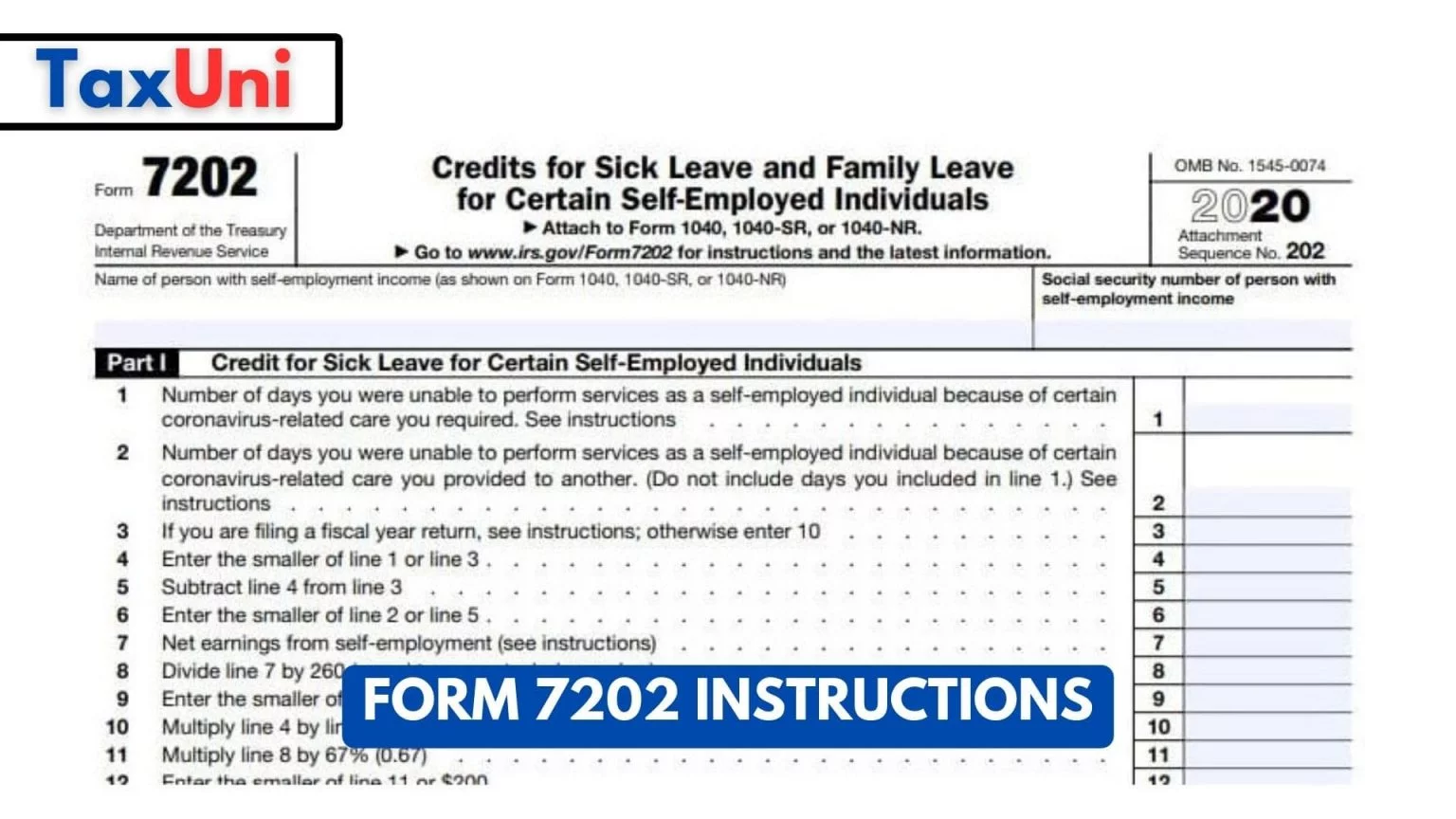

Form 7202 Calculator

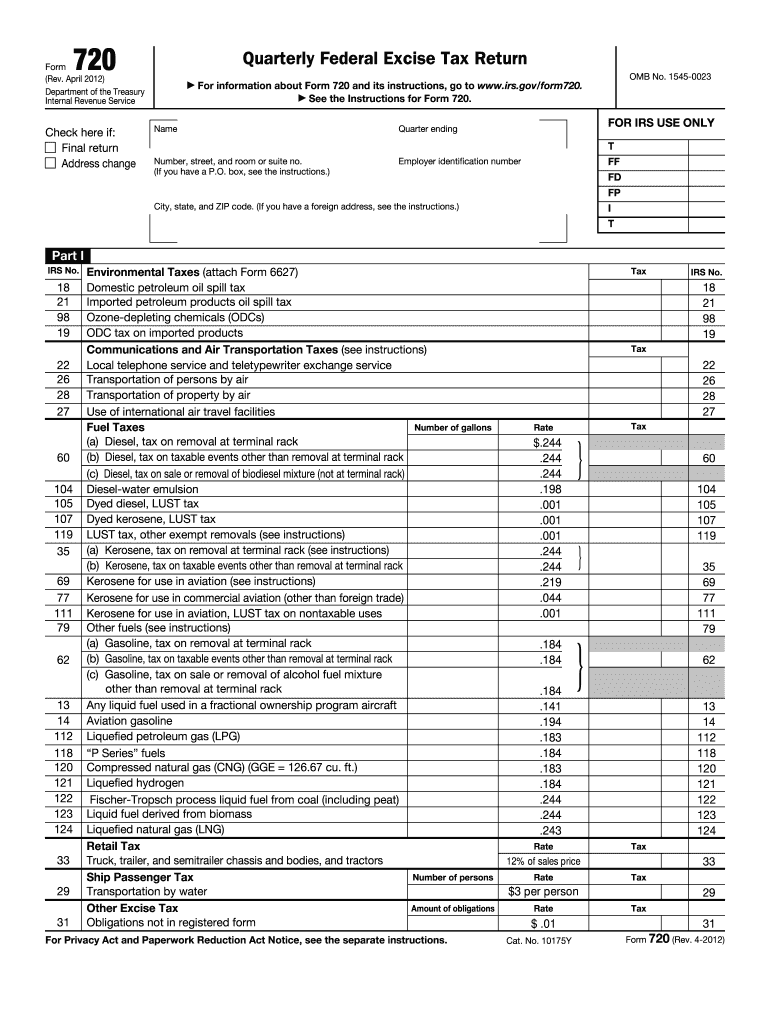

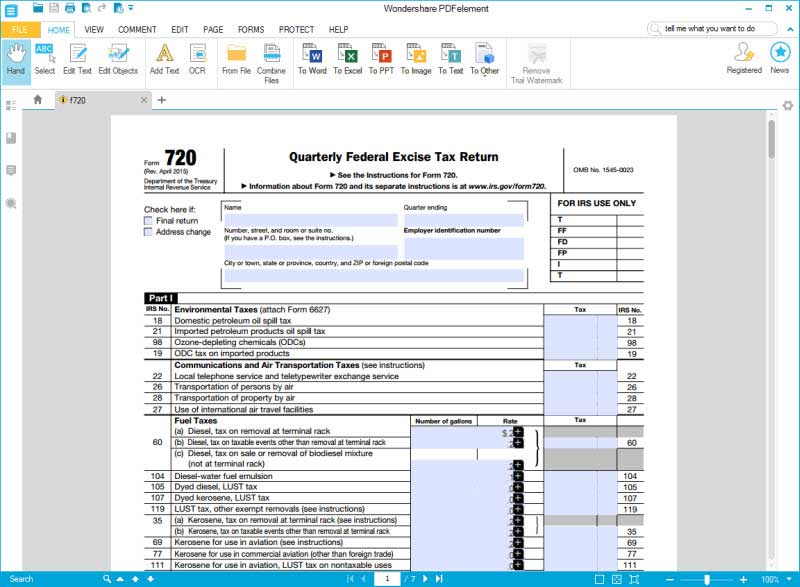

Form 7202 Calculator - Web solved • by turbotax • updated 2 hours ago. If you are a schedule c filer or a partner in a partnership, be aware of these new tax. Web however, form 7202 includes two separate credits, each with their own criteria. Web claiming the credits. Web irs form 720, the quarterly federal excise tax return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those.

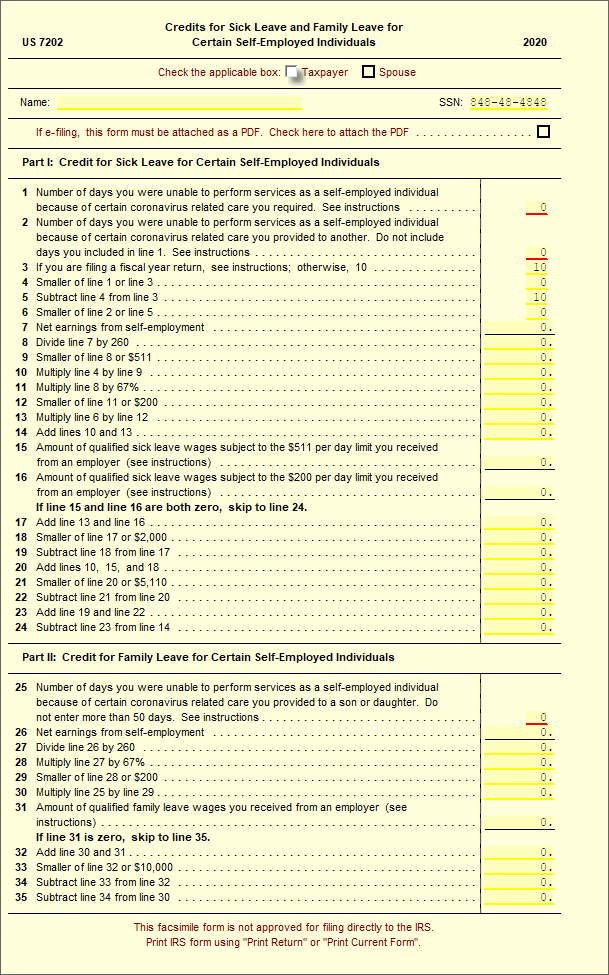

Maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. Web however, form 7202 includes two separate credits, each with their own criteria. To claim credit for sick leave on part i of form 7202, you. Go to www.irs.gov/form7202 for instructions and the latest information. If you are filing a joint return,. If the amount of the qualified leave equivalent credit has changed from the amount claimed on the individual's 2021 form 1040, u.s. Credits for sick leave and family leave for.

Form 7202 Instructions 2023 2024

Web the tax credits will be claimed on 2020 form 1040 for leave taken between april 1, 2020, and december 31, 2020, and on their 2021 form 1040 for leave taken. Web to complete form 7202 in taxslayer proweb, from the main menu of the tax return select: Web irs form 720, the quarterly federal.

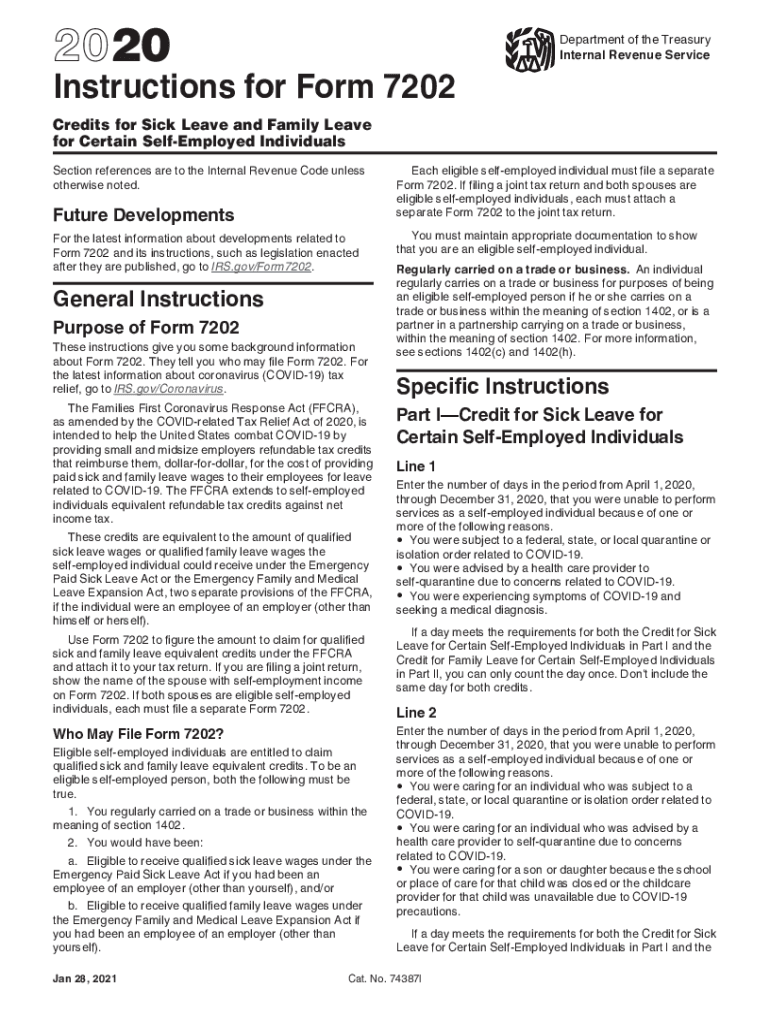

2020 Form IRS Instructions 7202 Fill Online, Printable, Fillable, Blank

Web recalculate the credit on the form 7202. Web the tax credits will be claimed on 2020 form 1040 for leave taken between april 1, 2020, and december 31, 2020, and on their 2021 form 1040 for leave taken. Web future developments for the latest information about developments related to form 7202 and its instructions,.

Printable Fileable IRS Form 7202 Self Employed Sick Leave and Family

To claim credit for sick leave on part i of form 7202, you. Web irs form 720, the quarterly federal excise tax return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those. If you are a schedule c filer or a partner in a.

IRS Form 7202 Examples

Web solved • by turbotax • updated 2 hours ago. Web claiming the credits. Web to complete form 7202 in taxslayer proweb, from the main menu of the tax return select: If you are filing a joint return,. If the amount of the qualified leave equivalent credit has changed from the amount claimed on the.

7202 Credits for Sick Leave and Family Leave UltimateTax Solution

Web claiming the credits. Web solved • by turbotax • updated 2 hours ago. Web the tax credits will be claimed on 2020 form 1040 for leave taken between april 1, 2020, and december 31, 2020, and on their 2021 form 1040 for leave taken. Web future developments for the latest information about developments related.

COVID19 tax relief What is IRS Form 7202, and how it could help if

Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Web recalculate the credit on the form 7202. If the amount of the qualified leave equivalent credit has changed from the amount claimed on the individual's 2021.

IRS Form 7202 Examples

Go to www.irs.gov/form7202 for instructions and the latest information. If you are a schedule c filer or a partner in a partnership, be aware of these new tax. Web claiming the credits. Web solved • by turbotax • updated 2 hours ago. Web irs form 720, the quarterly federal excise tax return, is a tax.

Form 7202 2020 Fill out & sign online DocHub

Web claiming the credits. If you are a schedule c filer or a partner in a partnership, be aware of these new tax. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Credits for sick leave.

Form 7202 Instructions 2023 2024

If you are filing a joint return,. Web however, form 7202 includes two separate credits, each with their own criteria. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. If you are a schedule c filer.

How to decode / read US Veterans Bureau Form 7202?

Maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Web to complete form 7202 in taxslayer proweb, from the main menu of the.

Form 7202 Calculator Web however, form 7202 includes two separate credits, each with their own criteria. To claim credit for sick leave on part i of form 7202, you. Web future developments for the latest information about developments related to form 7202 and its instructions, such as legislation enacted after they are published, go to. Go to www.irs.gov/form7202 for instructions and the latest information. Credits for sick leave and family leave for.

Web Recalculate The Credit On The Form 7202.

Web however, form 7202 includes two separate credits, each with their own criteria. Web the tax credits will be claimed on 2020 form 1040 for leave taken between april 1, 2020, and december 31, 2020, and on their 2021 form 1040 for leave taken. Maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. Web claiming the credits.

Web Use Form 7202 To Figure The Amount To Claim For Qualified Sick And Family Leave Equivalent Credits Under The Ffcra And Attach It To Your Tax Return.

Web future developments for the latest information about developments related to form 7202 and its instructions, such as legislation enacted after they are published, go to. To claim credit for sick leave on part i of form 7202, you. Credits for sick leave and family leave for. If you are filing a joint return,.

Web To Complete Form 7202 In Taxslayer Proweb, From The Main Menu Of The Tax Return Select:

Web solved • by turbotax • updated 2 hours ago. Go to www.irs.gov/form7202 for instructions and the latest information. Web irs form 720, the quarterly federal excise tax return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those. If the amount of the qualified leave equivalent credit has changed from the amount claimed on the individual's 2021 form 1040, u.s.