Expected Return On Portfolio Calculator

Expected Return On Portfolio Calculator - Web this free calculator enables investors to analyze the growth potential of their investments and make informed decisions. E(r i) is the expected return on. Rp = ∑wi ri where wi is the investment weight. Web expected return can be defined as the probable return for a portfolio held by investors based on past returns, or it can also be defined as an expected value of the. To find the er for a portfolio, sum up each position's er and then weight it by the position's percentage of the.

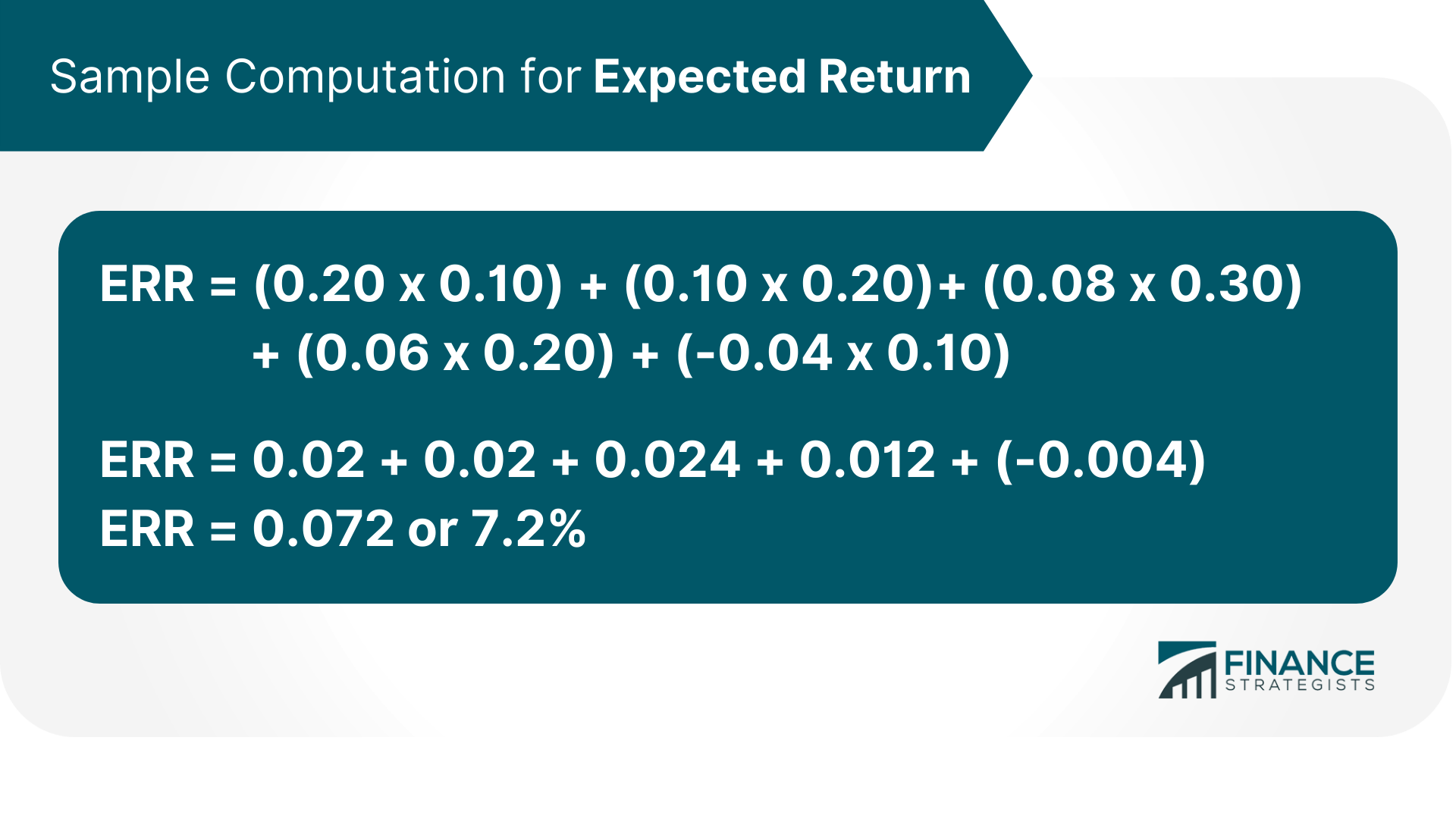

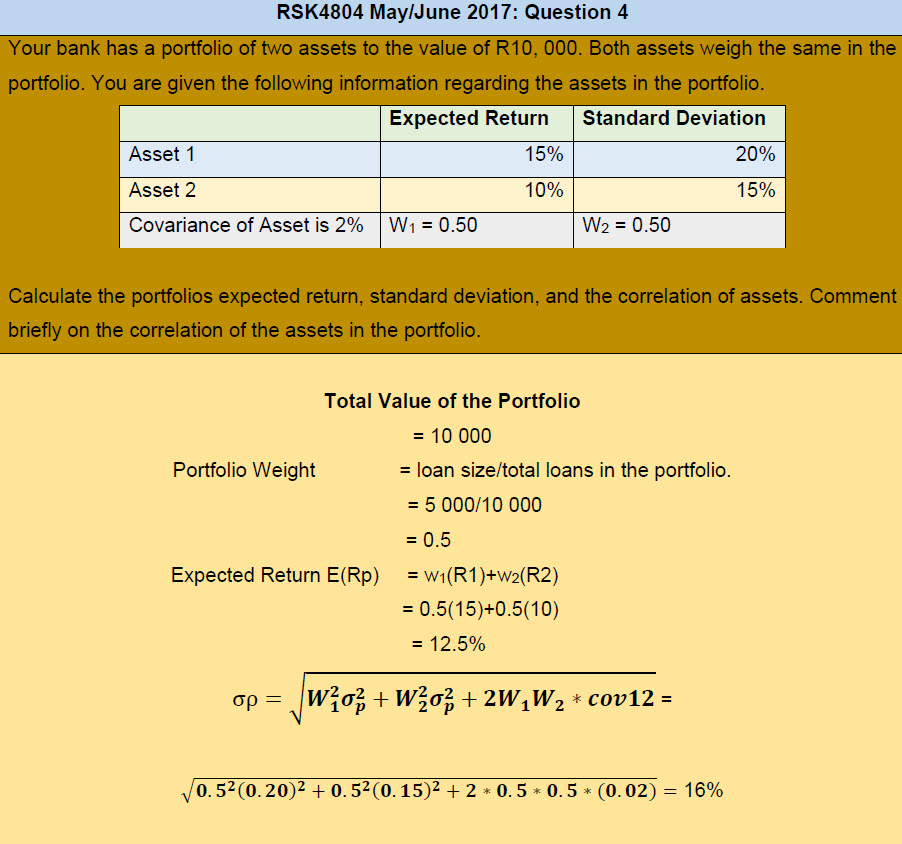

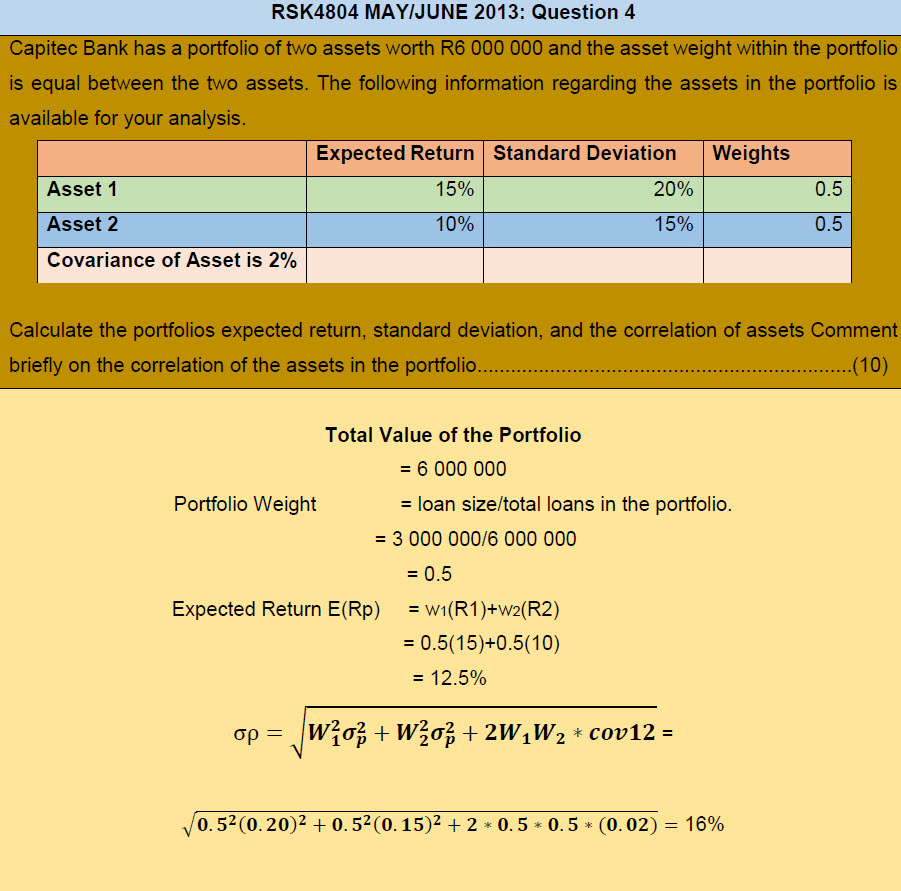

E(r i) = r f + [ e(r m) − r f] × β i. This means that e[r] is a. By inputting the initial investment amount,. Note that the probabilities must sum to 100%. Expected return of portfolio = 0.2(15%) +. Formally, the expected return formula can be written as follows: Web sample computation for expected return.

Expected Return (ER) of a Portfolio Calculation Finance Strategists

Web expected return can be defined as the probable return for a portfolio held by investors based on past returns, or it can also be defined as an expected value of the. By inputting the initial investment amount,. Enter the potential gains and their respective probabilities in the second row. Web this free calculator enables.

Expected Return Formula Calculator (Excel template)

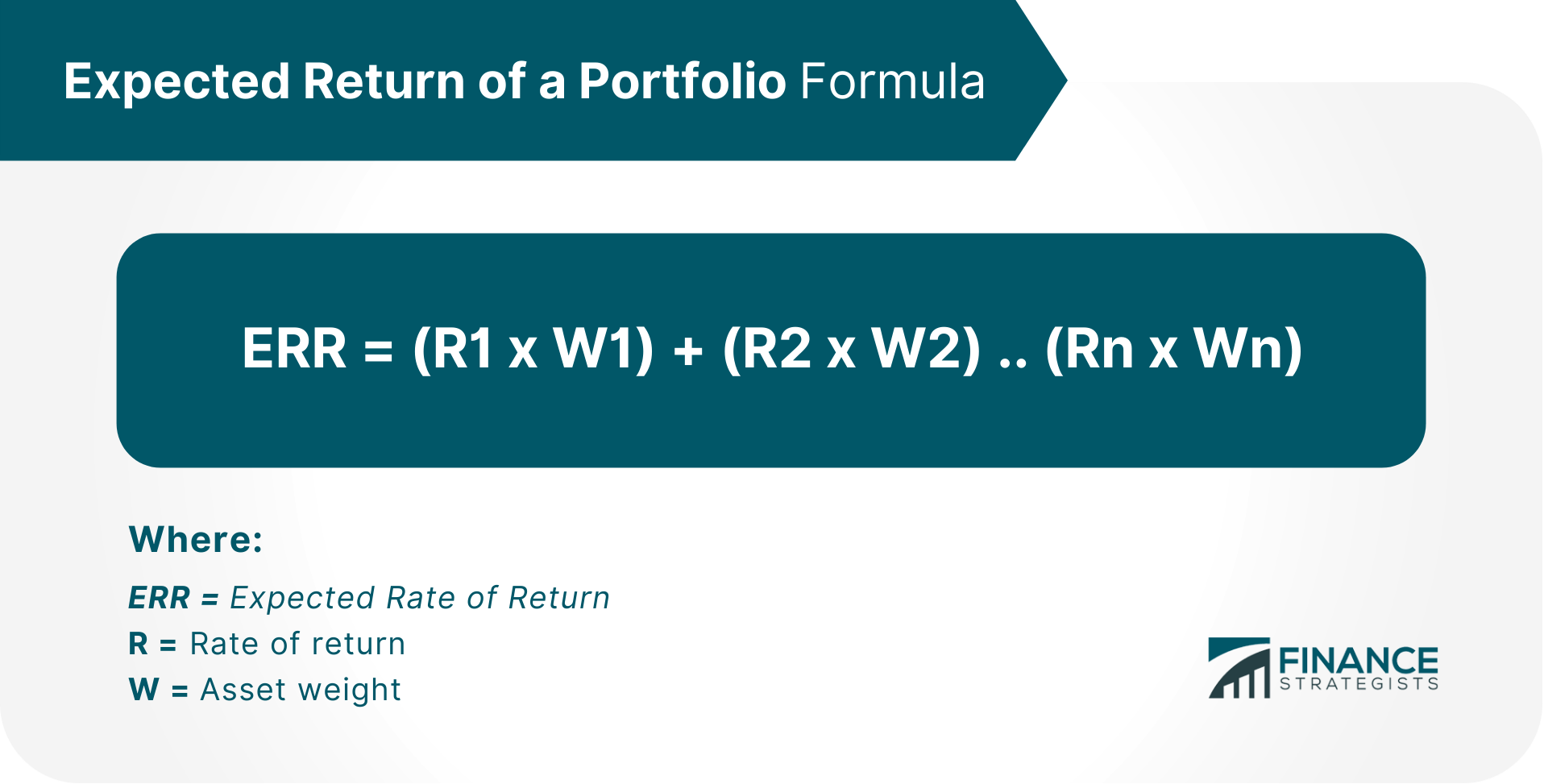

Web this free investment calculator will calculate how much your money may grow and return over time when invested in stocks, mutual funds or other investments. Web based on the respective investments in each component asset, the portfolio’s expected return can be calculated as follows: In this formula, “r” equals rate of return, while “w”.

How To Calculate Portfolio Return In 4 Steps FortuneBuilders

Web the formula of expected return for an investment with various probable returns can be calculated as a weighted average of all possible returns which is represented as below,. To find the er for a portfolio, sum up each position's er and then weight it by the position's percentage of the. Web key takeaways investors.

Expected Return (ER) of a Portfolio Calculation Finance Strategists

Web sample computation for expected return. Expected rate of return (err) = r1 x w1 + r2 x w2. Web expected return can be defined as the probable return for a portfolio held by investors based on past returns, or it can also be defined as an expected value of the. In this formula, “r”.

How to Calculate Portfolio Returns From Scratch (Example Included

Based on the probability distribution. Rp = ∑wi ri where wi is the investment weight. Web 60% (2%) + 20% (−1%) + 20% (0.5%) = 1.1% in general, the realized (or historical) return on a portfolio rp can be calculated as: Web the formula of expected return for an investment with various probable returns can.

Portfolio Expected Return Calculator Scaling Partners

Web return on portfolio calculator is an online personal finance assessment tool in the investment category to calculate the return on portfolio by choosing the proportion of. Expected rate of return (err) = r1 x w1 + r2 x w2. Expected return = (return a x probability a) + (return b x probability b) identify.

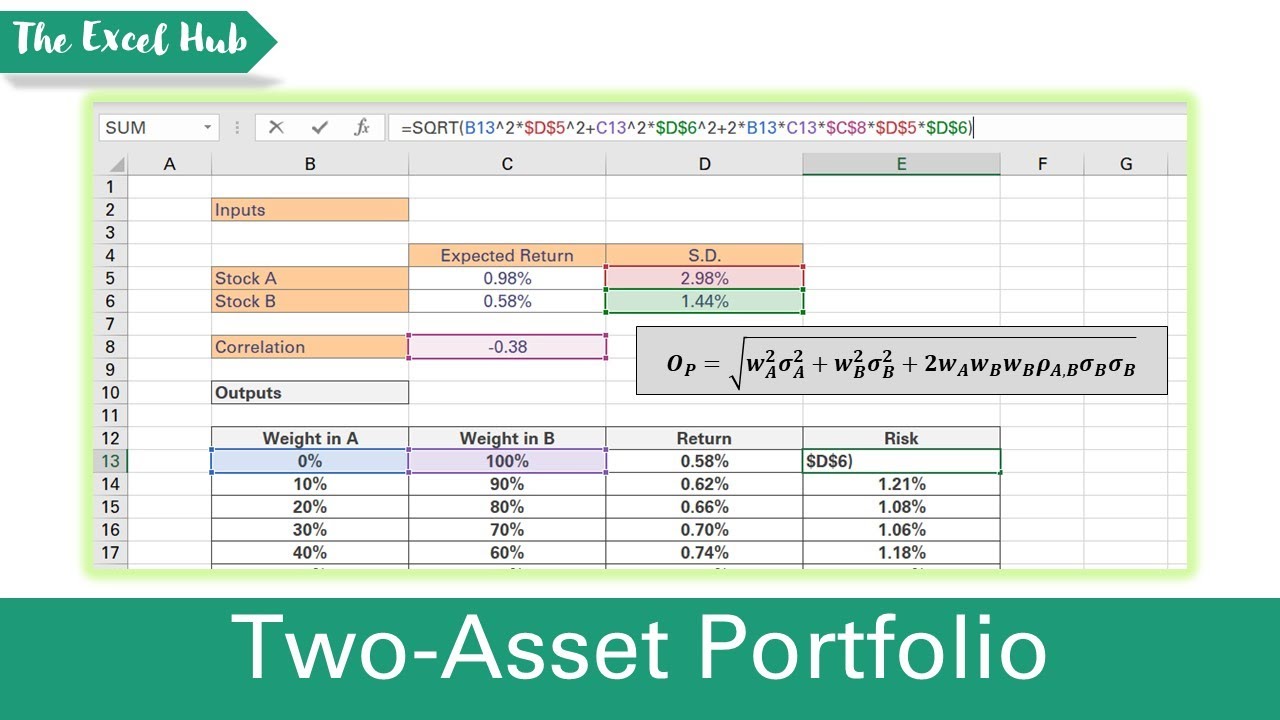

Calculate Risk And Return Of A TwoAsset Portfolio In Excel (Expected

Based on the probability distribution. Web the calculator uses the following formula to calculate the expected return of a security (or a portfolio): Web the expected return is calculated by multiplying potential outcomes (returns) by the chances of each outcome occurring and then calculating the sum of those results. Web in the 20th century, modern.

Calculate the portfolios expected return. Theron Group Blog

Formally, the expected return formula can be written as follows: Web return on portfolio calculator is an online personal finance assessment tool in the investment category to calculate the return on portfolio by choosing the proportion of. This means that e[r] is a. Based on the probability distribution. Web the expected return calculator is a.

Portfolio Return Formula Calculator (Examples With Excel Template)

Rp = ∑wi ri where wi is the investment weight. Enter the potential gains and their respective probabilities in the second row. Web 60% (2%) + 20% (−1%) + 20% (0.5%) = 1.1% in general, the realized (or historical) return on a portfolio rp can be calculated as: E(r i) is the expected return on..

Calculate the portfolio expected return. Theron Group Blog

Web key takeaways investors and portfolio managers can calculate the anticipated values of their portfolios by using the expected return and standard. This means that e[r] is a. Web the formula of expected return for an investment with various probable returns can be calculated as a weighted average of all possible returns which is represented.

Expected Return On Portfolio Calculator Web expected return can be defined as the probable return for a portfolio held by investors based on past returns, or it can also be defined as an expected value of the. Enter the potential gains and their respective probabilities in the second row. Expected return = (return a x probability a) + (return b x probability b) identify the. Expected rate of return (err) = r1 x w1 + r2 x w2. Note that the probabilities must sum to 100%.

Formally, The Expected Return Formula Can Be Written As Follows:

E(r i) is the expected return on. Web based on the respective investments in each component asset, the portfolio’s expected return can be calculated as follows: Web the expected return is calculated by multiplying potential outcomes (returns) by the chances of each outcome occurring and then calculating the sum of those results. Web expected return can be defined as the probable return for a portfolio held by investors based on past returns, or it can also be defined as an expected value of the.

Note That The Probabilities Must Sum To 100%.

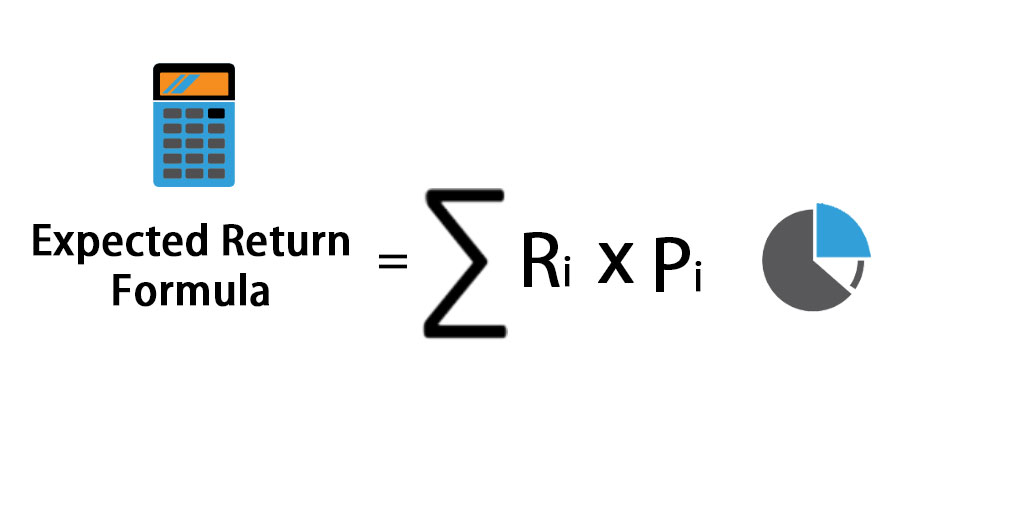

Web written as a formula, we get: Σ → summation notation p (i) → probability of outcome r (i) → return in outcome expected return. Web 60% (2%) + 20% (−1%) + 20% (0.5%) = 1.1% in general, the realized (or historical) return on a portfolio rp can be calculated as: In this formula, “r” equals rate of return, while “w” is equivalent.

Expected Return = (Return A X Probability A) + (Return B X Probability B) Identify The.

Web portfolio expected return e (r) = σ r (i) × p (i) where: To find the er for a portfolio, sum up each position's er and then weight it by the position's percentage of the. By inputting the initial investment amount,. Enter the potential gains and their respective probabilities in the second row.

This Expected Return Calculator Is A Valuable Tool To Assess The Potential Performance Of An Investment.

Web this free calculator enables investors to analyze the growth potential of their investments and make informed decisions. Based on the probability distribution. Web return on investment (roi) allows you to measure how much money you can make on a financial investment like a stock, mutual fund, index fund or etf. Web return on portfolio calculator is an online personal finance assessment tool in the investment category to calculate the return on portfolio by choosing the proportion of.