Expected Return On The Portfolio Calculator

Expected Return On The Portfolio Calculator - Expected return = (return a x probability a) + (return b x probability b) identify the. For real estate, we will multiply.56 by 10% to get 5.6%. In this formula, “r” equals rate of return, while “w” is equivalent to the asset weight. Formally, the expected return formula can be written as follows: Web portfolio expected return e (r) = σ r (i) × p (i) where:

Expected return = (return a x probability a) + (return b x probability b) identify the. For a point of reference, the s&p 500 has a historical average annual total return of about 10%, not accounting for inflation. Web return on investment (roi) allows you to measure how much money you can make on a financial investment like a stock, mutual fund, index fund or etf. Rp = ∑wi ri where wi is the investment weight. Web 60% (2%) + 20% (−1%) + 20% (0.5%) = 1.1% in general, the realized (or historical) return on a portfolio rp can be calculated as: E (ri) is the expected return. Web expected portfolio return = (asset 1 weight x expected return) + (asset 2 weight x expected return).

Portfolio Expected Return Calculator Scaling Partners

Web now that we have the return and weight of each investment, we need to multiply these numbers. Rp = ∑wi ri where wi is the investment weight. For real estate, we will multiply.56 by 10% to get 5.6%. Web this expected return calculator is a valuable tool to assess the potential performance of an.

Expected Return (ER) of a Portfolio Calculation Finance Strategists

For real estate, we will multiply.56 by 10% to get 5.6%. Web now that we have the return and weight of each investment, we need to multiply these numbers. Web the expected return of a portfolio is the sum of all the assets' expected returns, weighted by their corresponding proportion. Now let's use a hypothetical.

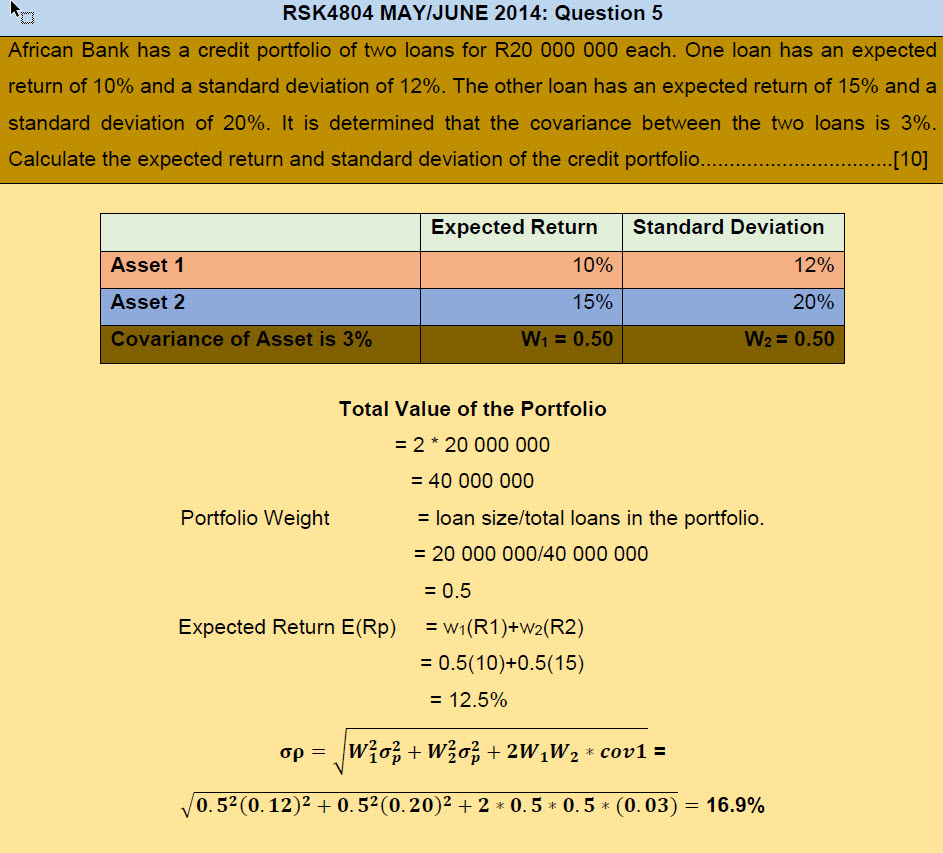

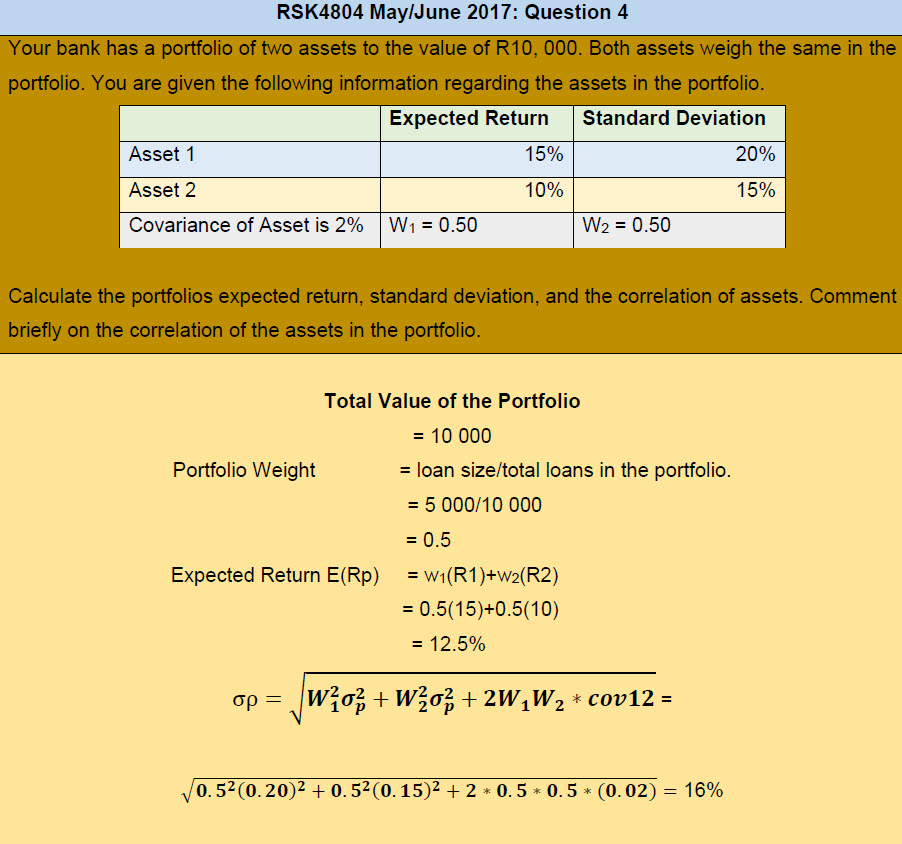

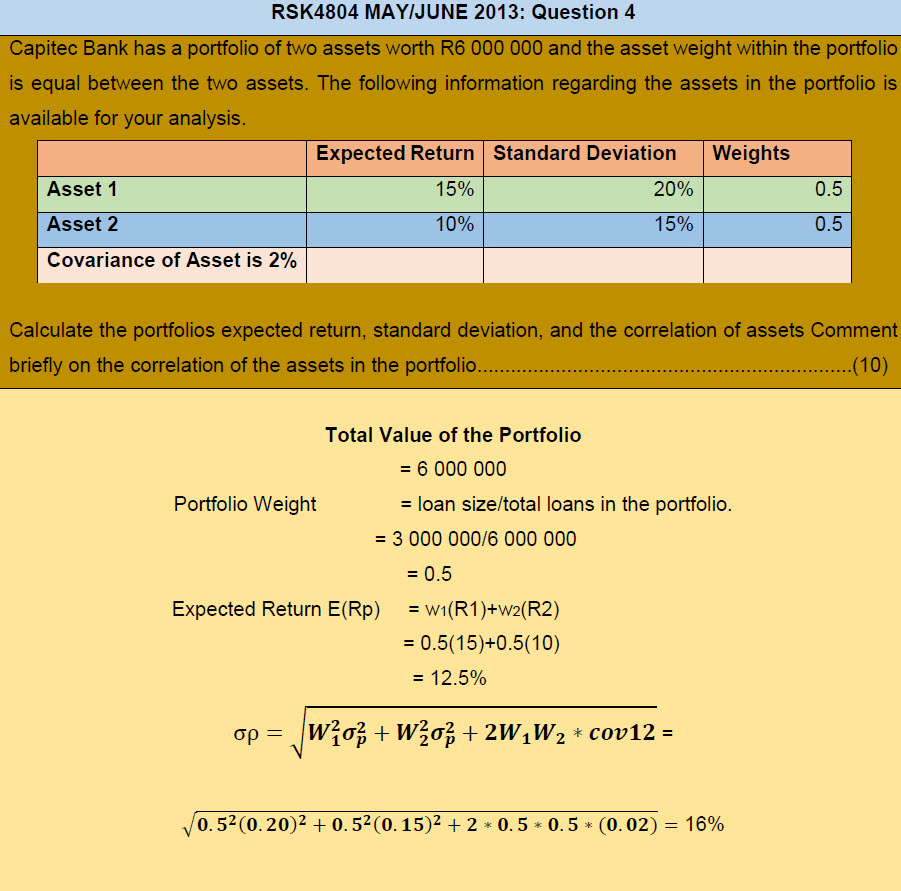

Calculate the expected return and standard deviation of the credit

Web this expected return calculator is a valuable tool to assess the potential performance of an investment. Web expected rate of return (err) = r1 x w1 + r2 x w2. Web the calculator uses the following formula to calculate the expected return of a security (or a portfolio): Web the expected return of a.

How to Calculate Portfolio Returns From Scratch (Example Included

Web the formula of expected return for an investment with various probable returns can be calculated as a weighted average of all possible returns which is represented as below,. Web based on the respective investments in each component asset, the portfolio’s expected return can be calculated as follows: Up to 10 holdings freebenchmarkingpainless administrationtrack your.

Portfolio Return Formula Calculator (Examples With Excel Template)

For real estate, we will multiply.56 by 10% to get 5.6%. Web outcome 1 has a probability of 0.6 and a potential return of 10%. Web the formula of expected return for an investment with various probable returns can be calculated as a weighted average of all possible returns which is represented as below,. Web.

Portfolio Theory Expected return of a portfolio YouTube

Expected return of portfolio = 0.2(15%) +. Up to 10 holdings freebenchmarkingpainless administrationtrack your dividends In this formula, “r” equals rate of return, while “w” is equivalent to the asset weight. For real estate, we will multiply.56 by 10% to get 5.6%. Web expected portfolio return = (asset 1 weight x expected return) + (asset.

Expected Return Formula Calculator (Excel template)

For a point of reference, the s&p 500 has a historical average annual total return of about 10%, not accounting for inflation. Web this expected return calculator is a valuable tool to assess the potential performance of an investment. Web 60% (2%) + 20% (−1%) + 20% (0.5%) = 1.1% in general, the realized (or.

Expected Return (ER) of a Portfolio Calculation Finance Strategists

Web outcome 1 has a probability of 0.6 and a potential return of 10%. Expected return of portfolio = 0.2(15%) +. Based on the probability distribution of asset returns, the calculator. Web 60% (2%) + 20% (−1%) + 20% (0.5%) = 1.1% in general, the realized (or historical) return on a portfolio rp can be.

Calculate the portfolios expected return. Theron Group Blog

E (ri) is the expected return. Expected return of portfolio = 0.2(15%) +. For real estate, we will multiply.56 by 10% to get 5.6%. Rp = ∑wi ri where wi is the investment weight. This means that e[r] is a. Expected return = (return a x probability a) + (return b x probability b) identify.

Calculate the portfolio expected return. Theron Group Blog

Rp = ∑wi ri where wi is the investment weight. Expected return of portfolio = 0.2(15%) +. For a point of reference, the s&p 500 has a historical average annual total return of about 10%, not accounting for inflation. Web expected rate of return (err) = r1 x w1 + r2 x w2. Formally, the.

Expected Return On The Portfolio Calculator Web expected rate of return (err) = r1 x w1 + r2 x w2. Web the calculator uses the following formula to calculate the expected return of a security (or a portfolio): Outcome 2 has a probability of 0.4 and a potential return of 15%. Σ → summation notation p (i) → probability of outcome r (i) → return in outcome expected return. Now let's use a hypothetical example to show how to.

Up To 10 Holdings Freebenchmarkingpainless Administrationtrack Your Dividends

Rp = ∑wi ri where wi is the investment weight. Web expected rate of return (err) = r1 x w1 + r2 x w2. Σ → summation notation p (i) → probability of outcome r (i) → return in outcome expected return. Web this expected return calculator is a valuable tool to assess the potential performance of an investment.

Web The Calculator Uses The Following Formula To Calculate The Expected Return Of A Security (Or A Portfolio):

Web the expected return is calculated by multiplying potential outcomes (returns) by the chances of each outcome occurring and then calculating the sum of those results. Now let's use a hypothetical example to show how to. Web now that we have the return and weight of each investment, we need to multiply these numbers. E (ri) is the expected return.

Web Return On Investment (Roi) Allows You To Measure How Much Money You Can Make On A Financial Investment Like A Stock, Mutual Fund, Index Fund Or Etf.

Web outcome 1 has a probability of 0.6 and a potential return of 10%. Web expected return can be defined as the probable return for a portfolio held by investors based on past returns, or it can also be defined as an expected value of the. In this formula, “r” equals rate of return, while “w” is equivalent to the asset weight. Web enter your expected rate of return.

Web The Formula Of Expected Return For An Investment With Various Probable Returns Can Be Calculated As A Weighted Average Of All Possible Returns Which Is Represented As Below,.

Expected return = (return a x probability a) + (return b x probability b) identify the. Web portfolio expected return e (r) = σ r (i) × p (i) where: Formally, the expected return formula can be written as follows: Web based on the respective investments in each component asset, the portfolio’s expected return can be calculated as follows: