Federal Ev Tax Credit Calculator

Federal Ev Tax Credit Calculator - The 2023 ev tax credit is calculated based on a vehicle’s. Within your taxact return (see screenshots below), click federal. $27,700 for married couples filing jointly or qualifying surviving spouse. If you decided 2023 was the year to tackle some home improvements, you could reap the reward of tax credits worth up to $3,200. Web under the new treasury rule, eligible models can receive between ev tax credits of $3,750 to $7,500, depending on whether their battery minerals, their battery.

$13,850 for single or married filing separately. Web this ev tax credit calculator is a tool that helps estimate the amount of tax credit an electric car buyer can receive. + $417 per kwh of a battery pack in excess of 5 kwh. Web your modified adjusted gross income (magi) is equal to or less than $300,000 (married filing jointly and qualifying surviving spouse), $225,000 (head of household), or. How to qualify for the 2024 ev tax credit ; + $417 for all battery packs. Web this tool will clearly identify the lowest cost ev rate plan and allow you to enroll in a rate plan online.

New EV Tax Credits The Details Virginia Automobile Dealers Association

Web your modified adjusted gross income (magi) is equal to or less than $300,000 (married filing jointly and qualifying surviving spouse), $225,000 (head of household), or. Get rewarded for going green. Intuit.com has been visited by 1m+ users in the past month Web the federal ev tax credit, worth up to $7,500, is a nonrefundable.

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA

Web a recently expired federal tax break for electric vehicle (ev) chargers got new life under the recently passed inflation reduction act—a move that will give. $13,850 for single or married filing separately. For a $500 charger and $750 install, total $1,250, you’d get a. Get rewarded for going green. Web this tool will clearly.

EV Federal Tax Credit for Chevrolet Bolt EV and Volt Wheelers Family

For a $500 charger and $750 install, total $1,250, you’d get a. $13,850 for single or married filing separately. Married/joint filers = $300k for new / $150k for used. Web the standard deduction for 2023 is: We'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for.

The Electric Car Tax Credit What You Need To Know OsVehicle

How to qualify for the 2024 ev tax credit ; Web yes, the following income caps apply to the federal ev tax credit and the new credit for used electric vehicles. Led rebatesev charger rebatesmaking rebates simplerebate estimates Web a higher percentage of materials must be produced in north america for evs to qualify. Within.

U.S. Federal EV Tax Credit Update For January 2019

Web the tax on $37,100 is $4,324. + $417 per kwh of a battery pack in excess of 5 kwh. Web the federal ev tax credit, worth up to $7,500, is a nonrefundable tax credit that has been an effective way to lower the cost of ev ownership for taxpayers. How the electric vehicle tax.

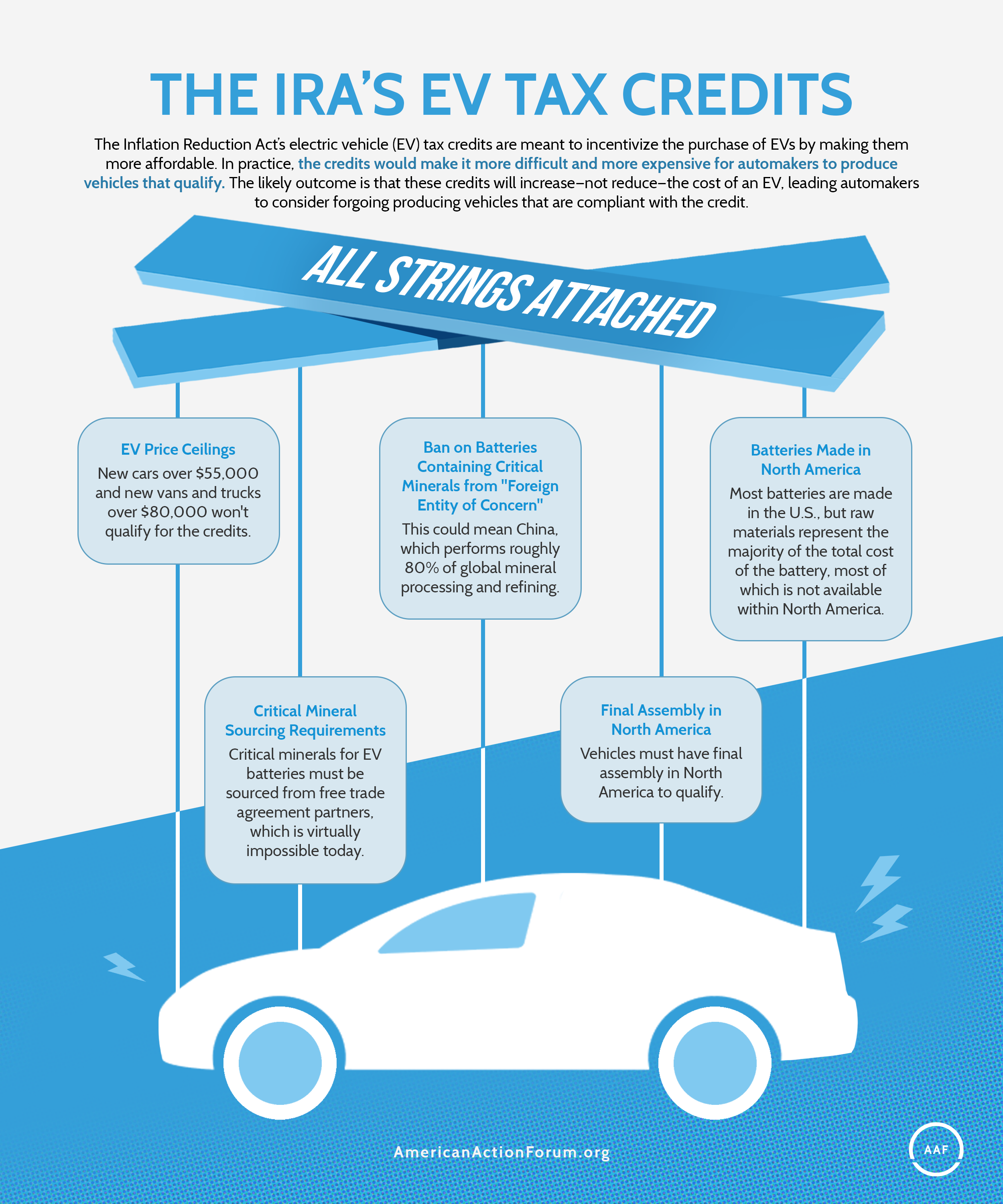

The IRA's EV Tax Credits AAF

The ev charger tax credit is back, thanks to. On smaller devices, click the icon in the top left corner, then click federal. Web this ev tax credit calculator is a tool that helps estimate the amount of tax credit an electric car buyer can receive. Married/joint filers = $300k for new / $150k for.

Ev Car Tax Rebate Calculator 2024

Even if you got an ev credit of $7,500, you could only use $4,324. Which cars qualify for a federal ev tax credit? If you decided 2023 was the year to tackle some home improvements, you could reap the reward of tax credits worth up to $3,200. How the electric vehicle tax credit is. Web.

UPDATE Here Are All The EVs Eligible Now For The 7,500 Federal Tax Credit

Find out how you can. If you decided 2023 was the year to tackle some home improvements, you could reap the reward of tax credits worth up to $3,200. Married/joint filers = $300k for new / $150k for used. + $417 per kwh of a battery pack in excess of 5 kwh. The 2023 ev.

Everything you need to know about the IRS’s new EV tax credit guidance

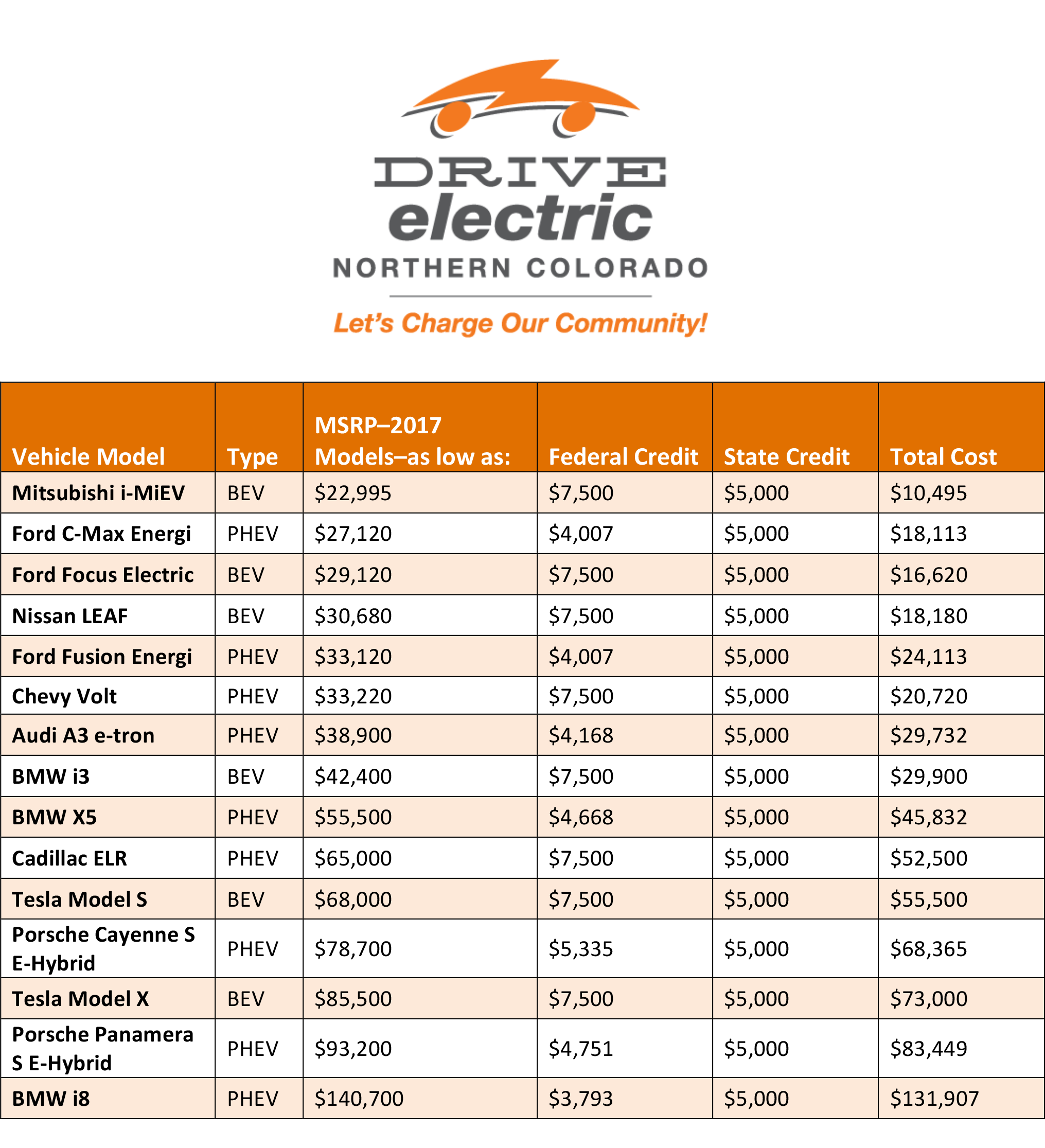

Zip code get started personalized rates in less than 1 minute. Web clean vehicle tax credits. Web the formula is as follows: $2,500 for a minimum of a 5kwh battery pack. Which cars qualify for a federal ev tax credit? In 2022 and 2023, the evs that qualified for the $7,500 federal tax credit were.

EV tax credit boost At up to 12,500, here’s how the two versions

A federal tax credit is available for 30% of the cost of the charger and installation, up to a $1,000 credit, means $3,000 spent. Married/joint filers = $300k for new / $150k for used. Web the standard deduction for 2023 is: Web a $7,500 tax credit for electric vehicles has seen substantial changes in 2024..

Federal Ev Tax Credit Calculator On smaller devices, click the icon in the top left corner, then click federal. It should be easier to get because it's now available as an instant rebate at. Led rebatesev charger rebatesmaking rebates simplerebate estimates Web what is the electric vehicle tax credit? Web your modified adjusted gross income (magi) is equal to or less than $300,000 (married filing jointly and qualifying surviving spouse), $225,000 (head of household), or.

Web The Formula Is As Follows:

$2,500 for a minimum of a 5kwh battery pack. Previously, buyers had to wait. Web the credit is available only to those who make less than a certain amount in adjusted gross income. for married couples, the limit is $300,000 per year. Even if you got an ev credit of $7,500, you could only use $4,324.

Web Federal Tax Credit Up To $7,500!

Web clean vehicle tax credits. Web a higher percentage of materials must be produced in north america for evs to qualify. In 2022 and 2023, the evs that qualified for the $7,500 federal tax credit were required to. On smaller devices, click the icon in the top left corner, then click federal.

If You Decided 2023 Was The Year To Tackle Some Home Improvements, You Could Reap The Reward Of Tax Credits Worth Up To $3,200.

Web the standard deduction for 2023 is: Get rewarded for going green. Web federal tax credit up to $4,000! Find out how you can.

Led Rebatesev Charger Rebatesmaking Rebates Simplerebate Estimates

$13,850 for single or married filing separately. Web under the new treasury rule, eligible models can receive between ev tax credits of $3,750 to $7,500, depending on whether their battery minerals, their battery. Web this tool will clearly identify the lowest cost ev rate plan and allow you to enroll in a rate plan online. Intuit.com has been visited by 1m+ users in the past month