Favr Car Allowance Calculator

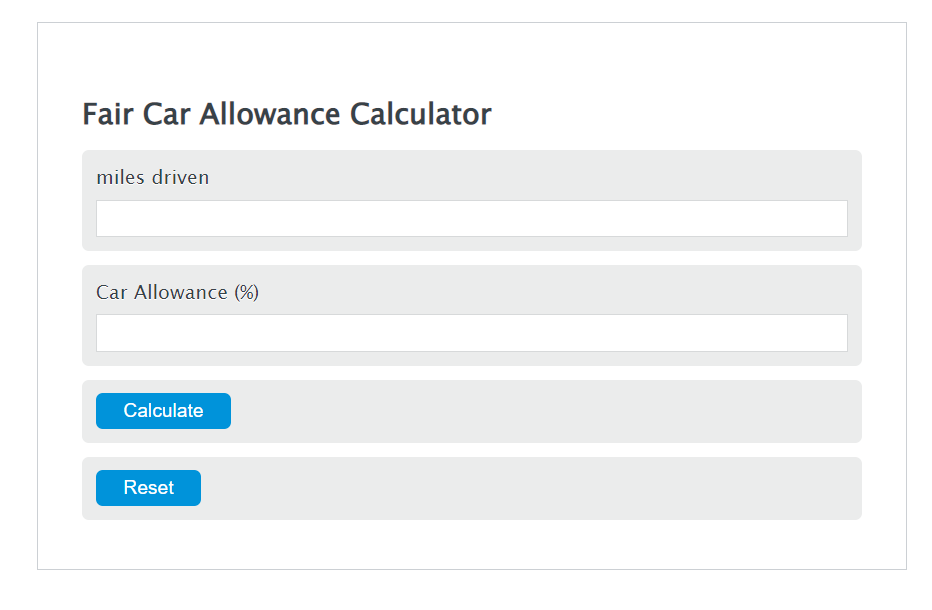

Favr Car Allowance Calculator - First, determine the miles driven. Web how the favr method differs from the irs standard mileage method. Next, gather the formula from above = fca = m *.656. Favr, accountable plans under publication 463, and taxable (or unjustified). Web how to calculate a fair car allowance.

First, determine the miles driven. Next, gather the formula from above = fca = m *.656. Car allowances remain one of the most popular ways for employers to offset their employees' business vehicle expenses. We then provide a report of the total dollar amount to. To calculate the favr allowance, add the total annual fixed price to the yearly variable cost. Web small business trends what is the favr car allowance? Understanding the key elements of.

Vehicle Programs The Average Car Allowance in 2022

Irs guidelines for correctly using. Web how to calculate a fair car allowance. Web the maximum value of a standard automobile used for favr rate computing purposes is set at $62,000 for 2024 by the irs. Everything you need to know story by joshua sophy • 10mo sponsored content what is the favr car allowance?..

Fixed and Variable Rate Allowance (FAVR) AwesomeFinTech Blog

Web the maximum value of a standard automobile used for favr rate computing purposes is set at $62,000 for 2024 by the irs. To calculate the favr allowance, add the total annual fixed price to the yearly variable cost. Web on a monthly basis, we calculate the employee reimbursement based on the plan vehicle using.

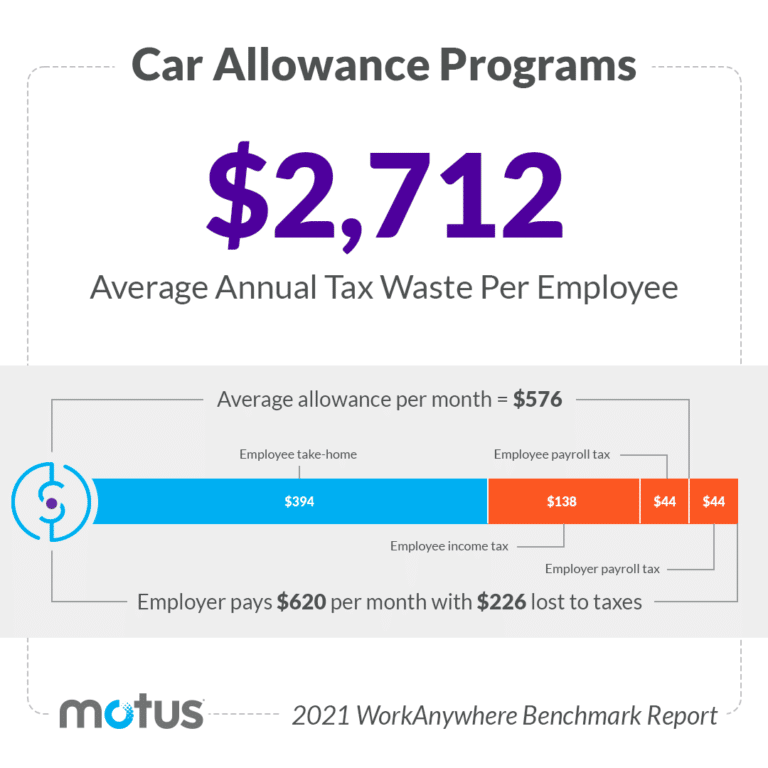

Car Allowance Tax Calculator CassiekruwFinley

Everything you need to know story by joshua sophy • 10mo sponsored content what is the favr car allowance?. Web calculate based on your $____ per month allowance annual employee benefits $0 increase per employee 0% increase in percentage annual company benefits: Next, gather the formula from above = fca = m *.656. How do.

ZinoZainul

Web calculate based on your $____ per month allowance annual employee benefits $0 increase per employee 0% increase in percentage annual company benefits: We then provide a report of the total dollar amount to. Irs guidelines for correctly using. Web on a monthly basis, we calculate the employee reimbursement based on the plan vehicle using.

Fair Car Allowance Calculator Calculator Academy

How do fixed and variable payments work? Web the following steps outline how to calculate the car allowance. Web add fixed and variable costs: This sum represents the total. The favr method recognizes that driving your own car for business makes for a different set of costs than. Web the maximum value of a standard.

Timeero FAVR Car Allowance 2024 Everything Your Company Needs to

Favr, accountable plans under publication 463, and taxable (or unjustified). What a favr car allowance is; Web small business trends what is the favr car allowance? Web on a monthly basis, we calculate the employee reimbursement based on the plan vehicle using our real cost database℠. Understanding the key elements of. How do fixed and.

Transition From a Flat Car Allowance Model to a FAVR Program

Web calculate based on your $____ per month allowance annual employee benefits $0 increase per employee 0% increase in percentage annual company benefits: Web how the favr method differs from the irs standard mileage method. Web on a monthly basis, we calculate the employee reimbursement based on the plan vehicle using our real cost database℠..

How to Calculate a FAVR Allowance

If your organization uses or is. First, determine the miles driven. Car allowances remain one of the most popular ways for employers to offset their employees' business vehicle expenses. What a favr car allowance is; Next, gather the formula from above = fca = m *.656. Web on a monthly basis, we calculate the employee.

2023 Everything Your Business Needs to Know About FAVR

Web the maximum value of a standard automobile used for favr rate computing purposes is set at $62,000 for 2024 by the irs. Consider a scenario where an individual drives 500 miles for business purposes out of a total of 1000 miles, with a. Web example of favr car allowance calculator. Web how to calculate.

FAVR Flat Car Allowance Reimbursement Assessment

This sum represents the total. Web calculate based on your $____ per month allowance annual employee benefits $0 increase per employee 0% increase in percentage annual company benefits: Favr, accountable plans under publication 463, and taxable (or unjustified). Web how the favr method differs from the irs standard mileage method. First, determine the miles driven..

Favr Car Allowance Calculator Web example of favr car allowance calculator. Understanding the key elements of. First, determine the miles driven. Web the irs has set the standard mileage rate for business use of an automobile at 58.5 cents per mile for 2022 and 56 cents for 2021. Irs guidelines for correctly using.

Web The Irs Has Set The Standard Mileage Rate For Business Use Of An Automobile At 58.5 Cents Per Mile For 2022 And 56 Cents For 2021.

The favr method recognizes that driving your own car for business makes for a different set of costs than. Web add fixed and variable costs: Web on a monthly basis, we calculate the employee reimbursement based on the plan vehicle using our real cost database℠. Compare your car allowance to a.

Web Example Of Favr Car Allowance Calculator.

Everything you need to know story by joshua sophy • 10mo sponsored content what is the favr car allowance?. Irs guidelines for correctly using. What a favr car allowance is; We then provide a report of the total dollar amount to.

Car Allowances Remain One Of The Most Popular Ways For Employers To Offset Their Employees' Business Vehicle Expenses.

Web how to calculate a fair car allowance. How do fixed and variable payments work? Web calculate based on your $____ per month allowance annual employee benefits $0 increase per employee 0% increase in percentage annual company benefits: Next, gather the formula from above = fca = m *.656.

Web In This Guide, We Will Explore Everything You Need To Know About Favr Car Allowance, Including:

Web the maximum value of a standard automobile used for favr rate computing purposes is set at $62,000 for 2024 by the irs. Web how the favr method differs from the irs standard mileage method. If your organization uses or is. Web the fixed and variable rate (favr) reimbursement is a method to reimburse mobile employees for the business use of their vehicle.