential gains,. 515/1000 = 0.515 or 51.5%. Web portfolio expected return e (r) = σ r.

How to Calculate Portfolio Returns From Scratch (Example Included

(35% x 6%) + (25% x 7%) + (40% x 10%) = 7.85% Then press enters to get your expected rate of return. Web expected rate of return (err) = r1 x w1 + r2 x w2. Web expected return = (w1 * r1) + (w2 * r2) +.……… + (wn * rn) w i.

How To Calculate Portfolio Return In 4 Steps FortuneBuilders

Finance calculatorspersonal finance & taxesinvestment tools & tipsveterans resources If you are working with more than two potential gains,. 515/1000 = 0.515 or 51.5%. (35% x 6%) + (25% x 7%) + (40% x 10%) = 7.85% Formally, the expected return formula can be written as follows: Web expected rate of return (err) = r1.

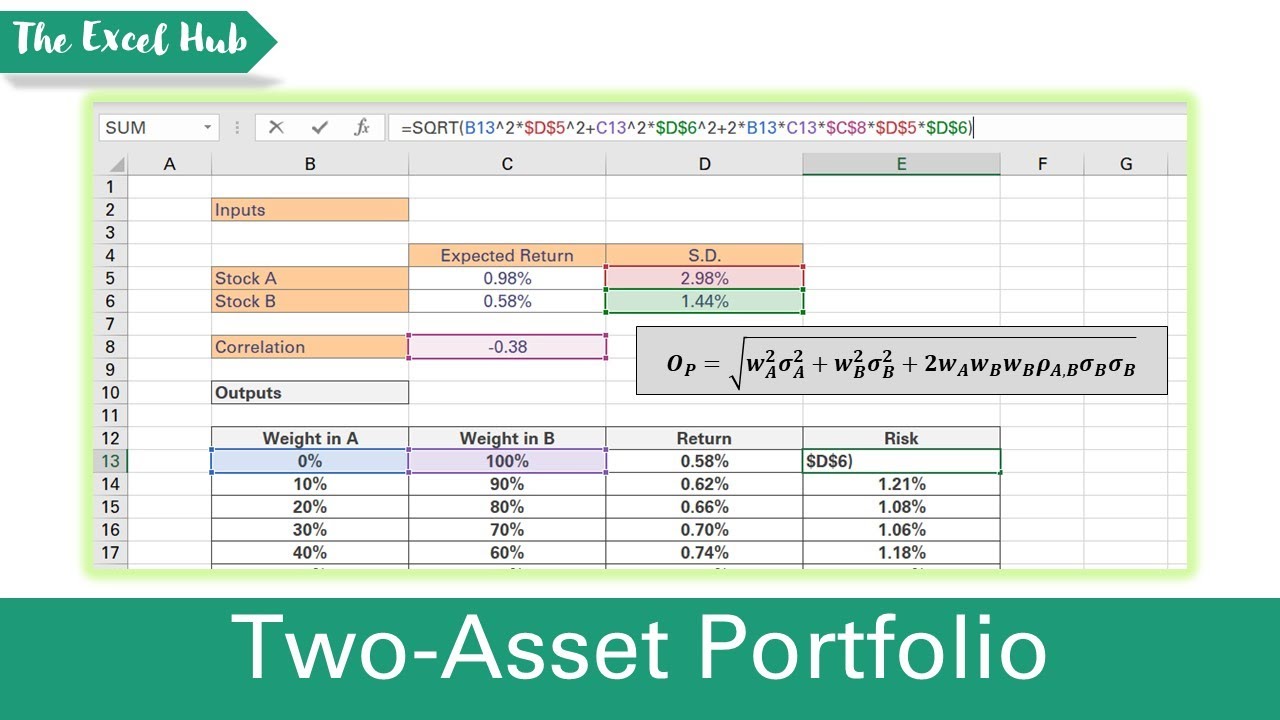

Calculate Risk And Return Of A TwoAsset Portfolio In Excel (Expected

Enter the probability, return on stock a, and return on. Then press enters to get your expected rate of return. In this formula, “r” equals rate of return, while “w” is equivalent to the asset weight. Web portfolio expected return e (r) = σ r (i) × p (i) where: Web return on investment (roi).

Portfolio Expected Return Calculator Scaling Partners

We arrive at this result by using the formula above: Web if you want your number as a percentage, multiply it by 100: Expected return = (return a x probability a) + (return b x probability b) identify the. If you are working with more than two potential gains,. Enter the probability, return on stock.

Expected Return (ER) of a Portfolio Calculation Finance Strategists

Then press enters to get your expected rate of return. In this formula, “r” equals rate of return, while “w” is equivalent to the asset weight. Web based on the respective investments in each component asset, the portfolio’s expected return can be calculated as follows: (35% x 6%) + (25% x 7%) + (40% x.

Expected Return (ER) of a Portfolio Calculation Finance Strategists

Web if you want your number as a percentage, multiply it by 100: Rp = ∑wi ri where wi is the investment weight. Then press enters to get your expected rate of return. Web in cell f2, enter the formula = (b2*c2)+ (d2*e2). Web we've added a default return of 6%, which is fairly conservative.

Expected Return Of Portfolio Calculator Calculating returns for an entire portfolio navigating the financial. Formally, the expected return formula can be written as follows: (35% x 6%) + (25% x 7%) + (40% x 10%) = 7.85% This means that e[r] is a. Expected return = (return a x probability a) + (return b x probability b) identify the.

Calculating Returns For An Entire Portfolio Navigating The Financial.

Finance calculatorspersonal finance & taxesinvestment tools & tipsveterans resources Web based on the respective investments in each component asset, the portfolio’s expected return can be calculated as follows: 515/1000 = 0.515 or 51.5%. Enter the probability, return on stock a, and return on.

Expected Return Of Portfolio = 0.2(15%) +.

Web a tool to assess the potential performance of an investment based on the probability distribution of asset returns. Web we've added a default return of 6%, which is fairly conservative — feel free to adjust it to match your expectations for your own investment portfolio. If you are working with more than two potential gains,. Web updated july 31, 2023 expected return formula expected return can be defined as the probable return for a portfolio held by investors based on past returns, or it can also be.

Expected Return = (Return A X Probability A) + (Return B X Probability B) Identify The.

Web portfolio expected return e (r) = σ r (i) × p (i) where: What is the formula of expected. Web 60% (2%) + 20% (−1%) + 20% (0.5%) = 1.1% in general, the realized (or historical) return on a portfolio rp can be calculated as: Web the expected return of a portfolio is the sum of all the assets' expected returns, weighted by their corresponding proportion.

Web Return On Investment (Roi) Allows You To Measure How Much Money You Can Make On A Financial Investment Like A Stock, Mutual Fund, Index Fund Or Etf.

This means that e[r] is a. (35% x 6%) + (25% x 7%) + (40% x 10%) = 7.85% Web in cell f2, enter the formula = (b2*c2)+ (d2*e2). Web return on portfolio calculator is an online personal finance assessment tool in the investment category to calculate the return on portfolio by choosing the proportion of.