Florida Probate Attorney Fee Calculator

Florida Probate Attorney Fee Calculator - Web $2,500 for estates between $40,000 and $70,000 $3,000 for estates between $70,000 and $100,000 three percent of the estate value for estates between $100,000 and $900,000 two and a half percent for estates between one and three million two percent for estates between three and five million We are part of your family. Fees can be paid to the attorney for the personal representative, as well as attorneys for beneficiaries and litigants. 1.5% for amounts above $10 million. Download the complete guide to attorneys’ fees in florida probate.

At the rate of 2 percent for all above $3 million and not exceeding $5 million. Web how much do attorneys charge for probate? The percentage amounts set forth above are based upon the inventory value of the probate estate. Probate administration & litigation lawyers. Web for example, if the estate is worth about $50,000, the lawyer will charge a flat fee of $2,000, but if the estate is worth $500,000, the lawyer may charge a flat fee of $3,000 plus three percent of the $500,000. Web the 2023 florida statutes (including special session c). In florida, the probate code sets a statutory fee for attorneys and executors for the administration of an estate.

Florida Probate Attorney Fees FL Probate Lawyers Cost

2% for amounts above $5 million up to $10 million. Web the 2023 florida statutes (including special session c) title xlii. So, you should not include the value of assets that avoid probate in your probate attorney fee calculations. Free probate administration & litigation case review. The percentage amounts set forth above are based upon.

Free Report Florida Probate St. Lucie County, FL Estate Planning

The biggest cost in a florida probate proceeding are usually attorney's fees. In florida, the probate code sets a statutory fee for attorneys and executors for the administration of an estate. Share your experience and we will call. Find out how much florida probate can cost (and how you can save money). A reasonable attorney.

Florida Probate Lawyer Fees Explained Florida Probate Law Firm

This will result in a total of $18,000 in probate fees. Web $2,500 for estates between $40,000 and $70,000 $3,000 for estates between $70,000 and $100,000 three percent of the estate value for estates between $100,000 and $900,000 two and a half percent for estates between one and three million two percent for estates between.

How to Reopen Probate in Florida Full Guide Jurado & Associates, P

In any event, the attorney or law firm may only charge a reasonable fee. Download the complete guide to attorneys’ fees in florida probate. At the rate of 2 percent for all above $3 million and not exceeding $5 million. Which is the inventory value of the probate estate assets and the income earned by.

Florida Probate Fees A Guide

Download the complete guide to attorneys’ fees in florida probate. Which is the inventory value of the probate estate assets and the income earned by the estate during the. The most important and significant probate expense is the fee the probate lawyer charges. Find out how much florida probate can cost (and how you can.

Probate Fees Calculator Ativa Interactive Corp.

Web a probate lawyer's fees (and most other costs of probate) are paid out of the estate, so your family will not need to worry about who pays probate fees, and they won’t have to cough up any money out of pocket. 733.106 costs and attorney fees.—. Web the 2023 florida statutes (including special session.

Florida probate attorney fees A Listly List

Estimating the cost to hire a florida probate attorney florida's probate rules were created to help define a reasonable attorney's fee based upon the size of the estate/probate. Web at the rate of 2.5 percent for all above $1 million and not exceeding $3 million. Estates between $3 million and $5 million cost 2.5%. Estates.

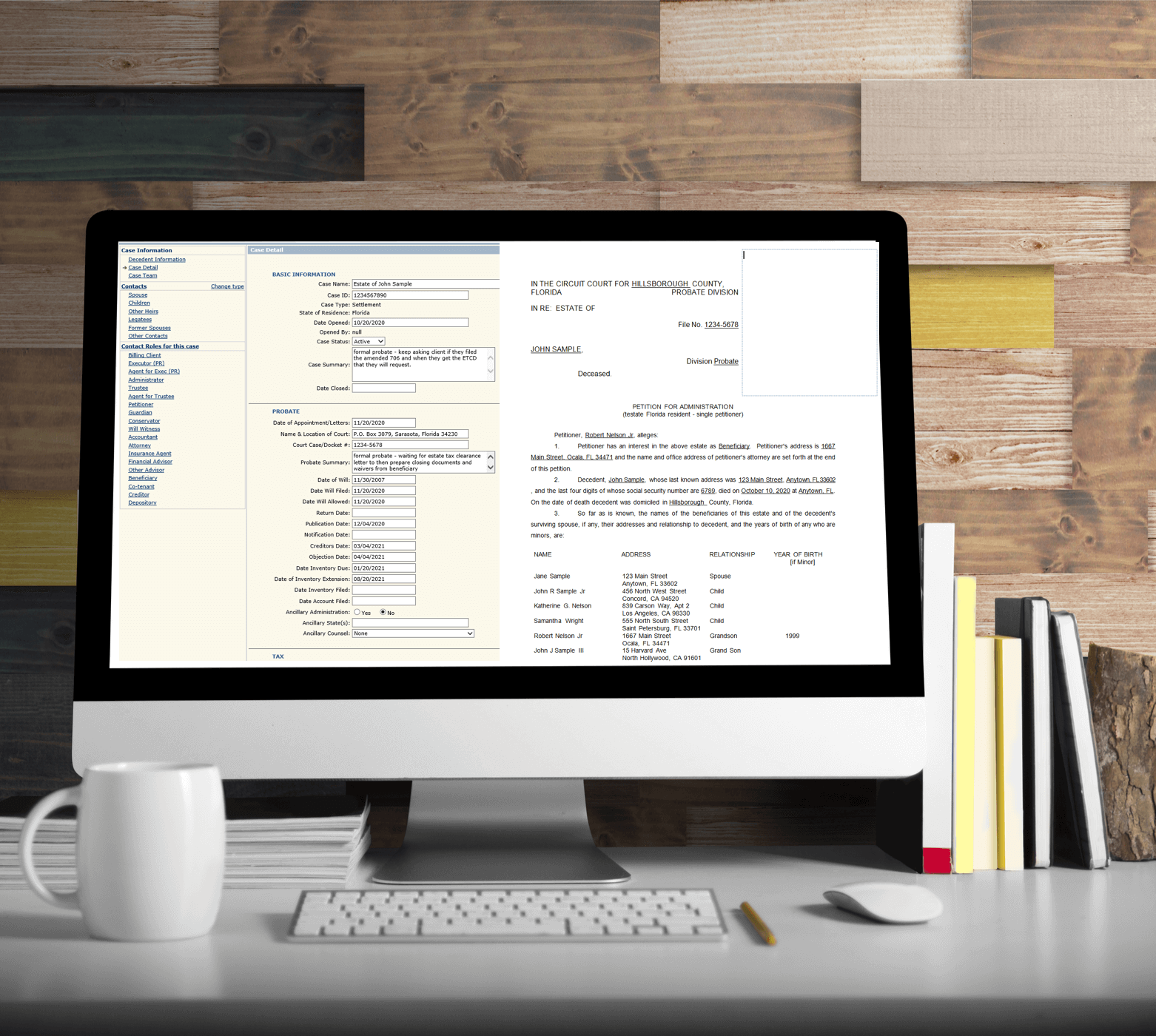

Florida Probate Software for Attorneys ProbatePlus

In fact, the state is one of just a handful that sets statutory fees based on the value of an estate. 3% of the first $1 million. · attorney legal fees · probate costs or expenses (example: Web the 2023 florida statutes (including special session c) title xlii. Web $2,500 for estates between $40,000 and.

Probate Attorney Fees Florida What You Want to Know

So, you should not include the value of assets that avoid probate in your probate attorney fee calculations. The executor pays the probate. Web a probate lawyer's fees (and most other costs of probate) are paid out of the estate, so your family will not need to worry about who pays probate fees, and they.

PERSONAL REPRESENTATIVE FEES IN A FLORIDA PROBATE ESTABLISHING

This will result in a total of $18,000 in probate fees. At the rate of 2 percent for all above $3 million and not exceeding $5 million. Fees can be paid to the attorney for the personal representative, as well as attorneys for beneficiaries and litigants. The biggest cost in a florida probate proceeding are.

Florida Probate Attorney Fee Calculator Estates between $1 million and $3 million cost 2.5%. We are part of your family. Probate administration & litigation lawyers. Web how much do attorneys charge for probate? · attorney legal fees · probate costs or expenses (example:

Web June 4, 2020 6:17 Pm Attorney Fees Are Paid In Connection With Florida Probate, For Administration And Litigation Purposes.

$500,000 500,000 x 0.025 = $12,500 last. Web estates between $100,000 and $900,000 cost 3% of the estate’s value. Fees are set forth in florida statutory rules, probate code section 10810 for the executor (personal representative) and attorney on any florida estate over. There are many variables, but this calculator is intended to assist you in estimating the presumed reasonable cost for the personal representative’s attorneys’ fees and compensation for the personal.

Web $2,500 For Estates Between $40,000 And $70,000 $3,000 For Estates Between $70,000 And $100,000 Three Percent Of The Estate Value For Estates Between $100,000 And $900,000 Two And A Half Percent For Estates Between One And Three Million Two Percent For Estates Between Three And Five Million

Web welcome to the probate fee calculator by the the edwards law group! Find out how much florida probate can cost (and how you can save money). Web in florida, the probate attorneys generally gets paid a fee of around 3% of the probate inventory, as explained a little better below. Share your experience and we will call.

This Will Result In A Total Of $18,000 In Probate Fees.

Estates between $3 million and $5 million cost 2.5%. So, you should not include the value of assets that avoid probate in your probate attorney fee calculations. Download the complete guide to attorneys’ fees in florida probate. Which is the inventory value of the probate estate assets and the income earned by the estate during the.

(1) In All Probate Proceedings, Costs May Be Awarded As In Chancery Actions.

At the rate of 2 percent for all above $3 million and not exceeding $5 million. Estates between $5 million and $10 million cost 1.5%. Fees can be paid to the attorney for the personal representative, as well as attorneys for beneficiaries and litigants. The biggest cost in a florida probate proceeding are usually attorney's fees.