Fringe Benefits Calculation

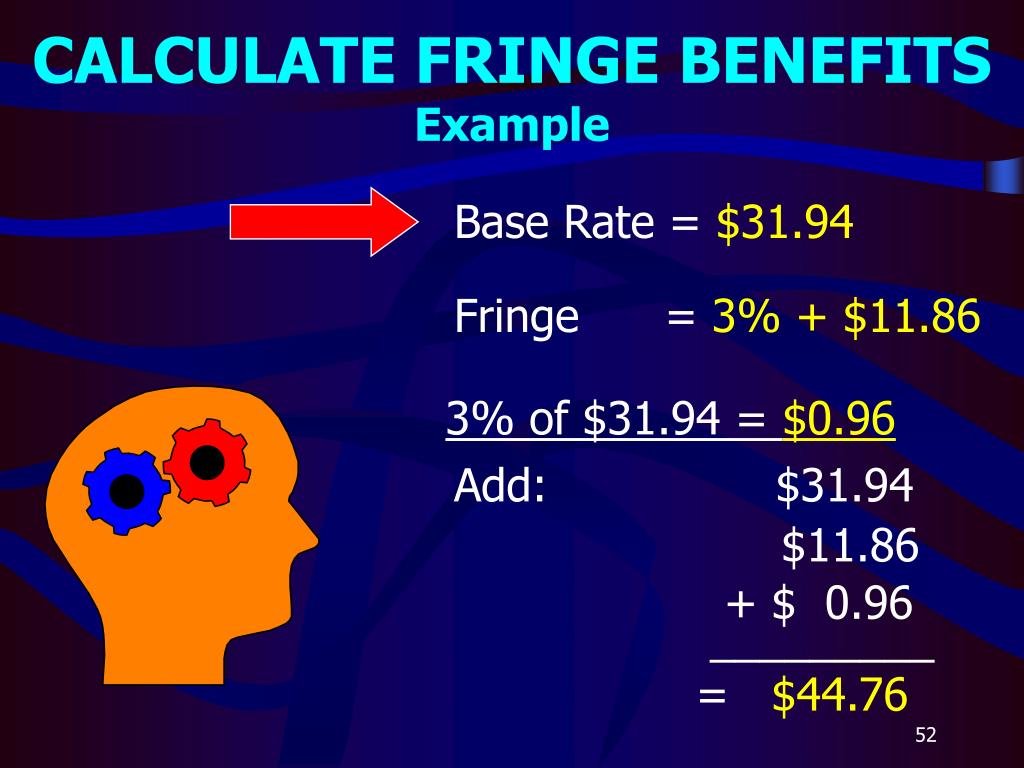

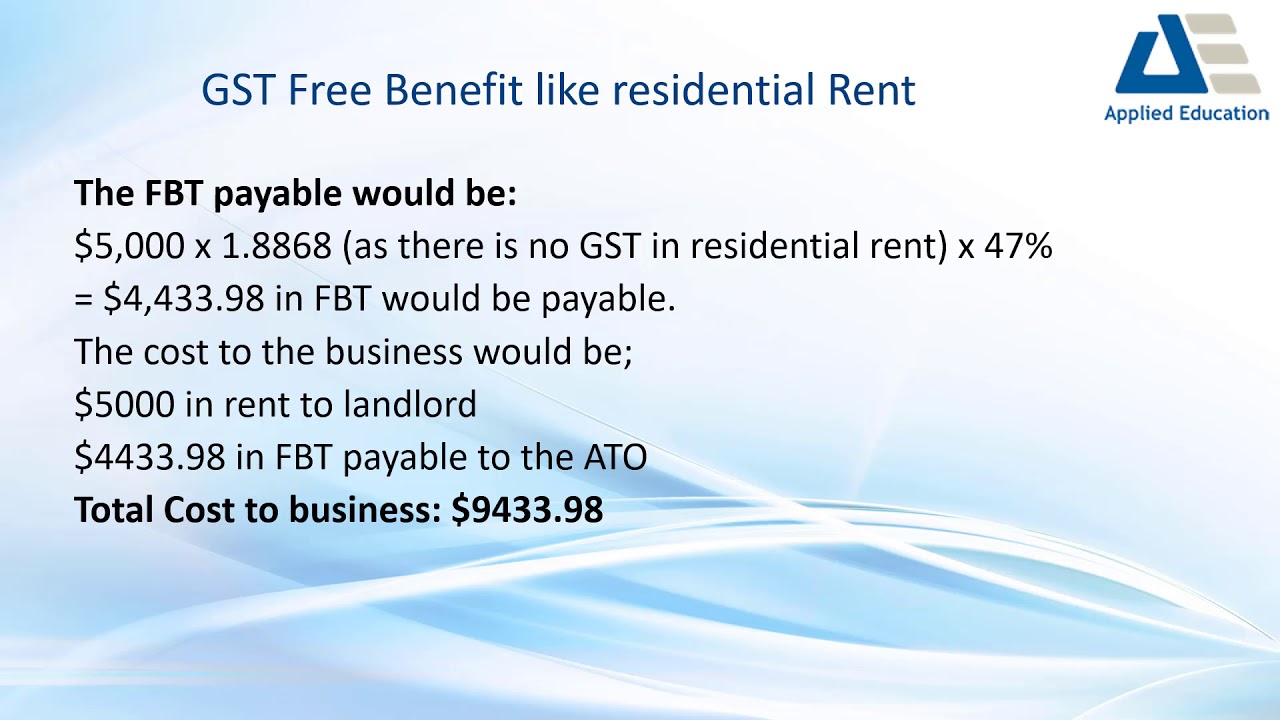

Fringe Benefits Calculation - Web the fringe benefit rate is calculated by adding together the annual cost of all benefits and payroll taxes paid, and dividing by the annual wages paid. Web rate methodology methods for allocating fringe costs there are two options for budgeting and charging benefits to funding sources: Calculate the annual amount of each benefit, and divide the amount by 2,080 to express the benefit. How you work out the taxable value of a fringe benefit varies. You must include in a recipient's pay the amount by which the.

Web use this calculator to help illustrate the total compensation package for an employee. Web you can calculate fringe benefits with a simple formula. Fringe benefits include, but are. The number of hours worked in a year. Web fringe benefits are allowances and services provided by employers to their employees as compensation in addition to regular salaries and wages. Web to calculate a fringe benefit rate, divide the total fringe benefits by the total salary, then multiply by 100 by to express the result as a percent. How you work out the taxable value of a fringe benefit varies.

How To Determine Fringe Benefits

The fringe benefit portion in dollars of the work per hour. Web additionally, alex received fringe benefits worth about 30% of his salary, including health insurance, retirement contributions, dental insurance, etc. Web a fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to stated pay for the performance.

PPT WAGE DECISIONS PowerPoint Presentation, free download ID836829

How you work out the taxable value of a fringe benefit varies. Web rate methodology methods for allocating fringe costs there are two options for budgeting and charging benefits to funding sources: The number of hours worked in a year. Web the first step to calculating fringe benefits on your employee’s payroll is determining the.

What is Fringe Benefits Tax (FBT) and how is FBT calculated? YouTube

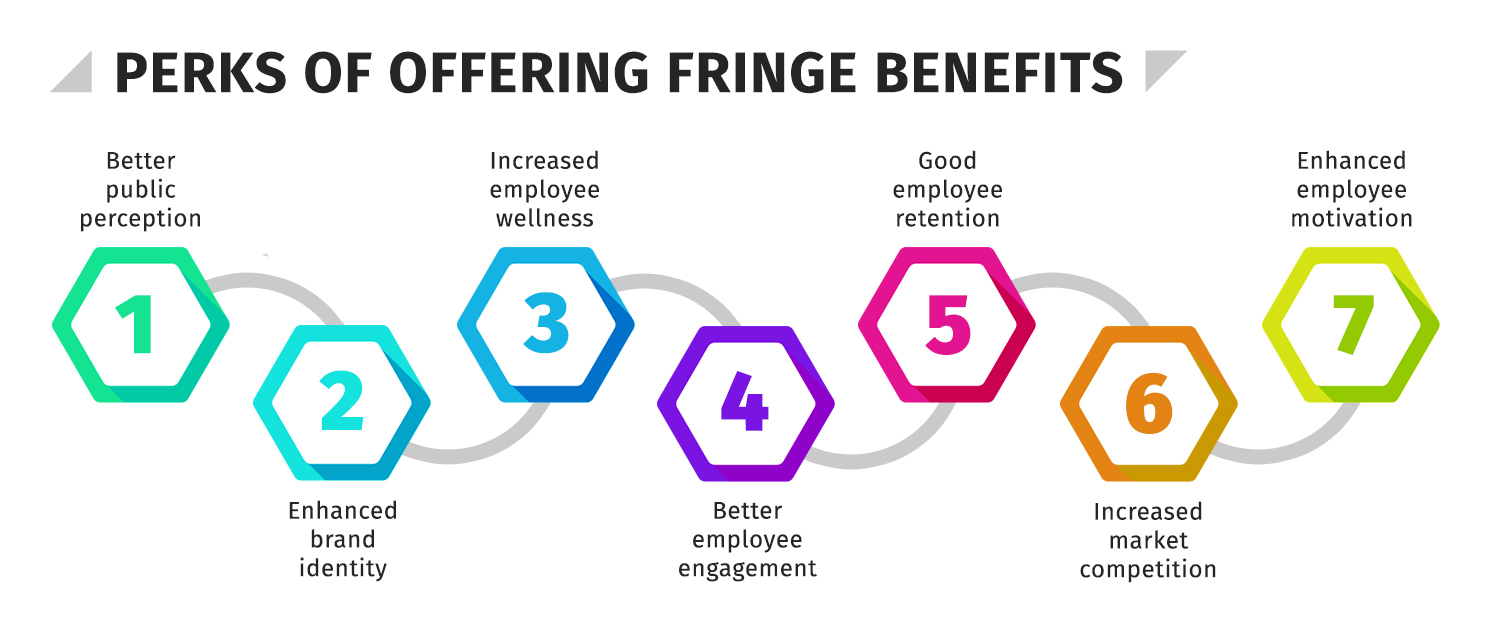

Web 5 min read start sending incredible swag and gifts simplify and enhance your employee swag and gifting experience for better retention, engagement and productivity. How you work out the taxable value of a fringe benefit varies. Web the first step to calculating fringe benefits on your employee’s payroll is determining the total value of.

The Comprehensive Guide to Fringe Benefits AttendanceBot

How you work out the taxable value of a fringe benefit varies. You must include in a recipient's pay the amount by which the. Web the number of employees that are doing prevailing wage work. Web use this calculator to help illustrate the total compensation package for an employee. Web to calculate a fringe benefit.

4 Ways to Calculate Fringe Benefits wikiHow

Web a fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to stated pay for the performance of services. Web you can calculate fringe benefits with a simple formula. Web to calculate fringe benefit credits accurately, employers need to keep detailed records of all contributions made on behalf.

How to Calculate Fringe Benefits HR University

Web to calculate a fringe benefit rate, divide the total fringe benefits by the total salary, then multiply by 100 by to express the result as a percent. Web fringe benefits are allowances and services provided by employers to their employees as compensation in addition to regular salaries and wages. The fringe benefit portion in.

4 Ways to Calculate Fringe Benefits wikiHow

Web fringe benefits are allowances and services provided by employers to their employees as compensation in addition to regular salaries and wages. Work out the taxable value of each fringe benefit. Web use this calculator to help illustrate the total compensation package for an employee. Web to calculate a fringe benefit rate, divide the total.

How to Calculate Prevailing Wage Fringe Benefits for your Building

Web to calculate a fringe benefit rate, divide the total fringe benefits by the total salary, then multiply by 100 by to express the result as a percent. Web you can calculate fringe benefits with a simple formula. Web 5 min read start sending incredible swag and gifts simplify and enhance your employee swag and.

How to Calculate Fringe Benefits HR University

You must include in a recipient's pay the amount by which the. Web to calculate a fringe benefit rate, divide the total fringe benefits by the total salary, then multiply by 100 by to express the result as a percent. Web additionally, alex received fringe benefits worth about 30% of his salary, including health insurance,.

4 Ways to Calculate Fringe Benefits wikiHow

Web the number of employees that are doing prevailing wage work. Web the fringe benefit rate is calculated by adding together the annual cost of all benefits and payroll taxes paid, and dividing by the annual wages paid. Work out the taxable value of each fringe benefit. Web fringe benefits are allowances and services provided.

Fringe Benefits Calculation Calculate the annual amount of each benefit, and divide the amount by 2,080 to express the benefit. Web a fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to stated pay for the performance of services. Web to calculate fringe benefit credits accurately, employers need to keep detailed records of all contributions made on behalf of each employee. Web use this calculator to help illustrate the total compensation package for an employee. The number of hours worked in a year.

You Must Include In A Recipient's Pay The Amount By Which The.

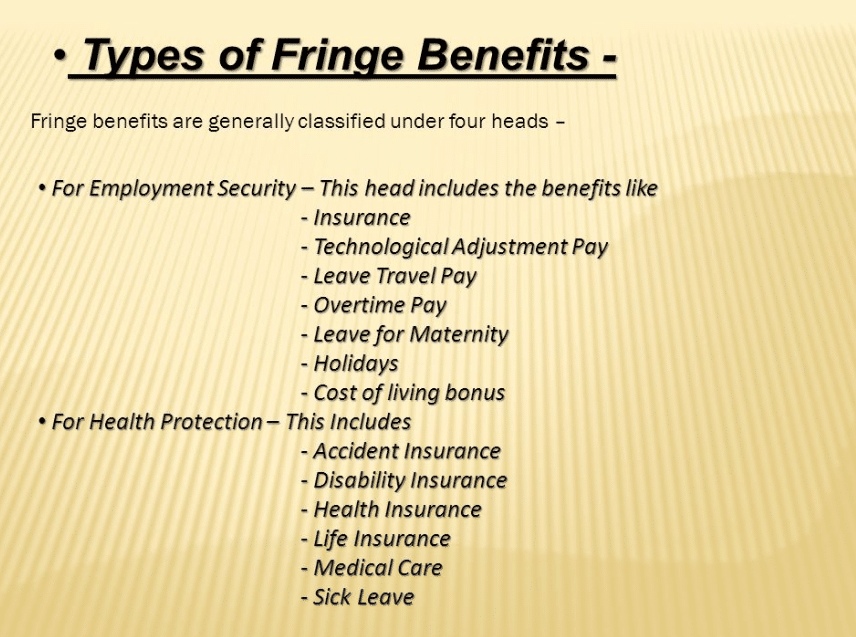

Web fringe benefits are allowances and services provided by employers to their employees as compensation in addition to regular salaries and wages. The fringe benefit portion in dollars of the work per hour. The number of hours worked in a year. Web a fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to stated pay for the performance of services.

Web Use This Calculator To Help Illustrate The Total Compensation Package For An Employee.

Independent contractors and freelancers are. Web rate methodology methods for allocating fringe costs there are two options for budgeting and charging benefits to funding sources: How you work out the taxable value of a fringe benefit varies. Web 13 rows including taxable benefits in pay.

Fringe Benefits Include, But Are.

Web to calculate fringe benefit credits accurately, employers need to keep detailed records of all contributions made on behalf of each employee. Web 5 min read start sending incredible swag and gifts simplify and enhance your employee swag and gifting experience for better retention, engagement and productivity. Web you can calculate fringe benefits with a simple formula. Web the fringe benefit rate is calculated by adding together the annual cost of all benefits and payroll taxes paid, and dividing by the annual wages paid.

Calculate The Annual Amount Of Each Benefit, And Divide The Amount By 2,080 To Express The Benefit.

Web the first step to calculating fringe benefits on your employee’s payroll is determining the total value of the benefits they receive. A fringe benefit is a specific type of benefit that employees receive on top of their normal wages or salaries. Web the number of employees that are doing prevailing wage work. Web additionally, alex received fringe benefits worth about 30% of his salary, including health insurance, retirement contributions, dental insurance, etc.